S&P 500 companies report their Q3 earnings. What if they invested in Bitcoin?

Industry News

Corporations included in S&P 500 reported their Q3 earnings. As for the index, S&P 500 increased by 0.69% (4 397 on September 30).

According to companies’ reports, 84% of corporations show better-than-feared outcomes. Corporations representing communication services, health care, materials, real estate, and utilities exceed the expectations, disclosing optimistic earning reports. Energy is the only category where more than 40% of corporations had been primarily overvalued.

On the other hand, energy is the leading industry according to the revenue growth (53.1%).

JP Morgan Chase is the world’s leading bank according to the Q3 revenue with $29.6 billion (overrunning Morgan Stanley with $14.2 billion and Goldman Sachs with $13.6 billion).

Netflix reported Q3 revenue of $7.4 billion (the all-time high quarter revenue for the corporation). Another corporate record is set by Tesla – the corporation has earned $13.76 billion within the third quarter.

What if the S&P companies invested their Q2 revenues into cryptocurrencies? Digital markets experienced another bullish run, as Bitcoin reached its new all-time high in October.

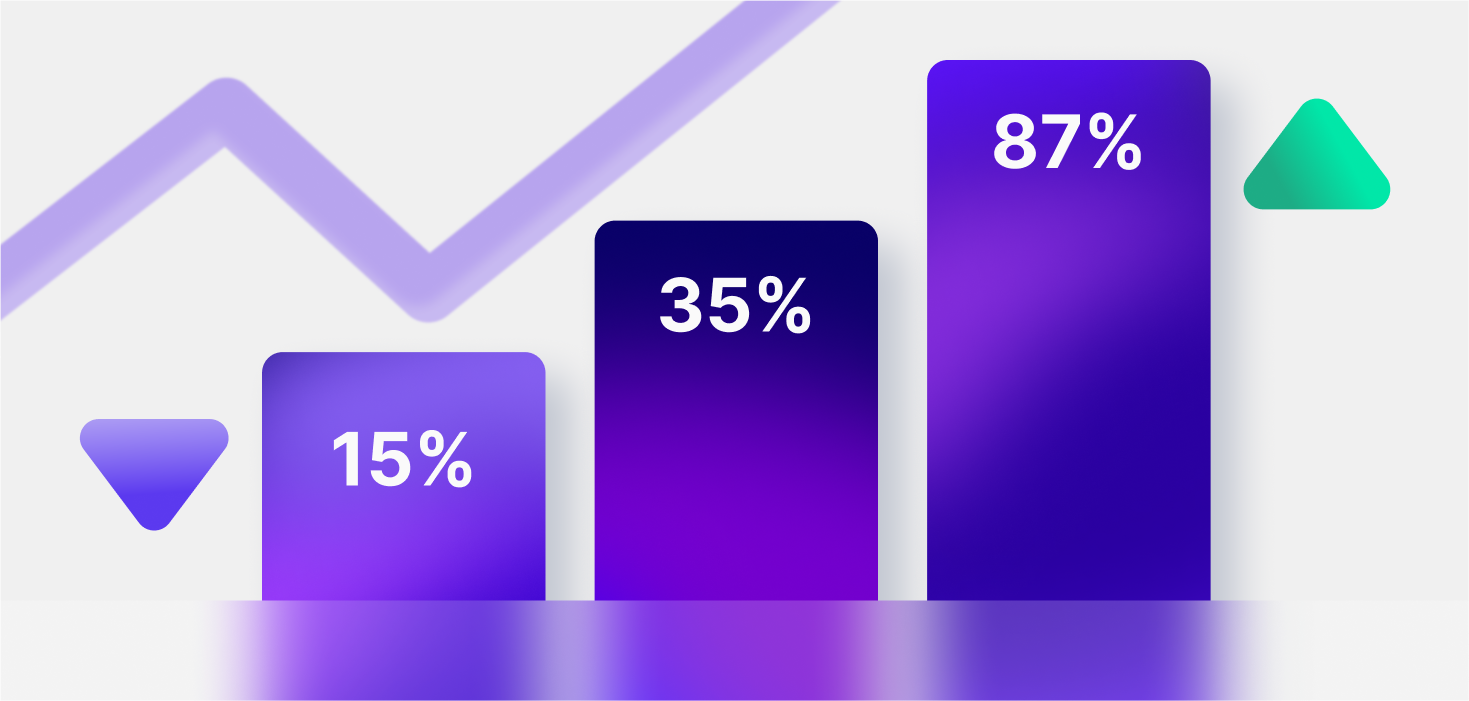

In Q3 Bitcoin price increased by 12.5%; meanwhile, October continued the trend, as the first cryptocurrency’s price has already skyrocketed by 43.1%.

It sounds crazy but Tesla reported a $50 M loss because of the Bitcoin investment. The company sold some BTC when the cryptocurrency’s price reached its yearly minimum. If Tesla had held its Bitcoin investments, the corporation would have doubled its revenues.