How to Find MetaTrader Liquidity Providers?

Articles

Every broker should ensure efficient execution of trades, which is why it is crucial to have access to a trustworthy liquidity partner. Although the MetaTrader 4 and 5 (MT4/5) trading platforms are the most popular choice for Forex and CFD trading, finding the right MT5 liquidity provider for smooth trade execution can sometimes be tricky for a MetaTrader broker.

In this guide, we will explore the nuances of MetaTrader liquidity providers, their classification, and the factors to take into account when choosing the partner for your brokerage.

Key Takeaways

- Tier 1 LPs handle large volumes through international banks, while Tier 2 providers cater to retail brokers.

- Selecting a suitable provider should be based on its technology capabilities, adherence to legal requirements, credibility, and the range of assets it supports.

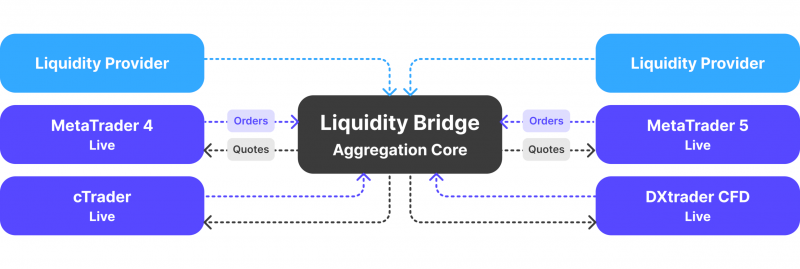

- A liquidity bridge enhances the quality of trading by connecting brokerages and multiple liquidity providers in real time.

What Is Liquidity?

In the Forex market, liquidity represents the depth of available orders at various price levels. A market that is highly liquid will have a large number of orders at various prices, while a low-liquidity market will have fewer orders and wider bid-ask spreads. Not enough orders to match buyers and sellers can lead to slippage and delays in order execution, resulting in significant losses for traders.

How MT4 Liquidity Is Provided?

MT4 and MT5 liquidity is provided through a network of liquidity providers (LPs) who connect to the platform via dedicated bridges.

Liquidity providers are intermediaries that connect brokerages with the broader financial markets. They typically have large reserves of funds and can provide order flow by continuously purchasing and selling currencies. Businesses have the option to choose from a variety of liquidity sources, including banks, investment banks, and prime brokerages.

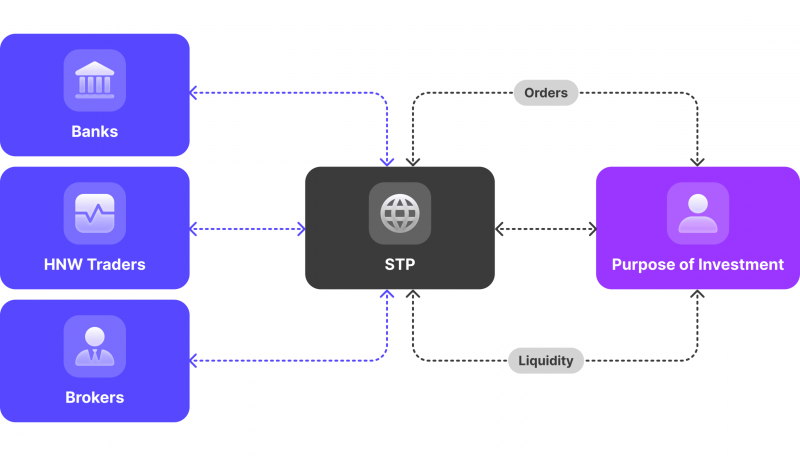

When a trader places a trade with a broker-dealer on the MT5 trading platform, the broker sends this order to a network of connected providers. The provider then analyses the order and matches it with a suitable counterpart. This swift and seamless process occurs in the background, allowing traders to place trades without delay.

Types of Liquidity Partners

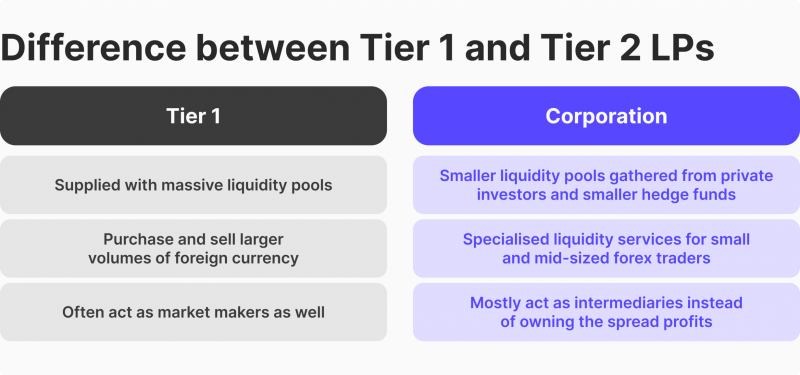

LPs in the Forex market can be grouped into two tiers:

Tier 1

Tier 1 financial institutions are the heavyweights of the financial world, comprising large international banks, such as Morgan Stanley, Bank of America, and Barclays Capital Bank, prominent financial exchanges like the London International Financial Futures Exchange, the CME Group, and the Intercontinental Exchange, hedge funds and other institutions. These entities have direct connection to the interbank market and are capable of handling large Forex trading volumes.

Tier 1 companies are typically affiliated with electronic communication networks (ECNs), which connect the largest Forex liquidity providers in the market. ECNs facilitate the seamless exchange of currencies and other financial instruments, ensuring that traders have access to the best possible prices.

Tier 2

While Tier 1 providers cater primarily to large institutional clients, the vast majority of Forex brokers do not have direct access to their capital volumes. This is where Tier 2 firms come into play, acting as intermediaries between a venue and the Tier 1 institutions.

Some of the notable Tier 2 liquidity providers for the MT5 brokers include X Open Hub, FXCM Pro, Swissquote, B2PRIME, and others. These providers offer brokerages exposure to the interbank market through a variety of execution models, such as Straight-Through Processing (STP) and Direct Market Access (DMA).

Advantages of Partnering with Tier 2 Providers

Working with a Tier 2 liquidity provider can offer several advantages for trading businesses:

- Accessibility: They often have lower barriers for using their services, making it easier for smaller market participants to participate in the currency market.

- Customisation: They may be more flexible in tailoring their services to the specific needs of their clients, providing a more personalised experience.

- Cost-Effectiveness: By acting as intermediaries, these providers can sometimes offer more competitive pricing and reduced trading costs in comparison to Tier 1 LPs.

How to Evaluate Liquidity Providers?

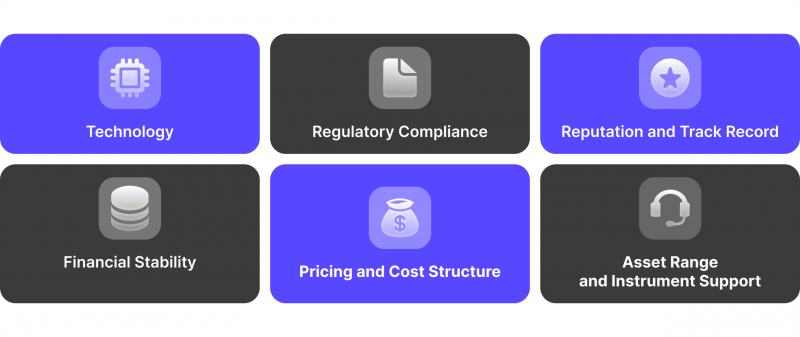

Selecting the right MetaTrader liquidity provider plays a significant role in determining the performance and success of the venue. The following key criteria should be considered when evaluating potential liquidity partners:

Technological Capabilities

The technological capabilities of an MT5 and MT4 liquidity provider matter immensely, as they directly impact the speed, stability, and efficiency of order execution. Make sure the provider is equipped with the latest and most advanced technology, capable of seamless integration with the platform and the MT5 liquidity bridge.

Adherence to Regulations

Compliance with regulatory requirements is important in ensuring a partner’s safety and credibility. Thoroughly research the firm’s compliance with relevant financial authorities.

Reputation

The credibility and legitimacy of a liquidity provider for MT4 are essential indicators of service quality and trustworthiness. Conduct thorough research, read online reviews, and seek feedback from industry peers to gauge the organisation’s standing in the market.

Pricing and Cost Structure

Evaluate the LP’s pricing and cost structure, including spreads, fees, and any hidden charges. Ensure that the company offers competitive rates that align with your business model.

Asset Range and Instrument Support

Confirm that the MetaTrader 4 liquidity providers you want to partner with support the full range of assets and instruments that you wish to offer your traders, including Forex, CFDs, and digital currencies. This will ensure that your clients’ trading needs are comprehensively met.

What Is a MetaTrader Liquidity Bridge?

A liquidity bridge is a real-time software solution that facilitates the seamless connection between brokers and LPs. It plays an integral part in the process of delivering orders to a broker, performing liquidity aggregation and enhancing the productivity and accuracy of the trading process.

Key Features of the MetaTrader Liquidity Bridges

Typical MT5 and MT4 liquidity bridge offers a range of features and functionalities that make it an indispensable tool for aspiring entrepreneurs:

- Order Processing: The bridge utilises advanced algorithms to route client orders to a reliable liquidity provider, ensuring optimal pricing and execution.

- Risk Management: Brokers can leverage the bridge’s risk management capabilities to monitor and limit their exposure to market fluctuations.

- Multi-Asset Support: The bridge supports trading across a wide range of assets.

- Real-Time Reporting: Comprehensive real-time analytics and reporting features enable brokers to closely monitor the performance of their trading operations.

How to Connect to a Liquidity Bridge

Brokers can connect to a bridge through technology providers that offer plug-and-play solutions or custom-built bridge integration. Most bridge providers also offer ongoing technical support and maintenance services to ensure a seamless and uninterrupted trading environment.

Conclusion

A seamless, competitive service for their clients depends on choosing the right partner. A robust liquidity bridge can also greatly enhance the effectiveness of executing trades through multiple Tier 2 LPs.

Top-tier liquidity allows broker-dealers to offer traders deep markets and tight spreads, helping them stand out in the fiercely competitive industry.

FAQ

Which Forex pair has the highest liquidity?

The five most traded currency pairs in the Forex market are EUR/USD, USD/JPY, GBP/USD, AUD/USD, and USD/CAD. Among these pairs, EUR/USD has the highest liquidity due to the popularity of the euro and US dollar in global trade and financial transactions.

Who is the best liquidity provider in Forex?

There are many reputable providers in the market, each with their own unique offerings and advantages. Some of the top ones include FXCM PRO, B2BROKER, X Open Hub, Finalto, and Global Prime.

What causes high liquidity?

High liquidity can be caused by various factors, including an influx of investment, strong market demand, and stable economic conditions.