What Are Affiliate Programs And How Do They Work?

In this article, we will explain how affiliate programs work, discuss the main idea behind the affiliate business, outline affiliate business models, and show every affiliate component and key functionalities.

Are you a Forex, stock, or crypto broker? Then we highly recommend reading further to learn more about this approach if you’re interested in becoming an even more successful and modern business!

Affiliate Business As A Concept

First, let’s begin with the affiliate business as a concept.

The fintech world is a buzzing place where hundreds of firms are constantly launching new platforms and projects — brokerages, cryptocurrency exchanges, margin exchanges, converters, banks, etc.

The main way to introduce end users to the business is to market it publicly. Thanks to marketing, clients can get acquainted with a platform and then register with it, perform trades, and so on.

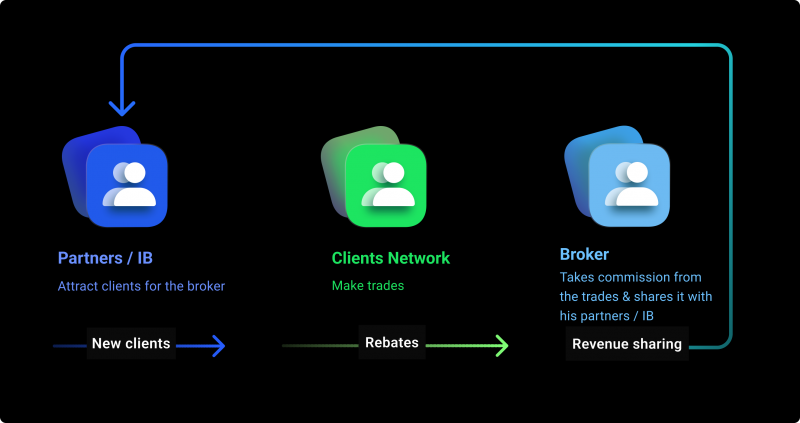

However, a completely new approach to introducing clients to businesses has emerged within the fintech industry. It is called the affiliate business, where apart from the broker itself and the clients’ network who make trades, there are also partners (IB, or introducing brokers). Such a relationship between the broker and these IBs is highly beneficial because partners introduce the end users to the main broker business. Partners who have their own network of users may want unique marketing tools, rebate programs, and so on, so they turn to the end broker.

When we talk about brokerages, there are generally two models: revenue sharing and cost per action, also known as CPA.

Brokerages allow end users to make deposits or withdrawals into their trading accounts, where they eventually trade, make profits, or lose money, which is an inevitable part of trading. Using these brokerages, all traders can try to gain profits from Forex or different types of markets.

When we talk about the IB-oriented model, it can be characterized as spreading out; it grows like a tree between end users and the brokerage, which attracts partners bringing their own markets and communities to the brokerage. That said, the IB-based model is free marketing — once you introduce partners and decide on the terms, partners will bring in their own users with their own deposits, which means additional revenue for your business. These “trees” are increasingly growing: brokerages invite IBs, who come as end users and then become IBs themselves. Consequently, more users join the ecosystem.

Now, let’s move on and discuss rebates models.

Rebates Models

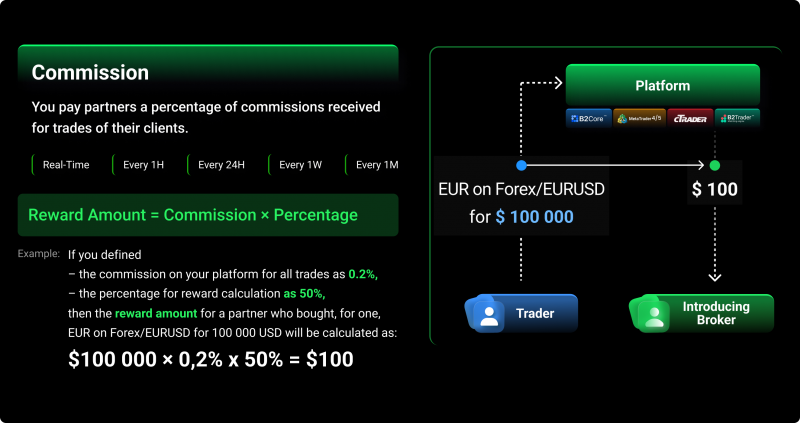

The simplest one is the commission-based model. It suggests that IB brings users to your brokerage and then receives a reward for every trade conducted by them. The process works as follows: after the user deposits money into his trading account, he starts to trade with you. At the same time, every trade he makes is accompanied by a commission. A part of this commission goes to the partner for providing his services.

You can set commissions for every hour, every 24 hours, every week, or even every month. However, real-time is the most common option since your partners want to take rebates right after trades.

The reward you pay your IB is the percentage of the commission that you take from client trades. Let’s take a look at the following example:

Say you define the commission of your platform for all trades to be 0,2%, and the percentage for the reward is 50%. Consequently, 100,000$ trade will mean that your partner will receive $100.

The more your end users make in terms of volume, the more rebates you’re paying to your IBs. Keep in mind that you can easily adjust the reward’s time frames, how much you want to pay, and so on.

Another rebate model is a markup model. In this model, you basically pay rebates to the partner according to the volume size of his clients and the marked-up spread. The formula for the rebate will be the traded volume multiplied by the markup. For example, if you set a markup of 14 points and the partner’s client traded the amount of 100,000 EUR on Forex, we can calculate the rebate as 100,000 EUR multiplied by 14 points, which equals 14 EUR.

Last but not least, there is a rebate model based on spread, which is the most widely used model in the industry. For instance, let’s take the gold and US dollar trading pair (XAU/USD). The spread rebate is calculated as follows: the ask minus the bid multiplied by the contract size (the contract that the brokerage can provide to the end trader) multiplied by volume in lots and multiplied by a percentage that you are willing to give to your partner as a reward. Let’s use the XAU/USD pair as an example. Assume that the spread of the XAU/USD pair is $0.12, and use 100 as the contract size wit 20 lots being executed by the trader with the commission set to 5% as the reward. To calculate the spread rebate, we would multiply $0.12 * 100 * 20 lots * 5% as a reward. $12 is what the IB will receive.

It should be noted that the rewards are fully customizable based on each and every brokerage model. That all comes down to the relationship between the brokerage and the IB.

It should be noted that the rewards are fully customizable based on each and every brokerage model. That all comes down to the relationship between the brokerage and the IB.

Affiliate System Components Flow

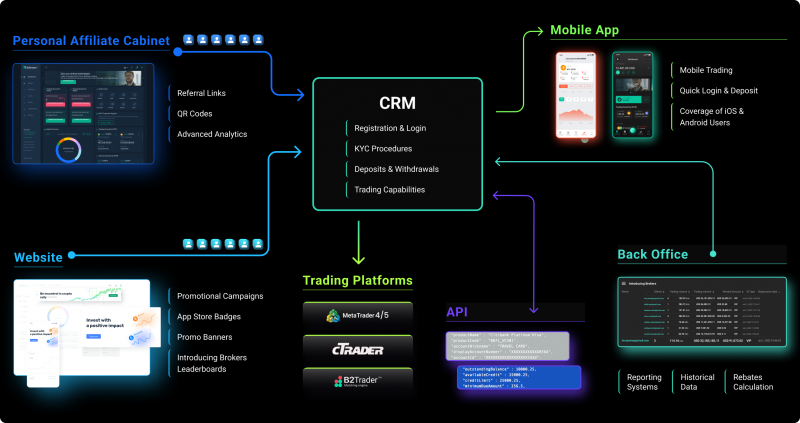

Personal affiliate cabinet is one of the main components of the system. All operations of the system must be smoothly interconnected with each other, so every participant needs to join this main centralized CRM where all of the functionality will be carried out. Utilizing CRM, end users can register, pass their know-your-customer procedures, or KYC, and deposit or withdraw funds. The rebates for every trade will flow back to the IBs via the CRM system.

Traders will log in to the system and register with IB’s referral link, so you can see who is coming and is engaged in your community. You can make this process easier for them if you have an easy-to-use website. It’s not only about bringing the users but also about retaining and making them want to come back to trade more. Therefore, your website must be organic and intuitive — you want to introduce your potential customers to your terms, your offers, and functionality like deposit methods, KYC procedures, and so on. Your website is the face of your business. Of course, you would like to introduce the affiliate business and provide information about all the important details of it.

So, everyone eventually logs in to CRM from the website and the client’s cabinet. CRM links everyone together because it integrates the trading platforms themselves, where all transactions will be executed, with the payment systems and KYC providers. Basically, the entire operation will take place there.

However, the back office is a primary source of information for owners since all the rebates are calculated here. The back office is where all brokerage officers, such as KYC compliance officers or IB marketers, can see who is the top IB, who is the worst IB, who needs more attention, who needs more coverage, etc.

Lastly, it’s important to have a mobile app. Once the business is online, once all of those components are up and ready, it is vital to make it comfortable for end traders to use trade everywhere, not just in front of their laptops.

Key Functionalities

Let’s examine the key functionalities of the affiliate business.

Below are the main components that you want to have in order to launch a successful affiliate business:

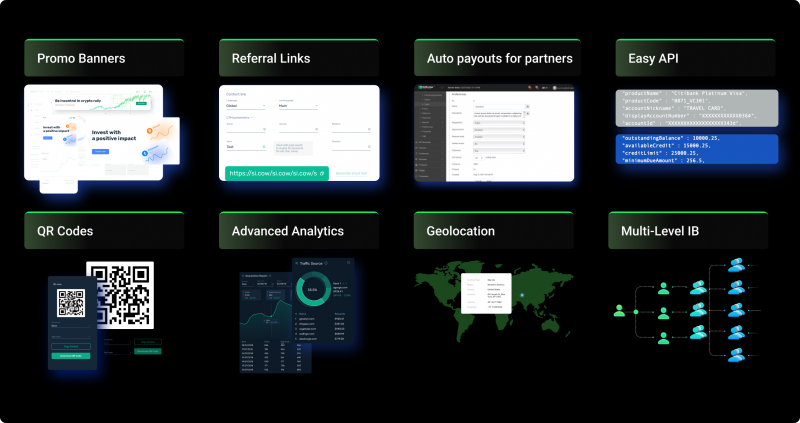

A) Promo banners

If you want to be successful, you will want to give the partner broker the option of putting the promo banner on the website to show the primary information about what end users will receive. You can include information about spreads, commissions, and other features that will attract clients. To do that, you just put in the HTML code with general CSS formatting, and you’re done.

B) Referral links

Referral links represent the connection between the partner and the end trader. When new clients register, the referral link allows the identification of the IB who referenced the new client. Using a referral link, which means registering with the invitation’s ID, indicates a connection between a trader and a partner. Once the trader starts making orders, he is automatically connected to the referrals and receives bonuses.

C) Auto payout for partners

Nowadays, nobody wants to calculate all the rebates manually. This could bring human errors and end up paying someone more or less. If that happens, you could end up losing the business partnerships. Therefore, there must be an automatic system that can efficiently calculate the trading volume, trading commission, and trading markups.

D) QR Codes

Using QR codes instead of typing everything manually makes things easier. Once your clients scan it, they will be redirected to the registration page and are automatically referred to the affiliate. It’s essential functionality for the affiliate part.

E) Advanced Analytics

Once you’re a brokerage and in communication with different affiliates, you want to ensure that you provide them with complete information. For example, what is the most exciting activity for your end traders? What are the top instruments that are being traded? Do people prefer to use iPhone or Android?

Your partners are doing work for you, so you want to share with them data that will help them to improve their operations.

F) Geographic location

Tracking the regions from which the end users came is also crucial. This data allows you to know where the marketing is most successful. You can easily target this territory and invest extra funds into this region and enhance marketing.

G) Multi-level IB

Last but not least, you are not just growing your client base; you are developing a large system with many partners and your brokerage. Therefore, you need to ensure that all your partners are high-quality and doing their job tight. This will allow the clientele to grow increasingly. The brokerage needs to come up with terms that will be suitable for the affiliate, allowing for growth for everyone involved.

Now, let’s proceed to the description of B2CORE.

B2Core: CRM, Client’s Cabinet, and Back Office Case

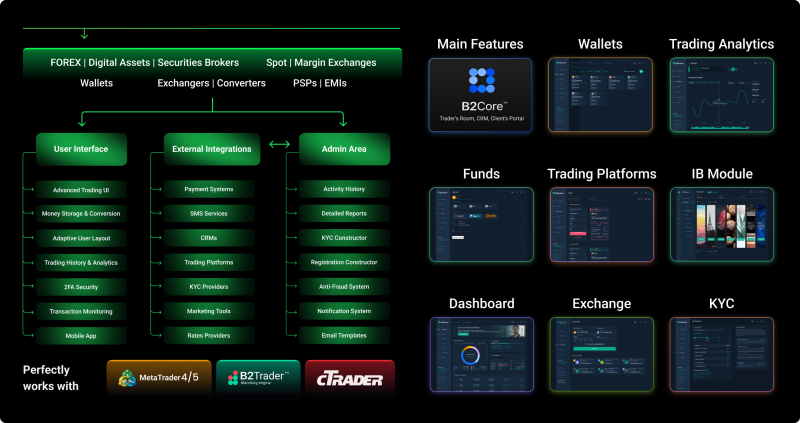

B2Core is the CRM system where all the functionality is aggregated to provide end users with the ultimate trading capabilities on different integrated platforms. B2CORE includes all the main features such as wallets, trading analyst’s funds, trading platforms, dashboards, exchange, KYC, and so on under one roof. Thanks to this solution, users can maintain their balances, deposit and withdrawal funds, and do other activities. Currently, it perfectly fits with MetaTrader, B2TRADER, cTrader, and others.

Moreover, this white-label solution allows for full customization under the brokerage name.

That said, you can use whatever business name you want. Your brand, which can be fully customized under the characteristics and layout of your choice, will eventually be able to target not only end users but also affiliates.

Representing in-house development technology systems, B2CORE functions as a CRM provider with complete SaaS solutions and white labeling. B2CORE is available on desktop, iOS, and Android.

The B2BROKER team also offers you a liquidity hub serving as the bridge to other exchanges or to perpetual futures. Also, a copy trading platform, a money management platform for copy trading, PAMM and MAM, and social trading, which are getting increasingly popular recently, are also available.

To conclude, knowing how affiliate programs work will let you leverage all the functionality and options available to the fullest. As a result, this will help you constantly grow and attract additional partners, leading to higher revenues and a better business environment.

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer