What is Notional Value, and How do Brokers Calculate It?

This piece will answer one of the essential questions: What is notional value? How can you calculate notional value? How can you utilise this concept to hedge market risks?

Spot trading is no longer the definitive choice for investors and traders worldwide. Since the trading industry has lowered its barriers and now accommodates all individuals with internet access, it has become essential to develop leveraged trading strategies. With leverage, investors can punch above their weight by acquiring multiplied trading positions, earning profits even with limited budgets.

However, leveraged trading practices are quite complex, requiring a firm understanding of technical details and intricacies. Otherwise, your margin account will lead you to a margin call, with brokerage companies seizing your entire portfolio. This piece will answer one of the essential questions: What is notional value? How can you calculate notional value? How can you utilise this concept to hedge market risks?

Key Takeaways

- Notional value is the total value of an underlying asset featured in a contract, separate from the contract’s value.

- Notional value is crucial in understanding potential profits and market exposure risk during investment deals.

- Notional value is featured in derivative contracts like futures, swaps and many other instruments.

What is Leveraged Trading?

Before discussing the notional value concept, let’s analyse the nature of leverage in modern trading. Since the investment industry is no longer exclusively accessible to wealthy individuals, hedge funds or other large institutions, brokerages and exchanges have formulated new mechanisms to empower their retail trading audience.

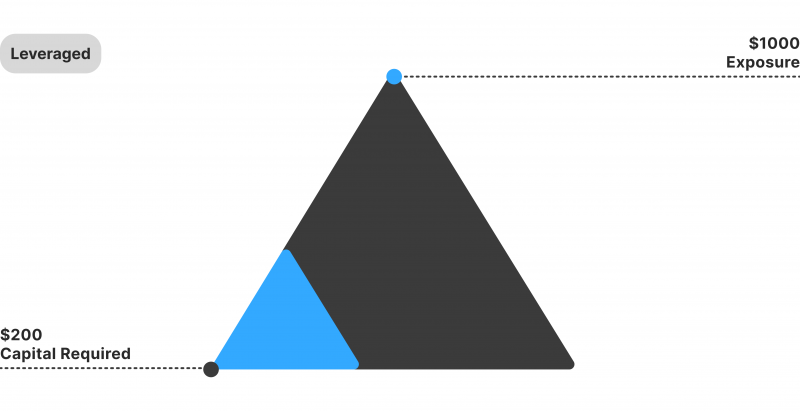

Leveraged trading is also known as margin trading. This practice allows traders to increase the total value of their potential profits from their investment strategies. Suppose you only have $5,000 as an investor, and you are confident that Nvidia’s current market price is about to increase two-fold in the coming months. While the projected growth of Nvidia is extremely promising, your entire investment capital will only yield another $5,000 in several months.

However, as a trader, you can create a brokerage account and increase the contract size for your derivative agreement on Nvidia’s stock. By acquiring a futures contract, you can gain a leverage ratio anywhere from 2 to 50, depending on your initial investment amount and track record.

This means that you will be able to purchase Nvidia stock without actually acquiring ownership of the underlying asset and sell it at a specific date. As a result, you can extract a larger amount of money from your correct predictions.

To follow Nvidia’s example, if you acquire a 5:1 leverage ratio, your earnings will constitute $25,000 instead of $5,000. Naturally, you will have to pay an interest rate to maintain your position until execution, but this expense is generally affordable compared to owning the asset.

Trading Beyond Your Financial Capabilities

As explained above, leverage allows you to multiply your profits even with limited budgetary capabilities. If you acquire leverage, your trading strategies will become more promising and riskier in the long run.

Leveraged trading is not for newcomers, though, as it presents amplified risks compared to spot trading practices. If your strategies will not pan out and you experience too many losses on your portfolio, your account will be seized by the brokerage business.

However, for experienced traders, margin trading can catalyse their road to success. Investors can swiftly increase their trading budgets with leverage and access large trading volumes. With enough expertise, it is possible to mitigate margin trading risks, employing cross or isolated margins to either consolidate or divide risks based on your specific strategies.

The invention of margin trading has allowed many retail traders to accumulate significant wealth, making this trading practice one of the most popular offerings in 2024.

How do Brokers Calculate Notional Value?

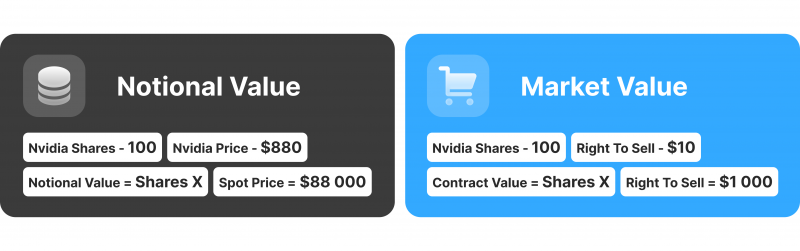

Notional value plays a crucial role in leveraged trading instruments, presenting the total potential value of a position. As a quick example, suppose you are considering buying Nvidia stock today to sell it at the height of its market face value. Currently, Nvidia stock is priced roughly at $880. You wish to purchase 100 shares but only have $22,000 available as an initial margin.

In this case, the notional value of the underlying asset is $88,000. To execute the trade at this notional volume, you will need a leverage ratio of 4:1. If your brokerage platform grants you this leverage ratio, you will be able to execute the trade without any complications.

So, understanding notional value is critical for individual investors and companies wishing to grasp their market exposure. Without knowing how notional value is used, you might not know how much risk you are up against or how much potential income your traders will yield after successful execution.

The above-presented example of a notional value of $88,000 is indicative of tremendous profit potential but also an enhanced amount of risk. Both metrics are crucial for investors or companies that employ derivative contracts or leveraged risk mitigation strategies.

Notional vs Nominal Value

Now that we understand the notional value meaning, let’s assess the difference of nominal vs notional amounts in trading. The nominal amount of the contract is also referred as a market price of the underlying contract. The nominal or market value in our Nvidia example would be the price of a futures contract acquired by the trader.

For example, if you wish to purchase Nvidia’s 100 shares in the future, the market value of this contract is much less than the notional amount of $88,000. Suppose the futures contract for each share equals $10. This means that the entire contract price will equal only $1,000. However, the position’s value can change depending on the stock’s performance or any underlying asset.

On the contrary, the notional value is calculated based on the asset’s market price and not the contract agreement. Knowing both figures at all times allows you to have a firm understanding of your trading positions.

For example, selling the acquired contract might be more profitable than carrying out the position for your own profits. To conduct this analysis, you need to know how your contract is valued compared to the potential profits acquired with the notional principal amount.

Applying Notional Value in Different Sectors

The notional value concept is useful in various scenarios and across different trading fields. Since leveraged trading has become popular in all major investment sectors, the notional value number has never been more prominent in the trading landscape. Let’s discuss.

FOREX

The notional value in FOREX is determined by the two parties that create a derivative agreement. In FX, derivatives are mostly used to exchange currencies at a specific date and with a fixed amount. The notional value, in this case, is the primary currency of exchange, as agreed upon by both parties.

Considering the tight profit margins of the FOREX industry, the notional value is critical in FX derivatives. The popular currencies on the exchange market are very saturated, resulting in minimal profits for retail traders. So, multiplying their profits by acquiring leveraged positions is a dominant strategy if traders are willing to take on the market exposure risk.

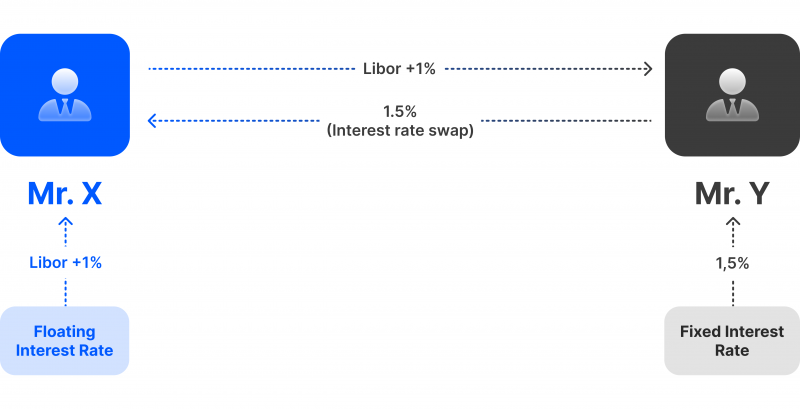

Swaps

Swap contracts can be applied to a variety of asset classes across industries. However, their popularity and unique use have transformed swaps into an industry. From interest rate swaps and total return swaps to currencies, commodities and equities, the swaps market can help you change your financial footing in various ways.

Interest rate swaps are a fascinating option for investors and mostly organisations to exchange the interests receivable with each other. Moreover, total return swaps allow parties to create an agreement where one party pays specific fees in exchange for capital gains of a pre-determined asset volume. Nominal values are crucial in both contracts, deciding the total volume and basis for the agreements and allowing parties to determine their potential income levels.

How to Use Notional Value in Risk Hedging

The notional amount definition is not only useful in maximising profits but hedging risks as well. Imagine you have asset X in your portfolio, and you just found out that it might be heading toward undervaluation soon. You can purchase a futures contract at a fixed rate to mitigate market exposure.

The futures contract allows you to set a fixed selling price for your assets, letting you hedge your risks against asset devaluation. As a result, you will have a chance to sell the asset at a preferred price even if its notional value vs. market value has become unfavourable.

Considering the fractional price of futures contracts, hedging your risks with this strategy is a great way to ensure your long-term solvency as an investor or an agency.

Final Thoughts

Notional value is a prominent part of leveraged trading across industries and sectors, making it easy for individuals and companies to assess their market exposure and buying power. So, understanding the notional value is important regardless of your role and responsibilities when you deal with margin trading or derivatives.

This simple figure determines whether investors will be profitable or if the brokers will provide a sufficient leverage ratio to reap significant profits from derivative contracts. Notional value is also critical in assessing the continued risk exposure of your contracts, allowing you to adjust strategies if necessary.

So, before you decide to create a new contract or take up a leveraged position, be sure to check the notional value number of your agreement and assess it carefully.

FAQ

What is the notional value of options, and why is it important?

The notional value of options represents the total value of the underlying asset in the contract, separate from the contract’s actual price. It is critical for assessing market exposure and potential profits when trading options.

What does notional amount mean in trading?

The notional amount refers to the total value of an asset involved in a derivative contract. This figure is essential for understanding the potential risk and reward of a trade, as it determines the scale of the market exposure.

Notional vs. market value: what’s the difference?

Notional value refers to the value of the underlying asset, while market value represents the price of the contract itself. For example, in futures trading, the notional amount might be the value of the stock, whereas the market value is the cost of the contract.

How does the definition of notional amount help in leveraged trading?

The notional amount definition helps traders calculate their market exposure and potential profits in leveraged trading. By knowing the notional value, traders can gauge how much they stand to gain or lose and adjust their strategies accordingly.

What is notional exposure, and how is it calculated?

Notional exposure definition refers to the total market value a trader is exposed to through derivative contracts. It is calculated by multiplying the number of contracts by the notional value of each underlying asset, giving a clear picture of risk and leverage.

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer