Understanding MT5 Trading Signals: How to Use?

Trading in financial markets demands time, knowledge, and confidence to achieve profitable results. However, the MetaTrader 5 (MT5) platform offers a game-changing feature called “Trading Signals” that simplifies the learning process. This feature allows traders to access expert perspectives by copying trades from professionals.

This guide will explain how to use MT5 trading signals to make the most of this powerful tool.

Key Takeaways

- Trading signals in MT5 are suggestions by professional traders that include necessary information for executing a trade.

- Copying signals in MT5 is simple and efficient because it involves automatic execution, signal selection, and real-time updates.

- Copy trading offers benefits such as leveraging expert insight, time efficiency, and trading diversification.

What Are Trading Signals in MT5?

At its core, the MetaTrader 5 Trading Signals services is a sophisticated system that connects signal providers, or experienced traders, with investors. The platform provides those eager to learn from ready-made trading strategies a direct connection to successful operators, all within the comfort of their MT5 terminal.

Trading signals themselves are suggestions generated by professional traders, trading systems or robots and delivered to the platform. These signals contain all the necessary information to execute a trade, including entry and exit points, stop loss levels, and take profit targets.

The Process of Copying Signals

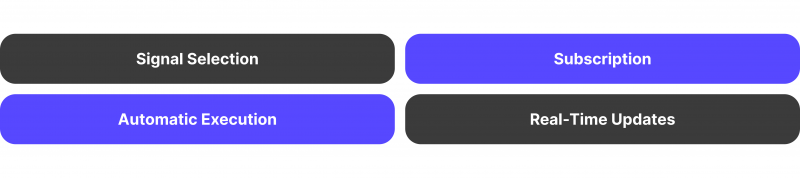

The strength of copy trading lies in their simplicity and efficiency. Here’s how they work:

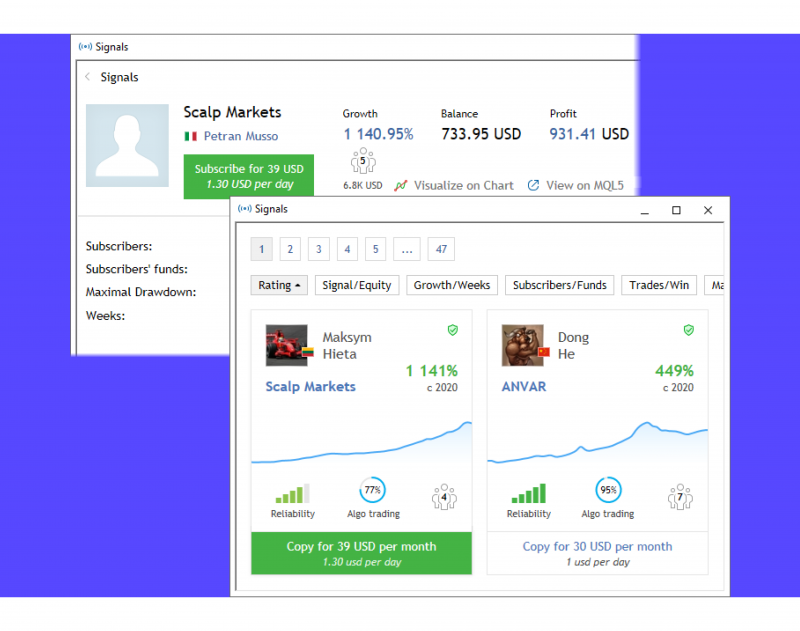

- Signal Selection: An investor browses through a list of signal providers, each with their own track record and performance metrics.

- Subscription: Once they find a provider that aligns with their trading goals, they can subscribe to the provider’s Forex or CFD crypto trading signals.

- Automatic Execution: The system then automatically replicates the provider’s trades in the investor’s account.

- Real-Time Updates: As the provider makes trades, the investor’s account mirrors these actions almost instantaneously.

This process eliminates the need for direct agreements between providers and investors, offering a streamlined, fully automated copying of trading operations. The ultra-fast data exchange protocols ensure that execution delays are minimal, keeping an investor in sync with their chosen expert.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Your Guide to Setting Up Signals in MT5

Here’s your step-by-step guide on how to get started with MetaTrader trading signals:

1. Install and Log In

- Download and install the MetaTrader 5 trading platform on your device.

- Log in to your trading account.

- Ensure you have a valid MQL5 account (create one if necessary).

2. Navigate to Signals

- On desktop: Open MT5 and click on the ‘Signals’ tab.

- On mobile: Open the main menu and select ‘Signals’.

3. Choose Your Signal

- Browse through available signals or use the search function on the signal copy settings page.

- Analyse provider performance, risk levels, and subscription costs.

4. Subscribe

- Click the ‘Subscribe’ button for your chosen signal.

- For paid signals, you’ll need to agree to the payment terms.

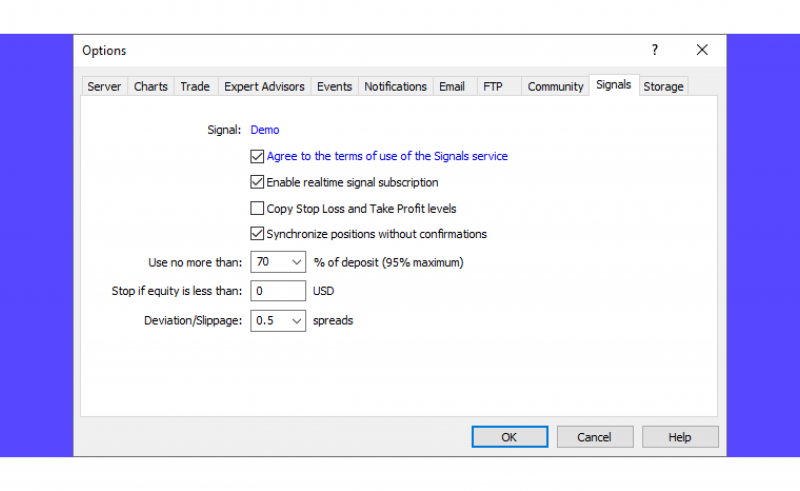

5. Customise Settings

- Set your copy trading preferences (e.g., maximum trade size, stop loss).

- Enter your trading password (found in your MetaQuotes email).

6. Activate

- Hit ‘Copy Trades’ to start mirroring your chosen provider’s actions.

- If you can’t find the Signals tab in MT5, open Options and ensure the service is enabled in the Community tab. If this option is unavailable or the Signals tab is missing, it means your broker doesn’t provide this feature for their traders.

Your trading password is different from your MT5 login. Check your email from MetaQuotes to find it.

Managing Signal Subscriptions

Understanding the subscription process is key to maximising the benefits of trading signals.

Free vs. Paid Signals

Trading signals can be free or come with a monthly fee. Paid signals require investors to pay a certain fee.

It’s important to note that free signals can transition to paid. Providers will notify you before any charges occur, ensuring you can decide whether you want to continue with the paid service.

Unsubscribing from a Signal Provider

Here’s how you can manage your subscriptions on both desktop and mobile platforms:

- To unsubscribe on desktop: Go to ‘Signals’ > ‘My Statistics’ > select the signal > click ‘Unsubscribe’.

- On mobile: Open ‘My Subscriptions’ from the main menu and tap the cancel icon.

Payment Handling

When you follow a signal, the subscription fees are frozen in your MQL5 account. If a signal provider decides to cancel their signal, your subscription fee is promptly returned to your MQL5 account.

Advantages of Trading Signals

Embracing signals in trading can significantly enhance your trading experience. Here’s why:

- Leverage Expertise: Forex signals allow you to tap into the knowledge and insights of seasoned traders. Instead of spending years learning through personal trial and error, you can leverage the expertise of professionals who have honed their skills over time.

- Time Efficiency: Copy trading allows you to automate your trading activities, which is a substantial advantage. You can free up valuable time that can be better spent on developing trading strategies and analysing market trends.

- Diversification: The service provides an excellent opportunity to diversify your trading portfolio. Following multiple signals can spread your risk across different strategies and markets.

- Transparency: A significant benefit of Forex trading signals is their transparency. You can access detailed performance metrics and assess the effectiveness of different providers.

- Flexibility: Trading signals’ flexibility allows you to adapt to changing market conditions and your evolving trading objectives, ensuring that your trading strategy remains dynamic and responsive to market fluctuations.

How to Become a Signal Provider?

For those who’ve mastered the art of trading, there’s an exciting opportunity to share your expertise and potentially earn additional income. Becoming a signal provider allows you to showcase your trading skills to a wide audience of MT5 traders.

To embark on this journey:

- Develop a consistent and profitable trading strategy.

- Build a solid track record on your MT5 account.

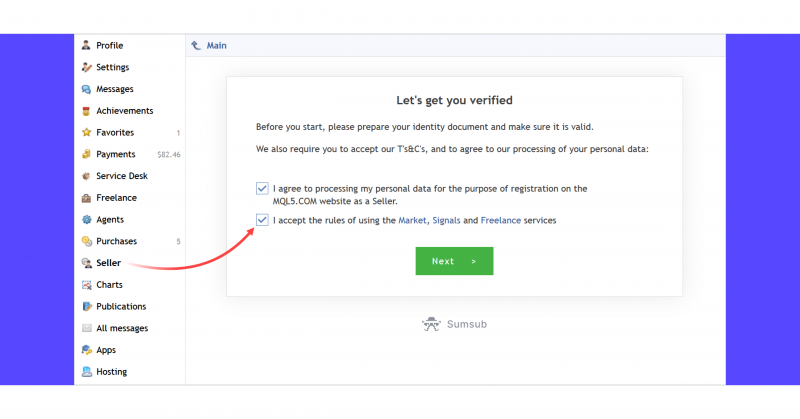

- Get the Seller status by completing a simple registration process on your MQL5 profile. To do this, you need to go through identity verification.

- Create a Signal and set your subscription fees and terms.

- Start attracting subscribers and sharing your trading wisdom.

Remember, as a trading signal provider, you’re not just trading for yourself anymore. You’re taking on the responsibility of guiding others in their trading journey. It’s a role that requires dedication, transparency, and a commitment to continuous improvement.

Some Advice Before You Get Started

While Trading Signals offer exciting possibilities, it’s important to approach them with a balanced perspective. Here are a few points to keep in mind:

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

- Past Performance: Remember that historical success doesn’t guarantee future results.

- Do Your Research: Carefully research providers’ performance metrics before committing to a signal. Don’t rely on just one metric.

- Risk Management: Always use proper management techniques, regardless of the signals you follow.

- Continuous Learning: Use signals as a tool for learning, not as a substitute for developing your own trading skills.

- Diversification: Don’t rely on one source for all your income. Consider following multiple signals to spread your risk.

Conclusion

The Trading Signals service in MetaTrader 5 represents a powerful tool in the modern trader’s arsenal. It offers a unique blend of automated trading, learning opportunities, and the potential for improved trading results. By leveraging the expertise of successful traders, you can navigate the complex waters of financial markets with greater confidence and insight.

Remember, while trading signals can be a powerful tool, they should be used as part of a comprehensive trading strategy. Always conduct your own research and never risk more than you can afford to lose.