What is a Market Maker, and Why Does The Market Need It?

The historical evolution of financial markets traces back to their origins and development, evolving from informal gatherings to organised exchanges. A significant transition occurred as markets shifted from open outcry systems, where traders physically interacted, to electronic trading platforms, streamlining processes and increasing efficiency. This shift has profoundly impacted market dynamics, fostering increased speed, accessibility, and automation in trading.

Market makers (MMs) have been central to this evolution, as they ensure liquidity and continuous trading opportunities. The article will discuss what market makers are and what role they play in the market.

Key Takeaways

- A market maker is an entity actively involved in buying and selling securities at quoted prices.

- Providing liquidity and profiting from bid-ask spreads are core functions of MMs.

- Automated, Designated and Crypto market makers are three main types of MMs.

- The future of market-making lies in technological advancements, global market integration, and overcoming evolving regulatory landscapes.

Definition of a Market Maker

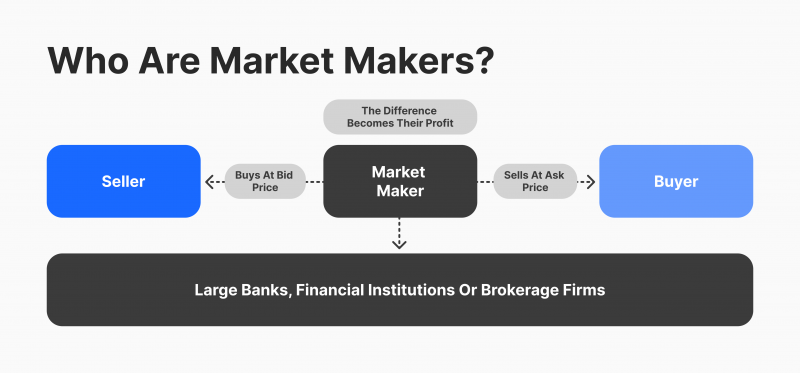

A modern market maker is a financial intermediary or institution facilitating trading in financial instruments by providing liquidity and buying or selling assets at quoted prices. They play a crucial role in financial markets by enhancing liquidity, reducing bid-ask spreads, and promoting price efficiency, contributing to overall market stability. MMs actively participate in buying and selling securities, continuously quoting prices to ensure a smooth and orderly market.

Functions

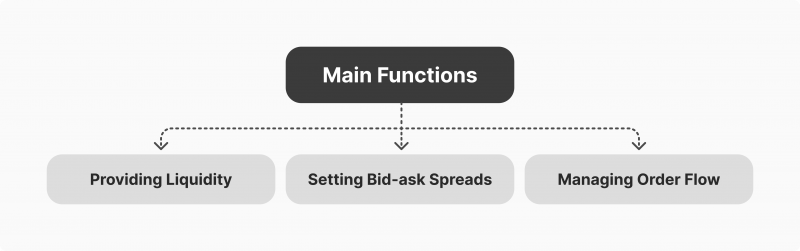

Let’s determine the primary role and key functions of market makers:

Providing Liquidity

Market makers are financial entities that play a vital role in providing liquidity to financial markets. Liquidity refers to the ease with which an asset can be bought or sold without significantly impacting its price. MMs facilitate smooth trading by offering to buy or sell financial instruments at quoted prices.

Setting Bid-Ask Spreads

The bid price is the maximum amount a buyer is willing to pay for a security, while the asking price is the minimum amount a seller is willing to accept. The bid-ask spread is the difference between these two prices and represents the market maker’s profit margin.

Market makers determine bid-ask spreads based on various factors, including the volatility of the asset, trading volume, and the level of competition in the market.

Managing Order Flow

MMs manage the continuous flow of buy and sell orders in the market. They act as intermediaries, matching buyers with sellers and vice versa. They aim to balance supply and demand by adjusting their bid and ask prices according to market conditions.

By actively monitoring order flow and adjusting inventories, market makers help prevent large price swings and maintain stable market conditions. This proactive role in managing order flow is crucial for overall market stability and investor confidence.

Modern Market Makers and Their Roles

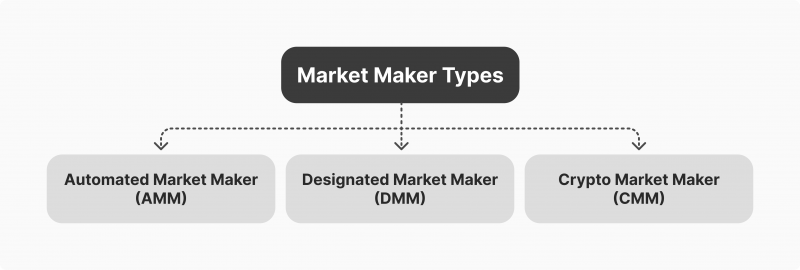

In modern reality, three types of MMs have gained popularity: Automated Market Makers (AMMs), Designated Market Makers (DMMs) and Crypto Market Makers (CMMs). Let’s determine them.

AMM

An automated market maker (AMM) is a decentralised financial protocol that facilitates the trading of digital assets without the need for traditional intermediaries like exchanges. AMMs operate on blockchain platforms, employing smart contracts to automate the process of liquidity provision and asset swapping.

Unlike traditional order book-based systems, AMMs use liquidity pools where users can deposit their assets, providing liquidity for various trading pairs. These pools are algorithmically managed, and prices are determined based on a mathematical formula, often the constant product formula. Users can trade directly against the pool, and the smart contract adjusts prices dynamically to maintain balance.

Popularised by decentralised finance (DeFi) platforms, AMMs have contributed to the democratisation of financial services by enabling permissionless and accessible trading for users worldwide.

DMM

Designated market makers are specialised individuals or firms assigned by stock exchanges to facilitate trading and maintain market liquidity for specific securities.

Unlike general MMs, DMMs must enhance market stability and provide continuous bid & ask quotes for the assigned stocks. They play a critical role in price discovery by actively managing the order book, narrowing bid-ask spreads, and mitigating volatility.

DMMs also act as intermediaries between buyers and sellers, helping to ensure fair and orderly markets. This concept is commonly employed in traditional stock exchanges, where DMMs contribute to the smooth functioning of the market and foster investor confidence.

CMM

In the context of crypto markets, MMs operate similarly to traditional financial markets but within the decentralised and often 24/7 world of digital assets.

They continuously quote buy and sell prices for various cryptocurrencies, ensuring there is a readily available market for traders. CMMs may operate on centralised exchanges, where they contribute to order books, or in DeFi environments, participating in automated market maker protocols.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

Working Principles & Strategies

To perform the functions discussed above profitably, market makers have implemented various strategies in their daily activities.

Arbitrage Opportunities

Arbitrage involves exploiting price differences of the same asset in different markets or at different times. Market makers engage in arbitrage to profit from inefficiencies in pricing.

They identify discrepancies between bid and ask prices in different markets or exchanges and execute trades to buy low and sell high, capitalising on temporary pricing imbalances. This strategy helps align prices across markets and contributes to market efficiency.

Risk Management

MMs actively assess and manage risks associated with their trading activities. This includes monitoring market volatility, adjusting inventory levels, and employing hedging strategies to offset potential losses. Identifying and mitigating risks is crucial for maintaining financial stability.

Advanced technological tools and algorithms are pivotal in market maker risk management. Automated systems help monitor market conditions in real time, enabling rapid responses to changing circumstances. These technologies aid in executing trades, hedging positions, and implementing risk mitigation strategies swiftly and efficiently.

Trading against the Trend – Contrarian Strategies

MMs often employ contrarian strategies, trading against prevailing market trends. By doing so, they capitalise on short-term deviations from the trend, buying during downtrends and selling during uptrends.

This contrarian approach allows them to capture profits when markets temporarily deviate from their long-term trajectory. Trading against the trend also serves a stabilising function in the market.

How Market Makers Earn Profits

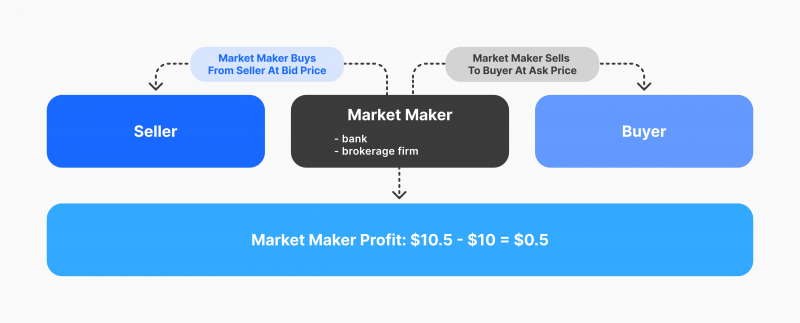

Market makers generate profits by capitalising on the difference between the bid and ask prices of securities. As they assume the risk of holding a particular security, which may experience a decline in value, they receive compensation for shouldering this risk.

To illustrate, envision an investor observing that the bid price for Apple stock is $60 while the ask price is $60.10. This indicates that the market maker acquired the Apple shares for $60 and is now selling them for $60.10, resulting in a profit of $0.10.

Citadel Securities LLC, an American market-making firm headquartered in Miami, is one of the largest market makers in the world and is active in more than 50 countries.

Market Maker vs. Other Market Participants

To overcome the complexities of fiscal markets, it’s crucial to have a deep understanding of the distinctive roles of market participants. Here is the comparison of the main market participants.

Distinction from Brokers and Dealers

Market makers, brokers, and dealers are distinct entities in financial markets. MMs facilitate trading by providing liquidity and continuously quoting bid and ask prices.

Brokers, on the other hand, act as intermediaries, connecting buyers and sellers without holding an inventory of securities. Dealers engage in trading by buying and selling securities for their own accounts.

While market makers facilitate liquidity, brokers facilitate transactions, and dealers trade for their own profit.

Liquidity Provider vs Market Trader

In financial markets, a liquidity provider contributes to market depth by placing orders to buy or sell assets. A market maker is a specific type of liquidity provider that actively quotes prices on both sides of the market, aiming to profit from the bid-ask spread.

While all market makers are liquidity providers, not all liquidity providers function as market makers. Both roles play a crucial part in enhancing market liquidity, with MMs focusing more on continuous quoting and spread management.

Interactions with Institutional Investors

Market makers play a crucial role in interacting with institutional investors, such as mutual and hedge funds. Institutional investors often execute large trades, and MMs provide the necessary liquidity to absorb these trades without significantly impacting the market price.

Through negotiated transactions and order book management, MMs assist institutional investors in executing trades efficiently and with minimal market impact.

Market Regulations and Oversight

The regulatory framework is established by the financial industry regulatory authority to ensure fair and transparent market operations.

Authorities often set rules to prevent market manipulation, ensure investor protection, and maintain overall market integrity. Market makers must adhere to specific compliance requirements, including periodic reporting, financial disclosures, and maintaining a certain level of capital adequacy.

Compliance also extends to ethical considerations, such as avoiding conflicts of interest and ensuring fair treatment of all market participants. Meeting these requirements is crucial for MMs to operate legally and responsibly.

Challenges Faced

Market makers face challenges in handling increased volatility and market uncertainty. Sudden price swings and unpredictable market conditions can affect their ability to maintain orderly markets, leading to higher risks and potential trading losses.

Also, technological challenges must be mentioned. MMs must continually adapt to evolving technologies. The fast-paced nature of the stock market requires robust and efficient systems for order execution, risk management, and market analysis.

Technological glitches or failures can disrupt operations and impact the ability to provide timely liquidity.

Future Trends in Market-Making

The future of market-making lies in technological advancements and the globalisation of markets. Market making is influenced by artificial intelligence and machine learning, enhancing predictive analytics and risk management.

Furthermore, high-frequency trading continues to shape market-making, leveraging advanced algorithms for rapid execution. The trend towards interconnected global markets impacts market makers, requiring adaptation to diverse trading environments.

Ongoing regulation changes shape the future of market-making, influencing compliance strategies and operational practices.

Illustrative Example of a Market Maker

Consider a hypothetical scenario involving a market maker engaged in trading XYZ stock. The market maker offers a quote of $10.00 – $10.05 with a quantity of 100×500. In this context, the market maker is willing to buy 100 shares at a bid price of $10.00 and simultaneously sell 500 shares at an asking price of $10.05.

Subsequently, other participants in the market can choose to buy from the market maker by accepting the offer at $10.05 (lifting the offer) or sell to the market maker at the bid price of $10.00 (hitting the bid). This dynamic illustrates the market maker’s role in facilitating trades and establishing bid-ask spreads.

Clever people study other’s failures, so let’s break down notable market-making failures and lessons to learn:

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

In 2012, Knight Capital’s trading algorithm malfunction led to a significant loss. This bug caused the system to go into a frenzy, buying and selling stocks at lightning-fast speed and besetting up millions of dollars in losses in just 45 minutes.

By the time Knight Capital Group realised what was happening, it had lost $440 million. The incident highlighted the risks associated with algorithmic trading and the importance of robust risk management systems.

This case emphasises the critical role of technology, risk management, and compliance in the success or failure of market-making firms.

Successful firms showcase the benefits of innovation and adaptability, while failures underscore the importance of prudent risk controls and the potential consequences of operational shortcomings.

Notable Market Makers

Market makers play a crucial role in enhancing liquidity in the global securities market, offering trading services to investors. Here are notable ones in various exchanges:

NYSE and Nasdaq (United States): NYSE defines a lead market maker as an “ETP holder or registered firm.” Nasdaq identifies a market maker as a “member firm buying and selling securities at displayed prices.” Notable New York stock exchange market makers include Credit Suisse, Deutsche Bank, Goldman Sachs, KCG Americas, and Timber Hill.

Frankfurt Stock Exchange (Germany): Operated by Deutsche Börse AG, the Frankfurt Stock Exchange calls its market makers “designated sponsors.” Key players on the Xetra platform include Berenberg, JPMorgan, Morgan Stanley, Optiver, and UBS Europe.

London Stock Exchange Group (United Kingdom): The London Stock Exchange is part of the giant London Stock Exchange Group. Prominent MMs in London include BNP Paribas, GMP Securities Europe, Liberium Capital, Mediobanca, and Standard Chartered.

Tokyo Exchange Group (Japan): Formed by merging the Tokyo Stock Exchange and Osaka Securities Exchange, the Tokyo Exchange Group ensures reliable trading venues. According to JPX, noteworthy MMs include ABN AMRO Clearing, Nissan Securities, Nomura Securities, Phillip Securities, and Societe Generale.

Toronto Stock Exchange (Canada): Toronto, Canada’s financial hub, houses the largest exchange, the Toronto Stock Exchange (TSX), owned by TMX Group. Market makers listed on the TSX comprise BMO Nesbitt Burns, Integral Wealth Solutions, Questrade, Scotia Capital, and TD Securities.

Conclusion

To sum up, MMs provide liquidity, maintain orderly markets, and facilitate efficient trading by quoting bid and ask prices. They play a pivotal role in fostering liquidity, stability, and overall functionality in financial markets, contributing to the foundation of a robust and efficient trading ecosystem. The future of market-making lies in technological advancements, global market integration, and overcoming evolving regulatory landscapes.

FAQ

What does the market maker do?

A market maker participates in the securities market by providing trading services for investors and boosting liquidity in the market. They specifically provide bids and offers for a particular security in addition to its market size.

Is market making illegal?

A broker, broker/dealer, financial institution, or market maker may face serious liability charges if they attempt to artificially change the price of a stock or other security or a market movement intending to make an illicit profit.

Do market makers make a lot of money?

In return for providing this service, market makers profit in two ways. From harvesting the spread between the bid and ask: While this spread is typically just pennies per share, this profit can add up on a stock trading hundreds of thousands or even millions of shares a day.