What is Overnight Trading, and How Does it Affect the Markets?

According to the “The Modern Trader” report by Broker Notes, there are 9.6 million traders globally. Essentially, 1 in every 781 people actively participates in financial markets aiming for profit opportunities. Lately, overnight trading has materialised itself as one such powerful approach. This practice occurs during the extended trading sessions, authorising financiers to react to international news.

Key Takeaways

- Overnight trading is a flexible strategy that enables investors to respond to worldwide events and market shifts after regular hours.

- Different markets, including FX, U.S. stocks, etc., exhibit unique characteristics during extended trading hours.

- Reduced liquidity, wider bid-ask spreads, and increased volatility are typical of overnight trading.

- Success overnight trading strategies include fundamental and technical analysis, continuous monitoring, and adaptability.

Understanding Overnight Trading

Overnight trading, as the name suggests, refers to dealings conducted after the closure of an exchange and before the market opens. Unlike normal market hours, overnight positions offer a unique window for financiers to react to news events and market changes occurring outside regular operational sessions.

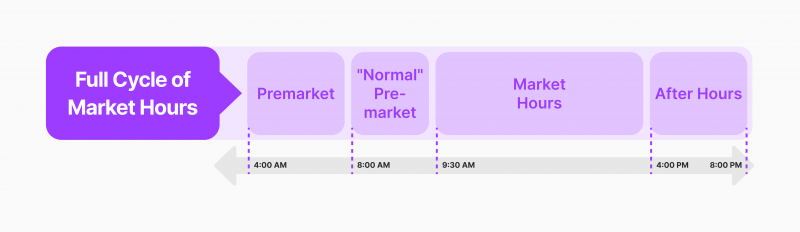

Overnight trading hours can encompass both after-hours trading and pre-market trading but generally, it can also differ based on the type of currency trading and financial instrument.

Investors can employ various strategies in overnight trading, such as holding positions from the market close to the next day’s opening or capitalising on market changes.

Overnight Trading in Various Markets

Overnight trading manifests differently across various markets, each influenced by distinct factors and regulations. Let’s take a look at them closely.

Forex Market

The giant FX market operates 24 hours a day throughout the week. Unlike other markets, there is no formal concept of overnight trading in FX, as it always remains open. Different time zones contribute to unique market dynamics during nighttime hours. The Asian session, for instance, is known for lower volatility, while the overlap with the European and North American sessions can lead to increased market activity.

Traders can take advantage of overlapping local market hours between different regions to execute trades at any time.

U.S. Stocks

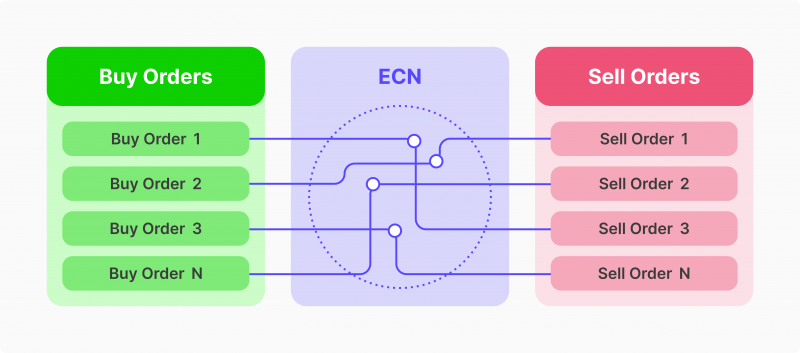

While standard trading hours for U.S. stocks run from 9:30 a.m. to 4 p.m. ET, certain brokers extend trading time to include overnight sessions. Brokers like Charles Schwab and Robinhood facilitate overnight trading from just after 8 p.m. through 4 a.m. ET. This extended trading involves Electronic Communication Networks (ECNs) and allows investors to trade even when the primary exchanges are closed.

Mutual Funds and Bonds

Mutual funds follow specific rules, with orders placed after the market’s close receiving the next day’s closing NAV price. On the other hand, bonds have extended trading time, allowing transactions from 4 a.m. to 8 p.m. ET.

Equities Markets

In the equity index options trade, extended hours trading allows investors to react to earnings reports released after the closing bell. Extended trading hours provide opportunities and challenges, with lower liquidity and heightened volatility compared to regular sessions. Traders must use these conditions skillfully to capitalise on price fluctuations.

Cryptocurrency Markets

Cryptocurrency markets, being decentralised and global, operate around the clock. Overnight trading in cryptocurrencies is particularly active, driven by factors like regulatory developments, technological advancements, and macroeconomic trends. Traders in the crypto space often experience significant price swings during non-traditional hours.

Commodity Markets

Commodity markets, such as those for oil and gold, also witness overnight trading. Geopolitical events, economic data releases, and global supply-demand dynamics influence these markets. Overnight trading in commodities requires vigilance, as unexpected news or geopolitical shifts can lead to substantial stock price drops during local market hours.

Robinhood is the most favoured 24-hour stock market for all customers, where they can use 43 of the most popular stocks and ETFs to place limit orders on assets of companies such as Tesla, Amazon, and Apple.

The Mechanics of Overnight Trading

Overnight trading involves a set of mechanics that distinguish it from regular market hours, presenting challenges and chances for traders. One key aspect is reduced liquidity, as fewer participants engage during extended sessions. This can lead to wider bid-ask spreads and increased price volatility. Traders must be adept at managing risk in these conditions, employing limit orders to mitigate potential slippage.

Market gaps, where the opening price significantly differs from the previous day’s close, are common in overnight trading. These gaps often result from after-hours news or events that impact sentiment. Traders may use gap analysis strategies to assess the significance of these price disparities and formulate informed trading decisions.

Moreover, ECNs facilitate overnight trading by matching buy and sell orders outside regular market hours. This technology allows for continuous trading and provides access to after-hours liquidity.

Understanding the mechanics of overnight trading requires knowledge of these dynamics and the ability to adapt to a less predictable and more volatile market environment. Traders who overcome the intricacies of reduced liquidity and market gaps and utilise ECNs effectively can capitalise on opportunities presented by overnight trading while managing associated investment risks.

Strategies for Success

Success in overnight trading demands strategic judgement and adaptability to the unique challenges of extended market hours. Traders should stay informed about global developments and news, particularly events occurring after regular trading hours, as these can significantly impact asset prices.

Fundamental and Technical Analysis

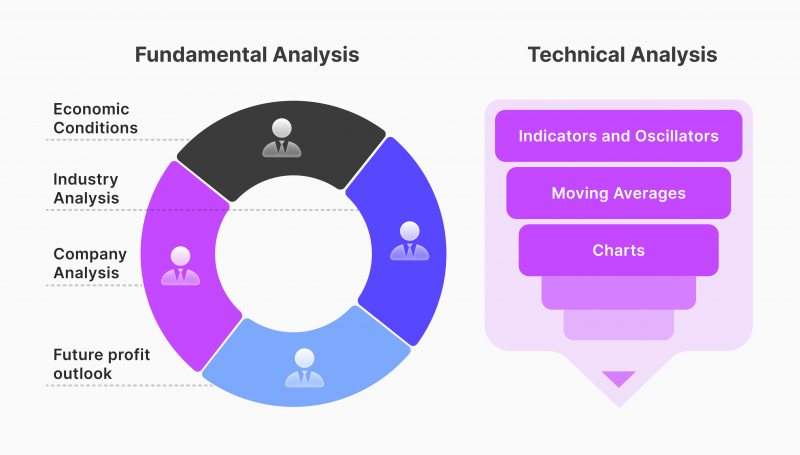

Successful overnight trading often involves a combination of fundamental and technical analysis.

Fundamental analysis, evaluating a security’s intrinsic value, becomes crucial during periods of significant economic news. Technical analysis, based on free overnight market data, aids in identifying trends and patterns for profitable trading opportunities.

Chart patterns, support and resistance levels, and trend analysis contribute to informed decision-making. However, it’s essential to complement technical analysis with a comprehensive understanding of fundamental factors influencing the market.

Here are several steps to achieve successful overnight trading:

- Understand the Market: Gain insights into the dynamics of overnight trading, including associated investment risks and potential rewards.

- Stay Informed: Keep abreast of global news and economic events that could impact markets during overnight sessions.

- Use Appropriate Tools: Leverage technical and fundamental analysis tools to inform trading decisions.

- Manage Your Risk: To mitigate potential losses, implement risk management techniques, including stop-loss orders.

Advantages and Challenges

Overnight trading offers both attractive benefits and essential risks, making it interesting and intriguing for market participants.

Pros

- Capitalising on Global Events: Traders can respond to news events happening outside regular market hours.

- Access to 24-hour Markets: Especially in FX, crypto, and futures, traders can access markets around the clock.

- Potential for More Elevated Gains: Due to higher volatility, successful trades may lead to more significant profits.

Cons

- Liquidity Risk: Overnight markets may have less liquidity, leading to larger bid-ask spreads.

- Volatility Risk: Lower liquidity often results in higher price volatility, potentially causing substantial losses.

- Limited Access and Higher Prices: Not all brokers offer overnight trading, and those that do may charge higher fees.

Successful overnight trading hinges on a nuanced understanding of these risks and benefits.

The Impact of Global Markets on Overnight Trading

Global markets heavily influence overnight trading. Economic markets are so linked that news in one area may cause major responses at non-traditional times in another.

Increased volatility and price fluctuations may occur in response to breaking news, the publication of economic data, or global geopolitical events.

Therefore, overnight traders need to be alert and ready to respond to these worldwide effects since they have a significant impact on market sentiment and the direction of assets traded over a prolonged trading period.

Final Remarks

Knowing the ins and outs, using successful methods, and being aware of how international events affect the global financial network are all crucial considerations of overnight trading. While quick responses to breaking news can be helpful, the risks of less liquidity and higher volatility must be carefully weighed against each other.

FAQ

What are overnight trades, and how do they work?

Overnight trades refer to transactions conducted after standard market hours and before the market opens. Traders hold positions overnight to capitalize on global news and price shifts during extended trading sessions.

What is overnight trading, and why is it important?

Overnight trading allows investors to trade outside regular market hours, enabling them to react to global events, economic news, and market changes that occur overnight, creating new profit opportunities.

How does overnight trading differ across markets?

Overnight trading varies by market: Forex operates 24/5, cryptocurrencies run continuously, while U.S. stocks and commodities have specific extended trading sessions facilitated through electronic communication networks (ECNs).

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.