Explaining The Difference Between Fixed And Floating Exchange Rates

Articles

Investors, dealers, and even whole nations’ economies depend highly on the direction of currency exchange, making currency conversion rates significant indicators for everyone involved. In this article, we will explore the rates of the exchange and their types.

Key Takeaways

- The exchange rate is the value of one country’s currency stated in some other currency.

- The self-correcting exchange rate depends on bid/ask levels.

- A monetary authority sets the fixed course of conversion.

- Countries’ governments often combine elements from both types in their monetary policies.

What Do Exchange Rates Mean?

Currency is the official monetary unit of a state. The exchange rate is the price of one country’s currency expressed in another country’s currency.

The currency conversion rate can be determined either by law (that is, set by the state) or formed solely under the influence of the state of the market, depending on the demand for currency and its provision to the currency market.

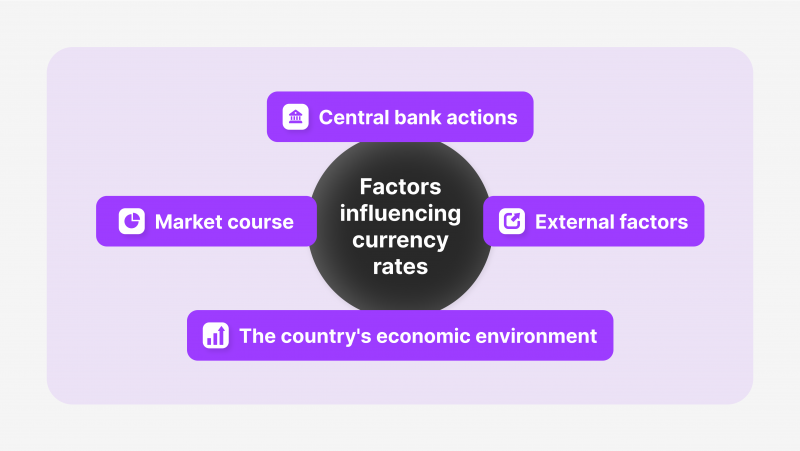

The course of exchanging currency can be influenced by many aspects, among which are the following:

- Actions of central banks – A central bank can control the national currency’s course of exchange in one way or another. The regulator can carry out currency interventions, conduct various transaction operations with its reserves and government securities, or change the interest rate.

- The course in the market – The commercial value of a currency depends on how much people want to use it and how much of it is available.

- The economic environment in the country – The exchange rate reflects the state of the national economy, production dynamics, volumes of export and import of goods, inflows and outflows of capital, investment volumes, socio-economic factors, and so on.

- External factors – The exchange rate can be significantly affected (usually negatively) by macroeconomic shocks, such as economic and political crises, large-scale natural disasters, or geopolitical tensions (wars, sanctions).

There exist two types of conversion rates: fixed and floating. Let’s discuss them in more detail.

What Is The Fixed Exchange Rate?

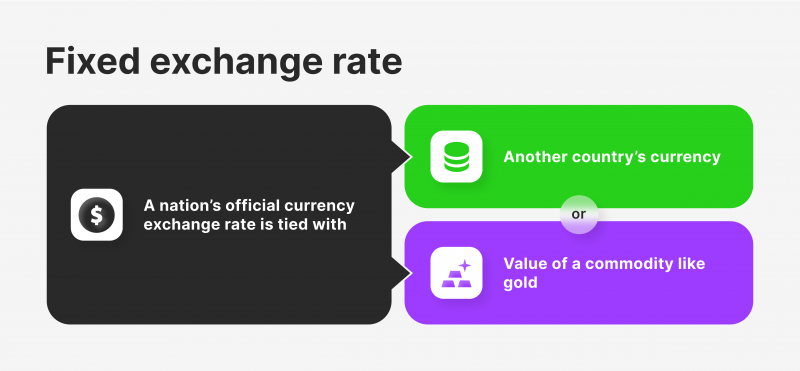

A pegged (or fixed) rate is a type of the conversion rate. Central financial authorities set a fixed rate for the value of major currencies like USD, GBP, or EUR. This means that traders who often trade with a country with a fixed exchange rate will always get the same rate and value for their money.

This type of exchange rate is favoured by countries seeking stable currency and predictable trade finances. But, it means that the value of their currency is tied to and fluctuates with the currency it’s pegged to.

To reduce the dependence on a single fixed currency, some central banks spread this risk by pegging their national currency to multiple currencies at different percentages, for instance, 60% to the US Dollar, 30% to the Euro, and 10% to the British Pound. This makes their national currency less exposed to the risk of changes to any other currency it is fixed to.

Governments typically establish pegged rates to maintain currency stability and ensure consistent and predictable financial transactions.

A governmental body or central bank can establish a fixed rate, or it can be based on gold prices.

Pegged exchange rates are set by central banks or governments. Their goal is to keep the currency’s value stable. They use an exchange rate mechanism to adjust this peg, which helps normalise trade and control inflation, ensuring that the currency peg remains consistent.

Pros And Cons

Akin to a flexible conversion rate, the fixed one has advantages and drawbacks.

Among the pros are the following:

- No rate fluctuations – A fixed rate maintains the purchasing power and eliminates arbitrage opportunities by keeping the currency constant despite market swings, ensuring currency steadiness.

- Stabilised inflation – A fixed conversion rate prevents inflation by pegging a national currency to another, keeping goods and services affordable and creating a stable economy.

- Encourages investment – A pegged rate system boosts investment by ensuring stability, preventing alterations in assets or income, and promoting trade between states by facilitating easy conversion of money into the desired currency, thereby increasing investment and growth in both countries.

Here is a list of some drawbacks:

- High maintenance – The central bank must consistently monitor the market and intervene to prevent significant economic changes, as improper management can lead to substantial costs and economic crises.

- Less freedom for corrections – If central banks want to adjust rates of interest and boost the economy, they may not do it properly due to the lack of freedom to do so.

- Complexity – A pegged rate loses the rebalancing and auto-correcting features of a floating one, making it more complex.

- Large reserves requirements – If the currency is under stress and requires support, it necessitates significant reserves.

What Is The Floating Exchange Rate?

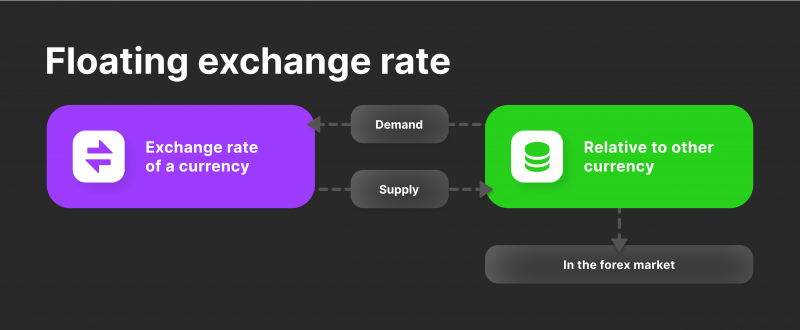

The floating (sometimes also called flexible or self-correcting) exchange rate) is characterised by the fact that it changes according to bid and ask.

So, do exchange rates change daily in this case? If many people want to buy a currency or there is not much of it available, this specific currency becomes more valuable than others. When the market indicators change, the rate at which currency is converted also changes.

Simply put, if there is not much demand for a certain currency, its worth decreases, leading to higher prices for goods imported from other countries. However, if many people want to buy a currency, its value increases.

Implementing a flexible system in a country minimises the central authority’s interference in correcting the exchange rate, meaning it should self-correct.

Factors such as inflation, interest rate swings, or overseas investments can influence demand and supply.

When a country gets a lot of money from overseas investors, the value of its currency goes up because more people want to buy it. These aspects have a considerable effect on how much the exchange is worth and cause changes in self-correcting courses.

Pros And Cons

Both advantages and cons are associated with a floating course of exchange.

Here are some of the profits:

- Adaptable trading – Flexible currencies can be traded independently in markets without monetary authority or government management. This allows for more flexible trading without strict monitoring and restrictions.

- Market efficiency – A flexible exchange course allows for more flexible investments between countries. This adds to the country’s attractiveness to investors, resulting in a boost to the country’s economy and domestic production.

- Lower requirements for reserved funds – The flexible rate allows central financial authorities or banks to use funds in reserve without the need to hold them to balance the exchange course. Instead, these reserves can be used to stimulate economic development through capital goods purchases.

- Inflation hedging – States with flexible exchange rates avoid the problem of import inflation that can arise from a balance of payments surplus or rising import costs.

- Balance of payments (BoP) – Self-correcting exchange rates stabilise the BoP since the resources and cash flow are freed up thanks to a lack of regulation.

Nevertheless, there are also some disadvantages of floating rates:

- Volatility risk – Self-correcting currencies are highly volatile due to their inherent instability and unpredictability. They can decline in value within a single trading day and are highly affected by unpredictable market conditions, including offer and demand fluctuations.

- Inability to solve economic problems – The self-correcting rate may not solve a country’s economic concerns like high unemployment, high inflation, and low GDP if the currency depreciates, increasing inflation and demand for commodities.

- Limited economic development – The absence of strict control over rates can hinder economic growth and recovery. Monetary depreciation, especially during high inflation, can cause issues like export and import difficulties, especially in countries with weak economies.

- Investment outflow – Fluctuations in the course could stop foreign businesses from investing in the country’s economy.

Which Rate Is Better?

Picking a floating or a pegged rate depends on a country’s financial situation.

A self-correcting rate can be seen as a fiscal benefit when the economy and fiscal policy are strong and sound. However, weakening market sentiment could lead to diminishing the currency value.

This competition has no winner, as neither rate is better than the other. A country commonly opts for the rate type that suits it best, often resulting in a hybrid model that uses elements from both methods.

The International Monetary Fund suggests that a floating exchange course indicates a country’s financial maturity. Still, some countries opt for a managed floating approach, allowing the governing body to get involved in the rate adjustment if the rate falls too low or rises too high.

Conclusion

The floating course of exchange moves in relation to ask and bid levels, while a financial or governmental authority establishes the fixed one. A country chooses the exchange rate based on its economic system and the benefits of each type. However, countries rarely opt for a single rate type. They often incorporate the elements of one exchange course type into the other, thus benefiting from both approaches.