How to Accept Crypto Payments in 2023?

Articles

The development of information technology strikes the imagination, forcing you to rethink many things. Blockchain technology, being one of the most progressive and promising technologies, has provided many valuable and indispensable tools that have greatly simplified not only the lives of ordinary users but also expanded business opportunities. One of these tools is cryptocurrency processing.

In this article, we’ll discuss crypto payment processing and how it works. We will also discuss the advantages and disadvantages of using crypto as a payment instrument. In the end, you will find a useful guide on how to find a reliable cryptocurrency payment processor.

What is Crypto Payment Processing And How Does It Work?

Crypto payment processing technology is a modern payment method that allows customers to pay for goods or services online using distinct cryptocurrencies (Bitcoin, altcoins, stablecoins) rather than conventional facilities via bank data or classic payment systems. Regardless of whether merchants or vendors use crypto payment solutions, the crypto industry’s growth today makes them more likely to consider new payment options for conducting business in the digital space.

Research conducted by Crypto.com, a crypto exchange, made it clear that ~60% of both merchants and customers would like to transact in crypto in 2022. Today, this percentage is even higher.

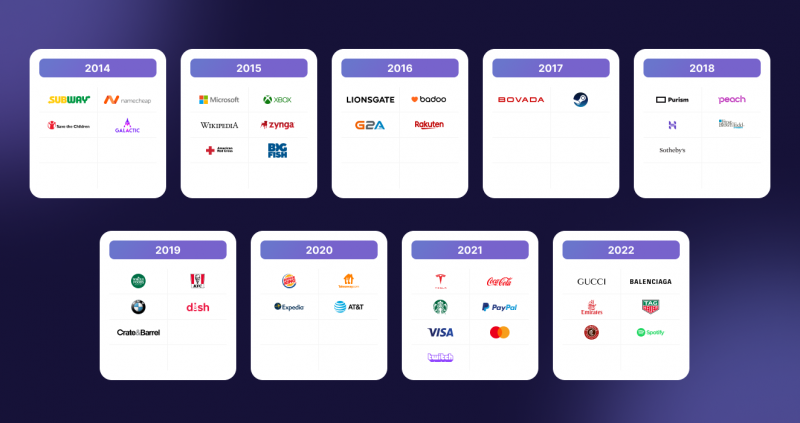

Crypto payment technology, which is gaining popularity at a high rate, has become mainstream today. Until a few years ago, one could notice a strong involvement and interest of various industries in accepting Bitcoin payments for their goods and services.

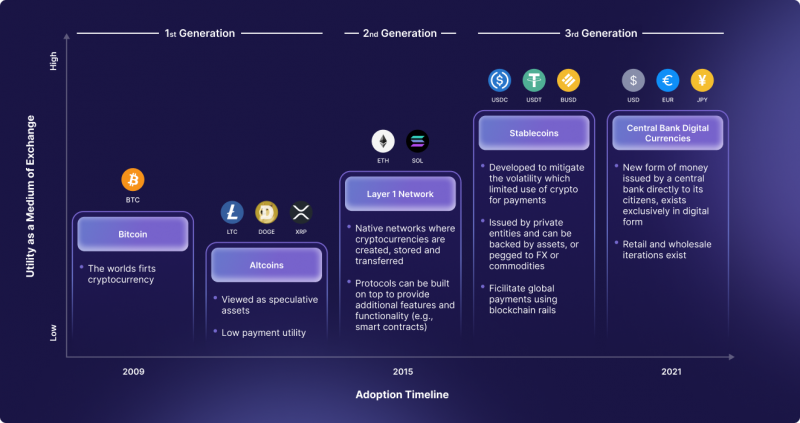

The history of cryptocurrencies, despite its short lifetime, is undergoing significant changes step by step, allowing new types of assets to be used to make payments using blockchain technology. Starting with Bitcoin in 2009, cryptocurrency has come a long way to date, epitomized by the creation of so-called central bank digital currencies, representing the 3rd generation of crypto asset development.

Cryptocurrency payment processing can be integrated into the company’s existing processes or launched as a new service to meet the needs of any business model. As the true objective of cryptocurrency processing, payments can be made with cryptocurrency in online stores and venues. To allow customers to make Bitcoin payments, a company must integrate a traditional payment gateway into its website to accept such payments.

Payments processed through cryptography are convenient for customers and advantageous for merchants. As a result, merchants can eliminate the need for exorbitant commissions by accepting cryptocurrency payments from their customers, since commissions are significantly lower than ordinary bank transfers, and increase the number of customers willing to pay with cryptocurrency. An increased customer base can result in higher profits for a company when new payment methods are offered. It is also worth adding that every year more and more companies integrate such payment solutions to accept Bitcoin and altcoins as a means of payment.

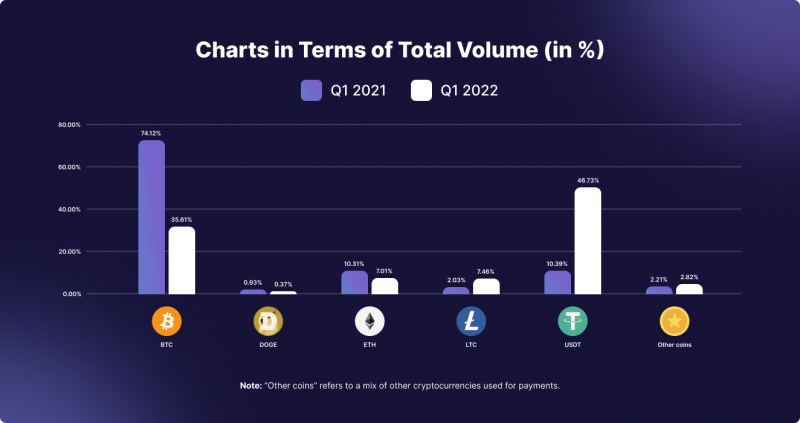

While more and more companies from entirely different industries start accepting crypto payments, new currencies are being created to keep up with the progress and take advantage of the opportunity to make more money by attracting new customers. However, despite this, today, some of the most reliable and popular assets used as payment remain Bitcoin, Ethereum, Doge, and stablecoin USDT.

KEY TAKEAWAYS

- Cryptocurrency payments have come a long way, which includes the creation of Bitcoin, altcoins, stablecoins, and eventually central bank digital currencies, which are now used as a means of payment.

- As of 2022, Bitcoin is the most popular cryptocurrency used for payments and transfers in the business environment. It is followed by the altcoins Ethereum and Doge.

- Research conducted by Crypto.com, a crypto exchange, made it clear that ~60% of both merchants and customers would like to transact in crypto in 2022.

Benefits and Drawbacks of Accepting Crypto as Payment Means

Bitcoin payments, like any other technology, have advantages and disadvantages. Binance, the world’s largest cryptocurrency exchange, agrees with this statement, saying on its Twitter account the other day that crypto payment technologies are rapidly gaining popularity among retailers and businesses alike.

Let’s start with the main positive aspects that cryptocurrencies have as a means of payment.

Low Fees

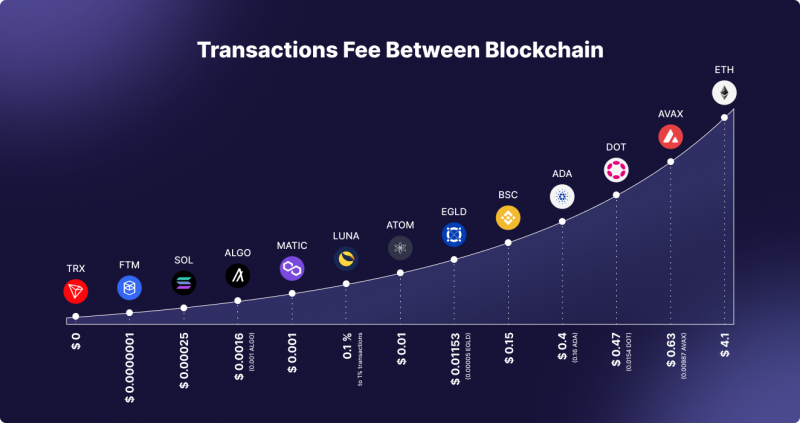

Bitcoin payments are incredibly cheap. Depending on the blockchain used, the transaction fee can be less than one dollar, which is an important criterion for many companies for mutual settlements. For example, for crypto asset transfer transactions on the Tron blockchain network, there are no transaction fees at all!

Security

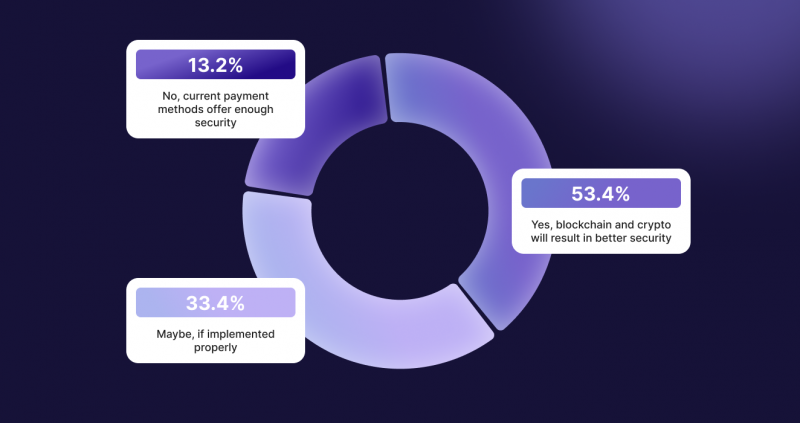

When it comes to the payment system that allows people to take payments in conventional money, there’s a potential the transaction will run into issues like rejection for a variety of reasons, chargebacks, the likelihood of regulators, MPS (Visa/MasterCard), acquiring banks, or the payment systems themselves monitoring transactions, blocking the account or card, and freezing funds until the check clears. Many people believe that blockchain technology and cryptocurrencies will definitely make payments more secure.

When accepting cryptocurrencies as payment, the situation is different. Since blockchain transactions are irrevocable, chargebacks do not exist. Additionally, because these parties are not linked to the chain, neither the regulator, MPS, acquiring bank, nor the payment system may influence halting transactions or freezing cash.

Speed

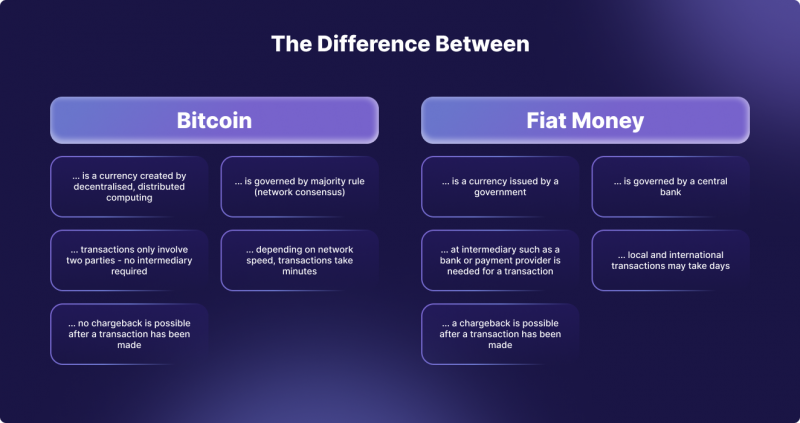

Today, speed is one of the quality measures of almost any service, including money transfer. While bank transfers can take days depending on the day of the week, Bitcoin payments are instant, and crypto transfers are much faster than bank transfers. This demonstrates the high technological base on which blockchain technology is built.

Now let’s look at a few major drawbacks of Bitcoin payments.

Volatility

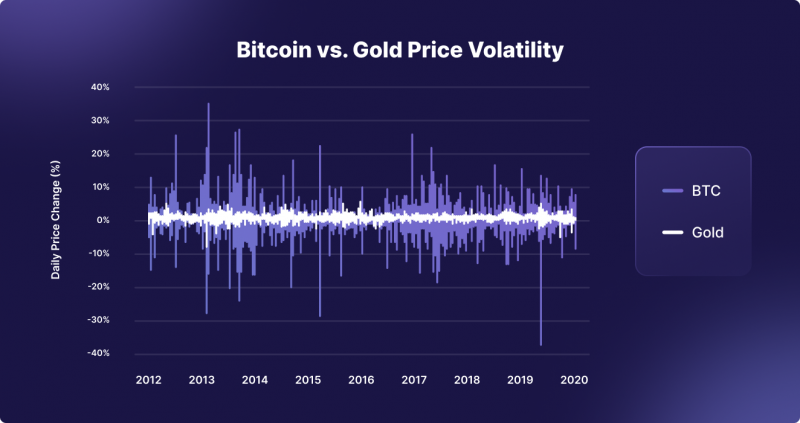

Crypto market volatility is one of the most unpredictable and uncontrollable phenomena which is a very big problem not only for those who decided to invest in cryptocurrencies or engage in speculative trading, but also for companies that decided to accept crypto as a means of payment. Due to periodic strong fluctuations in the value of crypto assets, this is a stumbling block to expanding the use of this technology to pay for goods and services.

Compared to gold, Bitcoin’s volatility is extremely high.

Fraud

Despite the high degree of protection of blockchain protocols, the current high popularity of the cryptocurrency niche unfortunately attracts undue attention and the world of criminal gangs, fraudsters, and cyber hackers who want to take possession of digital assets. Development of new data encryption systems for transactions to some extent helps in the fight against intruders, but there are many cases when not only crypto wallets, but entire crypto exchanges are hacked.

Anonymity

The anonymity of payments and the issuance process makes cryptocurrency attractive for users, on the one hand, from the point of view of taxation and departure to the shadow economy, but on the other hand, it increases the risks of loss of currency by owners in case of bankruptcy of electronic exchanges for cryptocurrency trading or as a result of hacker attacks. Also, the anonymity of payments prevents state regulation of the economy and does not comply with international standards of information disclosure by participants in financial markets.

Considering all positive and negative qualities, the anonymity of crypto-payments can belong to both groups, because on the one hand it allows one to keep secret the name of sender and recipient of funds, but on the other hand it attracts the attention of criminals and hackers.

How to Choose the Right Crypto Payment Processor: Useful Guide

Now that you know what cryptocurrency processing is and how it works, as well as the main advantages of accepting crypto payments, it’s time to learn how to choose a reliable crypto processing service. First of all, you should pay attention to the following points.

Available Cryptocurrencies

Today, there are many cryptocurrencies that can be traded on countless cryptocurrency exchanges, but not all are supported by cryptocurrency processing services, which can be a barrier to attracting customers. A large number of cryptocurrencies allows you to attract more clients, so multicurrency plays an important role when choosing a crypto processing service. A good advantage is that the processor has a volatility risk control system, or VRCS, which allows converting cryptocurrencies to Stablecoin tied to fiat currency.

Commissions

Commissions are one of the most unpleasant things you have to deal with when connecting any kind of service provider. Often, many cryptocurrency processing services have flexible tariffs which allow choosing the optimal set of necessary features, including low commissions. However, the amount of commissions can often vary greatly depending on the blockchain network in which the transactions are made. This aspect must be taken into account when working in different blockchain networks.

Currency Conversion

Cryptocurrencies have come a long way and created their own economic sector, but fiat still rules the global financial market. Cryptocurrency is not yet possible to pay for most goods and services. Therefore, people constantly need to convert cryptocurrency into regular money for household expenses.

Crypto-enthusiasts around the world are looking forward to cryptocurrency replacing fiat money in everyday life, but that future is still far away, and fiat money is still needed to buy many products. Many crypto processing services offer the ability to easily convert cryptocurrencies to fiat and back if needed.

Multi-Platform

Today there is a great variety of forms of access to the Internet, which have their own characteristics, pros and cons, but nevertheless are used everywhere and every day. This list includes computers, tablets, cell phones and other means of working with digital information. Moreover, there are a large number of different operating systems, including the most popular Windows, Macintosh for computers, and iOS and Android for mobile devices. It is important to find a crypto-processing provider that has a separate version for each of the operating systems and devices described above.

Security Criteria

Security plays the most important role when it comes to both crypto payments and financial assets in general. The high level of crime in cyberspace forces companies to look for optimal solutions to protect their customers’ funds in order to prevent theft. There are many different security protocols that are used in the crypto sphere to enhance the security of systems and resistance to DDoS attacks and encryption of users’ personal data. Therefore, it is necessary to choose a service that will help to accept Bitcoin without fear for the safety of personal data and money.

Geography of Presence

Business is a multifunctional structure that provides new services and benefits to society. Due to the high level of competition, one of the most important requirements for running a business in order to attract the maximum number of customers and partners is its geographic coverage. The more countries and continents a company covers, the wider its audience, the more successful it is. When choosing a crypto processor for implementation in business processes, it is necessary to pay special attention to where it provides its services. Is it possible to access its products from anywhere in the world, or only from a few countries. This choice will determine the convenience of using the provider’s services.

Conclusion

Deutsche Bank predicts that cryptocurrency payments may replace fiat in developed countries by 2030. Therefore, companies that integrate support for cryptocurrencies now will have a serious competitive advantage. And the earlier you integrate cryptopayments into your site, the more you will benefit from the coming crypto-transformation of business. One way or another, crypto payment technologies will continue to disperse even more business opportunities, both offline and in the digital environment.