What Does an ETF Stand For and How Does it Work?

ETFs have revolutionized the investing landscape, providing both individual and institutional investors with powerful tools to help them reach their financial goals. Offering versatility, diversification, and access to various asset classes, ETFs have quickly become one of today’s investors’ most popular investment vehicles.

Key Takeaways

- ETFs provide a cost-effective way to gain access to many asset classes and diversify your portfolio.

- ETFs come in different varieties, including inverse, stock, foreign market, leveraged, alternative investment, and more.

- Investing in ETFs can offer lower costs and fees than mutual funds, as well as easier trading and an opportunity to target specific industries or markets.

- However, ETFs may come with liquidity issues and tracking errors, plus certain costs that could add up over time.

What is ETF and How Does It Work?

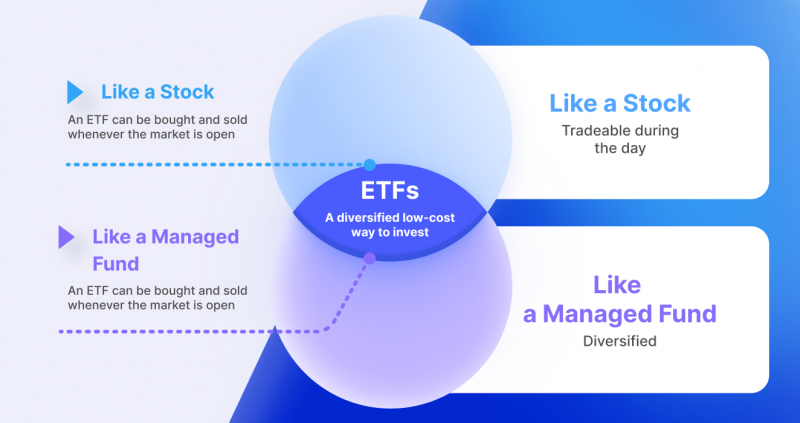

ETF stands for Exchange Traded Fund, and it’s an investment product that allows ETF investors to gain access to many different types of assets all at once. The main idea of these investment products is that, rather than purchasing one stock or bond, you can buy an entire basket of different assets – all in one security.

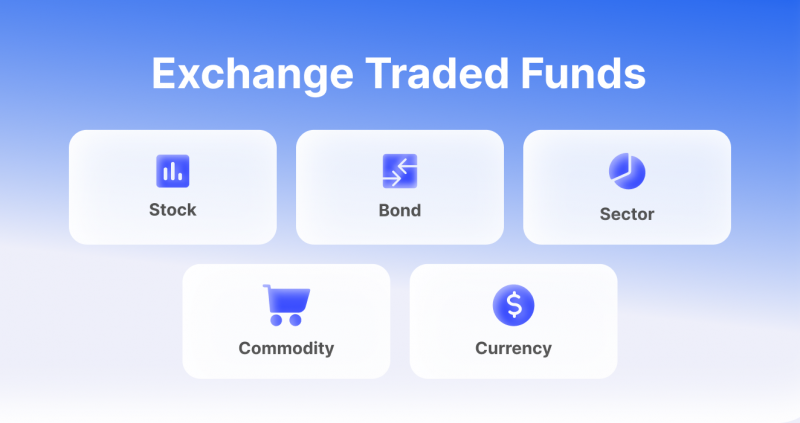

ETFs can track many different types of underlying assets, such as stocks, commodities, currencies or even indexes and crypto. ETFs can own a diverse range of assets from multiple industries or narrow in on one particular field. A few target only the United States markets, while others look to overseas businesses. For instance, banking-related ETFs will have stock holdings across many banks and financial institutions.

Exchange Traded Funds can be exchanged on a usual market like stock exchange anytime during the day. With their varying share prices, they’re easy to buy and sell. What’s more, traders can leverage ETFs for short selling.

ETFs differ from a stock in that they continually add and redeem shares, meaning the number of outstanding shares can vary daily. This perpetual cycling keeps an Exchange Traded Fund (ETF) prices consistent with their underlying securities, so investors don’t need to worry about market discrepancies.

Exchange Traded Funds vs. Mutual Funds

ETFs and mutual funds are similar in that they both offer investors access to a range of different stocks and other securities. However, there are key differences between the two.

A mutual fund is a type of professionally managed investment vehicle that pools investors’ money and invests it in various securities, such as stocks and bonds.

The main distinguishing factor between ETFs and mutual funds is their structure. Mutual fund prices are determined at the end of each trading day based on their net asset value (NAV). ETF prices are determined by the market, as investors buy and sell shares on an exchange throughout the day.

In addition, mutual funds often feature higher fees than ETFs. This is because they require ongoing management by professional money managers, whereas ETFs typically have little active involvement.

Types of ETFs

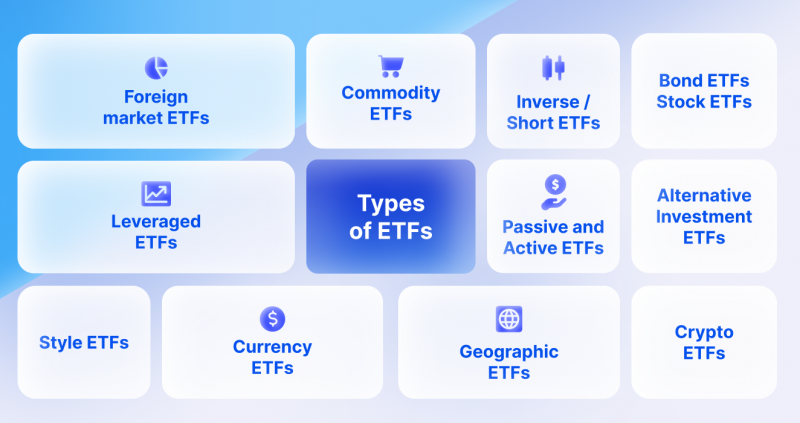

Numerous ETFs are available to investors, from broad-based, market-wide indices to specialized sector funds.

Passive and Active ETFs

Passive (Index Funds)

Passive ETFs track a particular index or benchmark, such as the S&P 500. These funds offer broad exposure to many different stocks and serve as an efficient way for investors to track the overall market.

The SPDR S&P 500 ETF, the very first Exchange Traded Fund in history, is still actively traded today. This ETF tracks the popular S&P 500 Index and has been a staple of investors since its launch.

Active

Active ETFs are managed by professional money managers and usually focus on a particular market sector or region. These funds may seek to outperform the broader markets and provide more targeted exposure for investors.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Sector or Industry ETFs

Industry or sector ETFs help investors to track the performance of assets or companies in a particular industry (stock ETFs). For instance, an energy sector ETF would include various companies within the energy industry, such as oil and gas companies.

Bond ETFs

Bond ETFs allow investors to gain exposure to different types of bonds. These ETFs can track a variety of debt securities, such as corporate and government bonds or mortgage-backed securities. In contrast to the bonds they track, bond ETFs do not have a predetermined expiration date. Generally, these ETFs are valued at either a premium or discount compared to the actual cost of their underlying securities.

Commodity ETFs

Commodity ETFs track specific commodities, such as gold or oil. They can also include futures contracts, which allow investors to speculate on the future price of a commodity. These funds can offer diversification benefits for investors looking to hedge against market volatility.

Currency ETFs

Currency ETFs track the performance of different foreign currencies. These funds are typically traded in pairs, allowing investors to speculate on how one currency will perform relative to another. Currency ETFs can be an effective way for investors to hedge against fluctuations in exchange rates.

Inverse ETFs

Inverse ETFs are designed to provide the opposite return of an index or sector. For example, if a particular index drops in value, an inverse ETF would rise in value. These funds can be used to hedge against market declines or to bet on short-term price movements.

Inverse ETFs use derivatives to short stocks. It is important to note that many inverse ETFs are exchange-traded notes (ETNs), which behave like stocks but are backed by an issuer such as a bank and are not true ETFs.

Style ETFs

Style ETFs track the performance of specific investment styles, such as value or growth stocks. These funds are typically composed of stocks that meet specific criteria and can be used to target different types of investments. For instance, a value ETF may include stocks with low price-to-earnings ratios and dividend yields.

Foreign market ETFs

Foreign ETFs offer investors access to non-US markets, such as Japan’s Nikkei Index or Hong Kong’s Hang Seng Index. These funds can offer a diversified approach to gaining exposure to different countries and regions, allowing investors to benefit from international growth.

Leveraged ETFs

Leveraged ETFs provide a multiple of the return of an underlying index or sector. For instance, a 2X leveraged ETF would double the performance of its underlying benchmark. These funds can offer investors a way to amplify their returns in both rising and falling markets, but they also come with higher risks.

Alternative Investment ETFs

Alternative ETFs offer a way for investors to gain exposure to otherwise difficult or costly assets, such as real estate or commodities. These funds provide a more straightforward and cost-effective approach than investing directly in the underlying asset.

Crypto ETFs

Crypto ETFs track the performance of cryptocurrencies, such as Bitcoin, Ethereum, and more. These funds provide investors with a more accessible way to gain exposure to digital assets and can be used for speculation or hedging purposes.

Why invest in ETFs?

If you want to gain access to many asset classes without breaking the bank, investing in ETFs could be ideal for your needs. There are many other reasons why these funds make sense for a wide range of investors:

Diversification

ETFs offer a way to diversify your portfolio across different asset classes, minimizing risk.

Lower costs

ETFs tend to be less expensive than mutual funds and more tax-efficient due to their passive management structure.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Easy to Trade

These funds make it easy for investors to adjust their allocations without having to buy or sell individual securities.

Target on Particular Industry

ETFs can be used to target a specific industry, sector, or market. This allows investors to take advantage of opportunities in different areas without having to buy individual stocks or bonds.

By leveraging innovative investment vehicles such as ETFs, investors can strategically diversify their portfolios while optimizing costs. ETFs trade provides the opportunity to trade volatility or gain exposure to a specific investment strategy, allowing for a more sound and cost-effective portfolio structure.

Disadvantages of ETF Investing

Despite its many advantages, ETFs do come with some risks including:

Liquidity Issues

Some ETFs may be thinly traded, making it difficult to buy or sell shares in large quantities.

Costs

While ETFs generally offer lower costs than actively managed funds, they still come with fees that can add up over time, especially if we talk about actively managed ETFs.

FAQ

What is a stock ETF?

A stock ETF is an exchange-traded fund that invests in a portfolio of stocks. These funds provide investors with a way to gain broad exposure to the markets without having to buy individual securities.

What is a crypto ETF?

A crypto ETF grants investors the opportunity to diversify their portfolios with a selection of cryptocurrencies without needing to purchase each coin personally. Exchange-traded funds provide an easy and accessible way for newcomers and experienced traders alike to explore digital asset investments.

What is the difference between an ETF and a mutual fund?

ETFs typically have lower costs and fees than mutual funds, as well as greater tax efficiency. ETFs can also be traded intraday on the stock market, while mutual fund trades are executed at the end of the day.

Can an ETF go broke?

It’s technically possible for an ETF to go broke, but it’s highly unlikely. The underlying assets of an ETF are held in a trust, which is managed and overseen by a custodian bank. This arrangement helps to ensure that the fund can never become insolvent and will always have enough assets on hand to cover any liabilities.