What is an IOC Order?

The world of trading is often dependent on time-sensitive and prompt execution. Numerous deals are great in a vacuum but could become unprofitable if the window of opportunity passes by. So, several crucial trading mechanisms have been implemented to prevent missed opportunities, allowing traders to automatically set orders on time limits and control the execution of unfavourable deals.

The IOC order is among the best trading mechanisms that automatically set a limit order, letting traders decide the limit price effectively and feel safe in the ever-evolving trading environment. This article will discuss how the IOC limit orders function and how to best apply them in practical trading situations.

Key Takeaways

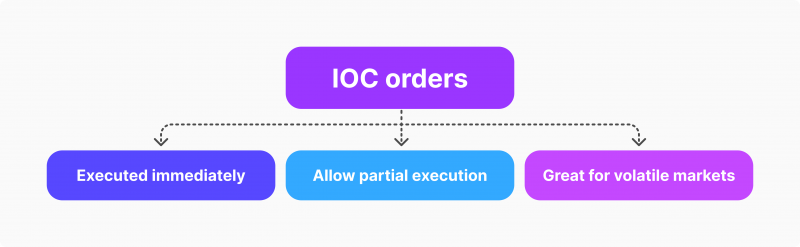

- IOC order is one of several automated trading orders with specific preconditions.

- IOC orders are executed immediately with full or partial volumes. If conditions are not met even partially, the order is completely cancelled.

- IOC Limit orders can specify desired prices, whereas IOC marker orders are still executed if the selected asset is in high demand.

Understanding the Concept of Immediate or Cancel Order

The IOC Acronym stated above stands for an Immediate or Cancel (IOC) Order. This automated condition allows traders to specify that their preferred trade should be executed immediately. Otherwise, the order will also be cancelled immediately. This precondition reduces market exposure risks and enables traders to purchase the assets only at a specified date. The IOC orders make this strategy possible by being linked to order-matching engines and promptly identifying the available offers on the market.

The IOC order stems from the extensive family of time-sensitive orders, including fill-or-kill, all-or-none and good-till-cancelled orders. The primary distinction of IOC orders is that they can be fulfilled partially, whereas most other mechanisms aim to execute the entire order or cancel it altogether.

IOC avoids this all-or-nothing principle and is best suited for traders who wish to retain at least a part of their desired transaction and finalise the deal even with a partial execution.

The Limit Order vs Market Order

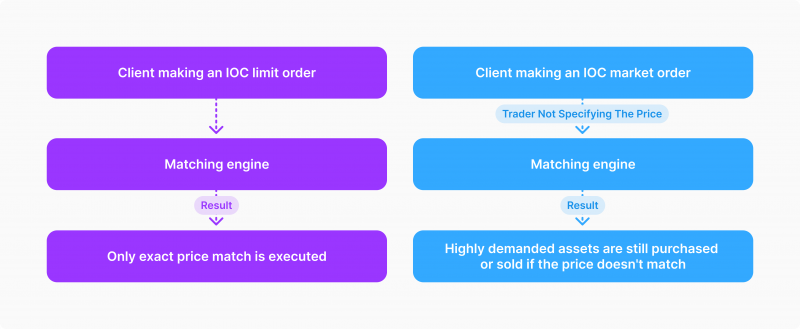

IOC orders can be divided into limit orders and market orders. The former allows traders to specify a price at which they wish to finalise the deal, whereas the latter aims to retrieve the assets at the best possible market price. While the IOC limit order grants higher degrees of choice to set a limit price, the IOC market order is much more likely to be executed promptly.

There is no obvious answer as to which option is superior, and traders should consider their unique circumstances when deciding which option to choose.

What is The Best Moment to Use an IOC Order?

IOC orders are best suited for more significant transactions to be fulfilled on time. Both buyers and sellers in any trading market wish to execute their strategies at a specified price. The prices naturally fluctuate in most markets, and IOC orders limit the possibility of purchasing or selling shares at an undesired price.

For example, if trader X wishes to purchase 10,000 shares of Apple Inc. at a specific price, the IOC order will ensure that all shares, if any, will be bought at that exact price. Otherwise, the portion, or sometimes the entire order, will be cancelled. This way, traders will not lose any money from asset value changes during the trading hours.

It is not uncommon to see an asset price change in the middle of the day. Without the IOC orders, traders might end up owning assets at an overvalued price or selling them at an undervalued quote. IOC orders prevent these unfortunate scenarios and give traders the chance to execute their strategies at least partially.

Finally, IOC orders are outstanding for active traders to set automatic “reminders” during everyday trading sessions. Suppose trader X has strategies to sell or purchase 20 stocks across several markets. In the case of manual execution, it is easy to lose track and forget to cancel orders that are no longer desirable. IOC orders can significantly assist in this task and reduce the risk of human error in trading.

The popularity of IOC orders rises proportionally to the volatility of trading markets. Naturally, IOC orders are the most popular in the crypto field due to their inherent price fluctuations.

Practical Applications of the IOC Order

Let’s imagine two scenarios where we utilise the IOC limit and market orders. In the first scenario, suppose we are trading with Apple Inc. stocks and placing a limit order on 10,000 shares at $200. The market currently provides the offer price on 500 Apple Inc. stocks at a $202 valuation. The automatic limit order will cancel the entire order due to the price difference.

On the other hand, if we trade with a market order and keep all other things equal, the 500 Apple Inc. shares will be purchased, and the rest of the order will be cancelled unless filled immediately. Although the price is slightly different, the market order variation of the IOC prioritises purchasing or selling shares at a price that is in high demand.

Which of the actions mentioned above most applies to your trading regiment? Well, it depends on the market conditions in your trading sector. For example, the stock market, more prominently the niche with well-established stocks, heavily prioritises the market orders.

These corporate stock assets have smaller price fluctuations, and it is generally profitable to purchase them even if the market price is slightly higher than initially desired. The same is true for the forex market due to its massive high liquidity.

On the other hand, lower liquidity and high volatility markets are less forgiving and could swing asset prices dramatically. It is not uncommon to see a whopping 10% price shift in a sector like cryptocurrency. In such cases, proceeding even with the best possible deal would lead to a significant loss. In this situation, limit orders are much more applicable.

Fill or Kill Order vs Immediate or Cancel order

As discussed above, IOC orders are just a single option in a large family of time-sensitive transaction mechanisms. The Fill-or-Kill order is another prevalent strategy that is often interchanged with the IOC order. Both fill-or-kill and IOC orders share the similarity of being executed immediately. However, unlike the IOC order, the FOK must be filled entirely to avoid cancellation.

The FOK alternative is suitable for traders that have an all-or-nothing approach or capitalise on trading with large asset quantities. This approach is beneficial primarily in markets with tight spreads and price variations, where the most profit is made by selling or buying large volumes.

In such conditions, it doesn’t make sense to purchase a small portion of shares since they will not lead to any significant profits. However, since the order cancel reason is more specified with the FOK order, the likelihood of execution reduces dramatically compared to the IOC strategy.

Final Takeaways

The IOC order is a handy tool in the trader’s toolbox. There are numerous scenarios where IOC orders can save investors from unpredictable price shifts and market volatility effects. However, it is crucial to understand your specific trading needs and market conditions to make the most out of IOC order capabilities. Both market order and limit order variations have their particular uses, and, as with every other trading concept, it is crucial to know the difference.

Recommended articles

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer