What is a Liquidity Pool and How Does it Work?

A liquidity pool is a collection of funds locked in a smart contract on a decentralized finance (DeFi) network. It is a cornerstone of DeFi since it provides a source of liquidity for users to exchange and interact with various digital assets.

Liquidity pools are intended to replace traditional order books by directly matching buyers and sellers within the protocol. They are the backbone of DeFi platforms, bringing together people eager to supply their assets and people looking to trade or borrow those assets.

Participants contribute to a shared pool of liquidity by depositing funds into a liquidity pool, which ensures the continued availability of assets for trading, lending, and other financial operations.

Liquidity pools improve market liquidity by allowing for more efficient price discovery, reducing slippage, and increasing market liquidity. They also make it easier to make loans and earn passive revenue through yield farming and liquidity mining.

Understanding Liquidity

Liquidity is a fundamental concept in all financial markets; it is compared to the lifeblood of financial assets and refers to the ease with which an asset may be purchased or sold without producing substantial price adjustments. Simply said, it denotes the ability to transform investment into cash rapidly and at a reasonable cost. It is critical for the smooth operation of markets because it allows participants to enter and exit positions expeditiously, lowering transaction costs and market volatility.

Traditional financial markets have relied on a variety of liquidity sources. Market makers, people, or organizations that regularly offer buy and sell orders for a certain asset, are one of the major primary sources. They increase liquidity by reducing bid-ask spreads, enabling traders to complete trades more quickly.

Institutional investors, such as pension funds and mutual funds, are another source of conventional liquidity since they do so by pooling enormous amounts of cash. These investors have the power to purchase or sell significant assets, which adds to the market’s stability and depth.

Liquidity Pools in DeFi?

The emergence of decentralized finance (DeFi) has led to the emergence of new liquidity mechanisms. These liquidity pools make use of both blockchain technology and smart contracts to establish decentralized markets where participants can offer liquidity and profit. Participants in these pools can deposit pairs of assets, usually cryptocurrency, to facilitate trading within the pool. Based on the trading activity within the pool, liquidity providers are paid.

Compared to traditional liquidity sources, the advantages of Liquidity pools in DeFi platforms are miles apart. Firstly, they offer a permissionless and decentralized approach, allowing anyone with compatible assets to become a liquidity provider without requiring permission from centralized intermediaries. This democratizes access to liquidity provision and promotes financial inclusion.

Secondly, liquidity pools in DeFi platforms have created opportunities for participants to earn passive income. By contributing assets to a liquidity pool, individuals can receive a portion of the transaction fees generated by the platform. This incentivizes liquidity provision and fosters a vibrant ecosystem of liquidity providers.

Furthermore, DeFi liquidity pools have facilitated the creation of innovative financial instruments, such as decentralized exchanges and lending protocols. These protocols rely on the liquidity the pools provide to enable peer-to-peer trading and lending, reducing reliance on traditional intermediaries and enhancing efficiency.

However, it is important to note that liquidity pools in DeFi also come with risks. Impermanent loss, smart contract vulnerabilities, and market volatility are among the challenges that liquidity providers should consider and manage.

Liquidity is critical to financial markets, ensuring smooth trading and efficient price discovery. Traditional markets have relied on market makers and institutional investors for liquidity, while DeFi platforms have introduced liquidity pools as a decentralized alternative. Liquidity pools in DeFi offer benefits such as accessibility, passive income generation, and the creation of innovative financial instruments. Nonetheless, participants should be aware of the risks and caution when engaging with these new liquidity mechanisms.

Key Concepts in Liquidity Pools

1. Automated Market Makers (AMMs)

These are decentralized protocols that simplify the creation and functioning of liquidity pools in the context of decentralized finance (DeFi) platforms. AMMs employ mathematical algorithms to automatically execute trades between multiple assets by ensuring that there is a balance between the supply of tokens in the liquidity pool.

They remove the need for traditional order books and centralized brokers, allowing users to trade directly with the protocol. Tokens can easily get liquidity because the AMMs play a vital role in facilitating that process. Liquidity providers deposit their tokens into the pool, and in return, they receive commensurate liquidity pool tokens as their incentive for contributing to the pool.

However, these tokens can be redeemed for the underlying assets at any time. AMMs utilize these liquidity pools to calculate prices based on the ratio of tokens in the pool, ensuring fair and efficient trading.

In comparison to traditional market-making models, AMMs offer several advantages. They provide continuous liquidity without relying on external market makers or intermediaries, which enhances accessibility and reduces costs.

AMMs also allow for greater transparency and decentralization as they operate on blockchain networks. However, AMMs may have limitations regarding price slippage and handling extreme market conditions, as they rely on predefined mathematical formulas rather than human judgment and intervention.

2. Liquidity Providers (LPs)

Liquidity providers are like the lifeblood of financial markets because they play a key role in ensuring the availability and stability of liquidity. Their primary function is to provide assets or funds to liquidity pools, facilitating trading and ensuring that buyers and sellers can execute transactions efficiently. By contributing their assets, liquidity providers enhance market depth and reduce price volatility.

In return for their contribution, liquidity providers are typically rewarded with transaction fees and other incentives, such as yield farming rewards or governance tokens. These incentives aim to attract and retain liquidity providers, encouraging their continued participation in the liquidity provision process.

However, being a liquidity provider also entails certain risks. Market volatility can result in impermanent Loss, where the value of assets in a liquidity pool fluctuates compared to holding them outside. Additionally, smart contract vulnerabilities, hacking risks, and sudden changes in market conditions can expose liquidity providers to potential financial losses.

Despite the risks, liquidity provision can be profitable for those willing to manage and mitigate potential downsides, making it an essential component of decentralized finance ecosystems.

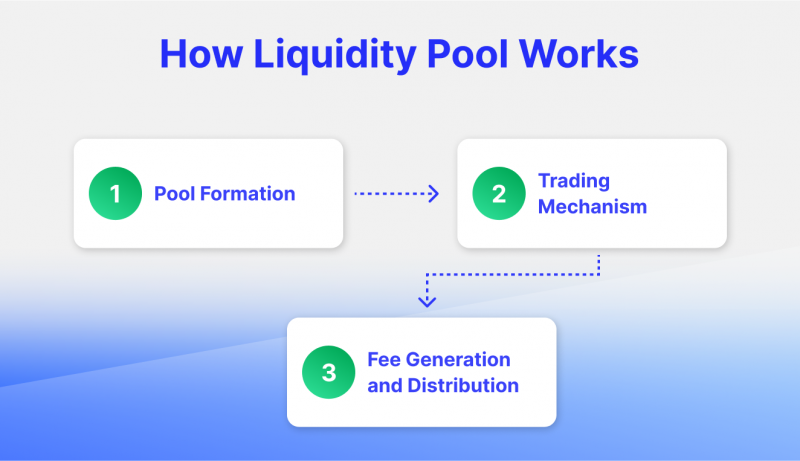

How Liquidity Pool Works

1. Pool Formation

Creating a liquidity pool contract involves a meticulous process. First, a smart contract is written, defining pool functionalities like token swapping and fees. Token pairs are then selected based on market demand, trading volume, and compatibility.

A thorough analysis of token economics is crucial. Once chosen, tokens are deposited in the pool, ensuring sufficient liquidity. The initial deposit amount must balance attracting traders and maintaining stability.

Careful consideration of token ratios is required to establish fair prices. Constructing a liquidity pool contract demands strategic planning to facilitate efficient and secure decentralized trading.

2. Trading Mechanism

The constant product formula, exemplified by platforms like Uniswap, revolutionizes price discovery and pool balance maintenance. This algorithmic approach ensures a continuous product of reserves in a liquidity pool, allowing for efficient trading without relying on centralized intermediaries.

However, slippage, the difference between the expected and actual execution price, can impact trades on these decentralized exchanges. High slippage arises when liquidity is limited, leading to potential losses or reduced gains for traders. Understanding slippage and actively managing liquidity pools are crucial for optimizing trading strategies on constant product platforms.

3. Fee Generation and Distribution

Calculating and collecting trading fees play a crucial role in the financial ecosystem. Platforms determine fees based on factors such as transaction volume or value. Efficient fee collection processes ensure accurate and timely revenue generation. Equally important is the fair distribution of fees among liquidity providers. This encourages their participation and provides a balanced market.

Effective algorithms and smart contracts allocate fees proportionally, considering factors like liquidity contribution and duration. Such mechanisms promote transparency, attract participants, and foster a healthy trading environment.

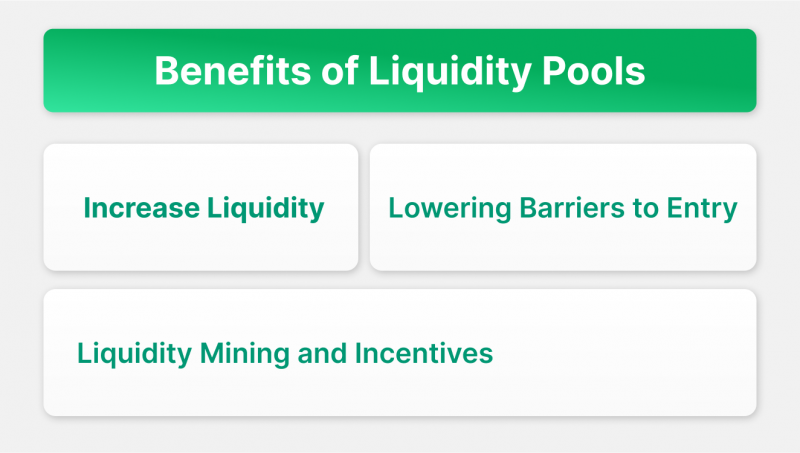

Benefits and Advantages of Liquidity Pools

1. Increase Liquidity

Liquidity Pools offer several advantages, including the ability to increase liquidity. These pools allow participants to contribute their assets, creating a collective pool of funds available for trading.

This aggregation of liquidity enhances market depth, ensuring sufficient funds are available to facilitate trades and reduce price slippage. Additionally, Liquidity Pools promote market efficiency by eliminating order book limitations. Instead of relying solely on order matching, participants can trade directly from the pooled liquidity.

This streamlined process enhances transaction speed and reduces costs. In summary, Liquidity Pools provide increased liquidity, deepen market depth, improve efficiency, and overcome the limitations of traditional order book systems.

2. Lowering Barriers to Entry

Liquidity pools offer numerous advantages; among them is the significant reduction in barriers to entry. These pools democratize access to financial markets by allowing anyone to participate, regardless of their economic background or geographic location.

With liquidity pools, accessibility is greatly enhanced, as retail investors can join without facing the limitations encountered in traditional markets. Moreover, the permissionless nature of these pools eliminates the need for intermediaries or cumbersome approval processes, empowering individuals to engage directly with the market.

This newfound inclusivity empowers retail investors to contribute liquidity actively, earn rewards, and partake in decentralized finance, fostering a more equitable and inclusive financial landscape.

3. Liquidity Mining and Incentives

Liquidity Mining and Incentives are integral components of Liquidity Pools, offering many advantages. They fuel the concept of Yield farming, enabling participants to earn passive income by providing liquidity to decentralized platforms.

Liquidity Mining programs incentivize users to contribute their tokens to these pools, rewarding them with additional tokens as compensation. This approach ensures sufficient liquidity for the platform and fosters community participation and engagement.

By actively contributing to Liquidity Pools, individuals become stakeholders in the ecosystem, aligning their interests with the platform’s success. This symbiotic relationship cultivates a vibrant community, propelling innovation and driving the overall growth of the decentralized finance landscape.

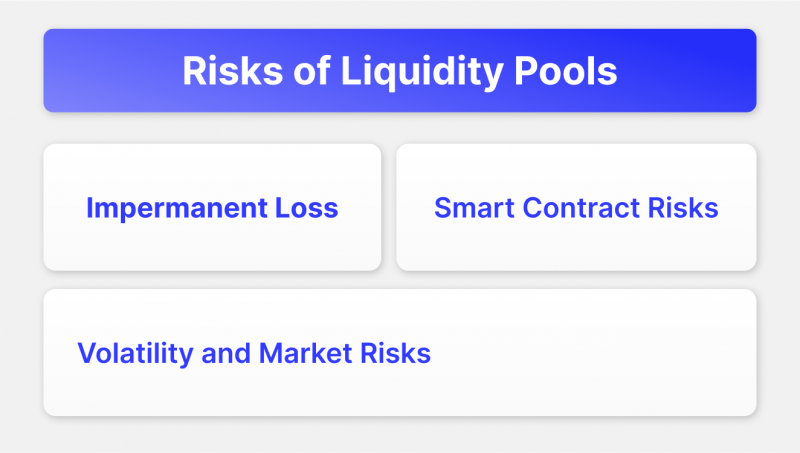

Risks and Considerations in Liquidity Pools

1. Impermanent Loss

Impermanent Loss is a significant risk associated with liquidity pools in decentralized finance (DeFi). It refers to the temporary reduction in value experienced by liquidity providers (LPs) when participating in these pools. When the price ratio between two assets in a pool changes, LPs may suffer Loss compared to simply holding the assets. This is caused by the need to rebalance the pool to maintain the desired asset ratio.

To mitigate impermanent Loss, LPs can employ strategies such as impermanent loss insurance, yield farming, or choosing pools with lower volatility. However, it’s crucial to thoroughly analyze the risks and potential rewards before engaging in liquidity pools.

2. Smart Contract Risks

Smart contracts, while revolutionary in their ability to automate transactions on the blockchain, come with inherent risks and vulnerabilities. These digital agreements are susceptible to coding errors, leading to unintended consequences and financial losses. Vulnerabilities such as reentrancy attacks, unchecked external calls, and integer overflow can be exploited by malicious actors, compromising the integrity of the contract.

The importance of audits and rigorous security measures cannot be overstated. Regular audits help identify and rectify vulnerabilities, ensuring smart contracts function as intended and minimize the risk of exploits. Implementing robust security measures like code reviews, formal verification, and bug bounties fosters trust and safeguards the decentralized ecosystem.

3. Volatility and Market Risks

Volatility and market risks play a significant role in the risk considerations for liquidity pools. These pools, designed to provide liquidity to decentralized finance (DeFi) platforms, are susceptible to price fluctuations that can impact their overall liquidity and risk management strategies. As prices of underlying assets experience volatility, liquidity providers (LPs) may face challenges in maintaining stable liquidity ratios. Sudden price drops can lead to impermanent Loss, eroding the value of LPs’ assets.

To mitigate these risks, LPs employ various strategies like diversifying their portfolios, utilizing hedging techniques, and actively monitoring market conditions. Constant evaluation and adaptation of risk management strategies become imperative to ensure the stability and sustainability of liquidity pools amidst price fluctuations and market uncertainties.

Popular Liquidity Pool Protocols

1. Uniswap

Uniswap, a decentralized exchange protocol built on Ethereum, revolutionized the world of liquidity provision. Uniswap allows users to trade ERC-20 tokens directly from their wallets by eliminating intermediaries. Its unique automated market maker (AMM) model uses smart contracts to facilitate trades, with liquidity providers pooling their tokens into liquidity reserves.

This decentralized liquidity enables continuous trading and price discovery. Uniswap’s popularity surged due to its simplicity, low fees, and permissionless nature, empowering anyone to become a liquidity provider. As a trailblazer in DeFi, Uniswap has catalyzed innovation and transformed the landscape of decentralized finance.

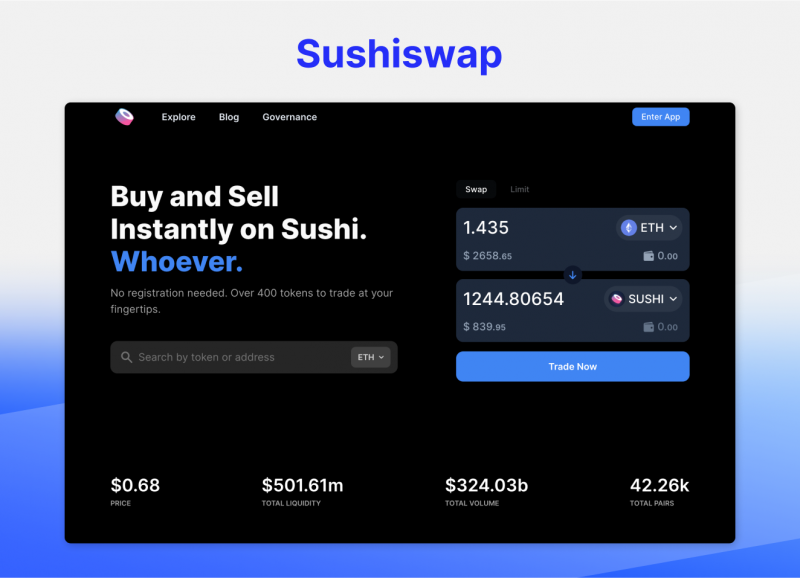

2. Sushiswap

Sushiswap is a decentralized liquidity protocol built on the Ethereum blockchain. It allows users to trade and provide liquidity for various tokens through smart contracts. Sushiswap’s unique feature is its use of Automated Market Making (AMM), which enables users to earn fees by providing liquidity to token pairs. With its community-driven governance model, Sushiswap has gained popularity in the DeFi space, offering a user-friendly interface and incentivizing users with yield farming opportunities. As a leading liquidity protocol, Sushiswap continues to innovate and contribute to the growth of decentralized finance.

3. PancakeSwap

PancakeSwap is a decentralized exchange and liquidity protocol built on the Binance Smart Chain. It allows users to trade and provide liquidity for various tokens. Using an automated market-making (AMM) system, PancakeSwap eliminates the need for traditional order books. Users can earn fees and rewards by staking their tokens in liquidity pools.

The protocol’s native token, CAKE, plays a vital role in governance and incentivizing participants. With its low fees and fast transactions, PancakeSwap has gained popularity as a user-friendly and cost-effective alternative to other decentralized exchanges.

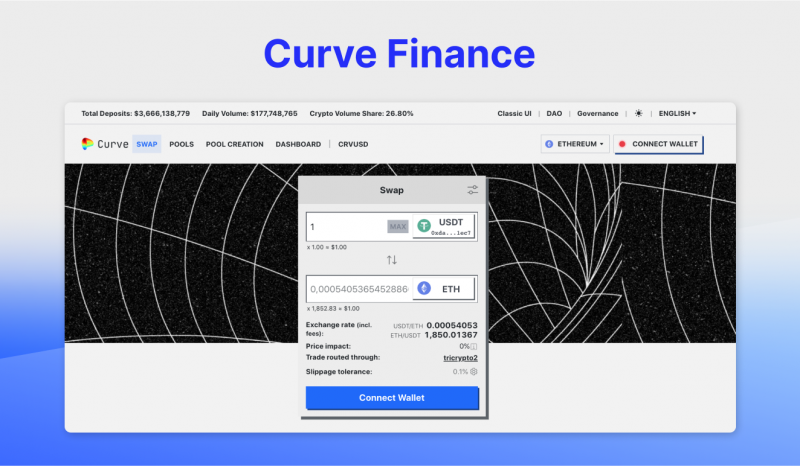

4. Curve Finance

Curve Finance is a liquidity protocol built on Ethereum that optimizes stablecoin trading. By leveraging automated market makers (AMMs) and low slippage, Curve offers efficient and cost-effective swapping of stablecoins with minimal impermanent Loss. Its unique design caters to the needs of DeFi users, particularly those engaged in yield farming and stablecoin trading strategies.

Curve’s innovative algorithms and deep liquidity pools ensure stablecoin trades with high precision, making it a popular choice among traders seeking low-risk and low-slippage transactions in the decentralized finance ecosystem.

5. Balancer

Balancer liquidity protocol is a decentralized finance (DeFi) platform that provides automated portfolio management and liquidity provision. It allows users to create and manage liquidity pools with multiple tokens, enabling dynamic asset allocation. With its customizable weightings and self-adjusting mechanisms, Balancer allows users to rebalance their portfolios automatically, ensuring optimal performance.

The protocol also supports token swapping and incentivizes liquidity providers through fees and token rewards. Balancer’s innovative approach offers greater flexibility and efficiency, empowering users to participate in decentralized exchanges and maximize their returns while maintaining control over their assets.

6. Convexity Protocol

Convexity Protocol is a prominent liquidity protocol, empowering decentralized finance enthusiasts with efficient capital deployment. Harnessing the power of convex financial strategies maximizes yields for liquidity providers. With its user-friendly interface and advanced automation, Convexity simplifies the process of earning attractive returns on digital assets.

This protocol optimizes liquidity provisioning by utilizing convex tokens, unlocking additional rewards and incentives. By offering a seamless experience and promoting sustainable liquidity, Convexity Protocol has gained recognition as a leading platform within the thriving ecosystem of liquidity protocols.

7. Kyber Network

Kyber Network Protocol is a leading liquidity protocol renowned for its efficiency and versatility. It empowers decentralized finance (DeFi) ecosystems by enabling seamless token swaps and enhancing liquidity across various blockchain networks. With a robust infrastructure, Kyber Network Protocol allows users to access digital assets with minimal slippage and competitive rates. It boasts a decentralized architecture ensuring trustless transactions and a secure trading environment.

Kyber Network Protocol’s user-friendly interface and extensive integration with other DeFi platforms have solidified its position as a preferred choice for traders seeking liquidity solutions in the ever-expanding blockchain landscape.

8. Bancor Protocol

Bancor Protocol is a leading liquidity protocol revolutionizing the decentralized finance landscape. Its unique design enables instant and continuous liquidity for a wide range of tokens. Bancor achieves this through an autonomous pricing mechanism based on smart contracts and a decentralized network of liquidity providers.

By eliminating the need for traditional order books, Bancor offers efficient and secure token swaps while maintaining low slippage and price stability. Its intuitive interface and seamless integration make it a popular choice among users, empowering them with easy access to decentralized liquidity pools and fostering vibrant token ecosystems.

9. DeversiFi Protocol

DeversiFi Protocol stands tall as a leading liquidity protocol, empowering users with unparalleled trading capabilities. It harnesses the power of decentralized finance to provide a seamless and secure trading experience.

With its robust infrastructure and cutting-edge technology, DeversiFi offers high-speed, non-custodial trading, allowing users to access diverse tokens while maintaining complete control over their assets. Its efficient order-matching engine and deep liquidity pools ensure optimal trading conditions. DeversiFi’s commitment to transparency, privacy, and user-centricity has solidified its position as a go-to platform for traders seeking liquidity and flexibility in the ever-evolving crypto landscape.

Case Studies and Real-World Applications

Decentralized finance (DeFi) has gained significant traction in recent years, revolutionizing the traditional financial landscape. Within the DeFi ecosystem, several key components have emerged, including decentralized exchanges (DEXs), yield farming platforms, decentralized finance applications, and cross-chain liquidity pools.

These elements showcase the power and potential of decentralized technologies. Let’s explore some case studies and real-world applications that highlight their significance.

Decentralized Exchanges (DEXs) — are platforms that enable users to trade cryptocurrencies directly with one another without the need for intermediaries. One notable DEX case study is Uniswap. Built on the Ethereum blockchain, Uniswap utilizes an automated market maker (AMM) system to facilitate token swaps. Its intuitive interface and low fees have attracted a vast user base, resulting in substantial trading volumes. Uniswap’s success demonstrates the efficiency and accessibility of DEXs, promoting financial inclusivity.

Yield Farming Platforms — have emerged as a popular trend in DeFi, allowing users to earn passive income by lending or providing liquidity to various protocols. A prominent example is Compound Finance. Users can earn interest and borrow against their collateral by depositing assets into a Compound. The platform utilizes an algorithmic interest rate model, dynamically adjusting rates based on supply and demand. Compound’s success has spurred the growth of numerous yield farming platforms, providing users with additional income-generating opportunities.

Decentralized Finance Applications — extend beyond simple trading and lending. One notable application is Aave. Aave is a decentralized lending and borrowing protocol that enables users to earn interest on deposits and take out loans using cryptocurrency as collateral. It utilizes a unique flash loan feature, allowing users to borrow without requiring collateral if the funds are returned within the same transaction. Aave’s innovative features have contributed to expanding DeFi’s capabilities, introducing new possibilities for financial services.

Cross-chain Liquidity Pools — facilitate the seamless transfer of assets across different blockchain networks. One prominent example is the Thorchain protocol. Thorchain enables cross-chain swaps by providing liquidity pools that allow users to trade assets from various blockchains. Through its decentralized network, Thorchain reduces the reliance on centralized exchanges and promotes interoperability among different blockchain ecosystems. Cross-chain liquidity pools like Thorchain are pivotal in fostering a more connected and efficient DeFi landscape.

The aforementioned case studies and real-world applications demonstrate the transformative potential of decentralized exchanges (DEXs), yield farming platforms, decentralized finance applications, and cross-chain liquidity pools. These innovations have democratized access to financial services, giving users greater control over their assets and enabling new income streams. As the DeFi ecosystem continues to evolve, it is essential to monitor these developments closely as they shape the future of finance and open avenues for financial inclusion and innovation.

In conclusion, decentralized exchanges, yield farming platforms, finance applications, and cross-chain liquidity pools have revolutionized the financial landscape. Through case studies and real-world applications such as Uniswap, Compound Finance, Aave, and Thorchain, we witness the power of these technologies in providing efficient, accessible, and interconnected financial services. As the DeFi ecosystem expands, these innovations will continue to drive the democratization of finance and foster new opportunities for users worldwide.

Future Developments and Challenges

1. Layer-2 Solutions and Scalability

Layer 2 solutions represent a promising future development for addressing scalability challenges in crypto. By enabling off-chain transactions and utilizing protocols like Lightning Network, they enhance transaction throughput and reduce fees. However, implementing and adopting these solutions on a large scale requires widespread consensus, user education, and seamless integration with existing infrastructure. Overcoming these challenges will pave the way for a more scalable and efficient crypto ecosystem.

2. Interoperability and Cross-chain liquidity

Interoperability and cross-chain liquidity are pivotal future developments in crypto, yet they also present significant challenges. With the proliferation of diverse blockchain networks, enabling seamless communication and transfer of assets across chains becomes imperative.

Achieving true interoperability demands standardization and scalable solutions. Likewise, establishing cross-chain liquidity necessitates trustless mechanisms that facilitate efficient asset swaps, ensuring liquidity flow across various networks. Addressing these challenges will unlock the full potential of decentralized finance, fostering an inclusive and interconnected crypto ecosystem.

3. Regulatory Considerations and Compliance

Regulatory considerations and compliance present significant future developments and challenges in the crypto space. As the industry continues to grow, governments worldwide strive to establish frameworks to address issues like money laundering, investor protection, and market stability. Striking a balance between innovation and regulation is crucial to foster trust and widespread adoption. Compliance with evolving rules and guidelines will be essential for crypto businesses to navigate this changing landscape successfully.

Summary & Conclusion

Liquidity pools have emerged as a revolutionary concept in decentralized finance (DeFi), providing a decentralized and efficient solution to the age-old liquidity problem. These pools have significant implications for the financial ecosystem, bringing forth various benefits and opportunities for participants.

Liquidity pools are crucial in facilitating seamless trading and investment in DeFi protocols. Liquidity is readily available by pooling funds from multiple participants, ensuring uninterrupted trading and reducing slippage. This accessibility and efficiency have attracted a growing number of users, increasing the liquidity and depth of the markets and ultimately enhancing the overall stability and functionality of the DeFi ecosystem.

Moreover, liquidity pools have opened up new avenues for individuals to generate passive income. Users can earn fees and rewards proportional to their contributions by depositing their assets into these pools. This incentive mechanism not only encourages users to participate but also aligns their interests with the growth and success of the protocols. This symbiotic relationship between users and DeFi platforms has created a self-sustaining ecosystem that continues to expand.

The potential for growth and evolution in the DeFi ecosystem is immense. As the DeFi landscape matures, liquidity pools will likely become more sophisticated, offering innovative features and strategies to optimize capital efficiency. We can expect the emergence of cross-chain liquidity pools, enabling seamless interoperability between different blockchain networks. Additionally, integrating advanced smart contract functionalities and algorithmic market-making strategies will enhance the performance and profitability of these pools.

There has never been a better time for individuals interested in exploring and participating in liquidity pools. Engaging with these decentralized financial instruments allows individuals to tap into diverse investment opportunities, irrespective of geographical or financial constraints. By actively participating in liquidity provision, users contribute to the DeFi ecosystem’s growth and benefit from the potential rewards and returns.

However, it is crucial to approach liquidity pool participation with caution. Users should conduct thorough research, understand the risks associated with each pool, and only invest what they can afford to lose. Furthermore, keeping track of evolving regulations and best practices within the DeFi space is essential to ensure compliance and security.

In conclusion, liquidity pools have revolutionized the DeFi landscape, providing a decentralized and efficient solution to liquidity challenges. Their significance lies in enhancing market stability, facilitating seamless trading, and offering passive income opportunities. The potential for growth and evolution in this space is immense, and individuals are encouraged to explore and participate in liquidity pools, contributing to the development of the DeFi ecosystem while potentially reaping significant rewards.

FAQ

How are liquidity pools explained in simple terms?

Liquidity pools explained simply: multiple investors combine their tokens into a shared pool, making it easier to trade assets smoothly on DeFi platforms.

Why do traders benefit from liquidity pools explained by market experts?

When liquidity pools explained by pros are understood, traders realize these pools minimize price swings, reduce friction, and ensure steady trading opportunities.

Can liquidity pools explained by developers help me earn passive income?

Yes, liquidity pools explained clearly show that by contributing your tokens, you gain a share of fees or rewards, turning your holdings into steady earners.

Recommended articles

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer