What Crypto Winter Means and When It Will Come to a Close?

Articles

A crypto winter occurs when digital asset prices decline and stay much lower than their most recent peak, similar to a bear market in traditional stocks. Technically, bear markets demand a 20% peak-to-trough price decline, but there is no such metric for crypto winters. However, with Bitcoin down more than 65% from its all-time high of 2021, it is obvious we are experiencing crypto winter.

No doubt, cryptocurrencies have had the best of times. Bitcoin (BTC), the crypto market’s bellwether, is currently hovering around $21,000, over 65% off its November 2021 high. Major altcoins like Ethereum, polygon(MATIC), Cardano (ADA), and so many others have been feeling the heat of the bear season.

These challenges have also been felt in the broader crypto community. The first cryptocurrency ETF in the market, ProShares Bitcoin Strategy ETF (BITO), has had a year-to-date decline of more than 58%.

Since cryptocurrencies are a relatively new asset class, it is challenging to anticipate when this particular crypto winter will end by looking at their long historical trends. But we can identify the starting point thanks to the amazing power of hindsight.

Key Takeaways

- Crypto winters are a phase in the crypto market circle; they represent times when crypto asset prices depreciate

- A bull sea precedes every crypto winter; possible signals for the end of a crypto winter are often seen from the rallying of altcoins, more investments in good crypto projects and Bitcoin halving

- This article also highlights possible tips to imbibe during crypto

Common Opinions On Crypto Winter

With the collapse of the cryptocurrency market in 2018, venture entrepreneur Eugene Etsebeth created the phrase “crypto winter.” It indicates that the cryptocurrency market is struggling, comparable to the stock market’s bear market in terms of its performance.

According to Piers Ridyard, the CEO of RDX Works based in Switzerland, when the stock market is negative, it declines. In contrast, the market moves sideways during crypto winters and is largely flat. As a result, an investor sees negative returns.

According to crypto analysts, the seeds of the current crypto winter were planted in the first half of 2022. The crypto winter is primarily due to several global events, high inflation, and rising interest rates. However, this is not the first crypto winter we have seen and might not be the last.

Besides the narratives, Eugene Etsebeth created the “crypto winter” phrase. The popular HBO series “Game of Thrones” is also likely another major origin of the term “crypto winter.” Winter Is Coming served as the House of Stark’s motto in the television series. It was interpreted as a sign that Westeros could face protracted conflict at any time.

In a more literal sense, “crypto winter” refers to a period when prices decline and stay low.

When Did Crypto Winter Start?

According to analysts, steep sell-offs from an all-time high in the price of Bitcoin typically signal the start of crypto winter.

Before beginning an extended decline, BTC reached a 52-week high of $68,990 in November 2021. From November 2021 until the beginning of September, Bitcoin has dropped significantly, dropping approximately 65%. A little more than BTC’s 52-week low of $17,708 on June 18, the crypto bellwether has been circling $20,000 recently.

Since its peak in November, Ethereum, the second-largest cryptocurrency, has decreased by 67%. Naturally, many cryptocurrency investors are interested in discovering if the merger of Ethereum and the second-largest cryptocurrency could aid in its recovery. But now, it’s too early to judge how well that improvement worked.

But according to experts, the current recession is getting worse due to expectations for further Federal Reserve monetary policy tightening, and institutional investors are driving sales. Given the decline in Bitcoin price, any investors who bought Bitcoin in the previous year will have suffered a loss.

Before the most recent cryptocurrency winter, Bitcoin had a high of about $19,500 in 2017 and a low of less than $3,300 in 2018, a loss of at least 83%.

The Federal Reserve injected unprecedented amounts of cash into the financial markets in late 2020 and early 2021, which is why the cryptocurrency markets skyrocketed during that time.

As a result, the crypto sector saw a significant period of hypergrowth in 2021, adding thousands of new crypto projects. Up until late last year, when things started to turn around, that huge boom phase persisted.

“In my opinion, recent months have seen an increase in the risks associated with cryptocurrencies. According to Robert Johnson, professor of finance at the Heider College of Business at Creighton University, “speculators are being particularly battered as they see Bitcoin drop abruptly from over $68,000 to current levels of under $20,000.”

When Will Crypto Winter End?

According to the majority of analysts, “stronger cryptos” will win out, and weaker crypto will fade out in the future of the cryptocurrency industry.

However, some investors still enjoy the pullback because they see it as an opportunity to increase their long-term investments in the market. Once the global political and economic crisis has passed, they are counting on a cryptocurrency resurrection.

For instance, Charles Schwab introduced its Crypto Thematic ETF (STCE) in mid-August despite all the negative headlines around cryptocurrencies. The assets managed by STCE total $7.6 million. The ETF monitors businesses that stand to gain from creating and using cryptocurrencies and other digital assets.

Alexis Ohanian, a co-founder of Reddit, recently took advantage of the bear season to raise over $200 million for a new fund via his seven seven six firms, which will only be invested in cryptocurrencies.

Bitcoin Halving and Its Impact On the Crypto Market

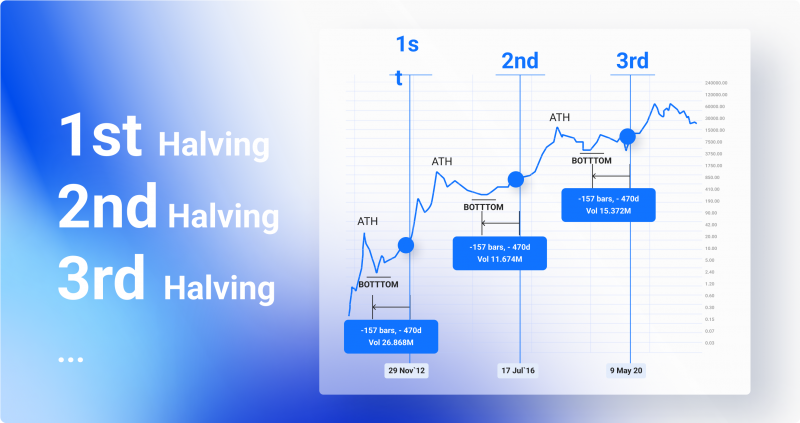

Bitcoin halving is a major indicator for determining the end of crypto winter. It occurs when miners’ reward (the reward for mining bitcoin) is reduced by half.

Halving is one of the most significant occurrences in the crypto space. The inflation rate is lowered with each halving, which raises the price of bitcoin (this is the belief). As of 2022, those participating in Bitcoin’s blockchain network as transaction processors and validators— known as “miners”—are paid 6.25 bitcoins (BTC) for each block they successfully mine.

The block reward will be halved again in 2024, dropping to 3.125. The effect of each halving will gradually lessen as the block reward gets closer to zero.

According to Du Jun, a co-founder of Huobi, if historical price cycles are any indicator, the next bull market for Bitcoin might not come until late 2024 or the start of 2025.

He also said that halving generally happens every four years and is specified in the code that underlies bitcoin.

In May 2020, the last halving, and in 2021, bitcoin reached an all-time high of more than $68,000. When the rate was halved in 2016, a similar thing transpired. The price of bitcoin reached a record high the following year.

Tips On How to Survive the Crypto Winter

Investing can be a whirlwind of emotions, whether we’re talking about stocks or cryptocurrency. It can be difficult to shake off the exuberant hangover from a year like 2021; however, the tips below could help you survive the crypto winter.

1. If You Must Pay With Crypto, Use a Stablecoin

Stablecoins offer the effectiveness and anonymity of cryptocurrencies but without volatility. Most pay merchants also accept the most well-known stablecoins, like USDC, GUSD, Binance USD, and others, in addition to conventional coins.

2. We’ve Gone Through this Before, Don’t Be Aghast

Crypto winters won’t last forever because it’s a phase that will pass; today’s lows were previous highs. Also encouraging for the space’s prolonged existence is that new ecosystems and technologies have continued to thrive there during the following years.

3. Upgrade Your Knowledge Of Cryptocurrencies

Like the last bull run, many newbies with little or no knowledge came into the crypto space at the peak of the bull run and could only do a little because of their lack of knowledge.

The current downtime is just the best time to brush up on your knowledge of cryptography basics, such as proof of work versus proof of stake, custodial versus non-custodial wallets, various types of crypto wallets, stablecoins, and other topics.

4. Keep Yourself Updated

Following a few reliable crypto news sources is fantastic, but going overboard with the analysis could make you even more anxious. It’s generally best to take it with two grains of salt because, in particular, crypto Twitter can be a murky stew of deluded shilling and unwarranted fear, uncertainty, and doubt (FUD) from the doubters.

5. Use The Dollar Cost Averaging (DCA) Technique

When you start your financial action plan, you may have had specific thoughts and objectives. A market slump only fundamentally changes your motives for investing if you already know you’re a diamond-handed HODLer.

6. Use The Dollar Cost Averaging (DCA) Technique

By acquiring more of an asset in equal amounts over time at regular intervals, dollar cost averaging is a method that enables investors to reduce their cost basis for the asset. The aim is to remove some emotion from the decision-making process by automating your investing. Additionally, it provides you with chances to purchase assets for less amount.

7. Invest In Legitimate Passive Sources Like Staking

There are a lot of reputable platforms for staking your crypto and earning passively; platforms like Binance, for instance, offer different; platform packages that allow for flexible and locked staking options with varying yields.

8. Research and Buy the Dip if You Can Afford it

Low prices are a given during the crypto winter. If you hang out in the crypto community at any time, you’ve undoubtedly heard the rallying cry of exhortations. So your decision to invest in a particular project is entirely up to you, but if you want to purchase the dip, avoid using your rent or feeding money to do it.

9. Don’t Panic Sell

As previously noted, crypto winters cause many people to feel uneasy about investing in cryptocurrencies. Someone has screamed out that cryptocurrency has been dead each winter since the beginning of time.

But despite everything, cryptocurrency is still around as we enter our third crypto winter. Even though cryptocurrency can be risky, it is still an investment.

Advantages of Crypto winter

As earlier stated, crypto winter is not the end but rather a phase that will pass. It comes with its advantages.

According to Jake Weiner, founder and CEO of Uncommon, “we observed a lot of weak new firms around the sector over the previous year, and many of them will fail.”

Weiner claims that more cryptocurrency businesses will cut spending as competing for venture capitalist dollars becomes harder. Sadly, some employers will be compelled to fire employees.

Conclusion

A crypto winter’s start and end dates are impossible to forecast with precision. By following bitcoin news and keeping tabs on communities on social media networks, one can gain insights into investor attitudes and future investments.

The cryptocurrency market is not for the “weak hands”. During bull runs, upside volatility can help cryptocurrencies fly to incredible highs, but it can also cause them to crash violently during protracted downturns. But historically, some of the biggest successes in the field have been those who adopt a long-term perspective and learn to accept downturns.