What Do Equities Stand For and How Do They Work?

Today, the world of electronic trading is a haven for many groups of society, from novice speculators to the most prominent professional players represented by institutional equity investors. The polarity is based on various financial markets, the most popular of which has recently become the digital asset market. However, despite this, many experts in the field of trading still prefer classic types of trading instruments, among which equities are in the lead.

This article will cover the question of what equities are and their features. We will also look at the main types of equities on the stock market, their purpose, and the process of issuing them in an IPO. Finally, you will learn about some of the most famous stock exchanges for buying equities.

Key Takeaways

- Equities are a classic trading instrument that can be found on any stock exchange.

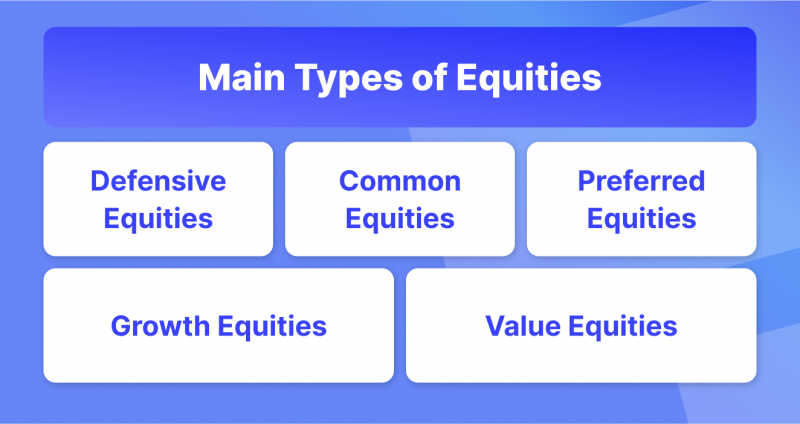

- The most common types of equities are common and preferred. However, there are also growth equities, value equities and defensive equities.

- Equities appear as a result of IPO, which includes several stages and serves as the main process in which the issue of equities.

What are Equities and What Features Do They Have?

A share is a registered issuance security indicating a contribution to the authorized capital of a joint stock company, issued for an indefinite term in book-entry form and certifying a certain amount of rights of the owner depending on its category (ordinary or preferred), type (for preferred equities).

Each share has a nominal value, which is an essential requisite share and corresponds to the amount of the contribution to the company’s authorized capital attributable to the share. The amount of the authorized fund of each joint stock company is equal to the sum of the nominal values of equities issued by that joint stock company.

Placement of equities at a price below par value is not allowed; that is, each investor purchasing equities must contribute a certain amount (or another property equivalent to that amount) to the authorized capital of the company, and the nominal value of equities determines the minimum amount of that amount.

Equities are issued in uncertificated form and do not have any physical expression in the form of a document executed in accordance with the requirements. Record of rights on equities is carried out by the depository by maintaining special registered accounts – “demat account” opened for each owner. To confirm the right of ownership, the shareholder can get a statement on his demat account from the depository at any time. Depositaries also carry out activities related to the transfer of equities between owners based on the results of completed transactions, for example, by transferring equities from the seller’s demat account to the buyer’s demat account, accrual, and payment of dividends on equities.

It is possible to buy equities in order to participate in the management of the company, but more often the purpose of investing money in equities is to receive income:

Through dividends

Dividends may be accrued by the decision of the general meeting of shareholders, either at the end of the year or for each quarter. It should be noted that if there is profit at the company’s disposal, the payment of dividends on preferred equities is the company’s responsibility. In contrast, the payment of dividends on common (ordinary) equities is carried out only if the general meeting of shareholders decides to direct it to the payment of dividends on common (ordinary) equities. That is, the purchase of equities does not guarantee a stable income in the future;

By increasing the market value of the stock at the time of sale

In this case, the income will be the difference between the sale and purchase price of the equities. However, you should not forget that the price of the stock in the market at any time can both rise and fall, which on the contrary will lead to a loss of money funds.

According to statistics, stocks are the most popular financial instruments in terms of asset liquidity and risk ratio.

Main Types of Equities on the Stock Market and Their Purpose

Today, the stock market is a time-tested system of electronic securities trading, which after many years, attracts the attention of not only professional pioneers of the industry but also beginners who want to learn the basics of investing in equities. At the same time, the stock market has grown significantly and today contains a countless number of equities (or shares) that can be divided into the following types:

Common Equities

Common equities is a security that has a higher degree of risk than bonds or preferred stock. Holders of common stock need to know their income in advance. Dividends on these equities can vary from year to year. If the company does well, it may pay significant dividends. But when times are tough, the company may not declare a common stock dividend. Also, even in good years, it may decide not to pay dividends but to leave the profits for production development. Sometimes dividends may be paid in new equities.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Preferred Equities

Preferred equities occupy an intermediate position between bonds and common equities. Preferred equities, like bonds, most often pay a fixed income as a percentage of the face value of the share. Unlike bonds, preferred equities are not a debt of the company that issued them, have no maturity, and create no property claims against the company by their holders, even if no dividends are paid on them.

The issuance of preferred equities enables joint stock companies to raise the necessary capital and simultaneously allows holders of common equity to retain control of the company. Preferred equities generally have no voting rights. But sometimes, under the terms of some issues, they may be vested with voting rights if no dividends are paid.

Growth Equities

Growth equities are a company’s securities with rapidly growing revenues and significant potential for future price appreciation. The securities of such issuers usually grow faster than value equities, which are owned by large and stable companies. However, representatives of growth equities rarely pay dividends and can fall heavily if financial problems arise.

Growth equities are issued by companies that are growing at a rate outpacing the average market growth and have dominant market potential going forward. Most growth companies’ profits are typically far into the future, with uncertainty. Thus, the price of securities depends on expectations: whether the market will grow, whether management can handle the scaling of the business, and whether there will be enough money to develop it before it enters profits.

Value Equities

Value equities (or companies) are the opposite of growth equities. If you look at key indicators, such as dividends or profits, such companies are significantly undervalued and are usually cheaper than their market counterparts. Often securities are undervalued because of external factors, not real financial indicators. For example, if a company is experiencing temporary difficulties, which are typical for the whole industry. Investors buy these types of equities in the hope that someday the market will recognize the true value of the company and the equity price will rise.

Defensive Equities

Defensive equities are securities of stable companies that profit and are less reactive to market fluctuations, external factors, and economic shocks. As a rule, these are shares of companies that produce a product that enjoys stable, well-predictable demand regardless of the market situation.

Defensive equities frequently give investors high returns compared with bonds and lower risks compared with “popular” equities. One source of high returns when buying such equities is their stable dividend yield, regardless of the state of the economy. Typically, non-cyclical dividend-paying companies do so steadily over a long period of time (10 years or more). This is because the financial performance of such companies does not depend on the phase of the economic cycle.

How Equities Appear on the Market: Initial Public Offering (IPO)

Initial Public Offering (IPO) refers to equity-based sources of financing. The IPO process consists of a private company offering its equities for the first time on a stock exchange employing an open subscription organized for an unlimited number of potential investors, during which it receives financing in exchange for the assignment of a stake in the company. The company uses the funds raised for its own purposes and goals, and the investors become shareholders.

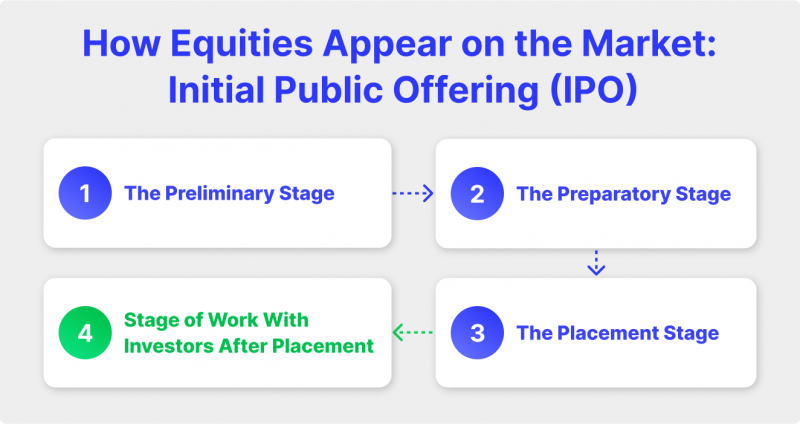

Issuing equities can be divided into three stages: the preliminary stage, the preparatory stage, the placement stage, and the stage of working with investors after the placement. Each stage may consist of several stages. The details and specific timing of the various stages may vary, but the sequence of the process itself remains constant. At each stage of the IPO, the company’s share offering price is formed. The process of public offering is time-consuming and requires certain expenses from the issuer.

The Preliminary Stage

In the preliminary stage, management will have to determine the preference for initial public offerings over other sources of financing. In the case of traditional companies, the top management should analyze the financial indicators for the retrospective period: if the growth rate is higher than the industry average, as well as good values of profitability and liquidity, the company has a better chance for a successful IPO. Otherwise, investors may not be interested in the securities of a publicly traded company, and, as a result, the necessary amount of funding will not be raised.

The Preparatory Stage

Approximately two years before going public, a company that has decided to go public undertakes certain internal measures to increase the transparency of its legal structure and financial statements and improve its governance. The company management develops corporate governance principles, creates appropriate structural divisions, and prepares the necessary information base for the issue. The preparatory stage includes many stages, but its essence is as follows.

The Placement Stage

Based on investor demand generated during the application process, the company’s management and the investment bank make the final decision on the offering price and number of equities. Once the final offer price and issue size has been agreed upon, the final version of the prospectus and the price amendment are printed, and a few days later, the IPO goes into effect. The transaction is deemed completed when the company hands over the securities to the lead investment bank, which transfers the funds raised to the company’s account, subject to its remuneration. This is how the placement stage is carried out.

Stage of Work With Investors After Placement

At this stage, the issuer provides an IPO report which contains basic information about the flotation: the start and end date of the IPO, the offering price, and the amount of funds raised. At this time, the lead manager is responsible for the equities’ price stability, as the IPO’s effectiveness largely depends on how the share price behaves in the first days after the placement. The lead investment bank also ensures that the demand for the offering is maintained to provide secondary liquidity, which is of great interest to investors.

Leading Stock Exchanges for Buying Equities

The stock exchange is the central point where the process of securities trading takes place. Having a complex system of interconnected elements, the stock exchange offers access to a wide range of systems necessary for interaction with the market. Among the largest and best-known stock exchanges today are the following:

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

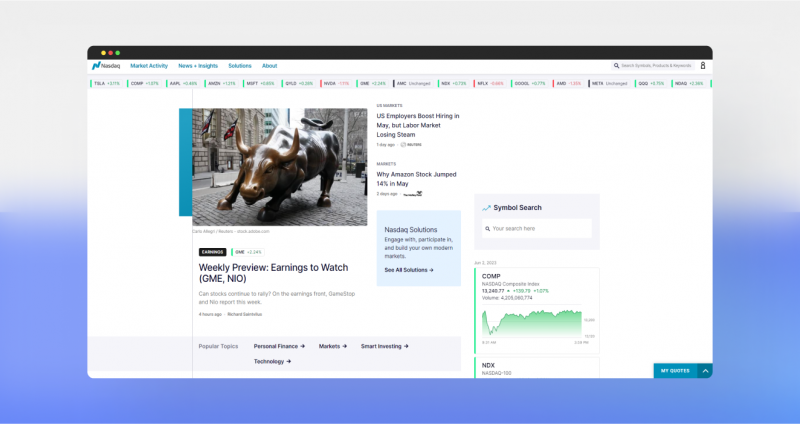

National Association of Securities Dealers Automated Quotation (NASDAQ)

NASDAQ is an American stock exchange specializing in shares of high-tech companies, one of the 3 major U.S. stock exchanges, along with the NYSE and AMEX.

The NASDAQ composite index is based on the market-weighted value of stocks of high-tech issuers. This means that each company’s security affects the index in proportion to the company’s market value. During a trading session, the Nasdaq index calculates the market value of more than 5,000 companies.

Tokyo Stock Exchange (TSE)

The Tokyo Stock Exchange is the largest of Japan’s eight stock exchanges. It accounts for 85% of Japanese securities turnover. The first section includes securities of 1,200 influential companies. The second section, where requirements for inclusion in the quotation list are less stringent, includes securities of 450 issuers. The third section lists foreign securities. The exchange also operates an over-the-counter stock market registered by the Association of Japanese Securities Dealers. The exchange members are permanent members who act as principals in transactions or agents who may only be intermediaries between permanent members.

Shanghai Stock Exchange (SSE)

The Shanghai Stock Exchange is the largest in Asia, based in China. The main financial instruments used on China’s largest stock exchange are stocks, bonds, and various stock indices. The Shanghai Stock Exchange is one of the few, and the only, of the major such organizations that did not cease operations for a single day, even during the global financial and economic crisis of 2008-2009.

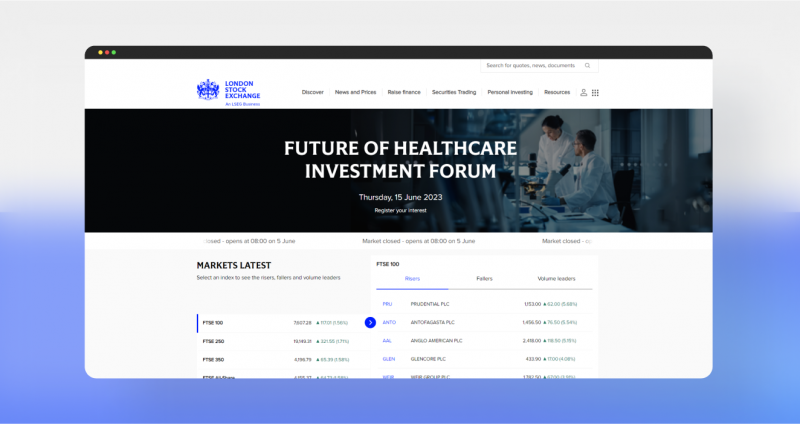

London Stock Exchange (LSE)

The London Stock Exchange (LSE) is considered the most international exchange, accounting for about 50 percent of international stock trading. It is itself a public company whose shares are traded on it. It is one of Europe’s largest and oldest stock exchanges and one of the world’s most famous securities markets. This exchange also has several essential divisions, including the non-ferrous metal exchange.

Conclusion

Stocks are a great tool for exaggerating capital and today remain one of the most reliable, time-tested trading tools, which has its own features and can be bought on any well-known international stock exchange, which together make the stock market one of the most trending and fastest growing at all times.

FAQ

What is the largest equities market in the world?

In March 2023, the New York Stock Exchange had an equity market capitalization of approximately 25.1 trillion US dollars, making it the largest stock exchange in the world.

What are private equities?

In private equity, companies are acquired and managed before being sold by investment partnerships

Why are equities volatile?

The fundamental cause of equity volatility is the large fluctuations in stock demand and supply. Volatility may also be caused by changes within the company or in national or global economies in which they compete.

How to invest in equities?

The most simple to do it is to open a demat account with a reliable broker firm and choose preferred stock market instruments.

Recommended articles

Recent news