What is Personal Finance, And Why Does it Matter?

It is impossible to imagine the modern world without money, as it is the basis of existence and the guarantee of material well-being. At the same time, money is a tool used in numerous activities, including investing, budgeting, credit management, etc., which in turn constitute a concept related to the process of personal financial management.

This article will explain what is personal finance, what elements it consists of, and why it is essential in the process of building financial literacy, stability, and security.

Key Takeaways

- Effective personal finance management encompasses several fundamental aspects, such as income, expenditures, savings, investments, and risk management.

- Successful personal finance practices require formulating strategies that involve budgeting, establishing an emergency fund, eliminating debt, utilising credit cards judiciously, planning for retirement, and various other considerations.

What is Personal Finance?

Personal finance encompasses the management of an individual’s or a household’s financial activities, which include earning income, creating budgets, saving money, investing wisely, handling debt, and preparing for future financial requirements.

This process requires individuals to make informed decisions that significantly impact their financial well-being, such as determining effective spending habits, establishing savings goals, investing in enhancing wealth, and safeguarding assets through insurance and estate planning.

The importance of personal finance cannot be overstated, as it equips individuals with the necessary knowledge and skills to handle their finances effectively. By mastering personal finance, individuals can achieve financial stability, alleviate stress, and work towards fulfilling their aspirations, whether purchasing a home, launching a business, or enjoying a comfortable retirement. This empowerment enables people to make educated financial choices, ultimately leading to a more secure and satisfying life.

In essence, personal finance serves as a crucial foundation for achieving financial independence and security. It encourages individuals to take control of their financial situations, fostering a proactive approach to managing money.

By understanding and applying personal finance principles, individuals can confidently navigate their financial journeys, ensuring they are well-prepared for current and future financial challenges.

The initial significant research in personal finance can be traced back to 1920, conducted by Hazel Kyrk. Her doctoral dissertation at the University of Chicago established the groundwork for the fields of consumer economics and family economics.

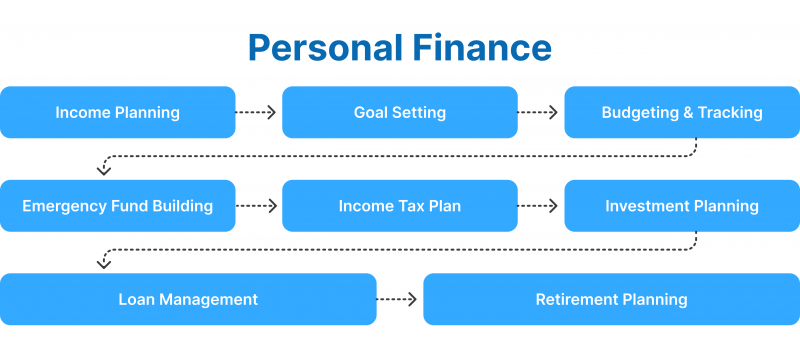

Major Components of Personal Finance

Personal financial management is a comprehensive approach to forming financial literacy and security — the key elements necessary for creating optimal conditions for the use of money and planning a properly structured budget, including with the help of personal finance services.

As a rule, this approach includes several activities involving money for a well-defined purpose. Among them, we can distinguish the following:

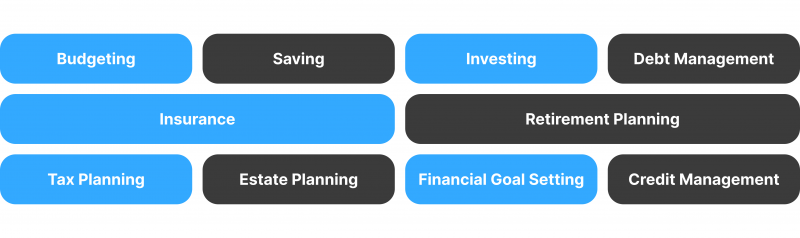

Budgeting

Budgeting is the foundation of personal finance. It involves creating a plan for allocating your income toward expenses, savings, and debt repayment. By tracking income and expenses, budgeting helps individuals manage their cash flow, control spending, and ensure they live within their means.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Saving

Saving is setting aside a portion of income for future needs or emergencies. It’s crucial for achieving short-term and long-term financial goals, such as building an emergency fund, making large purchases, or planning for vacations. Savings accounts, money market accounts, and certificates of deposit (CDs) are standard tools used for saving.

Investing

Investing is about using money to generate returns or grow wealth over time. It involves putting money into assets like stocks, bonds, mutual funds, real estate, or other investment vehicles. Investing carries varying levels of risk but is essential for long-term financial growth and achieving significant goals like retirement or funding a child’s education.

Debt Management

Managing debt involves understanding how to borrow responsibly and repay debt effectively. This includes credit cards, loans, mortgages, and other borrowing forms. Proper debt management helps avoid high-interest costs and financial strain, allowing individuals to maintain good credit scores and financial health.

Insurance

Insurance protects against financial loss from unforeseen events like accidents, illness, or property damage. Key types of insurance include health, life, auto, homeowner’s, and disability insurance. Adequate insurance coverage safeguards personal finances and provides peace of mind.

Retirement Planning

Retirement planning focuses on saving and investing to ensure financial stability in retirement years. It involves contributing to retirement accounts such as 401(k)s, IRAs, or pension plans and planning how much money is needed to maintain one’s desired lifestyle after retiring from active employment.

Tax Planning

Tax planning involves organising finances to minimise tax liabilities legally. This includes understanding tax deductions, credits, and retirement account contributions that can reduce taxable income. Effective tax planning ensures that individuals keep more of their earnings and optimise their financial strategies.

Estate Planning

Estate planning involves preparing for the transfer of one’s assets after death. It includes creating wills, trusts, and other legal documents to ensure that assets are distributed according to one’s wishes and that heirs are taken care of. Estate planning also involves considering potential tax implications and the management of assets during one’s lifetime.

Financial Goal Setting

Setting financial goals provides direction and purpose for managing money. Whether buying a home, starting a business, or saving for a child’s education, clearly defined goals help individuals stay focused and motivated, making it easier to develop plans and track progress.

Credit Management

Credit management involves understanding how to use and maintain credit effectively. This includes managing credit scores, understanding credit reports, and using credit responsibly to finance purchases. Good credit management is essential for securing loans, getting favourable interest rates, and maintaining financial flexibility.

Why Is Personal Finance Important? — Key Reasons

Personal finance is vital as it influences various dimensions of an individual’s life, affecting everything from everyday choices to the assurance of long-term financial stability. Understanding the significance of personal finance is essential for navigating these aspects effectively.

These are the reasons why it is of paramount importance for everyone looking for financial stability and freedom.

Financial Stability and Security

Proper management of personal finances helps ensure you have enough money to cover your needs and unexpected expenses. Budgeting and saving create a safety net that provides stability, reducing stress and anxiety about financial uncertainties.

Achieving Financial Goals

Personal finance allows you to set and work toward achieving your financial goals, whether short-term, like buying a car or going on a vacation, or long-term, like buying a home, saving for retirement, or funding education. Precise financial planning helps turn these goals into reality.

Debt Management

Understanding personal finance helps you manage debt effectively, avoiding high-interest costs and potential financial pitfalls. Good debt management preserves your credit score and financial reputation, making it easier to borrow in the future when needed.

Preparing for Emergencies

Life consists of unexpected events like job loss, medical emergencies, or significant repairs. Personal finance emphasises the importance of having an emergency fund, which provides a cushion to help weather unforeseen circumstances without derailing financial stability.

Building Wealth

Through investing and saving, personal finance provides the tools and knowledge needed to grow wealth over time. This is essential for building a comfortable future, securing financial independence, and having the freedom to make life choices without being constrained by financial limitations.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Retirement Planning

Personal finance is critical to ensuring you have enough money to comfortably retire. By planning and investing wisely, you can accumulate the necessary funds to support your lifestyle when you are no longer working, reducing the risk of outliving your savings.

Better Quality of Life

Sound financial management can significantly enhance your quality of life. It enables you to make informed spending decisions, avoid financial stress, and enjoy more freedom and opportunities. Whether travelling, pursuing hobbies, or providing for your family, sound personal finance practices contribute to a more fulfilling life.

Education and Empowerment

Understanding personal finance empowers you to make better financial decisions. It increases your financial literacy, helping you navigate complex financial products, avoid scams, and optimise your use of resources. This knowledge is crucial in an increasingly complex financial world.

Reducing Stress and Anxiety

Money is a common source of stress for many people. Taking control of your finances can reduce stress and anxiety, leading to better mental and emotional well-being. Knowing that you have a plan and are prepared for future financial needs brings peace of mind.

Legacy and Estate Planning

Personal finance includes planning for your future and the legacy you leave behind. Effective estate planning ensures that your assets are distributed according to your wishes, providing for your loved ones and potentially supporting causes you care about.

Conclusion

So, what is personal finance? Despite the obvious answer, there are different practices that, depending on the financial situation of an individual or family, may or may not have any activities related to cash flow management and budgeting, but in the end, the principles embedded in them serve as the basis for financial well-being, security and stability.

FAQ

What is personal finance?

Personal finance refers to the management of an individual’s or household’s financial activities, including budgeting, saving, investing, managing debt, and planning for the future.

Why is personal finance important?

Personal finance is important because it equips individuals with the knowledge and skills needed to manage their money effectively.

How does personal finance impact long-term financial stability?

Effective personal finance management directly impacts long-term financial stability by helping individuals build savings, avoid excessive debt, and invest in their future.