What is High-Frequency Trading (HFT)?

The way we think about finance has been completely changed by High-frequency trading (HFT). It’s brought a new era of super-fast, efficient trading. HFT is a big part of how things work in the modern financial field. High-frequency trading firms use very smart computer programs and the latest technology to buy and sell assets in the blink of an eye.

This article explores the essence of HFT, looking at how it works, the role of HFT companies, and what it means for the whole financial system.

Key Takeaways

- High frequency trading utilises sophisticated algorithms and high-powered computers to execute massive trades at lightning-fast speeds.

- HFT firms contribute to market liquidity and efficiency by tightening bid-ask spreads.

- HFT platforms and software are crucial for HFT firms, requiring significant technical expertise and infrastructure investment.

The Essence of High-Frequency Trading

HFT has its roots in the evolution of electronic trading, which began in the late 20th century. As technology advanced, the ability to process trades more quickly and efficiently led to the development of HFT.

The practice became more widespread in the 2000s, particularly after the introduction of decimalisation in the U.S. stock markets, which reduced the minimum price movement of stocks, making HFT more profitable.

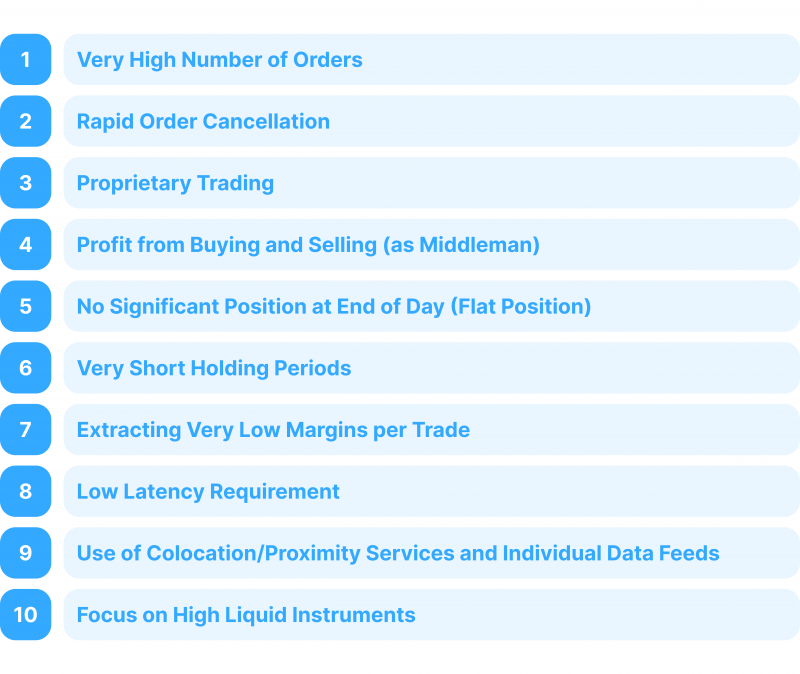

At its core, HFT is a computerised trading strategy that utilises complex algorithms and cutting-edge technology to execute a staggering number of trades in mere milliseconds.

The main goal of HFT is to capitalise on minute price discrepancies in the market, often exploiting tiny differences in asset prices that exist only for a brief moment. Unlike traditional trading strategies, which may hold positions for hours, days, or even months, HFT platforms aim to buy and sell securities in microseconds.

HFT firms – large investment banks, hedge funds, and institutional investors – leverage high-powered computers with specialised hardware and low-latency connections to stock exchanges. These algorithms constantly analyse market data, identify fleeting price discrepancies (arbitrage opportunities), and capitalise on them through automated buy and sell orders.

In essence, HFT represents the intersection of finance and technology, where the speed and precision of computers are used to navigate and profit from the complexities of the financial markets.

How High-Frequency Trading Works

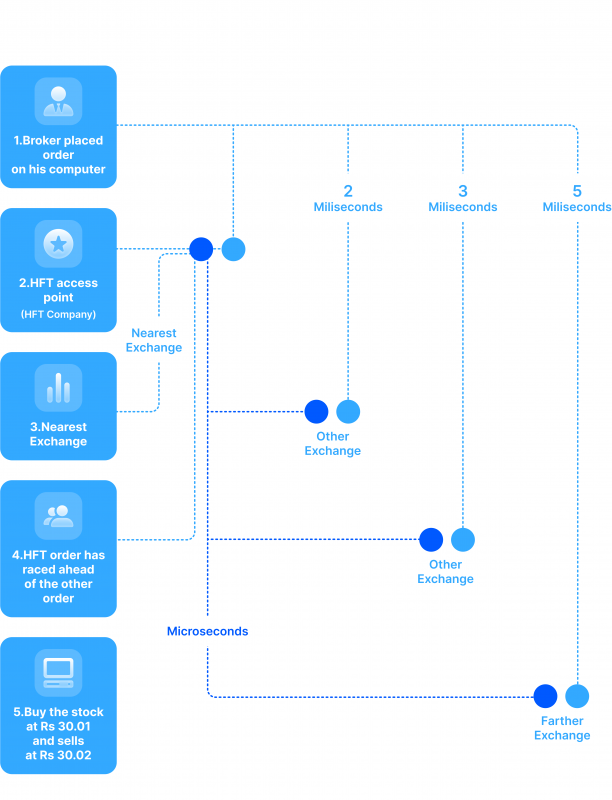

HFT analyses real-time market data, identifies profitable trading opportunities, and executes trades faster than any human trader could. The process begins with software that continuously scans multiple markets and exchanges for price anomalies or patterns. Once an opportunity is detected, the software automatically places orders, often in large volumes, to take advantage of the price movements.

For example, suppose a high-frequency trading platform detects that a stock is slightly cheaper on one exchange than another. In that case, it can buy the stock on the cheaper foreign exchange and sell it on the more expensive one, pocketing the difference. This strategy, arbitrage, is a common practice among high-frequency traders.

The Backbone of HFT: Algorithms and Technology

Sophisticated algorithms drive high frequency trading. These computer programs analyse vast amounts of market data in milliseconds, searching for tiny price fluctuations or patterns that could signal potential profits. By using complex mathematical models, these algorithms can predict short-term market trends and execute trades automatically.

Speed is everything in HFT. Trading companies spend a lot of money on the latest technology to make their trades as fast as possible. This includes special high-speed trading, co-located servers right next to stock exchanges to reduce delays, and direct connections to the market.

Components of High-Frequency Trading Systems

Proprietary software and HFT platforms are essential components of HFT systems. These platforms are designed to handle vast amounts of data in real-time and execute trades based on pre-programmed algorithms without human intervention.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

Access to real-time market data feeds is crucial for HFT. Firms subscribe to premium data feeds from exchanges, which provide up-to-the-millisecond information on stock prices, order book depth, and other market conditions.

High-frequency trading is a highly technical and fast-paced approach that leverages speed, technology, and data to generate profits. It operates in a world where milliseconds can mean the difference between profit and loss, making it a game of both precision and strategy.

Major Players in High-Frequency Trading

HFT firms are specialised entities that use HFT as their primary business model. These firms invest heavily in technology, infrastructure, and research to maintain their competitive edge. They employ teams of quantitative analysts, software developers, and data scientists who work together to develop and optimise trading strategies.

Some of the most well-known HFT companies include Virtu Financial, Citadel Securities, and Two Sigma. These companies are often at the forefront of technological innovation in the financial markets, utilising state-of-the-art software and infrastructure to execute trades across global markets.

Advantages of High-Frequency Trading

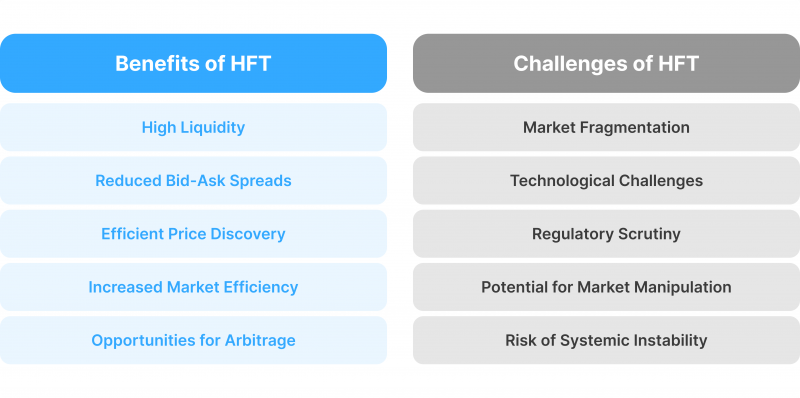

Proponents of HFT argue that it offers several advantages to the financial markets:

Increased Market Liquidity

HFT firms contribute significantly to market liquidity by constantly entering and exiting positions. This creates a more continuous flow of buy and sell orders, making it easier for investors to execute their trades.

Reduced Bid-Ask Spreads

The bid-ask spread often tightens with HFT firms actively competing for arbitrage opportunities. This translates to lower transaction costs for all market participants.

Price Discovery

HFT algorithms analyse vast amounts of data, potentially leading to a more efficient price discovery process. By identifying and exploiting price discrepancies, HFT can help ensure market prices accurately reflect underlying value.

Challenges and Controversies Surrounding HFT

Despite its advantages, this type of trading has been the subject of significant criticism and controversy. Critics argue that HFT can contribute to market volatility and create an uneven playing field where large HFT firms have an unfair advantage over traditional retail investors. There are also concerns about:

1. Market Manipulation

Critics argue that HFT firms, with their speed and sophisticated algorithms, could potentially manipulate markets for their benefit. The rapid influx of orders and cancellations can create short-term volatility, making it difficult for traditional, slower-paced retail investors to compete.

2. Systemic Risk

The reliance on high-speed technology raises concerns about potential systemic risks. A technical glitch or malfunction within an HFT system could trigger unintended consequences, impacting the entire market.

3. Fairness and Transparency

The opaque nature of HFT algorithms raises concerns about fairness and transparency. Regulators and policymakers grapple with ensuring a level playing field for all market participants.

The rapid growth of HFT has prompted regulators like the Securities and Exchange Commission to scrutinise the practice more closely. Recently, regulatory bodies worldwide have introduced measures to increase transparency and reduce the risks of HFT.

These measures include stricter reporting requirements, circuit breakers to prevent flash crashes, and rules to restrain excessive market manipulation.

The most notable example is the “Flash Crash” of May 6, 2010, when the U.S. stock market plunged nearly 1,000 points in minutes, mainly due to the activities of HFT algorithms.

High-Frequency Trading Strategies

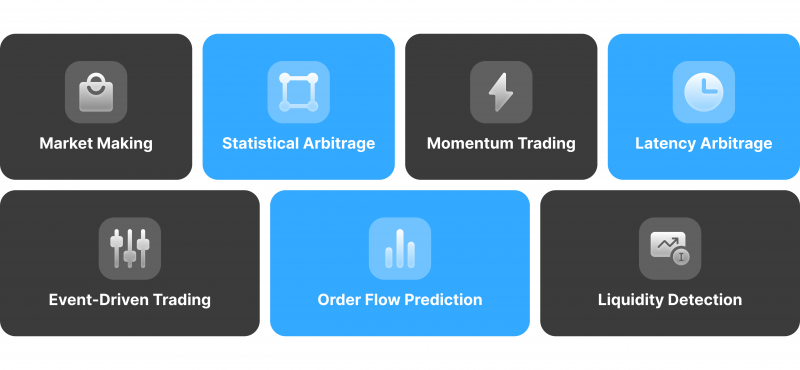

HFT firms deploy sophisticated strategies to capitalise on market inefficiencies and gain a competitive edge. Below are some of the most common HFT strategies:

Market Making

MM is one of the most common HFT strategies. In this approach, HFT firms continuously place buy and sell orders for a particular security, profiting from the bid-ask spread.

Market makers aim to buy at the bid price and sell at the ask price, pocketing the difference as profit. HFT firms make this strategy profitable by executing a high volume of trades, even if the profit per trade is minimal.

Statistical Arbitrage

This strategy involves identifying and exploiting pricing inefficiencies between correlated securities. For example, if two stocks that usually move together diverge in price, an HFT firm might buy the underpriced stock and short the overpriced one, expecting the prices to converge.

Latency Arbitrage

In latency arbitrage, HFT firms take advantage of the tiny delays in the transmission of market data between different exchanges or trading venues. By having faster access to information, they can execute trades before other market participants can react, profiting from short-lived price discrepancies.

Momentum Ignition

Momentum ignition is a more controversial HFT strategy. In this approach, an HFT firm might place a series of trades to create the appearance of buying or selling pressure in the market. This can lead other traders to react, pushing the price in the desired direction. Once the momentum is established, the HFT firm quickly reverses its position to profit from the price movement it helped create.

Momentum ignition takes advantage of the psychological reactions of other market participants, particularly those using automated trading systems that respond to sudden price changes. While profitable, this strategy can contribute to market volatility and has been criticised for potentially distorting market prices.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Event-Driven Trading

Event-driven trading involves executing trades based on market-moving news or events, such as earnings reports, economic data releases, or geopolitical developments. HFT firms use algorithms to scan news feeds and social media for relevant information and execute trades within milliseconds of the event.

Some HFT firms go a step further by using machine learning and predictive analytics to anticipate how the market will react to certain events. By identifying patterns in how prices have moved in response to similar events in the past, they can position themselves to profit from the expected price changes.

Order Flow Prediction

Order flow prediction involves analysing the patterns of buy and sell orders in the market to predict the future direction of prices. HFT firms use historical data, machine learning algorithms, and statistical models to detect patterns that indicate the likelihood of large orders being executed.

In some cases, HFT firms may engage in a controversial practice known as front-running, where they detect large incoming orders and execute their trades ahead of those orders. This allows them to profit from the price movement caused by the large order.

While illegal in many jurisdictions when done with insider information, certain forms of front-running based on public data remain a grey area in some markets.

Liquidity Detection

Liquidity detection strategies involve identifying hidden liquidity in the market, such as large orders that are broken up into smaller pieces (known as iceberg orders) to avoid revealing the total size of the trade. HFT firms use sophisticated algorithms to detect these hidden orders and position themselves to trade against them, often by placing their orders just ahead of the hidden liquidity.

HFT firms also operate in dark pools – private trading venues where large orders can be executed without revealing their size to the public market.

Final Remarks

High frequency trading has visibly upgraded and changed the financial world. Once confined to major economic hubs, HFT is now expanding globally, offering new opportunities and challenges. While its speed and efficiency can benefit markets, concerns about its potential impact on stability and fairness persist. HFT must strike a delicate balance between innovation and regulation to ensure a positive future.