US-China Trade War Strengthens: How Will It Affect the Financial Markets?

The drama after Trump’s victory in the US election continues, and this time, with threats of escalating the trade war with main trade partners.

During his campaign for the White House, the president-elect, Donald Trump, vowed to fix the US economy and solve main social constraints. Increased import tariffs are on the top of the agenda to support local produce and combat illegal migration and drug inflows.

However, these actions will spark a new US-China trade war, with promised tariffs of up to 60% on Chinese products and up to 20% on overseas imports. Let’s find out the possible outcomes on the US economy and the average US household.

Escalating The US-China Trade War

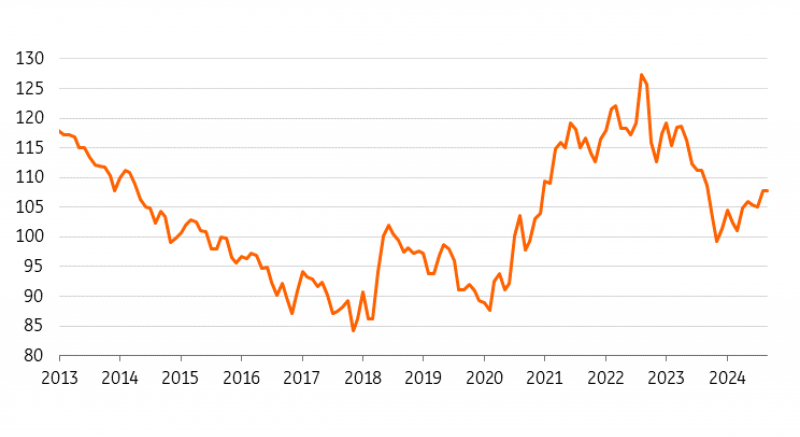

After introducing hefty sanctions in his last term in 2018 against China, Trump is eager to continue his aggressive campaign with a new package on the global production powerhouse.

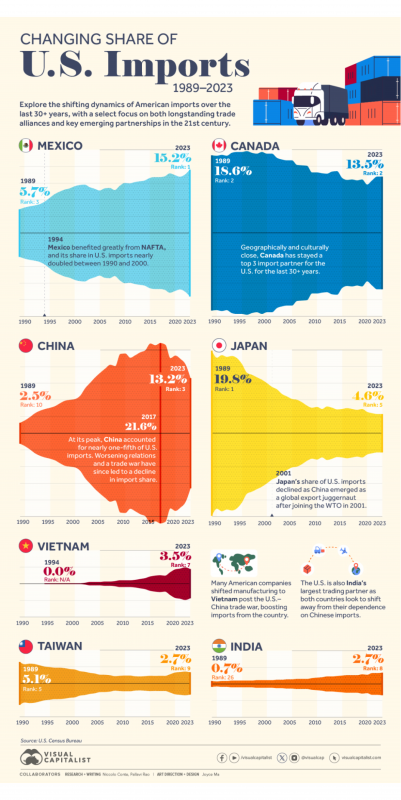

Trump vowed to increase the tariffs on Chinese products imported into the USA to 60%, with lowered quotas ranging from 10% to 20% on Mexico and Canada. This controversial decision spiralled debates considering the fact that these are the top 3 US import partners, totalling around 40% of US imports in 2023.

The expectation now is that counterparts can probably respond with sanctions or taxes on US goods, just like China retaliated with 25% tariffs in 2018. However, this would eventually damage the US economy.

Why is Trump Raising US Import Tariffs?

The motive behind the Trump trade war with China is to combat drug inflow and illegal immigration into the USA from these three countries.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

The president-elect mentioned that these tariffs are imposed until they reduce fentanyl trafficking and enhance border security but did not set an action plan beyond solving these social problems.

Trump also expressed concerns over trade deficits and that current trade agreements do not benefit American industries and households. By imposing tariffs, he aims to protect domestic manufacturing and improve the trade balance.

Global Reaction

The trade war news received an international reaction, especially from the three countries. The Spokesperson of the Chinese Embassy in the USA said there is no winner in a trade war. Liu Pengyu expressed the efforts to combat illegal drugs and trafficking and that new tariff packages would hurt everyone.

Mexican president Claudia Sheinbaum expressed concern about this news and mentioned that it would lead to job loss and inflation in the US and Mexico. She also hinted at a possibility of retaliation, which could only escalate the tariff war.

On the Canadian side, Premier of Ontario Doug Ford said this decision would devastate industries and businesses in both countries and called on local governments to strengthen border control to avoid the implementation of new taxes.

Impact on US Consumers

Asian stocks and Mexican and Canadian production will definitely be affected by this decision. How will it affect US households?

From an economic perspective, raising import tax leads to increased prices of foreign products. This will incentivise local businesses to raise their prices to compete, leading to higher consumer prices.

Moreover, if foreign exporters decide to stop trading, local households will suffer from local monopolies and have fewer choices. Let’s take, for example, the last sanctions on China in 2018.

Trump increased taxes on imported industrial machinery and products, leading to staggering washing machine prices. This happened because local businesses increased their prices to match foreign products and realise higher revenue.

An ING Bank research revealed that proposed tariffs would mean an increase in US household expenses by approximately $2,000 per capita.

Now, if we merge this increase with the potential labour supply issues resulting from combating illegal immigration, the cost of production would increase, and inflation rates could see an uptick.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Conclusion

The US-China trade war enters a new chapter, triggered again by the same US president. Trump vowed to raise tariffs on imports into the USA to deter countries from loose border policies and drug trafficking.

China, Mexico, and Canada are the main targets of this decision, and they are, in fact, the top trading partners with the US. The new decision would see a 60% import tax on the Asian partner, with 10%-20% on Mexican and Canadian goods.

The promise is to boost the local economy and support homeland businesses. Will the US citizen pay the price?

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.