Trump Tariffs Trigger Market Sell-Off: Is This the Start of a Trade War?

Just weeks after Donald Trump’s return to office, financial markets face turbulence again as his aggressive trade policies shake investor confidence. His latest move—imposing sweeping tariffs on key trade partners—has rattled investors, sending stock markets downward.

As analysts and the financial market digest these developments, speculation grows over the broader economic consequences, including the potential impact on the US dollar’s dominance.

The Tariff Turmoil Unfolds

Over the weekend, Trump ordered new tariffs of 25% on imports from Mexico and Canada, alongside a 10% levy on Chinese goods. While a last-minute halt to the Mexican tariffs provided temporary relief, the uncertainty surrounding the US trade war has left investors jittery.

Market analysts warn that this aggressive trade policy could have significant long-term consequences for the US economy and global financial stability.

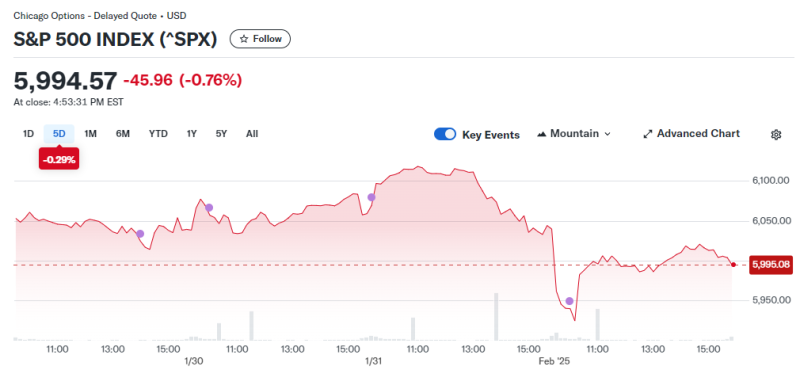

The Dow Jones Industrial Average tumbled early in the day before recovering slightly, closing down 0.3%.

The S&P 500 and Nasdaq fared worse, dropping 0.76% and 1.2%, respectively.

European and Asian markets also felt the impact, with Germany’s DAX falling 1.4%, France’s CAC 40 down 1.2%, and Japan’s Nikkei sinking nearly 3%.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

Understanding Tariffs: Who Pays the Price?

A tariff definition is a tax imposed on imported goods. While Trump has framed his tariffs as a tool to protect American industries and reduce trade deficits, the real question remains: who pays tariffs? The reality is that while tariffs are imposed on foreign goods, the costs often trickle down to American businesses and consumers.

Increased import costs force businesses to either absorb higher expenses—hurting their bottom lines—or pass them on to consumers through price hikes. Either way, tariffs can contribute to inflationary pressures, reducing consumer purchasing power and impacting corporate earnings.

The Ripple Effect on Global Trade

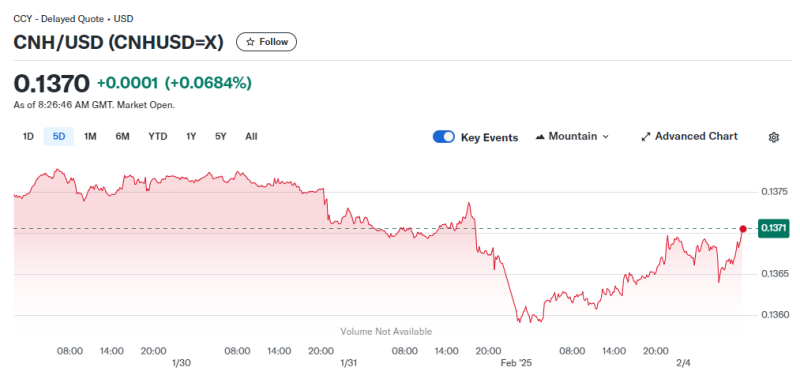

China, a key target of US tariffs, has already signalled retaliatory measures. China tariffs have been a consistent theme in Trump’s trade battles, and Beijing has vowed to counter these latest levies with its own economic defences.

The Chinese yuan hit a record low against the US dollar, indicating market worries about possible economic instability.

Meanwhile, Canada and Mexico—America’s largest trading partners—have threatened counter-tariffs. Canada’s economy is particularly vulnerable, with its currency plunging to its lowest level since 2003. Mexico, already facing economic challenges, risks slipping into a recession due to reduced trade with its northern neighbour.

What Stocks Will Benefit from Trump Tariffs?

While broad market indices suffer, not all stocks are losing ground. Historically, domestic manufacturing and agriculture stocks tend to perform better in a high-tariff environment. Companies producing goods domestically or supplying substitute products for affected imports could see increased demand.

- Steel and Aluminum Producers – With import costs rising, US-based companies like Nucor (NUE) and U.S. Steel (X) could benefit from higher domestic demand.

- Agriculture & Food Producers – Some agricultural businesses might see a short-term boost if consumers pivot away from higher-priced imports. However, retaliatory tariffs from trading partners could offset these gains.

- Defense & Aerospace – Companies like Lockheed Martin (LMT) and Northrop Grumman (NOC) could see an increase in government spending, particularly if trade tensions shift into national security concerns.

- Energy & Domestic Drilling – With Canadian energy exports facing a 10% tariff, US-based producers could gain market share. ExxonMobil (XOM) and Chevron (CVX) may benefit from reduced competition from imported oil and gas.

Investor Sentiment and Economic Concerns

Despite some sectoral winners, broader investor sentiment remains negative. Goldman Sachs estimates that the latest round of tariffs could push inflation up by 0.7% while reducing GDP growth by 0.4%. Morgan Stanley provides an even bleaker forecast, suggesting a potential 1.1% reduction in US economic growth.

Beyond the numbers, the uncertainty surrounding Trump’s trade policies continues to fuel volatility. Many investors remain sceptical that these tariffs will have the intended effect of reshoring jobs and strengthening the economy. Instead, there’s growing concern that prolonged trade battles could lead to supply chain disruptions, reduced corporate earnings, and slower global growth.

Global Currency and Commodity Market Reactions

The forex market also reacted sharply, with the US dollar strengthening against major currencies, including the euro, Canadian dollar, and Mexican peso. This trend could make US exports less competitive globally, further complicating trade relationships.

Meanwhile, oil prices spiked as markets factored in potential supply disruptions from Canadian and Mexican energy products. Similarly, gold prices surged, reflecting increased investor demand for safe-haven assets amid market uncertainty.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Looking Ahead: What’s Next for Markets?

While the Trump tariffs aim to exert economic pressure on trade partners, their implications remain uncertain. Investors will be closely watching for:

- Further retaliatory measures from China, Canada, and Mexico.

- Potential EU tariffs, as Trump has hinted at additional trade actions against Europe.

- US Federal Reserve policy, particularly in response to inflationary pressures resulting from higher tariffs.

With markets on edge, the next few weeks will be critical in determining whether this latest tariff turmoil is merely a short-term shock or the beginning of a deeper economic shift.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.