Top 10 Most Popular Trading Strategies

Articles

In this article, you’re going to learn about the top 10 most popular trading strategies employed by professional traders in all financial markets, from stocks and forex to cryptocurrencies.

If you’re someone who wants to become a trader, you know very well that it’s going to be complex, challenging, and risky.

To succeed in this incredibly competitive environment, you will need to develop a set of tools and strategies that you can add to your trading arsenal.

Trading Strategy #1 – Buy and Hold

As the name might suggest, buy and hold is a strategy you employ every time you buy an asset with the intention of holding that asset for a certain period of time regardless of its price fluctuations.

This is done with the expectation for long-term gains, and it’s a strategy employed over several years (and sometimes, even decades.)

This is one of the most popular trading strategies for people investing in stocks or other assets that have a history of slow but steady gains (such as mutual funds or index funds.)

If you’re a buy and hold investor, this means that you believe the likelihood for long-term potential gains ultimately outweighs the risk of short-term market volatility. There are many pros and cons to the passive buy and hold strategy.

In the cryptocurrency world, this strategy is often known as HODLing. HODLing is an investment strategy in which investors buy a crypto and hold it for a long time. The term “HODL” was coined in a Bitcoin forum, where a user misspelled the word “hold.”

Since then, the term has basically become synonymous with the strategy of holding onto cryptocurrencies with the expectation that their price will rise in the long-term.

Trading Strategy #2 – Value Investing

Value investing has been popularized by legendary investor Warren Buffet who is considered by many to be the world’s greatest value investor.

The strategy involves buying a stock or an asset that is undervalued by the market, with the belief that their genuine value will be recognized as market conditions change.

Because this strategy often involves finding companies with very strong fundamentals and a competitive advantage, it has become the go-to for investors who want to invest yet keep a certain margin of safety.

Trading Strategy #3 – Swing Trading

Swing trading is a popular trading strategy that involves aiming for quick profits resulting from short-term price movements.

While some swing traders open their positions and hold them open for a few days, others may go as high as a few weeks. Usually, these types of traders look for assets that are expected to move up in the short-term, and then they sell them once they hit their specific profit target.

If executed correctly, swing trading can be an effective way to trade, though it requires a good deal of trial and error (and not to mention, a lot of discipline.)

Trading Strategy #4 – Momentum Trading

Momentum trading is all about finding stocks or assets that are already on the way up, usually meaning they’re either increasing in prices or they’re achieving a significantly higher trading volume than usual.

If you’re a momentum trader, you’re typically focused on buying stocks based on their upward momentum and then selling them once that momentum begins to reverse.

Momentum trading has long been based on the idea that market trends continue for a while before they reverse, and it’s one strategy you should definitely have in your arsenal whether you’re a beginner or a pro trader.

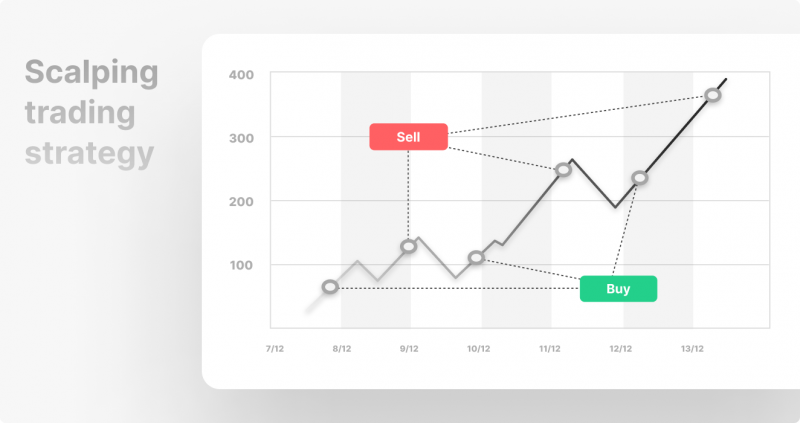

Trading Strategy #5 – Scalping

Scalping is a trading method that involves quickly buying and selling assets, often within the span of a few minutes or even seconds.

With the idea being maximizing the profits on each trade and taking advantage of bid-ask spreads and small discrepancies in the market, this has turned into a very high-frequency strategy utilized by a small portion of pro investors.

If you want to make scalping work for you, just know that you need to be fast, execute boldly, act on tight spreads, and most importantly, have pretty good reflexes.

Trading Strategy #6 – Day Trading

The day trading strategy has been popularized in the cryptocurrency community due to its pre-conceived volatility.

The strategy involves opening buy and sell positions on a stock or another asset usually within the same trading day, and often using technical analysis to try to predict short-term price movements. Although day traders are interested in making small gains on each trade, some go as far as using leverage to amplify their returns.

Although sometimes highly profitable, the trading strategy also carries many risks so it’s not the best strategy to employ if you’re a beginner who hasn’t learned to manage risk. In the crypto space, many traders prefer day trading because there are many cryptocurrency exchanges that make it easy and accessible to trade cryptocurrencies.

Trading Strategy #7 – Positions Trading

Position trading is a strategy in which traders or investors hold a specific position for weeks or months and largely base their decisions on macroeconomic trends and fundamental analysis.

Position traders are often interested in long-term trends, and they aim to profit off these larger price movements over an extended period of time. Although it’s definitely less stressful and high adrenaline than day trading or swing trading, it also requires an enormous amount of patience and discipline.

Trading Strategy #8 – Arbitrage

Doing arbitrage means buying and selling certain assets and securities and trying to take advantage of the price discrepancies between them.

In one example, an arbitrage trader (also known as an arbitrageur) might buy a crypto coin on one exchange where it’s undervalued and then sell it on another exchange where it’s overvalued, profiting from the difference.

Although it carries the potential for profit, it requires very quick thinking, access to multiple platforms in which the asset can be bought and sold, and a deep understanding of the market dynamics.

Trading Strategy #9 – Options Trading

Options trading is a type of trading in which you may bet on the future direction of the price of an asset with the help of something called an options contract.

If you’re an options trader, you might buy a “call” option if you believe that the asset will rise in price, or a “put” option if they believe a stock might tank in price.

Options are largely used for speculation and hedging, allowing a trader to profit off the market movements or even protect them against losses. However, it also a high level of risk similar to other speculative modes of investing.

Trading Strategy #10 – Market Making

Market making is a strategy used by traders who want to provide liquidity to the market by engaging in traders.

Market makers buy at something called a “bid” price. This is the highest price a buyer is willing to pay for a specific crypto or another asset. Then, they sell that asset at an “ask” price. This, as the name suggests, is the lowest price a seller is willing to accept for their crypto.

By providing both buy and sell orders, a market maker can basically narrow down the spread between bids and asks. This improves the market efficiency significantly and makes it very easy for other traders to buy and sell crypto.

In the crypto world, market making can be a profitable strategy because it allows traders to capture the various differences between bid and ask prices. This difference is known as the spread.

You should keep in mind that market making also assumes a high degree of risks because you, the trader or investor, must hold an inventory of specific cryptos in order for you to make trades.

Which crypto trading strategy is right for you?

Because the crypto market is, by nature, highly volatile, it’s important that you’re always aware of the risks involved and have realistic expectations about the outcome of the strategy you’re going to employ.

It’s absolutely crucial to stay up to date with all the latest news and developments in the crypto space. If you can gather enough data and use the right strategy to trade or invest your funds, you will likely be much more successful than those who don’t.

Ultimately, successful crypto trading (or trading altogether) requires a combination of knowledge, skill, and discipline. By keeping a cool head, doing your research, and being patient, you can potentially achieve significant gains in this new ever evolving market.

FAQ

What are some trading methods commonly included in popular trading?

Many investors rely on simpler approaches like “buy and hold” or “value investing” as part of their popular trading strategies.

Why are long-term strategies for trading stocks often considered effective?

They help investors ignore short-term market noise and focus on real company growth, which makes these strategies for trading stocks highly appealing.

Are there trading methods suitable for investors who have limited time?

Yes, swing trading or momentum trading are popular trading methods for those who prefer not to monitor the market constantly.