What is Forex Market Maker Manipulation and How to Avoid it

Articles

Forex markets have remained unforgiving despite the latest digital innovations and tools. It has never been easier to lose your entire forex portfolio in days. This piece will analyse one of the common pitfalls that could cripple the portfolios of retail investors – forex market maker manipulation. instead of However, forex markets have remained unforgiving despite the latest digital innovations and tools. It has never been easier to lose your entire forex portfolio in days. This piece will analyse one of the common pitfalls that could cripple the portfolios of retail investors – forex market maker manipulation.

The forex landscape has evolved dramatically in the 21st century. In the past, only proficient traders with numerous licenses, industry connections and substantial capital could access this market and make reliable profits.

Today, average individuals with little to no experience can enter the FX field and learn the basics without barriers. As a result, the forex practice has become globally renowned for newcomer traders, startups and individuals who wish to make part-time profits.

Key Takeaways

- Market makers are large institutions distributing liquidity through bid-ask offerings in the forex market.

- Market makers can manipulate the market through front-running, stop-loss hunting and spreads.

- There are many regulations trying to prevent manipulation, but most of them are ineffective against careful market makers.

- Avoiding manipulation requires in-depth market knowledge and a good comprehension of volatility metrics.

What is a Market Maker in Forex?

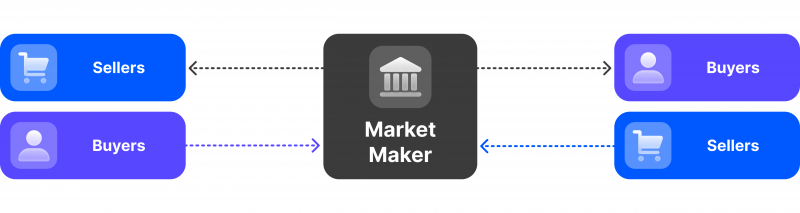

Market makers are invaluable in the forex market, delivering financial liquidity through various channels and helping the industry stay active. MMs facilitate activity growth by providing ample currency supplies whenever necessary and putting fair prices on their quotes.

As a result, the financial market no longer experiences scarcity in its currency offerings, allowing retail traders to purchase and sell pairings at optimal prices and without delays.

A market-maker model can come in many forms, including large financial institutions, prime brokerages, liquidity providers and hybrid companies that undertake multiple roles.

International and central banks are the largest market makers in the forex field, accessing nearly limitless currency funds from customer deposits and loan interest payments.

So, market makers can be regarded as the most important players in forex, especially for volatile or temporarily unstable currency sectors that desperately require liquidity sourcing.

How Do Market Makers Make Money?

Regardless of its contribution to the forex industry’s health, a market-making firm will always be focused on the bottom line. Like any other business model, the market-making strategy aims to generate profits through providing liquidity to other market participants.

Market makers generally supply funds through online or physical exchange platforms that feature the bid and ask prices for each currency pair. Suppose a market maker sells currency X for $1.25 and purchases it for $1.10; their respective profit margin also called the spread, is $0.15.

The above-described spread margins are the bread and butter of market makers, allowing them to earn substantial profits by selling high and purchasing low. However, if they put wide spreads on the market, the general public will refrain from actively selling or purchasing their currency options. So, it is important for market makers to

Can The Forex Market Be Manipulated?

As analysed, market makers have a mutually beneficial relationship with the forex trading landscape, facilitating liquidity gaps, supply scarcity at relevant points, and receiving healthy spread profits in return.

However, most market maker companies have abundant power that they could potentially abuse. Their ability to decide what currency pairings to distribute and what bid-ask prices to set allows them to heavily influence specific sectors and tip the scales in their favour.

So, while many regulations are set to prevent it, market makers manipulate forex through various means to increase their profitability. Market makers employ several strategies to achieve their goals through market manipulation.

Different Manipulation Tactics

The most dominant strategy is spread manipulation, where market makers can nudge the retail traders to purchase other currencies or, in desperate cases, deal with the unusually wider buying margins. Additionally, spread margins could be narrowed beyond the standard to motivate inexperienced traders to buy risky or volatile currencies.

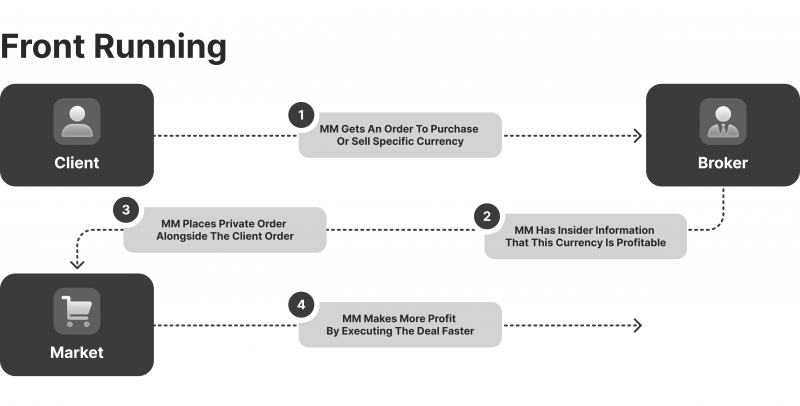

The second strategy is front-running, where market makers simply purchase or sell massive amounts of specific currencies before the market participants can do the same.

Market makers are privy to inside trading information, having a good understanding of what might happen in the immediate future. As a result, they can execute the best deals before the general public, taking most of the profits out of the retail trading field.

Finally, stop-loss hunting entails market makers manipulating spreads for specific purposes. Suppose there is a high demand for a particular currency in the market. If this currency were to become less valued, many investors would experience stop-loss orders on their accounts.

A market maker company can sometimes go stop-loss hunting by artificially decreasing the asset price and creating intense selling pressure.

With this strategy, market makers could gain majority control over more minor currencies, creating a monopoly in financial markets and setting unfair prices on the currency.

How to Avoid Forex Market Maker Manipulation?

While not all MMs are motivated to manipulate the market, the FX industry is dominated by the malicious practices described above. Unfortunately, the laws and regulations determined against front-running or stop-loss hunting have been only partially successful.

Retail traders can only be protected by their wits and experience. So, here are several optimal strategies you can implement to avoid manipulative practices in the foreign currency market.

Understand the Forex Market and Avoid Volatility

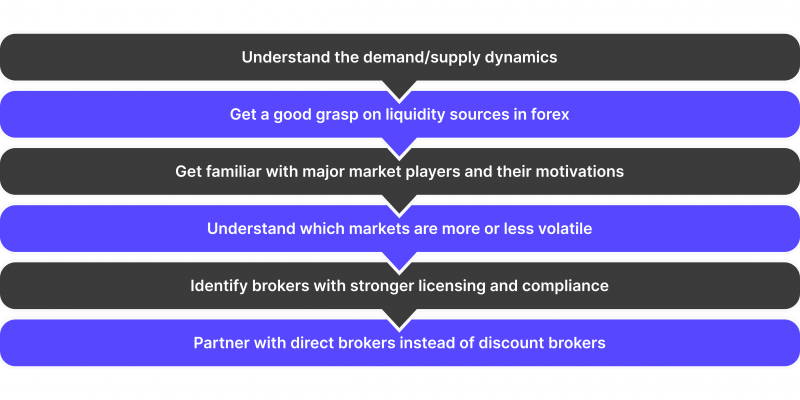

The FX industry is overwhelmingly complex, with numerous jurisdictions, political boundaries, currency flows, and unforeseen complications impacting the market at different times. For retail traders, it is crucial to have a solid understanding of the forex sector, grasp the idea of fair trading and how market-making fundamentals work.

By digging deep into the concept of supply and demand, volatility and distribution of currencies, traders will better understand how the market can be manipulated and when it is the wrong time to engage in aggressive trading.

Additionally, traders should seek the least manipulated forex pairs by assessing volatility levels. As a rule of thumb, it is easier to impact currency sectors that are more volatile and susceptible to instability.

On the contrary, established currencies like the USD and EUR are tough to manipulate due to enhanced regulatory attention and the sheer size of their respective sectors. However, the trick is to find lesser-known currencies that still avoid volatility, which requires substantial expertise in this field.

Seek Brokers with Licenses and Regulations

It is crucial to partner with brokers that operate with high-value licenses and adhere to stringent regulations, letting traders avoid harmful forex practices executed at their expense.

Dishonest brokers play a big part in forex manipulation strategy, routing the orders toward exchanges that might conduct front-running or stop-loss hunting strategies. So, partnering with discount brokers that route orders without disclosing the counterparty is dangerous in this environment.

It is advisable to seek brokers with elite licenses within the US or European territories since these jurisdictions have the most laws and regulations against market manipulation practices.

While this will not completely shield you from malicious trading activities, you will be much safer than partnering with unregulated or shady brokerage agencies.

Final Thoughts – Breaking Away From Forex Market Maker Manipulation

The forex trading field is inherently skewed toward manipulation. Market makers possess too much power to stay neutral and abstain from abusing their capabilities. Despite the regulatory bodies doing their best to minimise manipulative practices, market makers can still greatly profit from the mistakes and inexperience of newcomer traders. So, before entering the forex landscape, you must understand the market concepts from the inside out and get a good idea of what potential manipulation tactics could be going on at any given moment. This will help you make risk-averse decisions and avoid falling into stop-loss hunting, front-running or spread manipulation traps set by large market makers.

FAQ

Do market makers manipulate the market in forex trading?

Yes, market makers can manipulate the forex market through tactics like front-running, stop-loss hunting, and spread manipulation to increase their profitability, often at the expense of retail traders.

How do market makers manipulate the market with stop-loss hunting?

Market makers artificially lower prices to trigger stop-loss orders, forcing traders to sell. This creates intense selling pressure, allowing market makers to gain control over specific currencies.

How can traders avoid market manipulation by market makers?

To avoid manipulation, traders should partner with regulated brokers, understand volatility metrics, and focus on stable forex pairs like USD and EUR, which are harder for market makers to manipulate.