What is a Contract Size? Definition & Overview

A trading contract is a legally binding agreement between two parties to exchange an underlying asset or financial instrument. These contracts, often used in derivatives trading, outline the specific terms of the trade, including the asset, price, quantity, and delivery date. They can be standardised, customised, and traded on exchanges or over-the-counter (OTC) markets. The common types of contracts are Futures, Options, Forward and CFDs (Contracts for Differences).

Whether you are engaged in Forex trading, futures trading, or options contracts, understanding the concept of contract size is crucial. It helps to manage risk and determine the potential impact of price movements on trades.

Let’s explore the idea of contract size, how it’s calculated and how traders use it to manage risk.

Key Takeaways

- Contract size specifies the amount of the underlying asset represented in a single contract.

- In futures trading, large contract sizes offer significant exposure but come with higher risk, while mini and micro contracts provide more accessible options for retail traders.

- Risk management hinges on understanding contract size, as it allows traders to control their exposure to price movements.

The Essence of Contract Size

At its core, contract size refers to the amount of the underlying asset that one futures or options contract represents. A fundamental aspect of derivatives trading specifies the exact amount of a commodity, currency, or financial instrument being traded.

For instance, in futures trading, contract size defines precisely how much of a commodity or financial instrument a contract controls. This is crucial for both retail and institutional investors as it directly impacts the total value and exposure to price movements in the market.

For example, the standard contract size for crude oil futures is 1,000 barrels, while the contract size for gold futures is 100 troy ounces. Each of these contracts represents a large sum, making it essential for traders to use contract size calculators to determine their potential exposure and risk management strategies.

While standard contract sizes exist, some exchanges offer alternative contract options for smaller traders:

- Mini Contract: This contract represents a fraction of the standard contract size, allowing traders to participate in the market with a lower initial investment.

- Micro Contract: Even smaller than mini contracts, micro contracts further reduce the entry barrier for new traders.

Contract sizes are not one-size-fits-all. They vary depending on several factors:

- Underlying Asset: The underlying asset type will determine the standard contract size. For example, a gold futures contract might represent 100 troy ounces, while a wheat futures contract could represent 5,000 bushels.

- Exchange: Different exchanges might have slightly different contract sizes for the same underlying asset.

The Importance of Contract Size in Trading

Contract size plays a vital role in determining the total value of a trade. Larger contract sizes naturally provide more significant exposure to market fluctuations, meaning price movements can lead to substantial profits or losses. For example, if you hold a futures contract in crude oil, a slight price movement in oil prices can have a massive impact on your portfolio due to the sheer size of the contract.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

On the other hand, smaller contract sizes, like mini contracts or micro contracts, offer retail traders a more manageable level of exposure. These minor contracts are prevalent in Forex trading, where micro lots represent 1,000 units of the base currency, and mini lots represent 10,000 units. These allow traders to participate in the market without taking on as much risk.

Contract size plays a crucial role in several aspects of trading:

- Risk Management: Knowing the contract size helps traders calculate potential losses and implement appropriate stop-loss orders.

- Margin Requirements: Larger contract sizes typically require higher margin deposits, affecting the capital needed to open and maintain positions.

- Price Sensitivity: The contract size determines how much a single price movement affects the overall value of your position.

- Accessibility: Smaller contract sizes, such as micro contracts, allow retail investors to participate in markets that might otherwise be out of reach due to capital constraints.

The key distinction between contract size and lot size lies in their value and the granularity of trading. While contract size represents the total value of a trade, lot size determines the quantity of currency units being traded.

Contract Size Calculator

Using a contract size calculator can be immensely helpful in determining your exposure and potential profits or losses accurately. These tools take into account factors such as:

- The specific market you’re trading in

- The contract size of the instrument

- Current market price

- Your desired position size

By inputting these variables, you can quickly assess the total value of your position and the impact of price movements on your trading account.

To calculate the total value manually, multiply the contract size by the underlying asset’s current price. For instance, if the crude oil contract size is 1,000 barrels and the current price is $80 per barrel, one contract represents a total value of $80,000 (1,000 barrels * $80/barrel).

Contract Sizes in Popular Markets

Let’s explore popular market examples to better understand the essence of contract size.

Futures Market

The futures contract size varies depending on the underlying asset. For instance:

- A crude oil futures contract typically represents 1,000 barrels

- A gold futures contract on the COMEX exchange equals 100 ounces

- An E-mini S&P 500 futures contract is valued at $50 times the index value

Imagine you enter a futures position to buy 100 barrels of crude oil. The contract size for crude oil futures on a specific exchange might be 1,000 barrels. This means that by entering this single contract, you’ve committed to buying and receiving 1,000 barrels of crude oil on the expiry date unless you close your position beforehand.

The ability to determine contract size is crucial for futures traders. Larger contract sizes, such as those in commodities like crude oil or gold, offer greater exposure, but they also come with increased risk. Traders must calculate exactly how much exposure they want to take on, considering factors such as volatility, expiration dates, and market information.

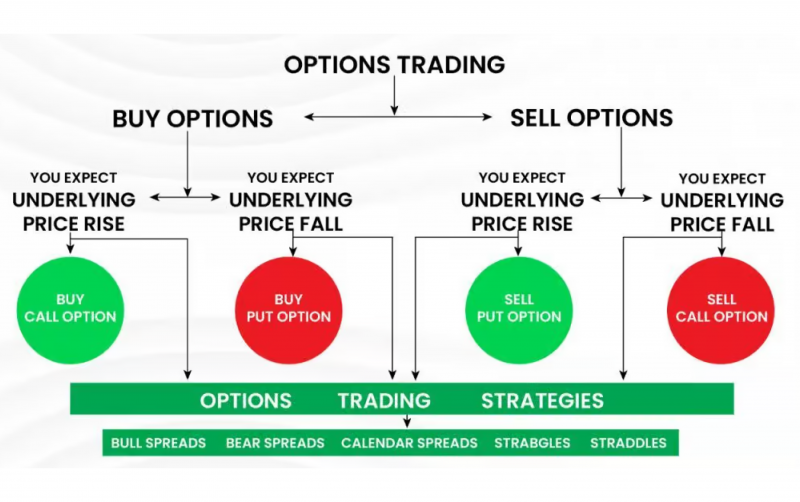

Options Trading

The contract size directly impacts a position’s potential profit or loss in options trading. The standard contract size for stock options is usually 100 shares of the underlying stock. This means that one options contract gives the holder the right to buy or sell 100 shares at the specified strike price.

Let’s say you purchase a call option on Apple stock, giving you the right (but not the obligation) to buy 100 shares of Apple at a certain price by a specific date. The contract size for Apple stock options on your chosen exchange might be 100 shares. So, this single-call option contract grants you the right to buy 100 shares of Apple at the predetermined price. If Apple’s stock rises by $1, a single call option contract would increase in value by $100 (1 * 100 shares).

The issuer or exchange determines the size of an options contract, and it’s essential to understand how many shares in a contract are involved when assessing your risk. The same goes for LEAPS contracts (Long-Term Equity Anticipation Securities), which allow investors to lock in favourable terms for an extended period. Knowing what is the size of one LEAPS contract is critical for long-term strategic planning.

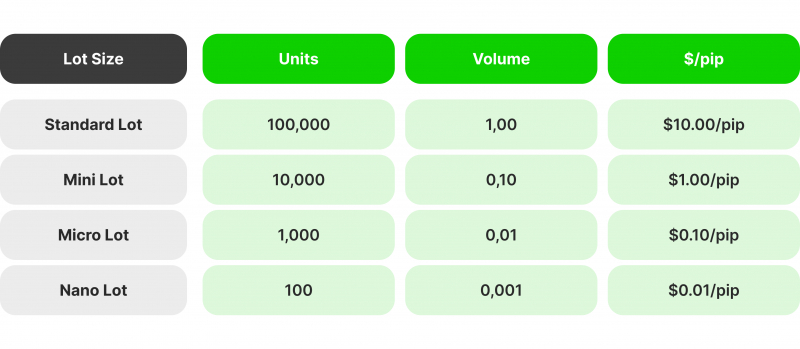

Forex Trading

Forex trading operates differently from futures and options, as no formal currency exchanges exist. Forex contracts are not standardised, but the contract size remains essential for traders. In Forex trading, contract sizes typically come in three categories: standard lots, mini lots, and micro-lots.

- A standard lot represents 100,000 units of the base currency.

- A mini lot is 10,000 units of the base currency.

- A micro lot is 1,000 units of the base currency.

- A Nano lot: 100 units (offered by some brokers)

To calculate your exposure in a Forex trade, you need to multiply the contract size by the pip value. A pip is the smallest unit of change in a currency pair. The pip value for a standard Forex contract is usually $10.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

For example, if you enter a long position on EUR/USD with a contract size of 100,000 units and the pip value is $10, your total exposure would be $100,000 (100,000 * $10). This means that for every pip the EUR/USD pair moves in your favour, you would potentially gain $10.

Risk Management

Contract size plays an integral role in risk management. By determining the size of your contracts, you can control exactly how much exposure you take on in the market. Larger contract sizes increase your exposure to price movements but also increase the risk of more significant losses.

Understanding contract size is fundamental to effective risk management in trading. Here’s how it impacts your trading decisions:

- Contract size helps determine how many contracts you can safely trade based on your account balance and risk tolerance.

- Larger contract sizes often come with higher leverage, potentially amplifying both profits and losses.

- Smaller contract sizes allow for more diverse positions across different markets or assets.

- Knowing the contract size helps calculate the exact price levels for stop-loss orders to limit potential losses.

Conclusion

Contract size is a crucial concept traders should understand and incorporate into their trading strategy. Whether you’re trading futures, options, or Forex, the contract size directly impacts your exposure, risk, and potential profits or losses. By mastering this concept, you can make more informed decisions and manage your trading portfolio better.

Remember that contract sizes can vary significantly between markets and even within the same asset class. Conduct thorough research and consult a financial advisor before entering any trading position.

FAQ

Who creates options contracts?

Options contracts are typically created by market makers and listed on options exchanges.

How much is one futures contract?

A futures contract’s value is typically its contract size multiplied by the current price. For example, if gold futures are trading at $1,900 an ounce, one futures contract representing 100 troy ounces would be valued at $190,000

What is contract size in trading?

Contract size refers to the amount or quantity of an underlying security represented by a derivatives contract.

What is the size of one LEAP contract?

Like a standard options contract, the size of a LEAPs contract is 100 shares.