Why is the Forex Market so Liquid? – Volume & Liquidity

Foreign exchange, or Forex, is the biggest financial market in the world. With a daily volume of over 5 trillion US dollars, it is traded almost everywhere on the planet. Its popularity increases daily, and demand for trading Forex is attracting not only newcomers but also professional traders worldwide.

In this article, we will describe what Forex liquidity is and why it is important to FX traders and trading volume, the effects of liquidity on the Forex market and how it impacts prices, how liquidity is measured, and what factors affect liquidity in the Forex market.

The first aspect we will go through is Forex liquidity.

What is Forex Market Liquidity?

The possibility of an asset to be acquired, sold, or converted into money instantly at stable prices is referred to as liquidity. In the case of a financial asset, like a stock, or a tangible asset such as real estate, liquidity relates to how fast and effectively one can sell it.

It is very rare to find an asset market that is totally liquid, where the fundamental value can be immediately converted into cash or cash equivalents. In most cases, there is always a certain amount of time needed for the transaction to be processed.

The rate at which a buyer of an asset could exchange money for that asset is yet another measure of liquidity. Therefore, in a market with optimal liquidity, a buyer wishing to acquire an asset with a fundamental worth of $500 will be able to do so quickly for exactly $500 and obtain the asset right away.

Furthermore, liquidity in the market is an indicator of the number of participants engaged and the simplicity with which transactions may be completed. The volume of trades or the volume of awaiting trades that are currently on the market is typically used to calculate liquidity. When there is a large degree of trading activity and a strong correlation between supply and demand for an asset, liquidity is said to be “high,” making it simpler to locate a buyer or seller. Liquidity is minimal when there is a shortage of market participants, which brings the market to an illiquid state.

But why is liquidity so important, you may ask. Since it affects how quickly you can enter and exit positions, Forex liquidity is considered a core part of the whole system. Since there is almost always somebody ready to take the other side of a particular position, a liquid market is typically associated with lower risk. More traders may be encouraged to participate in the market, which will sustain the favorable market circumstances. A seller won’t need to lower the asset’s price to make it more appealing in a liquid market to find a buyer.

On the other hand, a bidder won’t need to increase the price in order to obtain the asset they prefer. The liquidity of an asset plays a significant role in determining the spread that a broker or trading platform offers. High Forex liquidity refers to the quantity of buy and sell orders present in the market. The increase contributes to the likelihood that the top bid of whatever customer is willing to pay and the lowest price any seller is willing to accept will converge. In other words, the bid-offer spread will narrow in a liquid market. The market’s bid-offer spread will increase if it is illiquid.

Now that you have more knowledge about Forex liquidity, you can continue reading further to find out what trading volume is.

What is Trading Volume?

The overall number of hours an asset is exchanged over a specific period of time is known as the trading volume. Typically, it is calculated for traded assets on exchanges such as commodities, futures, currencies, securities, and stocks. The trading volume covers the total value of the asset that was bought or sold during the transaction, as well as the number of transactions that are taking place. Based on the chosen timeframe, the trades always present volume charts. One can see multiple charts, from minute to monthly, and modern platforms even offer customizable timeframes. It is worth noting that the daily report released after market closure is more precise, whereas hourly volume reports are usually assumptions.

But what does trading volume even indicate, and why is it important? When there is a significant amount of traders in the market, we can say that the volume is high. Although this doesn’t always imply that all traders will take the same positions, it usually indicates that a trend is present.

The market price typically goes on the same path as trading volume, but this does not necessarily imply that high volume equals high prices since there can also be many sellers.

High trading volume is viewed as a substantial advantage. The more buyers and sellers are available on the market, the greater the likelihood of finding a counterparty for your trade at your preferred price. Tighter spreads are also associated with greater volume.

On the other hand, reduced liquidity will result in lower volume, which suggests that there are fewer buyers and sellers on the market. Low liquidity can be dangerous and lead to loss of money if the market moves against you since it can leave you in positions when it is hard to exit the trade.

In Forex, volume trading refers to something slightly different than volume trading in other asset classes. The quantity of lots traded in a currency pair within a given time frame in foreign exchange trading is the amount of money transferred from sellers to buyers.

Volume has become crucial because liquidity, which is directly related to a trader’s ability to open and exit trades at the price they choose, depends heavily on it.

Let’s proceed to examine what are the effects of liquidity.

What are the Effects of Liquidity on the Forex Market?

For a retail trader, spreads and currency pairs volatility serve as liquidity indicators. A market with high liquidity undergoes many changes in quotations per unit and price movement with periodic pullbacks. Dramatic price spikes and rapid quotes change over a short period of time are common in low-liquid markets.

The volume of currency pairs traded on the exchange is one of the factors impacting Forex liquidity. Note that the US dollar is the most used currency in the world, and it takes up the vast majority of the volume. With the dollar and other major world currencies, the most liquid pairs are EUR/USD, GBP/USD, USD/JPY, USD/CAD, USD/CHF, and AUD/USD. The larger the volume of currencies on the market, the closer the supply and demand prices are. When it comes to the spread, it is the smallest for the most liquid pairs. For instance, EUR/USD always had the smallest spread.

The foreign exchange market is open 24/5. Volatility and Forex liquidity vary depending on the trading session during business days. Due to their various time zone locations, the major financial centers cannot operate simultaneously. For example, the leading financial centers in Asia are Japan, Australia, and China.

Peak activity occurs when the American and European markets are open. Liquidity is usually decreasing as the European session comes to a finish. During the state holidays and the holiday season, liquidity also declines. These market conditions are referred to as “thin markets”. Although prices in a thin market typically move in a limited range, price outliers can occasionally be in response to unexpected economic reports. Low liquidity makes it more challenging to predict price swings, making it unattractive to trade during these times.

How to Measure Liquidity?

There is no one definitive answer to the question of how to measure market liquidity, as there is no predetermined value for this metric. However, there are some indications that can be employed to evaluate a market’s liquidity.

A) Trading volume – It’s a metric for how many times a specific asset was traded over a particular time frame. Low volume often suggests considerably fewer counterparties, whereas high volume typically means more Forex liquidity and good performance.

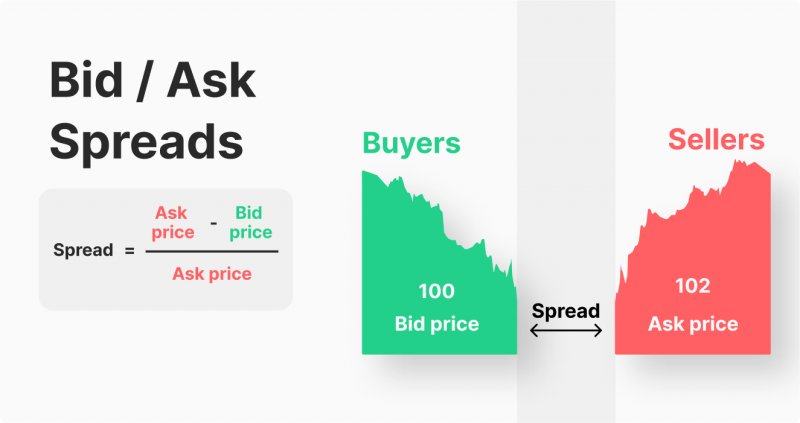

B) Bid/ask spreads – The variation in pricing of buyers and sellers willing to accept, known as the bid/ask spread, will narrow in liquid markets and broaden in illiquid ones. When the spread in the market is reduced, your provider will impose lower spread fees to carry out your trade.

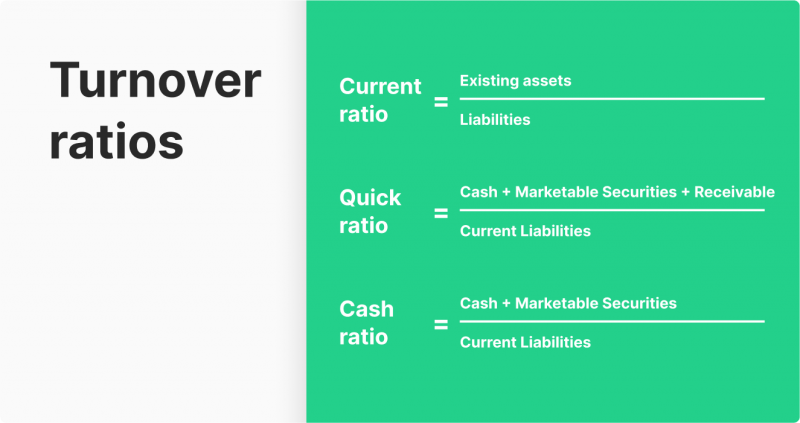

C) Turnover ratios – Share turnover is usually used to measure liquidity in stock markets. By dividing the number of positions exchanged throughout a certain period by the average amount of positions for the same period, share turnover is a method of calculating liquidity in the market. Theoretically, a higher share turnover ratio means that the market is more liquid.

Particular ratios are used to measure accounting liquidity. The most common are:

- Current ratio – the difference between existing assets and liabilities.

- Quick ratio – the overall amount of money, accounts receivable, and equities divided by liabilities.

- Cash ratio – the total cash balance deducted from liabilities.

Factors that Can Affect Liquidity in the Forex Market

Several various factors impact the Forex market. These factors include market conditions, GDP, unemployment rates, international trade, and other data.

While trading foreign exchange, there are numerous events and factors you must be aware of. Therefore, there are different signals to consider. Once you get involved in a specific trade, you instantly need to know vital information about a particular currency.

During your trading period, you must constantly keep an eye on what is going on in global economics and geopolitics. Being late and not executing before a particular report is released, you can miss significant moves. Therefore, monitoring online resources for FX-related news is highly recommended. You can try official economic calendars or forums where other traders share valuable information. All of this can help you to keep track of the world economy. These calendar lists include important real-time global trading environments and financial/economic events that could significantly impact Forex liquidity and the overall market trend.

Being continually aware of all the aspects influencing the foreign exchange trading market will not be a simple undertaking. Their significance shifts with time and situation. However, anyone can access the information and utilize it to their own advantage. A currency trader has the opportunity to respond right away to any available data.

When compared to other markets, one factor significantly affecting Forex trading is the ability to conduct transactions practically anywhere in the world. Since Forex is the largest, decentralized and global, it contains traders and institutions from every region of the world.

When we consider financial centers of the world, such as the USA, Japan, or Great Britain, these countries have the most significant GDP data that impact currency trading.

Due to their role in adjusting the nation’s interest rate, central banks significantly impact the FX market. A central bank must sustain economic growth in line with inflation in order to achieve a favorable balance in interest rates. The Forex market, where the value of a currency or set of currencies fluctuates in real-time, is fueled by speculation due to the bank’s decisions over whether to raise, lower, or retain the interest rate. Besides state authorities and their decisions, other factors, such as natural disasters, terrorist acts, and military conflicts, can also considerably affect the FX market.

Conclusion

You should comprehensively understand the Forex market in order to trade in volatile currencies and generate returns. However, investing in highly liquid and slightly volatile currencies is highly recommended if you are just starting in the Forex because they carry less risk. You should also pay special attention to the frequent updates so that you are familiar with the variables influencing the volatility and liquidity of the Forex market and can execute profitable transactions as a result.

This article’s main goal was to illustrate to you how crucial Forex liquidity is to the currency market. While working with extremely liquid instruments can considerably boost the likelihood of completing profitable trades, ignoring the liquidity of assets might harm your trading experience.

It is incorrect to assume that only “seasoned traders” with immense capital and trading volume need to consider liquidity. Liquidity is undoubtedly highly significant for pros, but beginners should also be aware of it. Currencies like the euro, US dollar, Japanese Yen, and other major currencies are more liquid and reliable than trading with exotic pairs. In order to grow trading volumes as quickly as possible when you first begin trading on the financial markets, it would be good for you to invest in currencies with high liquidity.

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer