What is Prime of Prime (PoP)?

In the world of online trading and brokerage services, where the entry barriers are low and big-money players dominate, it can be challenging to compete against those who have been in the game for years and have accumulated tremendous capital.

FX brokers and trading startups find it difficult to solidify their market position and deliver eye-catching offerings. This is where Prime of Prime service comes into play: connecting retail brokers with tier-1 liquidity providers.

The financial services space keeps expanding, and PoP firms make it feasible to onboard new brokerage firms and equip them with the means to compete successfully. Let’s review how Prime of Prime works and who actually needs it.

Key Takeaways

- Prime of Prime firms intermediate between small trading platforms and tier-1 financial institutions.

- PoP providers offer competitive pricing and liquidity aggregation to retail brokers, allowing them to operate and compete more effectively.

- PoP services are more affordable for platforms that cannot comply with the capital requirements of investment banks and financial institutions that offer liquidity and trading assets.

What is Prime of Prime?

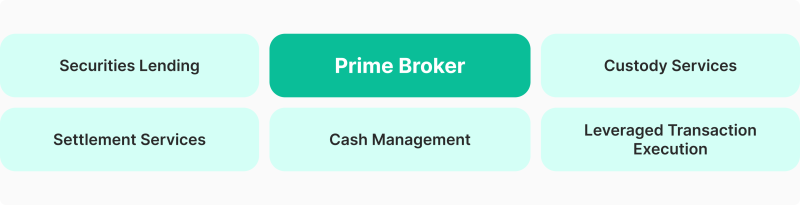

Prime of Prime (PoP) is a service that allows retail brokers to access tier-1 liquidity pools and providers. PoP firms act as intermediaries between small trading firms and large financial institutions, offering trading infrastructure and credit facilities that growing businesses and startups cannot directly obtain due to high capital or credit requirements.

PoP firms aggregate liquidity from multiple sources, offering competitive pricing, optimised trading conditions, extended leverage and risk management services, enabling smaller players to operate efficiently in global markets.

As such, they bridge the gap between top-tier liquidity providers (LPs) and non-institutional entities, facilitating market participation for a broader range of clients.

How Prime of Prime Liquidity Works?

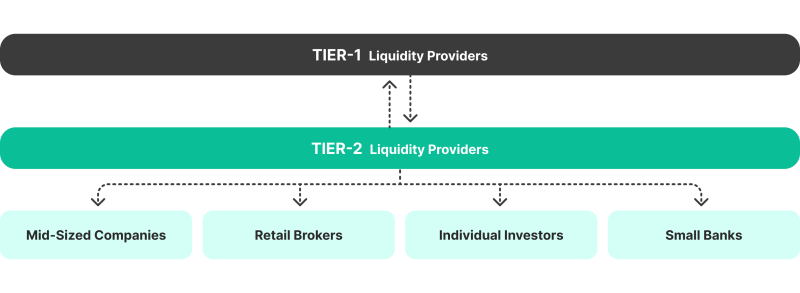

If you are launching a brokerage firm, getting compelling rates and products from market-leading financial institutions can be challenging. PoPs are tier-2 institutions that meet the requirements and have an account with tier-1 LPs.

Then, PoP firms extend this connection to retail brokers, such as FX trading platforms, CFD brokers, or crypto exchanges, allowing them to acquire deep liquidity and access a broad range of financial instruments.

Then, they offer trading services at favourable rates and prices to their clients, including online traders. This chain enables Forex brokers to facilitate trading on smaller lots, lower budgets and higher leverage. However, the spread can be relatively wider than that of tier-1 firms.

Who Uses PoP Services?

PoP firms enable smaller and newly launched businesses to compete effectively in global financial markets. As such, they leverage their access to:

Retail Brokers: Gain access to deep liquidity pools and competitive spreads, improving trade execution for their clients.

Hedge Funds: Leverage PoP services for cost-effective liquidity, credit access, and seamless execution of trading strategies.

Proprietary Trading Firms: Use PoP providers for fast execution and reliable infrastructure to support high-frequency or algorithmic trading.

Asset Managers: Rely on PoP firms for efficient trade execution and risk management across diverse asset classes.

Family Offices: Benefit from access to institutional-grade liquidity and credit for their investment strategies to suit their cost-efficient plans.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

Market Insights

Prime of Prime (PoP) services emerged in the early 2000s, following the Internet revolution and as an evolution of traditional prime brokerage models.

This sphere grew massively due to the increasing demand for institutional-grade liquidity among smaller brokers and firms that could not meet the high capital requirements of top-tier institutions offering trading capabilities.

The market gap increased after the 2008 financial crisis when the Basel III framework was adopted, imposing stricter capital and requirements on T-1 liquidity sources and reducing the number of their clients.

The rising FinTech practices, financial innovations, and the entrance of cryptocurrencies have further solidified Prime of Prime firms as an integral part of the financial services industry.

While the PoP market size remains vague, the prime brokerage sector is booming, generating $20 billion in annual revenue in 2023.

Today, the Prime of Prime liquidity industry expands to multiple asset classes, including cryptocurrencies, non-deliverable forward, derivatives contracts, and more, enabling new brokers to compete effectively and boosting the overall market.

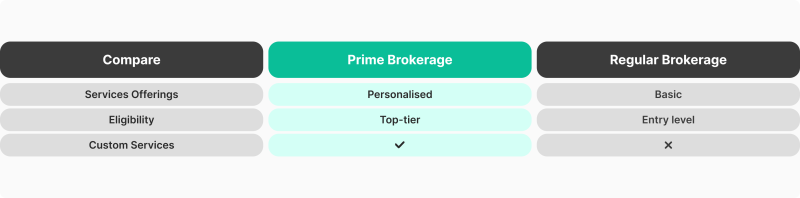

Prime of Prime vs Prime Brokerage

While PoP services empower retail Forex brokers to access liquidity and products from top financial institutions, prime brokerage companies serve broader needs with sophisticated offerings.

Prime brokerage focuses on large institutional clients and provides comprehensive trading, clearing, and financing services, while PoP bridges the gap for firms unable to access prime brokerage.

PoP Features

Prime of Prime providers intermediate between tier-1 banks and smaller brokers, offering access to liquidity, credit, and trading instruments without requiring direct relationships with prime brokers. As such, they enable smaller players to compete with institutional-grade tools.

- Aggregates tier-1 liquidity across various markets for better pricing.

- Offers credit lines to brokers unable to secure direct access.

- Access to deep liquidity pools for large-volume trade execution.

- Provides multi-asset liquidity across major international markets.

- Tailored solutions to fit the needs of brokers, traders, and funds.

PB Services

Prime brokerage caters to large institutional clients like hedge funds and asset management firms, providing comprehensive trading, clearing, and other financing services. As such, they enable corporations to execute sophisticated strategies across global markets.

- Facilitates access to multi-asset trading across global markets.

- Ensures efficient clearing, settling and executing of trades.

- Provides support for short-selling strategies and borrowing.

- Offers margin and credit for large-scale trading operations.

- Delivers detailed insights into portfolios, trades, and market risks.

Regulatory Environment

PoP firms and activities are governed by financial authorities such as the FCA (UK), CFTC (US), ASIC (Australia), and ESMA (EU), ensuring transparency, capital legality, and risk management.

Firms must comply with strict licensing requirements, including proving financial stability, segregating client funds, and adhering to Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols.

Some jurisdictions impose restrictions to leverage limits, trade reporting, and marketing practices to provide fair competition and dynamics.

Brokers using PoP services must ensure compliance with their local regulatory guidelines. Additional restrictions may apply in the Forex and CFD markets due to their complexity and risks, with limitations often placed on leverage and negative balance protection.

Selecting B2BROKER as Your PoP Liquidity Provider

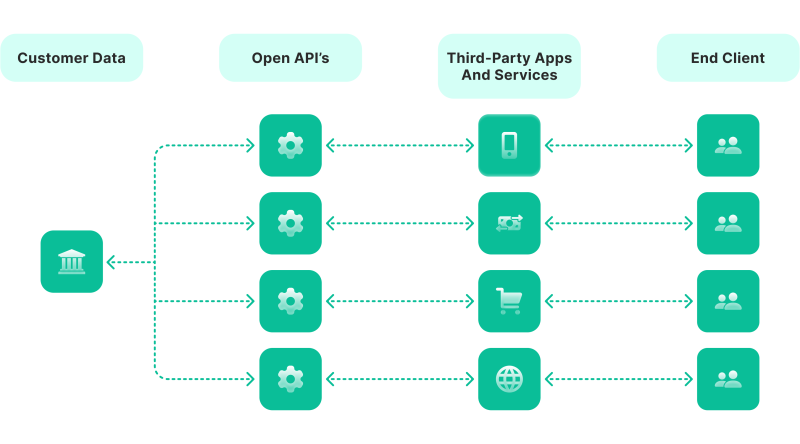

B2BROKER is a leading Prime of Prime liquidity provider offering access to Forex, cryptocurrency, CFD liquidity, and over 1,000 assets from 10 classes.

We aggregate pricing and instruments from Tier-1 banks and non-bank providers, ensuring deep market reach and competitive spreads for brokers looking for institutional-grade access.

As such, brokerages can explore tailored solutions, implement hedging tactics, and get liquidity for their proprietary trading desks. Let’s review the technological ecosystem of B2BROKER.

Key Advantages

B2BROKER is distinguished for its convenient and tailor-made solutions, empowering newly starting brokers and established institutions to get liquidity more easily, faster, and with cost-efficient plans. This includes:

- Transparency: Opt-in for zero hidden fees and clear pricing schemes to better plan your investments and profit and loss.

- Flexible Settlements: Settle transactions in cryptocurrencies or fiat money with easy automation that suits your business plans.

- 24/7/365 Support: Multi-language support is available around the clock to resolve your issues and questions.

- Smart Server Hosting: Physical proximity to major exchanges and liquidity providers to maximise processing speed.

- User Education: Comprehensive guides and learning materials to support informed decision-making in highly dynamic markets.

- Advanced Reporting: Gain full control and transparency over business operations with detailed and fully analytical reports.

- Dedicated Assistance: Brokers are assigned a personal manager to resolve issues promptly and ensure long-term success.

- Limited NOP: Implementing high limits on open positions to minimise trade execution rejection risks.

- Continuous Updates: We consistently improve our offerings with new instruments and unique features that will boost your journey.

Gain Competitive Edge

We help you succeed in the market, especially with the influx of sophisticated financial institutions offering top-notch services. Stand out with a competitive advantage that will support your long-term growth.

Aggregated Tier-1 Liquidity

We source quotes and assets from T-1 banking and non-banking liquidity providers, ensuring high market depth and broad access to financial markets. This attracts professional traders seeking to maximise their investments through efficient pricing and swift execution.

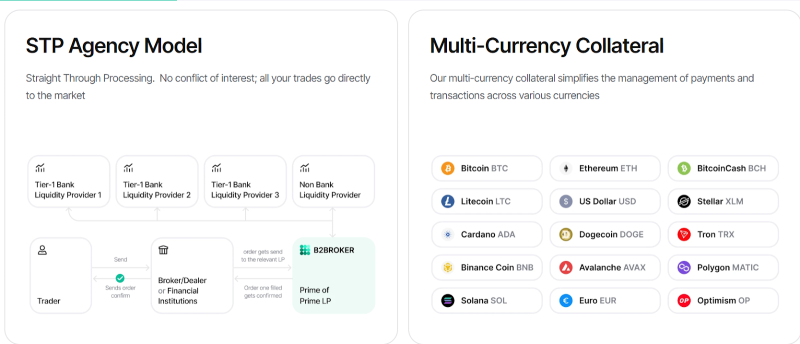

Straight-Through Processing

The STP Model ensures that all your trades are processed directly in the relevant financial market, thereby reducing conflicts of interest. This reduces operational risks, minimises errors, accelerates speed, and lowers processing costs — ultimately attracting more users to your platform.

Multi-Currency Collateral

Simplify your transaction management with a flexible collateral system that enables you to support crypto and fiat currencies as a hedge for margin trading. It adds more flexibility for traders using leverage and enhances capital efficiency.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

This approach attracts sophisticated traders by providing operational agility, reducing FX conversion costs, and supporting global client onboarding.

Deep Liquidity Pools

Our liquidity pools ensure tight spreads, low slippage, and fast execution, which are key to handling large-volume trading orders.

This enables you to serve institutional clients and high-frequency traders without having to switch between liquidity providers and venues, offering better price stability and boosting order fulfilment.

Volume-Weighted Average Price Execution

The VWAP execution model splits large orders over time at average market prices. This ensures processed orders are not impacted by sudden price hikes due to increasing demand and supports execution at favourable prices.

This increases transparency, appeals to institutional clients, and adheres to regulatory frameworks.

Advanced Tech Stack – Higher Security

Trading comes with challenges, whether technical or market-related. We minimise these risks by implementing cutting-edge systems and protocols that support customers to trade with confidence.

Our tech infrastructure is supported by servers located in main data centres, such as USA NV4, UK LD4, Japan TY4, and China HK3. This makes trading and getting PoP liquidity from B2BROKER faster and more efficient.

We also implement high-DDoS protection practices, incorporate hot backups, and a failover system to minimise server downtime.