CFD vs Futures in Crypto: Practical Differences to Consider

Crypto trading has evolved into a complex field incorporating numerous advanced trading tools and techniques. Gone are the days of simple exchange or arbitrage practices to earn short-term profits. In 2024, traders must master exponentially more intricate trading strategies to generate measurable and consistent profits.

The benchmark for sufficient knowledge has been raised in crypto, and retail traders should be aware of many different trading tools to stay competitive. Trading Futures and Contract for Differences (CFDs) are two such advanced mechanisms in crypto and the trading markets in general. This article will analyse the nature and critical differences between CFDs and futures markets, allowing you to make an informed decision when choosing a perfect trading strategy.

Key Takeaways

- Derivatives contracts are future-oriented agreements that change in value according to the underlying asset price.

- Futures contracts are agreements to purchase a specific asset at a fixed price on a future date.

- CFDs are similar to futures but don’t demand asset ownership. Instead, CFDs are settled by paying an asset price difference amount.

- Futures contracts are more transparent but have higher capital requirements, whereas CFDs are more affordable but sometimes riskier.

Exploring The Crypto Derivatives Market

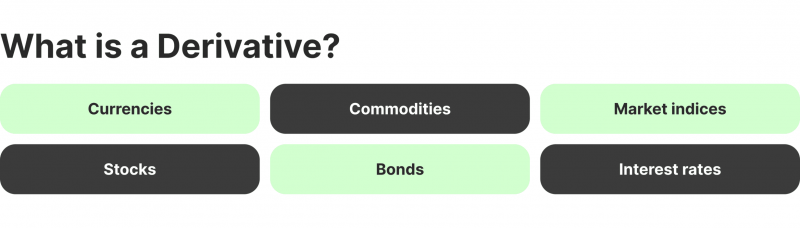

Futures contracts and CFDs fall under the financial derivatives category, a type of contract that will be honoured in the future. Derivative contracts are set between two parties to exchange, buy or sell a specific asset at a certain price and date. The value of derivative contracts is linked to the underlying asset, which increases or decreases the contract price.

In most cases, derivatives use leverage, allowing parties to acquire more assets without paying for the entire asset ownership. There are many variations on derivative contracts, including futures, options, swaps, contracts-for-difference, etc.

Each type has different contractual obligations and practical use cases in the trading and financial markets. Derivatives are not exclusively useful in trading, as they enable companies to swap loan agreements and other business contracts for their benefit.

Crypto Futures Explained

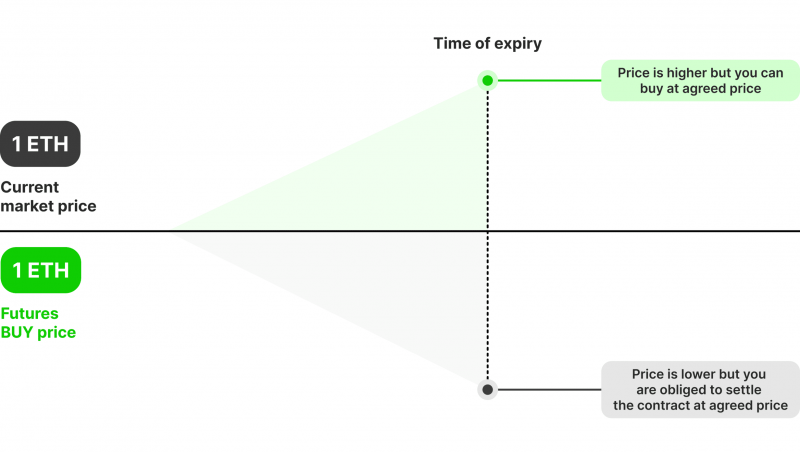

Futures contracts are fixed agreements between two market participants on purchasing a specific asset at a predetermined price and future date.

The current market price of the asset heavily influences the price of futures contracts, making it cheaper or more expensive depending on which way the asset value climbs. For example, if the asset price approaches future prices, the demand for these contracts will increase as investors wish to purchase the asset at a lower price.

While straightforward at first glance, futures trading carries a lot of practical implications for individuals and companies that wish to mitigate risks or maximise their profitability.

For instance, futures can be used to anticipate price movements of a specific crypto asset and profit from guessing the trend correctly, allowing investors to purchase virtual currencies at a lower price or sell them at a higher price.

Also, traders can hedge their risks by buying futures contracts that are opposite their primary strategy, ensuring they will not suffer huge losses if the market price goes sideways. This practice is especially important in the blockchain field, as it allows investors to stay relatively safe in the volatile crypto environment.

What Are CFDs?

Like futures, CFDs are also derivative instruments but with one huge distinction. CFDs are financial contracts that allow two parties to set a similar agreement on an asset price at a predetermined date, but they only have to exchange the price difference once the deadline approaches. So, CFDs do not incorporate ownership into their contract, allowing investors to profit from significant price movements without making a massive purchase commitment.

CFD benefits are plentiful for newcomer investors strapped for budgets, letting them acquire positions well out of their financial range. However, CFDs are more specialised compared to futures, as they are useful only with price movement profits.

So, CFD investments can’t be used to exchange contracts or assets between two parties, making this instrument exclusively useful for potential gains or risk mitigation within the trading field.

CFD vs Futures Contract: Critical Differences

As analysed above, both futures and CFDs are derivative contracts focused on the future price movements of specified assets. Both CFDs and futures can be applied to forex, crypto, stocks, commodities and virtually any other tradeable assets market in the world. However, these two instruments differ significantly in numerous details, making them applicable in distinct situations.

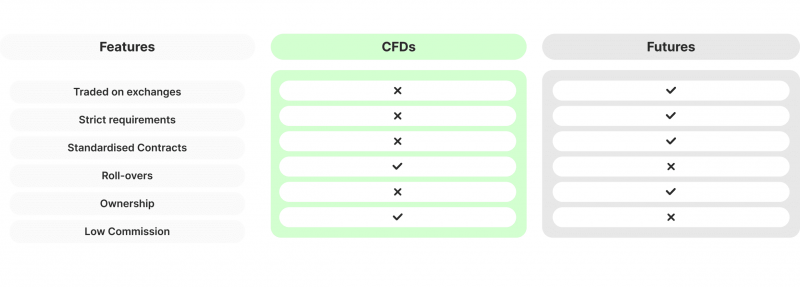

Contract Structure and Ownership

Futures contracts have a predetermined expiration date, with no rollover possibilities, even if the two parties agree. On the other hand, CFDs accommodate a roll-over function, enabling users to extend their agreement beyond the initial deadline. Since futures contracts are mostly traded on futures exchange markets, they include third-party commissions for contract mediation and additional centralised fees like the National Futures Association (NFA).

Conversely, CFDs are frequently traded over the counter (OTC), meaning that two parties directly engage in a contract without significant monitoring from a dedicated third party. So, CFDs incur less expenses for involved parties by default.

Market Types and Capital Requirements

Since most CFDs are OTC mechanisms, the broker creating a CFD contract frequently takes the opposite side of the trade. As a result, traders can often find themselves going against much more experienced and powerful counterparties. Additionally, OTC contracts are not as transparent as centralised exchange contracts, which could potentially harm inexperienced investors.

On the flip side, futures are traded on popular exchanges that are more regulated and transparent, providing all the necessary information about the contract and its respective rates. So, futures are more predictable and safe, as brokers and exchanges do not take the opposite positions of traders and instead refer them to trade futures directly with the second party.

Regarding capital requirements, CFDs are more relaxed, allowing traders to create or purchase contracts with smaller base amounts. On the other hand, futures contracts have larger base requirements and are typically much larger than CFDs.

Which Strategies Work Best for Each Mechanism?

The CFD or futures contract debate has been going on for a while, with newcomer investors frequently confusing the two options as virtually the same instrument. However, these mechanisms are helpful in different scenarios and shouldn’t be used interchangeably. Considering your circumstances and financial capabilities, here are the best scenarios to utilise each mechanism.

When to Consider Futures Contracts

Futures contracts are primarily suitable for traders with bigger budgets and specific strategy timeframes. These instruments are transparent and let traders avoid betting against brokers, which is a dangerous practice in some cases.

However, futures have high capital requirements and entail purchasing the entire contract amount once the date expires. So, futures contracts are expensive and time-sensitive, which might not be optimal for smaller investors.

When to Consider CFDs

CFDs have no strict expiration dates and do not require traders to purchase the asset outright by the contract’s end. They are also more flexible, presenting lower capital requirements and affordable commission charges. So, opening a CFD trading account is more manageable for newcomer investors.

However, CFD trading is also considered high-risk due to its over-the-counter nature, forcing traders to take positions against their providers. In most cases, brokers and exchanges have a far better understanding of price movements and will not take positions that could be unprofitable in the long run. So, betting against them is not a good idea for rookie investors.

Final Thoughts – Trading CFDs vs Futures

CFDs and futures contracts are two mechanisms that appear similar but serve considerably different purposes. For experienced investors, both of these mechanisms can be harnessed to maximise profits and hedge risks in volatile or frequently changing trading markets.

So, it is imperative to understand both contracts well and have a good grasp on when to use them. As a rule of thumb, you should trade CFDs for strategies that don’t require asset purchase, and futures are optimal for long-term trading strategies that entail asset ownership at the end. So, choose your contracts well and consider your specific circumstances to come up with a perfect technique!

FAQ

What are crypto futures?

Crypto futures are similar to regular futures contracts in every considerable way. Crypto futures have become increasingly popular due to their ability to mitigate risks in the volatile blockchain field.

What is a spot position in crypto?

A Spot position in crypto trading is the opposite of derivative contracts, as it entails purchasing or selling an asset “on the sport” instead of creating a contract for the future.

What’s the difference between Spot markets vs. futures markets?

Spot markets are designed for immediate execution, whereas futures and CFDs are well-suited for price speculation and longer trading strategies.

How does a cfd futures contract differ from direct asset ownership?

A cfd futures contract allows traders to benefit from price swings without actually holding the underlying asset, making it more flexible.

Recommended articles

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.