How to Accept Bitcoin Payments as a Business?

The development of crypto technology has been the starting point for creating great opportunities for both individual investors and large companies to increase capital. On the other hand, it allowed introducing numerous new ways to develop business processes, increase customer base, expand geography of presence through the mutual settlements with the help of crypto processing, the most popular cryptocurrency for which Bitcoin is used.

This article will explain what Bitcoin is and the advantages of using it for payment. We will also discuss some challenges of using Bitcoin in 2023 and how to set up your business for Bitcoin payment processing. Ultimately, you will learn a few security measures to remember if you plan to accept Bitcoin as a payment means.

Key Takeaways

- According to many reputable sources, Bitcoin is the most popular cryptocurrency used in the business environment for mutual settlements.

- The crypto payment gateway and crypto payment processor are the most important elements in the Bitcoin transactions processing.

- On the one hand, Bitcoin is a great tool for fighting inflation, but on the other hand, its volatility prevents its full use.

What is Bitcoin and What Are the Benefits of Accepting Bitcoin Payments?

Bitcoin was created in 2009 as an alternative to fiat money by an unknown programmer known as Satoshi Nakamoto. Bitcoins are not printed like fiat money; they are generated by “mining”, that is, using the hardware resources of computers within a distributed global network of volunteer software developers. In essence, Bitcoin is nothing more than a file containing a list of all the transactions passed on the network in an electronic version of the ledger called the “blockchain”. In the ever-expanding cryptocurrency field, the Bitcoin payment system was the first example of using open-source software to perform complex mathematical calculations in which new coins are “mined”.

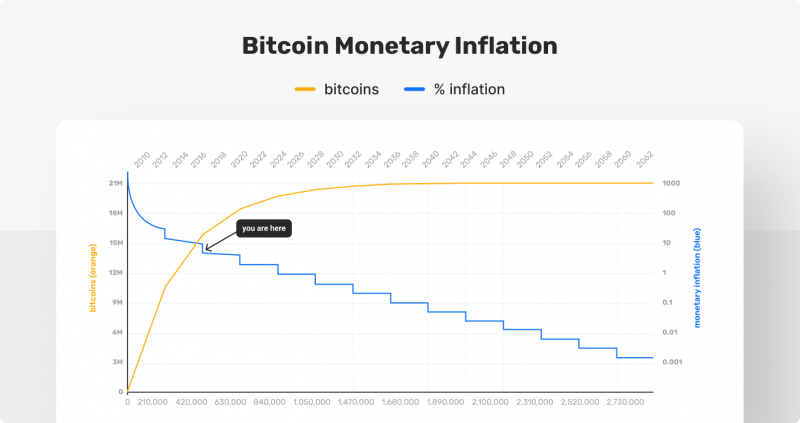

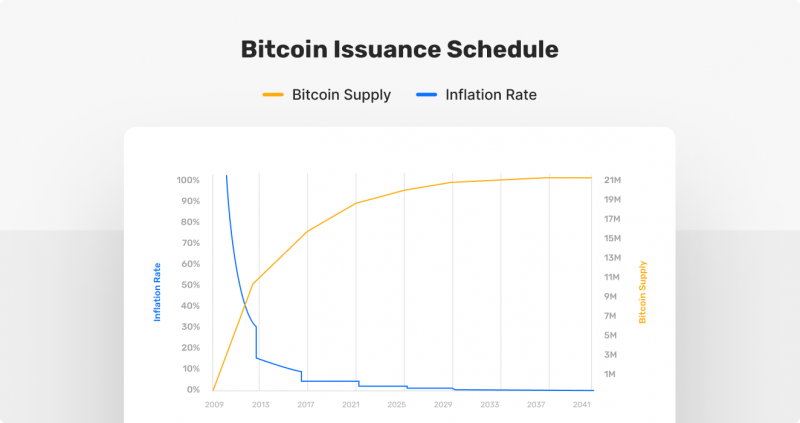

“Miners” confirm these blocks of transactions and include them in the blockchain, competing with each other to perform mathematical calculations. Each time a miner’s computer finds a solution that confirms a transaction block, the miner is rewarded with Bitcoins. Every four years, the reward is halved so that the total number of Bitcoins does not exceed 21 million.

Today, many companies are experimenting with crypto payments and accept Bitcoin as a payment instrument for their goods and services, and there is a reason for that.

Immunity to Inflation

Unlike fiat money, which can be printed to increase the money supply, the Bitcoin system is designed in such a way that the maximum number of Bitcoin coins in it is limited. According to a predetermined algorithm, only 21 million coins can be issued. About 19.3 million Bitcoins have been issued so far.

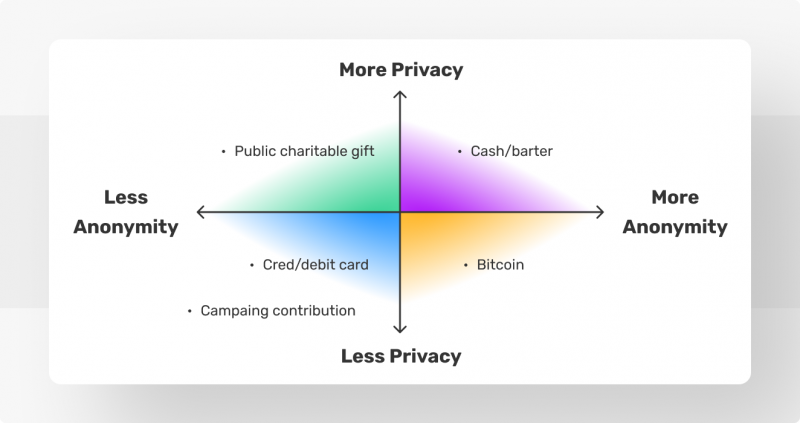

Anonymity

Users can have multiple Bitcoin addresses, but these are not tied to names, actual addresses, or other identifying information. However, as shown below, recently introduced rules for exchanges make maintaining anonymity on the Bitcoin network difficult. In addition, specialists have found ways to track transactions at public addresses, but linking the public address to an individual’s specific address is still tricky.

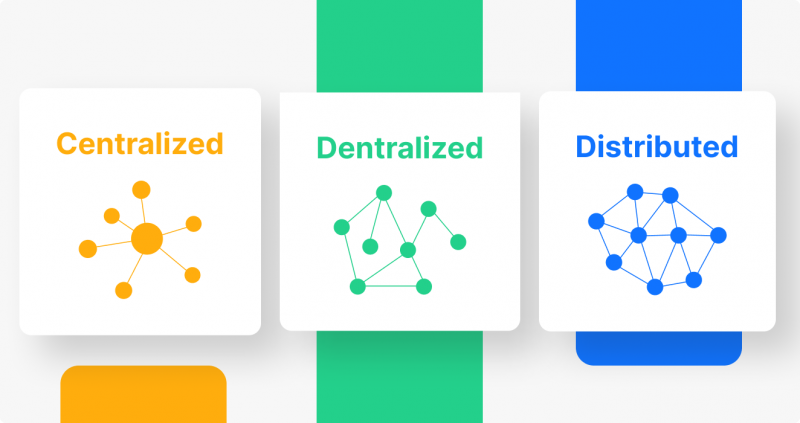

Decentralization

Bitcoin is a system based on a decentralized, peer-to-peer network that operates without a centralized clearinghouse or other intermediaries. The Bitcoin network is not controlled by a single institution in the same way that a central bank controls fiat money. Every computer involved in “mining” Bitcoins and transaction processing is part of that network.

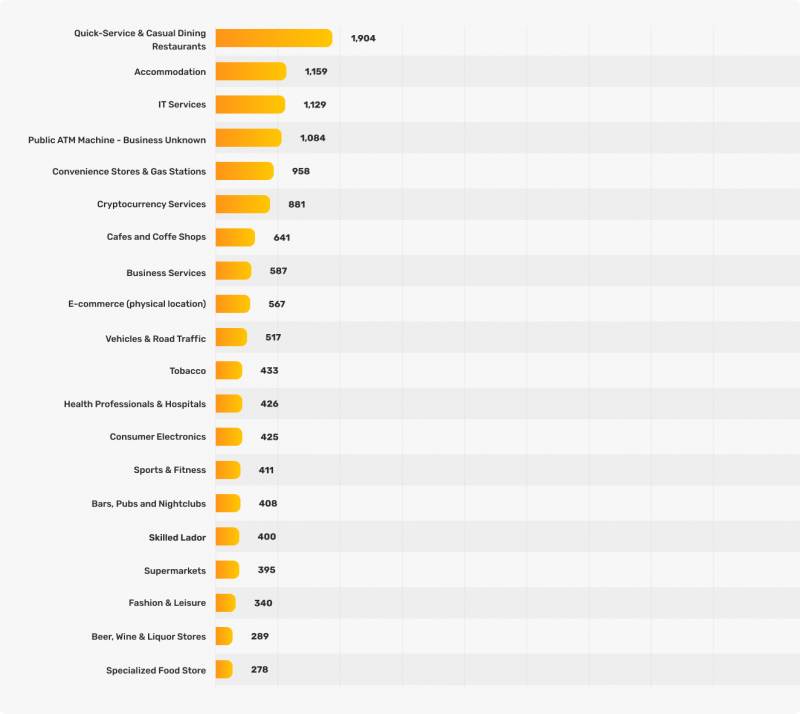

Today, an incredibly large number of different companies around the world use Bitcoin as a means of making payments. Quick services and casual dining restaurants are the largest segment already using crypto processing to accept crypto payments.

Challenges of Accepting Bitcoin Payments in 2023

Despite its attractiveness and myriad benefits, Bitcoin has several problems, primarily related to its volatility and, in some cases, security, which prevents it from being accepted at the state level to be legally regulated. On the other hand, the same problems also create obstacles for businesses to accept Bitcoin payments, and here are a few of them.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

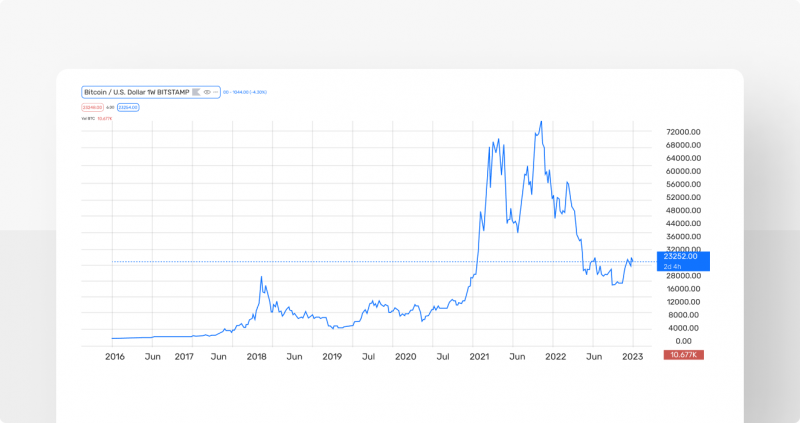

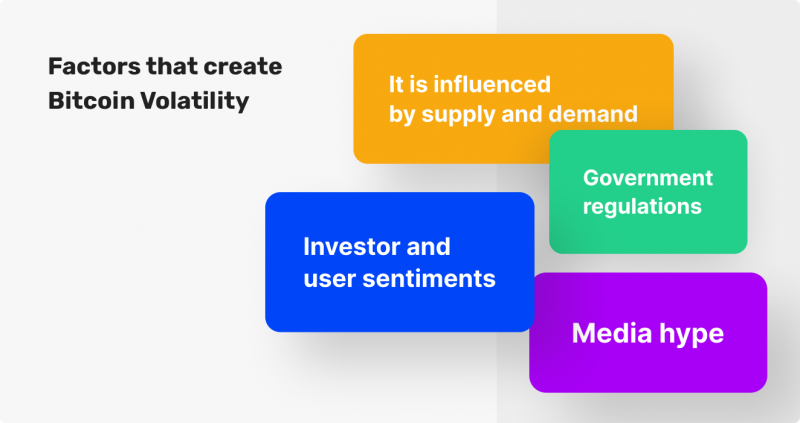

Volatility

Bitcoin has received tremendous attention from the media, the digital currency has become the most popular one and the number of people who want to buy it has increased. High number of views on news articles has led to increased volatility in Bitcoin, as have the sentiments of some large investors, usually referred to as “whales”. While excessive volatility threatens Bitcoin’s path to becoming a successful currency, many scholars are interested in the determinants of such volatility. Factors such as speculative investments or public attention are also drivers of Bitcoin’s volatility.

No Regulation

Bitcoin has no clear legal regulation. This leads to a lot of problems related to defending people in court if they have suffered at the hands of fraudsters. There is no precise, fixed information about how the value of assets and their legal status are determined. It also directly affects merchants and buyers, i.e. the two parties involved in mutual settlements, because in this case they do not have any normative legislative base for settling disputes and other conflicts which arise in the context of financial transactions.

Limited Supply

In the Bitcoin network, information is stored in blocks, which are confirmed every 10 minutes. Approximately 210,000 blocks are processed every four years, after which halving — halving the remuneration for miners — takes place. The maximum number of BTC is 21 million.

The limited issuance helps control the distribution of new coins and keeps inflation in check, causing the price of Bitcoin to rise. Today, more than 19 million coins have already been mined, and the mining process is becoming more complex. Given the high demand for cryptocurrency, its rate, despite the constant jumps, is going up. Given the speed of Bitcoin’s price growth in the future, there may be a problem with making payments using it.

It is believed that due to its limited issuance and incredible popularity, Bitcoin will be the most popular crypto payment instrument for at least the next 5–10 years.

Setting up Your Business for Bitcoin Payment Processing

When the time comes to accept cryptocurrency payments, every business thinks about the sequence of steps to take. Coinmap.org provides a global map showing all stores and ATMs that accept cryptocurrency. According to coinmap.org, there are 31,766 such facilities around the world at the time of this writing. For comparison, in May 2018 their number was 12,541. Without further ado, here’s a list of steps you need to take to accept Bitcoin payment just like other crypto payments.

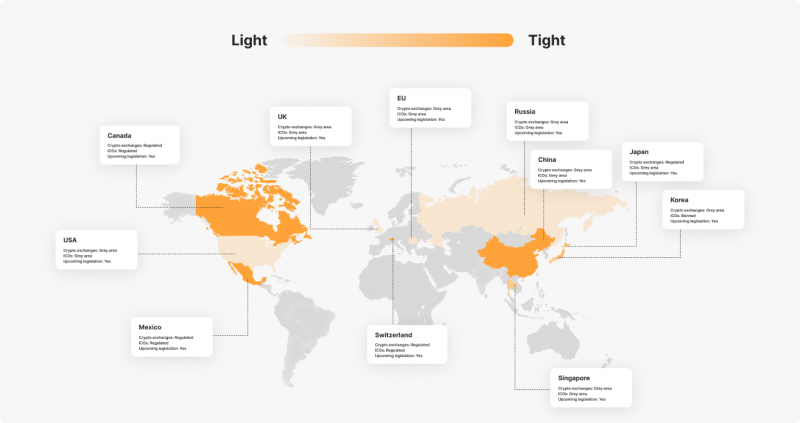

Understand Cryptocurrency Regulations

An important step before starting to work with cryptocurrency payments is the preparation and study of all legal aspects, including legislative projects in the field of cryptocurrency regulation (if they already exist) and the study of service policies and other regulatory documents that stipulate the use of crypto processing to be able to process crypto transactions. The same applies to Bitcoin wallets that you wish to use to store Bitcoins and other cryptocurrencies. Each company has its own requirements and conditions for using their products and services, so knowing them and following them is one of the first steps to getting started with crypto payments.

Set Up a Bitcoin Wallet

A cryptocurrency wallet is a special program that allows you to account for, store and perform other actions with cryptocurrency. Such a wallet contains public and private cryptographic keys to your cryptocurrency. It is important to understand that the wallet does not store the cryptocurrency directly, but only the keys that provide access to it. With a public and private key, you can make crypto-transactions — buying, selling, and exchanging your assets.

Set Up a Bitcoin Payment Gateway

Crypto payment gateway performs important work in cryptocurrency processing as a kind of bridge between buyer and seller, and therefore its choice should be based on a thorough analysis of all existing options on the market. There are many things to consider, such as price, availability of cryptocurrencies, usability, interface, flexible rates, support and much more.

Integrate Crypto Payments Into Your Online Checkout or Website

At this stage, it will be necessary to enlist the help of programmers who will help to carry out a full complex of integration of the crypto-processing service with an online cash register or a website. In the first case, it is necessary to make a direct connection via the API protocol or using other methods, depending on the type of cash desk that is used. One such approach is the integration of QR codes to make payments for each individual cryptocurrency. In our case, this is Bitcoin, but there are hundreds of others that can act as a means of payment.

Expand Payment Opportunities

As mentioned above, Bitcoin is the most volatile cryptocurrency in the crypto market. Volatility creates many problems that result in a lot of inconvenience for both retail investors and the business environment. In order to protect yourself from this harmful factor, it is necessary to foresee the use of a crypto converter that will help you instantly exchange Bitcoin to fiat or other cryptocurrencies. It is also worth considering offering your customers the opportunity to pay in other cryptocurrencies, the number of which is growing daily.

Security Considerations for Accepting Bitcoin Payments

When dealing with crypto payments, there are a number of important security considerations to keep in mind. Here is a list of the most important ones.

Passwords

When working with crypto wallets, the safety of funds is guaranteed solely by your responsibility. Due to security, many crypto wallets have a complex mechanism for recovering forgotten passwords or secret phrases. Forgotten passwords and passphrases can lead to complete loss of access to your funds. To prevent this, keep passwords in a safe and secure place that is not accessible to third parties. It can be different hardware devices, applications, or a regular notebook that is exclusively for your use. By taking care of this aspect from the very beginning, you can avoid problems with access to your accounts and funds.

Phishing Attacks

Phishing is a type of Internet scam used to obtain user identities. It steals passwords, card numbers, bank accounts, and other confidential information.

Phishing sites usually imitate popular companies’ websites: social networks, online stores, streaming services, etc. Hackers rely on the fact that the user will not notice the fake and will submit personal data on the page: card details, login and password, and phone number. If a person does this, the scammers will get his data.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

The main problem with phishing is that no software can protect people and companies: fake sites and emails are difficult to distinguish from the originals. It all depends on the potential victim — how attentive she will be and whether she will recognize the fake. Everything is decided by the human factor: even the largest technology companies are vulnerable.

Hacking

The recent surge in interest in cryptocurrencies has prompted some hackers to start looking for different ways to cash in on defenseless users by hacking into their crypto wallets. The latest news about hackers shows that no one is immune from their interference. There have already been several cases of exchange hacking. For example, in January 2018, the cryptocurrency exchange service Coincheck was hacked and about 500 million NEM tokens worth about $385 million were withdrawn from the exchange. Although Coincheck was able to compensate all users with their own capital, there is no certainty that more serious incidents will not occur.

For example, the recent hack of the FTX cryptocurrency exchange, a native token that had previously almost completely depreciated due to the collapse, showed that no one is immune from hacking. According to some sources, more than $400 million was stolen by hackers, irretrievably.

Conclusion

Today, cryptocurrency processing plays a vital role in the business processes of many corporations interested in developing and expanding their presence in different markets. By introducing the technology of crypto payments into the infrastructure of the company, it is possible to achieve significant progress in the implementation of mutual settlements and increase the influx of new customers who will undoubtedly appreciate this innovative way to pay for purchases and services of various types, avoiding high commissions and long waiting times for transactions that have traditional payment methods.

Resources for Further Learning About Bitcoin Payment Processing and Acceptance

Today, there are many companies that offer access to crypto payment processing and are well versed in this topic. It can be difficult for beginners to navigate this niche without skills and experience, so below is a list of useful resources that will certainly help you better understand the essence of how Bitcoin payments work and start accepting Bitcoin payments.

- How to Accept Crypto Payments in 2023?

- Top 15 Crypto Payment Gateways in 2023

- How to Start a Crypto Business?

FAQ

What Is a Cryptocurrency Payment?

Cryptocurrency payments are those made by merchants or individuals for a product or service using any cryptocurrency that is accepted by them.

How Do I Accept Payments With Cryptocurrency?

Payments can be accepted through a cryptocurrency wallet. Although many of them are free, if you are interested in accepting cryptocurrency as payment but lack the time to learn about it, a cryptocurrency payment gateway may be able to help you.

Which Payment Gateway Is Best for Cryptocurrency?

Many options are available. You should compare them so that you can determine which one is best suited to your needs. For example, there is a payment service called Coinbase Commerce offered by Coinbase, an exchange that is based in the United States and regulated by the government.