Your Guide To Algorithmic Trading

Articles

Financial markets are rapid, and a split-second decision can make you win or lose on your trades. Over time, traders tried multiple strategies and approaches to capitalise on the market and make as much as possible every trading session. The rise of technology made traders’ lives easier by providing necessary tools and information timely and clearly to operate multiple trade orders at once.

Algorithmic trading utilises machine computing and information technology to trade faster and more frequently with programs and software on behalf of the trader. So, we will discuss algo trading and some algorithmic trading strategies with examples you can apply today.

Key Takeaways

- Algorithmic trading utilises sophisticated machines with complex programming to trade in the financial markets on behalf of the trader.

- Few strategies can be combined with algorithmic trading, making algorithmic trading profitable.

- Algorithms require deep knowledge of programming language to write code lines and build the system. Or, a trader can use no-code platforms that help build algorithmic trading systems based on the trader’s preferences.

- Trading with algorithms is more consistent since it removes the human factor of delays or emotional decision-making. However, this can hinder human judgement and the learning curve.

Algorithmic trading was founded in the 1970s, and today, around 70% of equity trading in the United States is carried out using algorithm trading.

Understanding Algorithmic Trading

An algorithm is a sequence of mathematical and logical orders that the computer follows and makes decisions based on given information and circumstances fed to the algorithm.

Processes are done with algorithmic order and give a particular outcome if certain conditions are met. This applies to algorithmic trading strategies and their rationale, where software places trading orders following specific orders about what to trade, when to trade, and when to stop trading.

Algorithmic trading can conduct hundreds of orders in a second and place orders faster and more accurately than a human could possibly do. These programs consider trading-related information and indicators like trend, volume, price, and time.

Algorithmic traders can implement algo trading strategy with every financial market and on various instruments, including spot and futures algorithmic trading strategies in the stock market, Forex market, Crypto, etc.

How Algo Trading Works

Usually, developers must write lines of code to program an algorithmic trading system and make them well-suited for trading. Especially with the complex nature of financial markets, sophisticated programming is required for efficient algorithmic trading strategies.

Then, once you run these trading algorithms, they will execute trading orders once the criteria are met, and all you have to do is overwatch and keep track of your investments.

Consider a trader who wants to buy 10 shares in the stock market. They can insert the following conditions:

- Buy 10 stocks if the 20-day moving average exceeds the 50-day moving average line.

- Sell 10 stocks if the 20-day moving average goes under the 50-day moving average line.

Given these two conditions, the automated software will execute the requested orders without human interference and usually faster than manually placed orders.

Algorithmic Trading Strategies

These programs allow for automated trading in different markets and can be combined with typical methods to get the best results. Let’s find the best algorithmic trading strategies that you can implement.

Trend Following Strategies

Algorithmic trading can be implemented on a wide range of strategies. However, the trend-following approach is the most common and straightforward way to use algorithms.

These strategies do not require any price prediction or futuristic analysis, and they only rely on historical data to identify a trend and make decisions based on that.

Moving averages, price level moment, breakout, and other technical indicators are typically used with forex algorithmic trading strategies because they are simple and easy to implement.

The algorithm will execute buying or selling orders once a favourable price trend appears and monitor the trend movement and direction.

Momentum Trading

Momentum trading is a very common practice for intraday traders, who tend to place and close orders on the same day according to the price trend.

As the name suggests, this method entails the trader taking advantage of and following the trend. If the stock price is steadily increasing, then it is a great chance to place a buy order.

On the other hand, if the price starts falling beyond a certain level, then a trader places a sell order. Given the simplicity of this trading strategy for market participants, the automated software will implement it much faster and more accurately.

Inverse Volatility

The inverse volatility strategy is usually used with exchange-traded funds, or ETF markets, where algorithmic traders invest against the portfolio risk of the ETF through exposure to market volatility.

Traders who use this strategy earn profits when the market has low volatility because inverse volatility ETFs rely on market stability, and the more stable the market is, the higher the gains.

This method can be merged with the Cboe Volatility Index (VIX), which identifies the price volatility of the S&P 500 index, for example. Therefore, this index helps the algorithm to identify volatility, bet against it, and place orders accordingly.

Index Fund Rebalancing

Every fund has a rebalancing period that happens at a specific time. During the rebalancing, instruments and trading assets in the fund are aligned with the fund index.

The rebalancing duration depends on many factors, including the fund’s activity and assets. Typically, it can take several hours to days, representing a unique opportunity for traders to capitalise on.

Trading during the realignment period can render from 0.2% to 0.8% returns, which varies based on how many assets are there before the rebalancing.

Trading with algorithmic software helps traders make multiple buy and sell orders faster than manually placing them, which can generate exaggerated returns at high speed and minimum slippage.

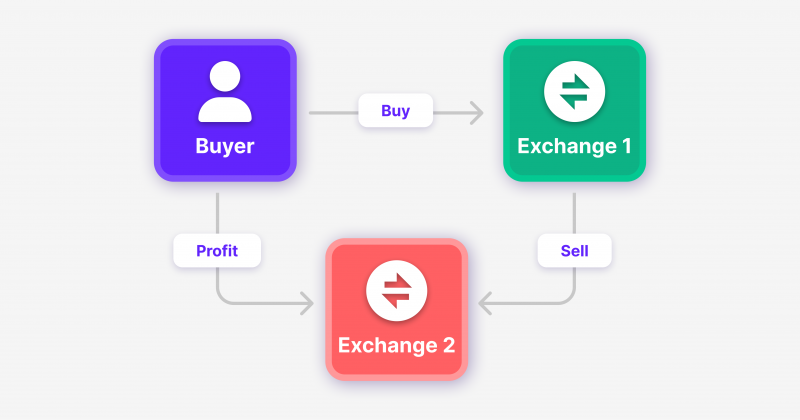

Arbitrage

Arbitragers benefit from the tiny differences between the market. Thus, they continuously buy and sell the same assets from different markets and accumulate the differences among other marketplaces.

For example, a trader can buy a stock of a telecommunication company in the NYSE for $50 and sell it in the LSE exchange for $50.50, benefiting from the price and currency exchange differences.

This trading process requires maximum accuracy and knowledge of the market to identify the opportunity. Therefore, coupling arbitrage with an algorithmic trading strategy can generate sufficient returns.

This automated trading relies on short-term orders, which automated trading software can handle at a high rate and pinpoint accuracy.

Risk on/ Risk off

This might not be an algo trading strategy itself. However, it can be combined with algorithmic trading to make decisions given the current risk level in a specific market.

Using this method, a trader can change their risk tolerance according to the market patterns. For example, if it indicates a specific period in a particular market is high risk, the investor must lower the investment risk.

Similarly, if the indicator shows that the market is low-risk, it is the proper time to make high-risk investments.

However, applying this indicator alone can be inefficient because many factors underlying the market patterns, such as global events, central bank policies, annual reports, and more data, can be fed to the algorithm to determine the market risk level.

Black Swan

The periods when the market is unpredictable due to uncontrollable events are called Black Swan, and they usually happen when a global crisis occurs, and it becomes hard to predict the market movement.

During Black Swan, the market becomes highly volatile, and some financial instruments like options trading and futures become highly demanded. The 2008 financial crisis and the Covid-19 pandemic are examples of black swan events.

Traders benefit from the high volatility during these times and capitalise on more trading opportunities, especially when combined with algorithm trading, to place orders quickly and timely.

Mean Reversion

This trading strategy refers to the fact that after asset prices move up and down, they will eventually come back to their average value, and this return represents a good trading opportunity.

Therefore, if a potential reversion is expected to move the market price trend up, it is a good time to execute a buy order. Similarly, if the mean reversal triggers a declining trend, then investors can place sell orders.

However, the challenge is to identify these events and analyse when will the mean reversal happen. That’s why using algorithmic trading can help analyse a huge set of data, determine trading opportunities, and execute accordingly.

Market Timing

Finding the right time to place an order is a challenge for all traders, and it is usually a hit or miss. Traders usually use historical data or technical analysis to determine the all-time low or high the price can reach.

After determining the all-time points, a trader places an order, hoping the trend will reverse, representing the perfect entry time. However, it is not always this easy and many enter the market while the price trend is still moving, resulting in a losing trade.

Therefore, using automated trading machines can help make faster and more accurate decisions based on historical data and values. Despite being not 100% accurate, it is usually more accurate than manual order execution.

How To Start Algorithmic Trading?

Traditionally, creating algorithms requires writing code lines and knowledge of programming languages like Python, which can be used to develop sophisticated algorithms for trading.

However, new technologies are emerging, offering a no-code platform to build an algorithm for trading that does not require the trader to enter a single code line.

Thus, a user would need to enter the conditions that need to be met in the no-code builder and the proper course of action.

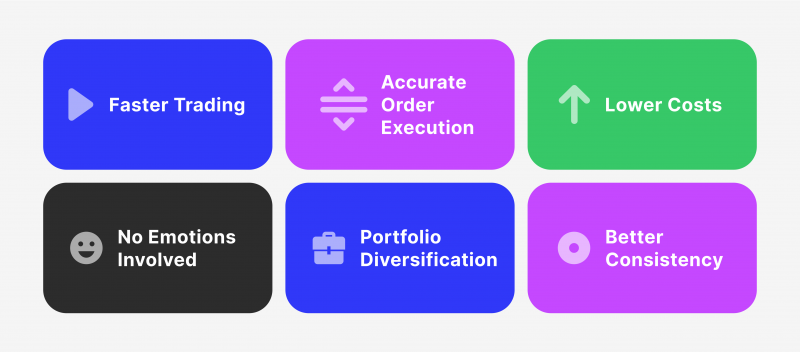

Advantages Of Algorithmic Trading

Trading with an algorithm is the perfect way to adopt technology in trading. More benefits of algorithmic trading include the following.

Faster Trading

Algorithmic trading uses ultra-fast machines that can process lots of data and execute orders much faster than human traders. Therefore, you can perform high-frequency trading in a short time with minimum delay.

Accurate Order Execution

Depending on the market volatility, manually placing orders can come with slippage. The few milliseconds between seeing the price value, placing the order, and actually processing the order is called slippage. However, machines can quickly place orders with minimal slippage time.

Lower Costs

You can minimise transaction costs by combining multiple orders together. An algorithm can execute hundreds or thousands of orders at the same time, leading to lower transaction fees.

No Emotions Involved

Human emotions can interfere and drive the trader to place orders earlier or without factual information. However, the lack of human touch in algorithmic trading promotes making informed decisions.

Portfolio Diversification

Since algorithms help place multiple orders at the same time, it encourage getting involved in multiple markets with different trading instruments to diversify the trader’s portfolio.

Better Consistency

Algorithms follow the rules every time unless the user changes them. This makes order placement more consistent than manual execution.

Disadvantages Of Algorithmic Trading

Although algorithmic trading seems the ideal way to indulge in the financial markets, you can expect a few drawbacks.

Overusage and Dependency

Most wealthy traders reached the top by experience and learning by doing. However, the exaggerated reliance on technology and machines can affect human judgement and learning.

Human Interference Still Needed

Despite being fully automated, manual interference may still be required if the system goes down or just to monitor trends and analysis. Therefore, it does not mean that human touch is not required at all.

Lot of Backtesting Required

Whether you are building an algorithm from scratch or using a no-code platform, algorithms require adequate testing to ensure their effectiveness.

Therefore, this requires developers to run the tests and enhance. Also, it may take time to optimise the system to your preferences.

Program Latency

Depending on how sophisticated the algorithm is programmed, latency and delays can still happen. These delays, even for a few seconds or milliseconds, can significantly impact your trades.

Conclusion

Algorithmic trading, or algo trading, implies using machines and software to execute trading orders on behalf of humans. These are programmed software that rely on a set of rules and conditions and trigger a course of action if the criteria are met.

There are a bunch of advantages to using algorithmic trading strategies, such as placing orders faster and more accurately. Besides, diversifying the portfolio using the algorithm’s ability to place lots of orders at the same time.

Few drawbacks exist in over-relying on this technology, but the proper use with sufficient background knowledge helps the trader capitalise on this sophisticated solution.

FAQ

What is the best strategy for algorithmic trading?

Algorithmic trend-following strategy is one of the most commonly used strategies. It uses the machine to identify trends based on historical data and place market orders after determining the right entry time.

Is algorithmic trading easy?

Algorithmic trading needs complex programming. However, implementing algorithmic trading strategies is easy. All you need to do is feed the program with conditions and the course of action. For example, if X is met, then execute Y.

How do I start algorithmic trading?

Learn the financial markets, how they operate, and the factors affecting the prices. You still need to have comprehensive knowledge despite relying on the automated program. Then, either build the algorithm if you have sufficient programming knowledge or get a no-code platform to build the algorithm you want. Afterwards, determine the conditions and what you want the algorithm to trade for you, and supervise how your trades are being executed.

How successful is algorithmic trading?

The quick and accurate order execution of algorithmic trading makes it quite successful. This is due to the ability to place many orders at the same time and with minimum delays. However, some glitches, latency, or outages can significantly affect how successful your trades are.