Trump Tariffs Start Today, Causing Stock Market Turbulence

The Trump administration’s aggressive tariff policy officially takes effect today, marking a new chapter in U.S. trade relations with Canada, Mexico, and China. Under the Trump tariff plan, imports from America’s closest trading partners will now be subject to 25% duties, with additional 20% tariffs on some Chinese goods.

Markets reacted immediately. On Monday, ahead of the Trump tariffs start date, the Dow Jones Industrial Average (DJIA) dropped 1.5%, while the NASDAQ and S&P 500 fell by 2.6% and 1.7%, respectively. Investors braced for further instability as businesses and consumers prepared for price hikes across multiple sectors.

The Impact on Trade and Consumers

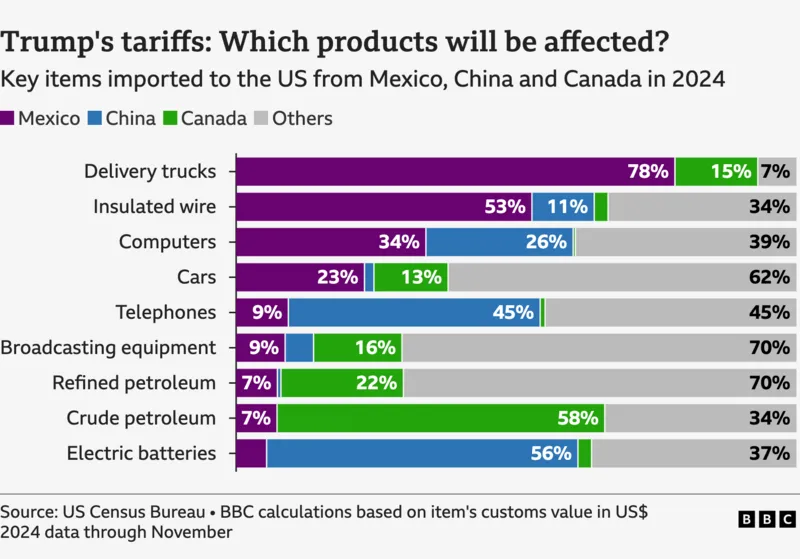

Unlike traditional taxes, tariffs are imposed directly on importers, who in turn pass the cost to consumers through higher prices. This means that everyday Americans will soon feel the impact of rising costs on cars, electronics, groceries, and raw materials.

New York, a state deeply dependent on trade with Canada and Mexico, is expected to face significant economic challenges. In 2024, the state imported $22.8 billion worth of goods from Canada and $3.5 billion from Mexico. Many of these imports—including metals, agricultural products, and energy—are essential for local businesses.

With tariffs now in effect, higher costs for imported goods will ripple through industries, threatening jobs and raising operational expenses for companies that rely on international supply chains, some experts believe.

Trump Tariffs and the Stock Market Reaction

The stock market after tariffs is already showing signs of distress. Monday’s sharp decline suggests investor uncertainty about how businesses will absorb the added costs. Analysts warn that corporate earnings reports in the coming quarters may reflect these financial burdens, potentially leading to further stock sell-offs.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

Tariffs historically slow economic growth, and the market’s reaction mirrors concerns from previous trade wars. The U.S. saw similar patterns during the 2018-2019 tariff battles with China, which disrupted global supply chains and led to economic slowdowns in key sectors such as manufacturing and agriculture.

Political and Economic Risks

Beyond Wall Street, Trump’s tariffs and the stock market downturn could carry political consequences. The U.S. economy and inflation remain top concerns for voters, with 82% of Americans believing economic stability should be the government’s priority, according to a CBS survey.

While Trump argues that these tariffs will boost domestic manufacturing and increase border security, economists warn that they could trigger inflationary pressure, further straining household budgets. With inflation already rising—January’s Consumer Price Index (CPI) was up 3%—there’s growing concern that higher import costs will keep consumer prices elevated.

Trump’s strategy is clear: he believes that short-term pain will lead to long-term economic gains. However, history suggests that tariffs often backfire. The Smoot-Hawley Tariff Act of 1930, implemented during the Great Depression, worsened economic conditions by shrinking trade and increasing costs.

Industries That Will Be Hit the Hardest

The automotive, technology, and agriculture sectors will likely be among the hardest hit. Trump’s message to automakers is clear—move production to the U.S. or face high tariffs. While this policy may encourage domestic production, it also increases costs for manufacturers that rely on imported parts.

Meanwhile, tech companies that source computer chips and components from China will have to adjust pricing strategies, potentially passing costs onto consumers. Grocery prices will also feel the strain, as tariffs on Mexican food imports—including fresh produce—will increase food costs across the U.S.

A High-Stakes Political Gamble

Trump’s tariff gamble is a defining moment in his second term. While his administration claims that these measures will strengthen U.S. industry and reduce dependency on foreign economies, the immediate consequences—higher consumer prices and stock market volatility—pose risks to both the economy and his political standing.

Public sentiment remains divided. While some support the move as a step toward economic sovereignty, others fear that it will prolong inflation and stifle economic recovery. Trump is expected to address these concerns in a primetime speech to Congress, where he will argue that these tariffs are necessary for America’s long-term economic health.

What’s Next?

Market watchers and economists are closely monitoring corporate earnings reports, inflation data, and consumer confidence indexes to gauge the true impact of these tariffs. If inflation accelerates or stock market instability worsens, Trump may face mounting pressure to adjust his trade policies.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Retaliatory tariffs from Canada, Mexico, and China further complicate the situation, potentially leading to a prolonged trade war. If foreign governments impose their own tariffs on U.S. goods, American exporters may suffer reduced global demand, adding another layer of uncertainty to an already volatile economic landscape.

Conclusion

With Trump tariffs officially in place, the U.S. economy enters a period of heightened uncertainty. While the administration is confident that these trade policies will ultimately strengthen domestic industries, the immediate effects—rising costs, stock market turbulence, and inflation risks—suggest that the road ahead may be turbulent.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.