Forex Position Size Calculator: What it is and How to Use it

A majority of new Forex traders do not succeed. Statistics show most lose capital, and it is not due to a lack of intelligence. It is often due to a complete disregard for risk. They commit too much capital emotionally, incur a significant loss, and then attribute it to market conditions.

This is where a Forex position size calculator can be a helpful tool. It is a simple, mechanical tool that prevents the loss of an entire account due to a single adverse trade. It requires you to quantify your maximum acceptable loss before entering a position.

This article describes a critical risk management tool that is often underutilised. We will analyse what this calculator is and how to apply it, so you can avoid common pitfalls in your trading strategies.

Key Takeaways

- A position size calculator is a risk management tool; its primary function is to prevent oversized positions that can lead to catastrophic losses.

- Effective use requires a disciplined process: define your risk percentage, set a stop loss, input trade parameters, and adhere to the calculated lot size.

- This discipline helps mitigate common trading errors, including the misuse of leverage, failure to define an exit point, and emotional decision-making.

What is a Forex Position Size Calculator?

A Forex position size calculator is a tool for determining how much money to invest in each trade. It’s a key part of risk management, ensuring traders don’t take on too much risk and lose more than they can afford.

Position sizing is crucial in FX because:

- Prevents overleveraging – It helps avoid the use of excessive leverage, which can lead to rapid account depletion.

- Protects your capital – Proper sizing is a primary method of capital preservation. It’s a key defensive measure.

- Keeps emotions in check – Defining the exact amount at risk mitigates panic in trading. It helps prevent impulsive, emotional decisions.

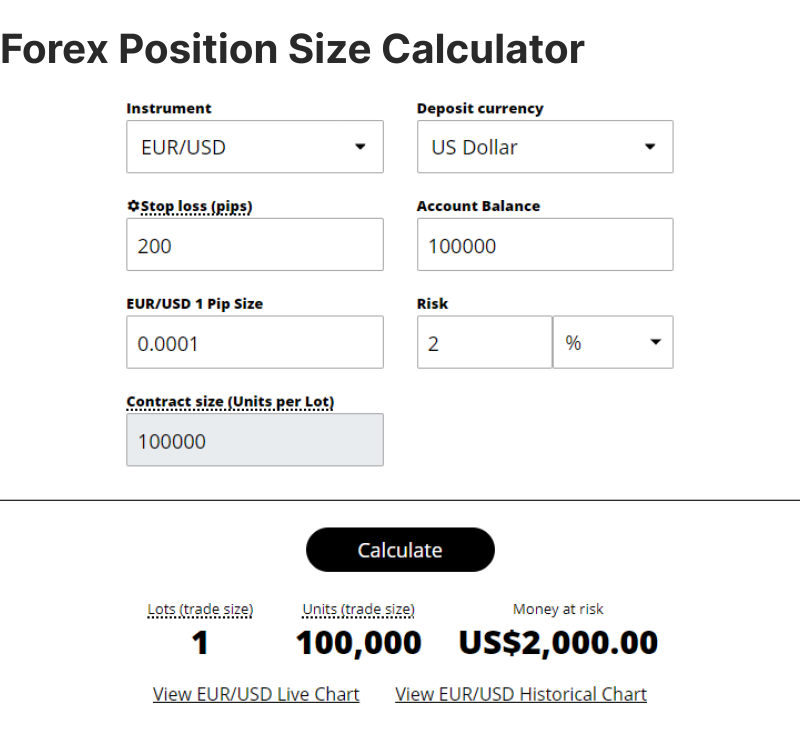

Ignoring this can lead to a complete loss of capital. Quickly. An effective position size is not about maximizing a single gain; it is about ensuring individual losses are small enough to be inconsequential, even on incorrect trades.Here’s an example of such a calculator from securities.io:

Key Factors That Influence Position Sizing

Several factors influence the size of your Forex position. Understanding these variables ensures that you use an FX position size calculator correctly.

Account Balance

This is a fundamental rule. You cannot risk a thousand with an account of a hundred. The amount of capital in your account is the absolute limit on the risk you can assume. A small account necessitates small trades.

Risk Percentage Per Trade

Here is a core principle that new traders often disregard initially: the 1-2% rule. If you have $10,000 in your account, any single trade should not place more than $200 of it at risk. This is a critical barrier that prevents one adverse trade from depleting your account.

Stop Loss Level

A stop loss is your exit mechanism. It’s the price at which you have predetermined that your trading decision was wrong, and the trade is closed automatically before losses escalate. It is your most critical safety net.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Your position size depends on how far your stop loss is:

- A wide stop loss (more room for price movement) → You need a smaller position size.

- A tight stop loss (less room for price movement) → You can have a slightly more prominent position size.

Currency Pair Volatility

Some currency pairs move a lot more than others. These are called volatile pairs. If you trade a very volatile pair, you may need a smaller position size to stay safe.

For example:

- EUR/USD (less volatile) → You can take a bigger position.

- GBP/JPY (very volatile) → You should take a smaller position because prices can jump quickly.

Keeping an eye on volatility helps you avoid significant losses.

Leverage

Leverage allows you to control a larger trade with a smaller amount of money. It can increase your profits, but it also increases your risks.

For example:

- Using 10:1 leverage, you can trade $10,000 with only $1,000 in your account.

- Using 50:1 leverage, you can trade $50,000 with just $1,000.

Do not be reckless with leverage. It is a powerful tool, but it is also the quickest path to liquidating an account if not respected. Using it judiciously is non-negotiable.

How to Use an FX Position Size Calculator: Step-by-Step Guide

Here’s a step-by-step guide on how to use a position calculator effectively.

Step 1: Choose a Currency Pair

Pick the currency pair you want to trade, like EUR/USD or GBP/JPY. Your choice should match your trading strategy and the market conditions. Some pairs move more than others, so keep that in mind. Consider volatility and spread costs.

Step 2: Determine Your Account Size

Next, identify the total capital available in your trading account. This is important because it determines how much you can risk on each trade. For example, if you have $5,000 in your account, that’s your starting point.

Step 3: Decide on Your Risk Percentage

Decide the percentage of your account balance you’re willing to risk on a single trade. For example, with a $5,000 account, risking 2% equates to $100 per trade.

Step 4: Set Your Stop Loss

You enter a trade and set a 50-pip stop loss (pips measure price movement in FX). This means if the price moves 50 pips in the wrong direction, the trade closes automatically to limit your loss.

Step 5: Enter Trade Details Into the Calculator

Now, input the information into the Forex position size calculator. The calculator will tell you the correct position size—how many units or lots of the currency to trade, so you stay within your risk limit.

Step 6: Execute the Trade

Once you have your position size, enter the trade in your FX trading platform. Ensure the lot size matches the calculator’s result so you don’t risk more than planned.

Common Mistakes in Position Sizing in Forex and How to Avoid Them

Position sizing in forex is the process of determining the size of your position. Incorrect application is a primary cause of account failure. Here are the common ways new traders make critical errors, and how to avoid them.

Taking on Too Much Risk with Leverage

Leverage lets you trade with more money than you have, but also increases your risk. If the market moves against you, you could lose much more than expected. Many beginners overuse leverage and end up losing their money quickly.

How to Avoid This Mistake:

- Use leverage wisely – Start small and only use it when necessary.

- Risk only a small amount per trade – A common rule is to risk just 1-2% of your total trading balance.

Not Setting a Stop Loss

Trading without a stop loss is equivalent to hoping the market will reverse in your favor. It rarely does. This practice is how small, manageable losses become catastrophic ones.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

How to Avoid This Mistake:

- Always set a stop loss before entering a trade – This keeps your losses under control.

- Adjust your position size – If your stop loss is far away, reduce your trade size so you don’t risk too much.

Risking Different Amounts on Different Trades

Some traders risk 1% of their money on one trade and 5% on another. This makes it hard to keep track of your risks, and one bad trade could wipe out several good ones.

How to Avoid This Mistake:

- Keep your risk the same for every trade – Choose a fixed percentage (like 1-2%) and stick to it.

- Review your trades regularly – Make sure you’re staying consistent with your risk.

Letting Emotions Control Your Trades

Fear and greed can lead to bad decisions. Some traders panic and close trades too soon, while others get greedy and take on bigger risks than they should. Emotional trading can cause big losses.

How to Avoid This Mistake:

- Follow a trading plan – Decide your entry, exit, and risk before placing a trade.

- Keep a trading journal – Write down why you made each trade. This helps you spot emotional patterns and fix them.

Not Adjusting for Market Conditions

Markets change all the time. What works in a slow-moving market may not work when prices move fast. If you don’t adjust your trade size, you could end up taking too much risk.

How to Avoid This Mistake:

- Check market volatility – Use tools like the Average True Range (ATR) to see how much prices are moving. If the market is wild, reduce your trade size.

- Stay updated on market news – Events like economic reports or political news can make markets more volatile, so be prepared to adjust your trades accordingly.

Bottom Line

A Forex position size calculator is a risk management instrument, and not a profit-generation tool. It improves trading outcomes by enforcing discipline. It provides the correct trade size so you can protect your capital, prevent large losses, and separate your emotions from your decision-making.

FAQ

What is position trading in Forex?

Position trading is a long-term FX strategy where traders hold positions for weeks, months, or even years. It focuses on fundamental analysis and larger market trends rather than short-term price movements.

What are the best position sizing strategies?

Some of the best position sizing strategies include the fixed percentage risk model (risking 1-2% of your account per trade), the volatility-based model (adjusting size based on market movement), and the fixed lot size method (using a set number of lots per trade).

How long can I hold a Forex position?

You can hold a forex position as long as your trading strategy allows, whether for a few minutes (scalping), hours or days (swing trading), or even weeks and months (position trading). Just be mindful of swap fees, market conditions, and fundamental factors that may impact your trade.