What Is A Liquidity Trap? Causes, Signs, Solutions

In a situation characterised by near-zero interest yields, cut-price loans, and central banks incorporating substantial funds into the economy, one might expect significant changes. However, the reality is that businesses refrain from making investments, consumers are reluctant to spend, and economic stagnation continues unabated.

This scenario exemplifies a liquidity trap, a phenomenon where conventional monetary policy measures fail to promote economic prosperity effectively. Grasping the underlying causes, identifying the indicators, and exploring potential remedies for this economic conundrum are essential for managing financial crises and maintaining stability during turbulent periods.

This article is a guide where you will find answers to questions about the liquidity trap phenomenon, what preconditions contribute to it, and what strategies you should use to avoid it.

Key Takeaways

- A liquidity trap occurs when nearly zero interest rates and abundant liquidity fail to boost spending or investment, making traditional gelding schemes ineffective.

- Overcoming a liquidity trap requires radical monetary tactics, aggressive fiscal measures, and structural reforms to restore confidence and demand.

- Key signs of a liquidity trap include low loan demand, high savings rates, deflationary expectations, and stagnant economic output.

What Is Liquidity Trap?

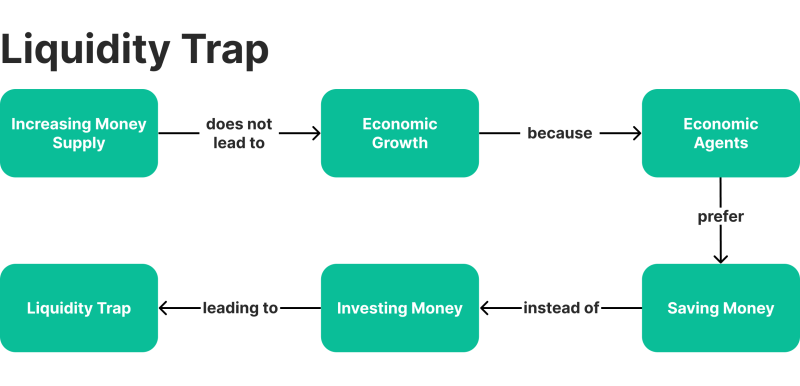

A liquidity trap is a unique economic condition where established monetary policy methods lose their effectiveness in stimulating economic development. This situation arises when interest rates are near or zero, and central banks cannot lower them further to incentivise expenditure or investment.

Despite the prevalence of cheap credit, business organisations and consumers prefer to hoard cash due to low confidence in the economy, deflationary expectations, or uncertainty about the future. This lack of spending and investment leads to prolonged economic stagnation or slow growth.

The term “liquidity trap” was popularised by economist John Maynard Keynes, who observed that people might prefer holding liquid assets (like cash) rather than investing in bonds or other financial instruments in certain circumstances.

This happens because they expect interest rates to rise in the future, which would reduce the value of these investments, or because they believe economic conditions will worsen. Consequently, even when central banks insert cash into the economy through quantitative easing or other measures, the increased money supply fails to spur economic activity.

The term “liquidity trap” was introduced by John Maynard Keynes, who observed that people may prefer holding cash over investments when they expect worsening economic conditions or rising interest rates.

Examples of Liquidity Traps in History

There have been many economic shocks in history, which directly or indirectly caused a lot of negative consequences for business, trade and other financial spheres. In particular, one of such consequences is the liquidity trap, which occurred at different times. Among them, we can single out the following:

The Great Depression (1930s)

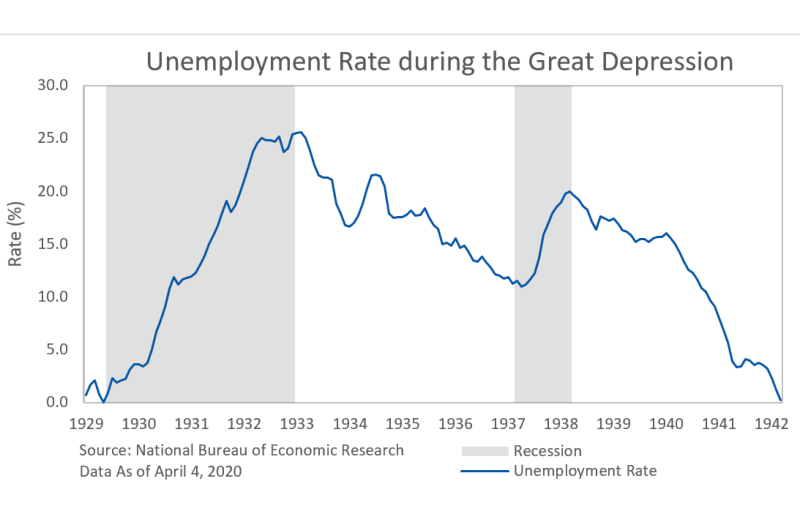

The Great Depression is one of the earliest and most notable examples of a liquidity trap. The global economy faced a severe downturn during this period, and deflation gripped many countries. In the United States, interest rates dropped to historically low levels, but consumer confidence was so shattered that people and businesses chose to save money rather than spend or invest.

Despite central banks flooding the economy with liquidity, the loan demand remained weak, and economic progress stalled. Policymakers eventually turned to large-scale fiscal measures, such as Franklin D. Roosevelt’s New Deal, which combined public works projects and social programs to restore demand and economic activity. The Great Depression illustrated the ineffectiveness of monetary policy alone in addressing deep economic crises.

Japan Lost Decade (1990s-2000s)

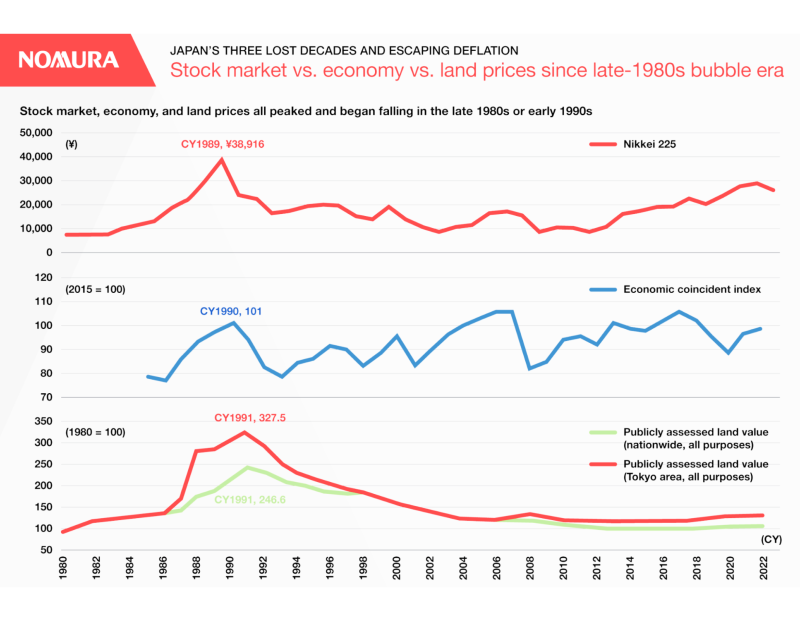

Japan’s economic stagnation following its asset price bubble burst in the late 1980s is another classic example of a liquidity trap. During this period, deflation and weak demand plagued the Japanese economy, even as the Bank of Japan reduced interest rates to near zero. Despite the availability of cheap credit, businesses were hesitant to borrow, and consumers delayed spending in anticipation of further price declines.

The central bank implemented extraordinary measures, such as quantitative easing, but the economy remained sluggish for over a decade. Structural issues, including an ageing population and over-reliance on export-driven growth, compounded the problem. Japan’s Lost Decade is often cited as a cautionary tale of how difficult it is to escape a liquidity trap without addressing more profound structural challenges.

The 2008 Global Financial Crisis

The 2008 financial crisis thrust many advanced economies into liquidity traps. Following the collapse of major financial institutions and housing markets, central banks slashed interest rates to near zero to stimulate repayments and investment. However, the crisis severely weakened consumer and business confidence, leading to a preference for saving and deleveraging overspending. Deflationary pressures in some economies further discouraged economic activity.

Central banks employed different monetary policies, such as quantitative easing and forward guidance, to combat the liquidity trap. At the same time, governments implemented fiscal stimulus packages like the U.S. American Recovery and Reinvestment Act. Although these measures eventually helped the global economy recover, the experience highlighted the challenges of reviving growth during a liquidity trap.

European Sovereign Debt Crisis (2010s)

The European Sovereign Debt Crisis began in 2010 and pushed several European countries, including Greece, Spain, and Italy, into liquidity trap-like conditions. The crisis was marked by low interest rates and high public debt levels, combined with austerity measures that suppressed demand. Even as the European Central Bank (ECB) lowered interest rates and introduced bond-buying programs, economic activity in many affected countries remained weak.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

The lack of consumer and business confidence and deflationary pressures prolonged the stagnation. Eventually, targeted fiscal measures and structural reforms were implemented in addition to the ECB’s monetary interventions, but recovery was slow and uneven across the Eurozone.

COVID-19 Pandemic (2020s)

The COVID-19 pandemic created conditions resembling a liquidity trap in many countries. To inject liquidity into the economy, central banks slashed interest rates to near zero and implemented massive quantitative easing programs. However, uncertainty caused by the pandemic, lockdowns, and supply chain disruptions reduced consumer spending and business investment. Many households and businesses prioritised saving or paying down debt instead of borrowing and spending.

To counteract the downturn, governments worldwide responded with unprecedented fiscal measures, such as direct stimulus payments, business grants, and unemployment benefits. The pandemic underscored the importance of effectively combining monetary and fiscal policies to address liquidity trap scenarios.

Signs of a Liquidity Trap

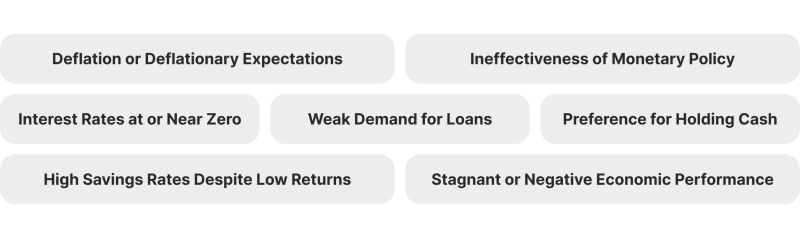

A liquidity trap is characterised by specific economic and financial conditions that signal the ineffectiveness of traditional monetary policy in stimulating the economy. Below are key signs of a liquidity trap, explained in detail:

Interest Rates at or Near Zero

One of the most prominent indicators of a liquidity trap is when short-term interest rates are extremely low or at the zero lower bound (ZLB). Central banks reduce interest rates to encourage borrowing, spending, and investment. However, rates cannot be lowered further in a liquidity trap, rendering monetary policy ineffective.

Even with these historically low borrowing costs, economic activity remains stagnant because consumers and businesses lack confidence in the economy. For example, during the 2008 global financial crisis, central banks worldwide, including the Federal Reserve, slashed interest rates to nearly zero, but economic production remained sluggish.

Weak Demand for Loans

Despite the availability of cheap credit, a liquidity trap is characterised by weak demand for loans from consumers and businesses. This reluctance to borrow is often driven by uncertainty about the future, pessimistic economic outlooks, or deflation expectations (falling prices). In such conditions, businesses may postpone investments, and consumers may delay large purchases.

Moreover, banks may tighten their lending standards if they perceive increased risks of defaults, further exacerbating the situation. An example of this phenomenon is Japan’s Lost Decade (the 1990s–2000s), during which corporations avoided taking new loans and focused on reducing debt despite favourable interest rates.

Preference for Holding Cash

A liquidity trap often leads to a widespread preference for holding cash or highly liquid assets instead of spending or investing. This behaviour is driven by fears of economic instability, uncertainty, or deflation, where money holds its value better than other assets.

In a deflationary environment, cash becomes more valuable over time because the purchasing power of money increases as prices fall. This “hoarding” of cash further inhibits money circulation in the financial system, weakening demand for goods and services and prolonging economic stagnation.

Deflation or Deflationary Expectations

Deflation, or the persistent decline in the overall price level, is both a cause and a symptom of a liquidity trap. When consumers and businesses forecast prices to fall further, they delay spending and investment decisions, anticipating better deals later.

This behaviour depresses demand, causing prices to fall even more, creating a self-reinforcing deflation cycle and low demand. Japan’s economy during its Lost Decade experienced prolonged deflation, severely limiting consumer and business spending and worsening the liquidity trap.

Ineffectiveness of Monetary Policy

Traditional monetary tools, such as cutting interest rates or increasing the money supply, fail to stimulate economic output in a liquidity trap. Even when central banks flood the economy with liquidity through measures like quantitative easing, the additional money does not translate into increased spending or investment.

Instead, it remains in the banking system as excess reserves or is held by individuals and businesses as cash. This ineffectiveness forces central banks to explore nontraditional measures, such as forward guidance (promising to keep interest rates low for an extended period) or more aggressive fiscal interventions.

High Savings Rates Despite Low Returns

In a liquidity trap, households and businesses often prioritise saving over spending, even when the returns on savings accounts or other safe investments are negligible. This behaviour reflects a lack of confidence in future economic emergence or stability.

People save rather than spend to protect themselves against potential economic hardships, which further suppresses aggregate demand. High savings rates and weak consumption significantly impede economic recovery.

Stagnant or Negative Economic Performance

Another hallmark of a liquidity trap is a prolonged period of stagnant or negative economic growth. Despite low borrowing costs and central bank efforts to stimulate the economy, demand remains weak, leading to resource underutilisation, reduced production, and high unemployment. This slow growth or contraction creates a feedback loop of low confidence, further discouraging spending and investment.

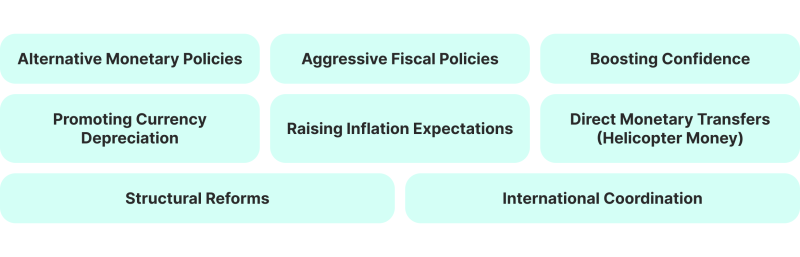

Strategies to Overcome a Liquidity Trap

Overcoming a liquidity trap requires radical monetary policy, aggressive fiscal measures, and structural reforms. Since traditional monetary tools like cutting interest rates are ineffective in such situations, policymakers must adopt more innovative and coordinated strategies to stimulate demand and restore economic growth.

Here are key approaches to curing a liquidity trap:

Alternative Monetary Policies

Central banks deploy unusual manoeuvres to incite economic turnover when traditional interest rate cuts are ineffective. Quantitative easing involves purchasing long-term financial assets to strengthen the funds supply, lower contracting costs, and encourage spending and investment.

Negative interest rates charge commercial banks for holding idle stashes, incentivising them to lend money and push funds into the broader economy. Forward guidance entails clear communication of future monetary policy intentions to shape market expectations, encouraging immediate consumption and investment. Yield curve control targets specific interest rates on government bonds to ensure affordable long-term borrowing.

Aggressive Fiscal Policies

Governments use direct fiscal interventions to bolster collective demand. Greater government intervention in public projects creates jobs and stimulates economic activity.

Tax cuts and direct transfers reduce taxes or provide financial support, increasing disposable income and boosting consumer spending. Business support through subsidies, loans, or guarantees helps companies maintain operations, prevent layoffs, and sustain economic momentum.

Boosting Confidence

A lack of confidence in future economic prospects often underpins a liquidity trap, making it essential to address this psychological barrier. Policy credibility ensures consistent and reliable policies, reducing uncertainty and encouraging households and businesses to spend and invest.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Collaborative initiatives, such as partnerships between the public and private sectors, affect investment and economic turnover. Encouraging credit demand through guarantees and subsidies for loans lowers the perceived risk of taking out debt, motivating businesses and households to invest or make significant purchases.

Promoting Currency Depreciation

Central banks can weaken the domestic currency to make exports more competitive internationally. This increases external demand, boosts production and employment, and stimulates economic growth.

Raising Inflation Expectations

Higher inflation expectations discourage cash hoarding and spur speedy spending. Adjusting inflation targets allows central banks to commit to higher inflation levels, signalling that holding cash will eventually result in a loss of purchasing power.

Direct Monetary Transfers (Helicopter Money)

Providing funds directly to consumers ensures that money reaches households, bypassing intermediaries and encouraging immediate spending. This approach focuses on direct stimulus to consumption, distinct from traditional monetary policies.

Structural Reforms

Long-term structural changes improve economic resilience and efficiency, making the economy less prone to future liquidity traps. Labour market flexibility reduces barriers, ensuring adaptability to economic shocks.

Productivity enhancements through investments in education, technology, and innovation improve long-term financial performance. Simplifying regulations reduces bureaucracy and compliance costs, promoting entrepreneurship and economic dynamism.

International Coordination

Collaborating with other nations ensures synchronised fiscal and monetary regulation, amplifying the effectiveness of domestic measures. This reduces the risks of competitive devaluations and promotes balanced global economic growth.

Conclusion

Overcoming a liquidity trap requires a coordinated blend of innovative monetary policies, bold fiscal measures, and long-term structural reforms. By addressing the root causes of economic stagnation and boosting confidence, policymakers can reignite growth and restore stability.

As history shows, overcoming a liquidity trap isn’t easy, but with the right strategies, economies can emerge stronger and more resilient than ever. Ultimately, the key lies in fostering confidence and creating an environment where spending, investing, and innovation thrive.

FAQ

What is a liquidity trap in simple terms?

A liquidity trap is observed when interest rates are very low, but people and businesses avoid borrowing, spending, or investing, making traditional monetary policies ineffective.

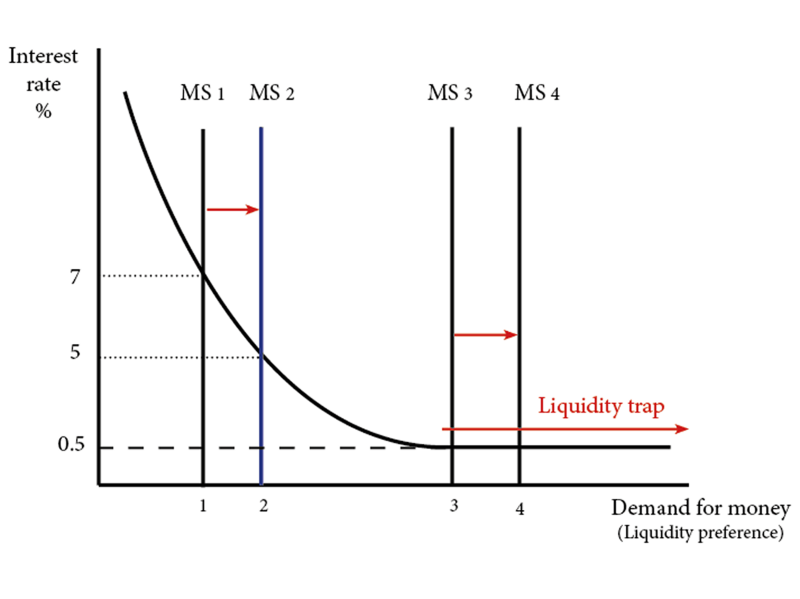

What is a liquidity trap graph?

A liquidity trap graph shows that at near-zero interest rates, augmenting the fund’s supply fails to accelerate economic output, as people prefer holding cash overspending or investing.

What are the key signs of a liquidity trap?

Near-zero interest rates, weak loan demand, high savings expenses, erosion, and stagnant or negative economic progression.

Why do liquidity traps happen?

They occur due to low economic confidence, deflationary expectations, or uncertainty, leading people to hoard funds on top of spending or investing.

How can a liquidity trap be resolved?

Using informal monetary procedures and fiscal incentives, increasing inflation expectations, and implementing structural reforms.