Best Crypto ETFs: The Broker's Gateway to Digital Assets

Crypto ETFs are entering the mainstream. In 2025, U.S. spot Bitcoin ETFs recorded over $1 billion in inflows on two consecutive days for the first time. This surge signals not just retail enthusiasm, but real momentum from institutional capital.

For brokers and fintech platforms, that’s the opening: crypto ETFs offer a regulated, scalable gateway into digital assets — without the overhead of custody, blockchain integrations, or wallet management.

In this article, we explore how brokers can build, integrate, and scale crypto ETF offerings in the next frontier of digital finance.

What Are Crypto ETFs and What Benefits Do They Bring?

Crypto ETFs (exchange-traded funds) are financial instruments that track the price of crypto assets or related sectors such as blockchain infrastructure.

These ETFs trade on traditional exchanges and come in different forms: some hold actual digital assets (spot ETFs), while others track futures contracts or invest in stocks tied to the crypto economy.

In 2025, crypto ETFs become part of the core multi-asset mix for retail and institutional portfolios. Brokers that move early can benefit in several ways:

- Add crypto exposure without building a blockchain stack. No need to manage wallets, custody, or token infrastructure — just offer the ETF via existing rails.

- Serve a broader client base. ETFs attract investors who are crypto-curious but want the familiarity and protection of regulated instruments.

- Boost AUM and client engagement. Crypto ETFs create new cross-sell opportunities with equities, bonds, or custom portfolios.

- Generate recurring revenue. Beyond trading spreads, brokers can monetise via management fees, ETF wrappers, data subscriptions, or premium access.

In short: crypto ETFs give brokers a clean, compliant way to tap into crypto demand — without rebuilding their infrastructure from scratch.

Why Brokers Should Care About Crypto ETFs

Crypto ETFs represent a major growth lever for brokerages, especially in 2025 and beyond. As demand for regulated, accessible crypto exposure surges, brokers that integrate crypto ETFs early can unlock significant competitive advantages.

1. They Attract a Broader Client Base

Not every trader is ready to manage their own wallet or interact with decentralised exchanges. Crypto ETFs make it easy for traditional investors — especially those coming from equities, commodities, or retirement portfolios — to gain crypto exposure without changing habits. That’s an entirely new audience for brokers to capture.

2. They Add a Compliant Crypto Product Line

Crypto ETF issuers handle custody, security, and underlying asset management. For brokers, that means you can offer regulated crypto exposure without building wallet infrastructure or dealing with digital asset compliance internally. It’s crypto, but cleaner.

3. They Enable Portfolio Diversification

Most investors aren’t putting 100% of their capital into crypto. ETFs offer a modular way to include Bitcoin, Ethereum, or crypto-related equities as part of a broader, balanced portfolio — all in one account, through one interface.

4. They Fit Into Existing Trading Platforms

Most crypto ETFs are listed on major exchanges (like NYSE or CBOE) and can be offered via the same systems that power forex, commodities, or equity CFDs. You don’t need to reengineer your stack to list them; you just need the right liquidity provider and routing setup.

5. They Strengthen Cross-Sell and Upsell

Once a client buys their first Bitcoin ETF, they’re far more likely to explore other asset classes — whether it’s ETH, DeFi-related stocks, or crypto spot trading. ETFs are often the first step on the crypto adoption journey, and brokers are well-positioned to own that entry point.

Types of Crypto ETFs

Crypto ETFs come in various formats designed to match different risk appetites, strategies, and regulatory needs. For fintech firms, brokers, and institutional platforms, understanding the structure behind these products is essential when building offerings around them.

Spot Crypto ETFs

These ETFs hold the actual cryptocurrency—typically Bitcoin or Ethereum—safely in institutional-grade custody. Their value reflects the live market price of the asset, offering the most direct exposure without requiring the end client to self-custody or interact with wallets.

Spot ETFs are the most popular product with retail investors due to their simplicity and clarity. Since January 2024, the approval of multiple spot Bitcoin ETFs in the US (including BlackRock’s IBIT and Fidelity’s FBTC) has significantly boosted demand.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Futures-Based Crypto ETFs

Futures ETFs track the price of crypto using derivatives, specifically, regulated futures contracts. Instead of holding Bitcoin, these ETFs buy and roll over futures on exchanges like the CME.

Futures ETFs may be more palatable in conservative jurisdictions due to their structure, but they can introduce tracking errors and higher costs. Offering them requires clients to understand concepts like contango, roll yield, and derivative exposure. Platforms servicing institutional or professional clients often include both spot and futures ETFs to provide choice.

Equity-Based Crypto ETFs

These funds invest in publicly traded companies operating within the crypto or blockchain ecosystem: mining firms, crypto exchanges, wallet providers, and infrastructure builders. They offer indirect exposure to the crypto economy without direct digital asset holdings.

For brokers operating in regions where crypto assets are still restricted, equity-linked ETFs provide a compliant on-ramp. They also appeal to investors looking for growth potential with lower volatility compared to BTC or ETH.

Thematic / Diversified Crypto ETFs

These ETFs blend multiple crypto-related themes (DeFi, NFTs, Web3 infrastructure) or combine digital assets and blockchain equities into a single fund. For example, a thematic ETF might give exposure across protocol tokens, Layer‑1 ecosystems, and infrastructure stocks.

Thematic ETFs allow you to offer differentiated products. They can position you as a curator of future-facing crypto exposure. Clients who believe in sector themes (e.g. “AI + crypto,” “Metaverse”) often prefer a thematic basket rather than picking individual tokens.

Active, Leveraged, and Inverse Crypto ETFs

Some ETFs use active management (dynamic rebalancing), leverage (2×, 3× exposure), or inverse strategies (profit when crypto falls). They rely on derivatives and complex positioning to deliver aggressive return profiles.

These can be lucrative to offer, but also riskier. You’ll need robust risk controls, deep liquidity, and educated clients. Use them for advanced segments (pro accounts, hedge desks) rather than mass retail. Make sure your platform clearly communicates the risk, structure, and costs.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Best Crypto ETFs That Brokers Should Track or Integrate

As interest in crypto investment vehicles grows, brokers have a clear opportunity to differentiate their platforms by integrating access to the most in-demand ETFs.

These products offer secure, regulated exposure to digital assets while fitting neatly into traditional infrastructure — ideal for onboarding investors who are crypto-curious but not crypto-native.

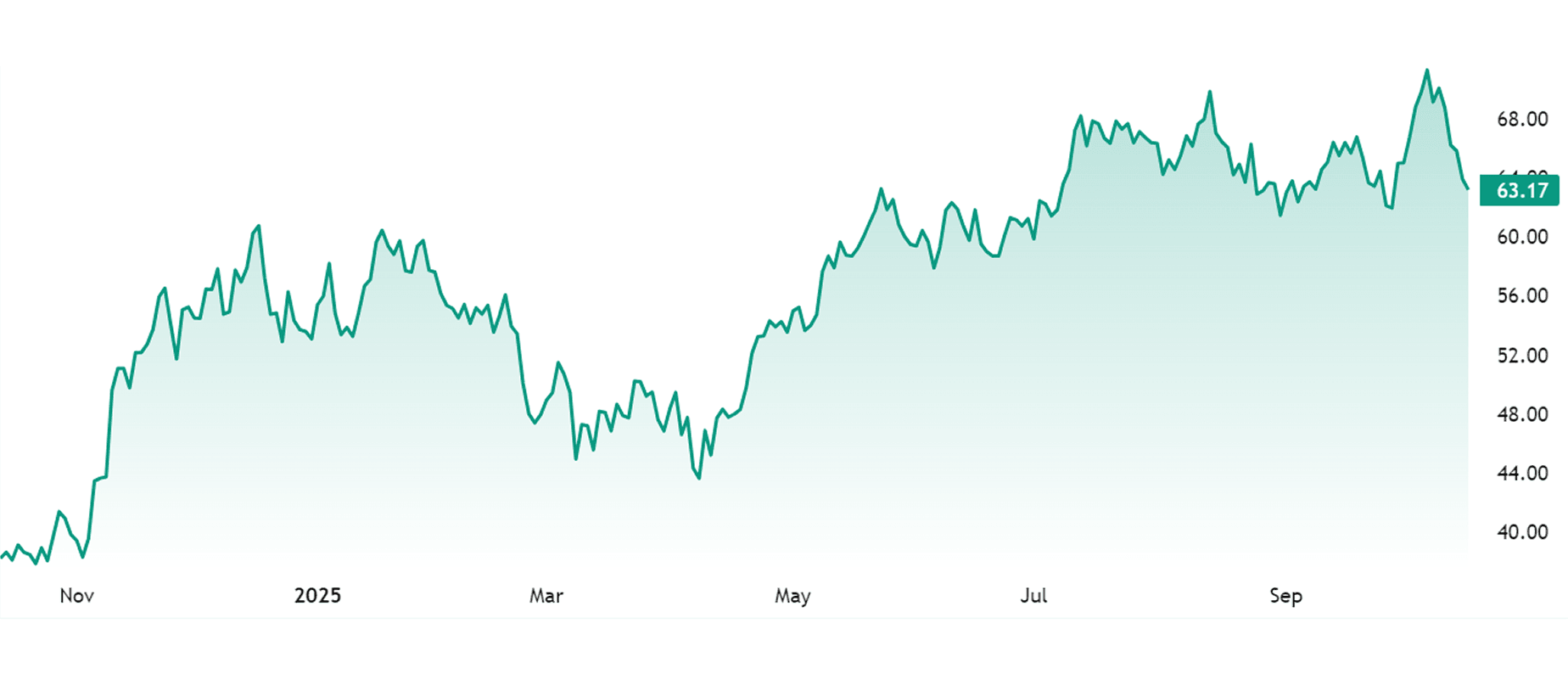

iShares Bitcoin Trust (IBIT)

- Type: Spot Bitcoin ETF

- Issuer: BlackRock, Inc.

- AUM: $91 billion

IBIT has become the flagship ETF for Bitcoin exposure. Backed by BlackRock’s infrastructure, it's now one of the most traded crypto investment vehicles globally. Its massive AUM and deep liquidity make it a must-track product for any broker offering regulated crypto access. For platforms serving retail or institutional clients, IBIT is often the first step in expanding ETF offerings around digital assets.

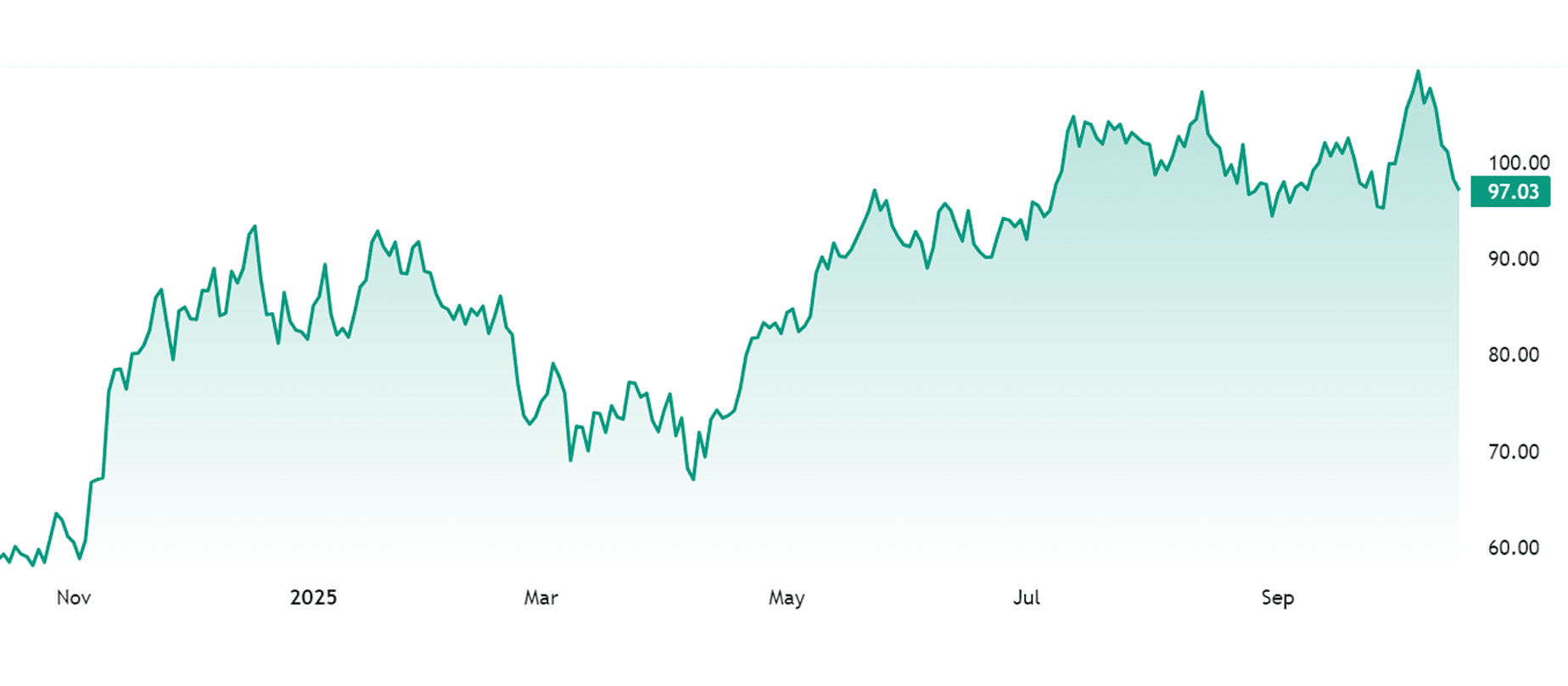

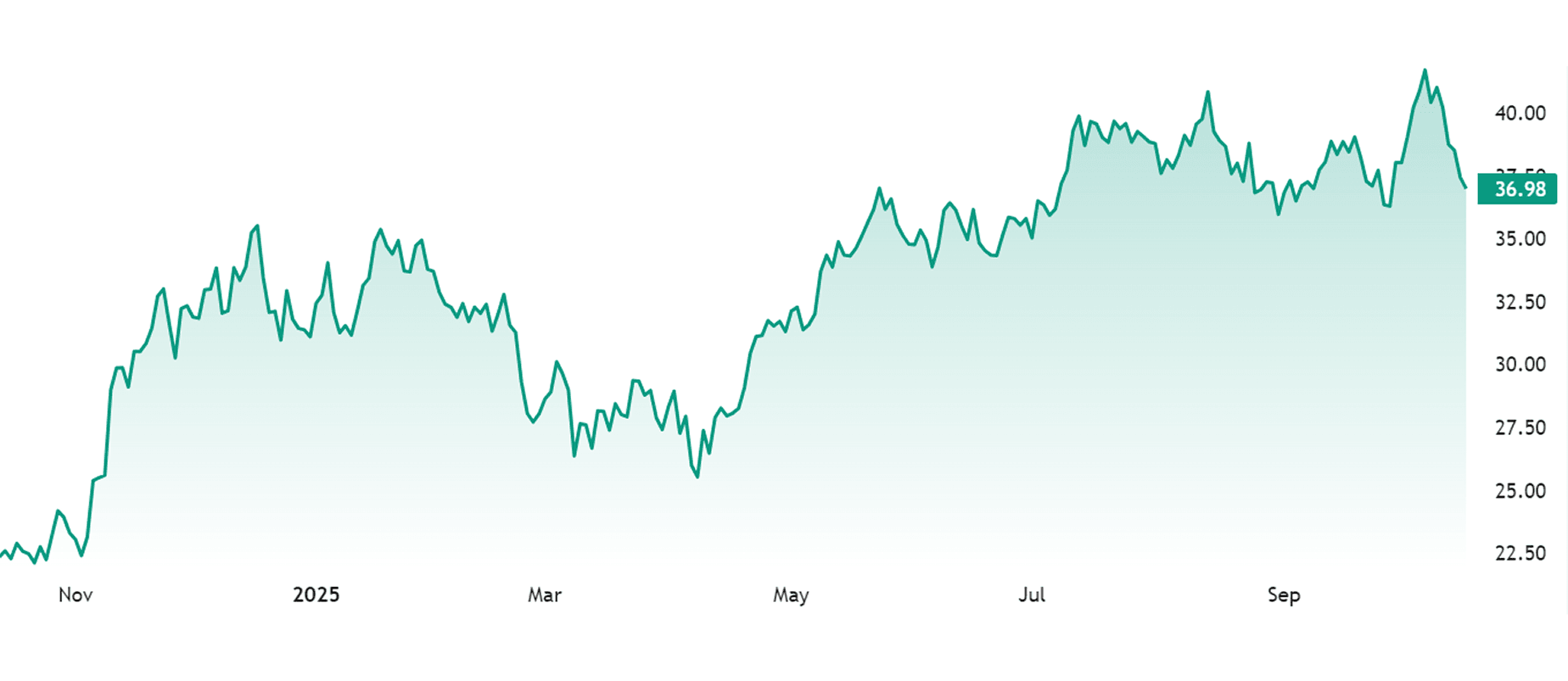

Fidelity Wise Origin Bitcoin Fund (FBTC)

- Type: Spot Bitcoin ETF

- Issuer: FMR LLC

- AUM: $23,88 billion

Fidelity brings traditional wealth management credibility to the crypto ETF space. FBTC offers low fees, strong institutional support, and seamless custody via Fidelity Digital Assets. Brokers targeting conservative clients or RIAs should consider this fund as a lower-volatility onramp into BTC exposure — especially in markets where regulated spot access is newly available.

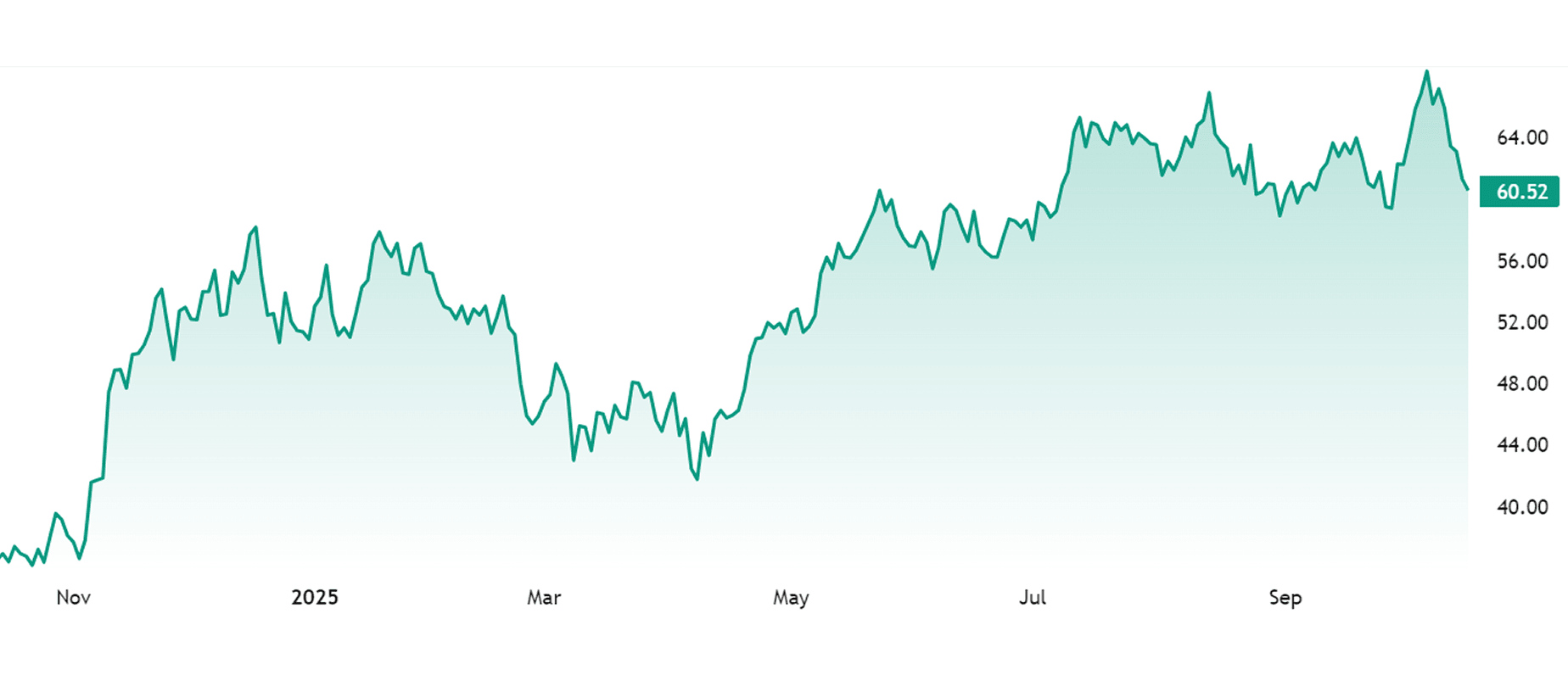

ARK 21Shares Bitcoin ETF (ARKB)

- Type: Spot Bitcoin ETF

- Issuer: ARK Invest LLC

- AUM: $5,09 billion

ARKB has carved out a distinct position with its innovation-first branding and highly competitive fee structure. It resonates strongly with tech-savvy investors, younger traders, and platforms focused on thematic investing. With steady inflows and strategic visibility from ARK Invest, this fund works well for brokers looking to align with “next-gen” investment narratives without needing to build their own.

Bitwise Bitcoin ETF (BITB)

- Type: Spot Bitcoin ETF

- Issuer: Bitwise Asset Management, Inc.

- AUM: $4,66 billion

BITB leads the market in transparency. Bitwise publishes daily wallet holdings and real-time proof-of-reserves—an approach that appeals to both crypto-native audiences and compliance-focused institutions. For brokers looking to differentiate on governance, educational tools, or public trust, BITB makes a strong addition to the lineup.

ProShares Bitcoin Strategy ETF (BITO)

- Type: Futures-Based Bitcoin ETF

- Issuer: ProShare Advisors LLC

- AUM: $2,85 billion

BITO was the first U.S. Bitcoin futures ETF and remains one of the most actively traded. While it doesn’t hold BTC directly, it fills a key gap for brokers in jurisdictions where spot crypto products remain restricted. For platforms onboarding clients who want regulated access to Bitcoin price exposure—without dealing with custody—BITO remains a go-to option.

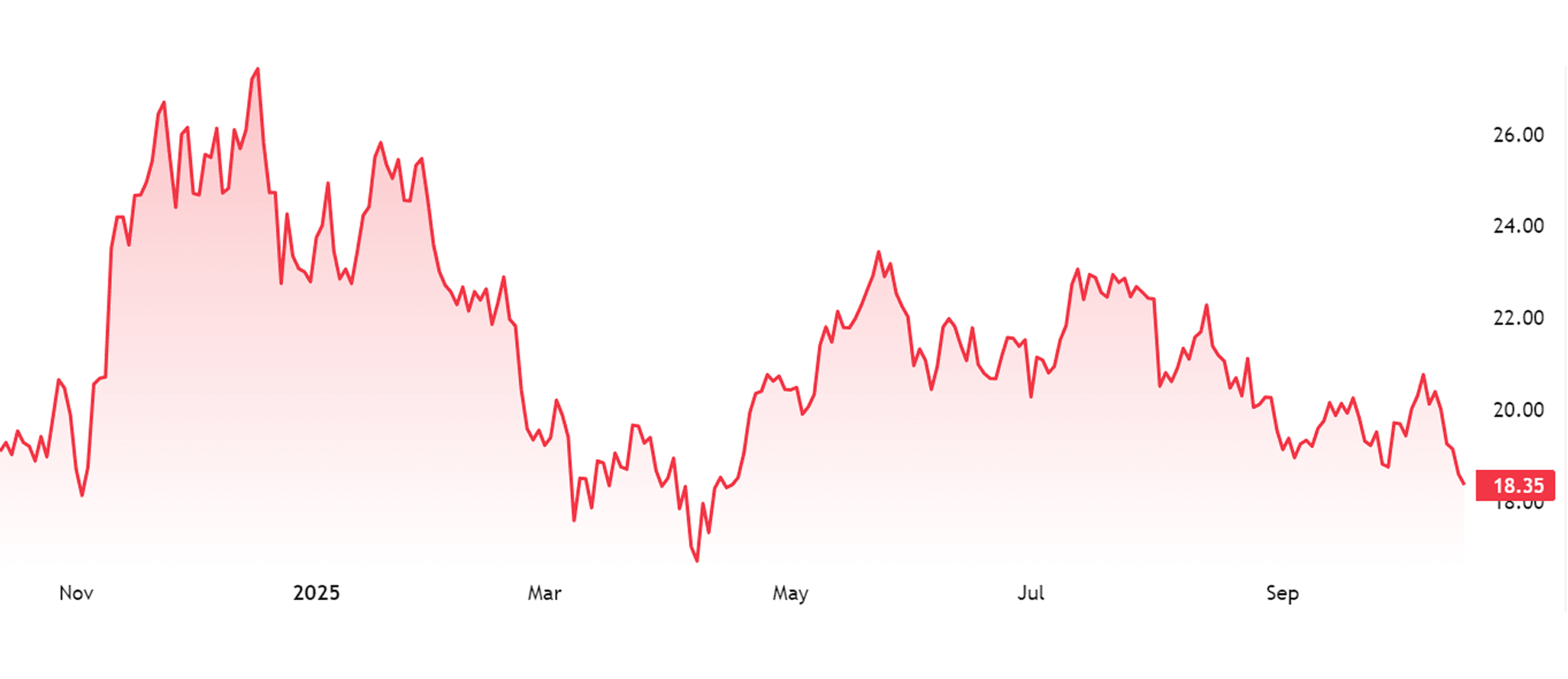

CoinShares Bitcoin Miners ETF (WGMI)

- Type: Equity-Based / Thematic ETF

- Issuer: Coinshares International Limited

- AUM: $421,32 million

WGMI offers exposure to public Bitcoin mining companies—functioning as a high-beta play on Bitcoin itself. It’s a strong thematic option during bull cycles, where miner stocks often outperform. For brokers targeting retail users who want more than just BTC, WGMI introduces an accessible way to trade on Bitcoin’s ecosystem growth with a different risk/return profile.

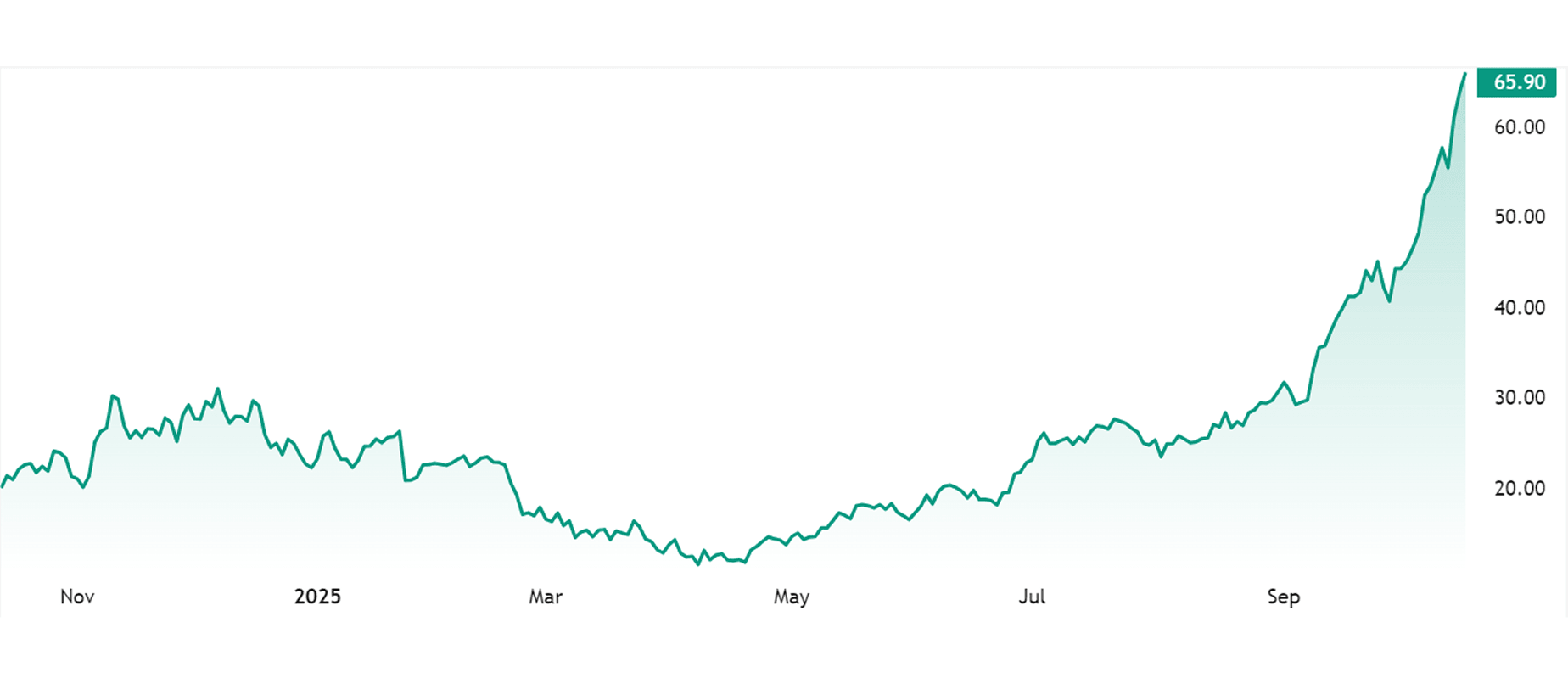

Global X Blockchain & Bitcoin Strategy ETF (BITS)

- Type: Diversified (Futures + Blockchain Equities)

- Issuer: Mirae Asset Global Investments Co., Ltd.

- AUM: $50,51 million

BITS blends Bitcoin futures with equity exposure to blockchain innovators, exchanges, and miners. It’s a middle ground for brokers catering to clients who want crypto exposure without going all-in on direct asset volatility. This ETF works well for thematic portfolios, risk-conscious clients, or educational use cases.

Build Crypto ETF Infrastructure with B2BROKER

Crypto ETFs are unlocking new ways for brokers to offer digital asset exposure—without the hassle of managing wallets, tokens, or custodial risk. But to support ETF-style products, brokers still need serious backend infrastructure.

We at B2BROKER power the backend systems that make ETF-style exposure possible.

Our turnkey ecosystem includes:

- Deep multi-asset liquidity across crypto, forex, commodities, and indices. This lets you replicate ETF-style execution and offer professional-grade spreads from day one.

- Flexible infrastructure for both front and back office, complete with CRM, client onboarding, reporting, and compliance tools.

- Support for fractional trading, synthetic baskets, and custom logic, giving you the tools to create your own ETF-like products or thematic exposure.

- Full compatibility with cTrader, MT5, and other platforms, so you can launch with the tools your audience already trusts.

If you want to bring crypto ETF-style access into your brokerage (without building from scratch), B2BROKER is your infrastructure partner.

Want to explore how B2BROKER can help you build or expand your crypto brokerage?

FAQ

- What are crypto ETFs?

Crypto ETFs are financial instruments that track the value of cryptocurrencies or blockchain-related assets. They’re traded on regulated exchanges and offer a simple way to access the crypto market without holding the actual coins.

- How do crypto ETFs work?

Depending on the type, a crypto ETF might hold actual digital assets (like Bitcoin), track futures contracts, or invest in companies tied to the crypto ecosystem. Investors gain exposure through a single regulated product.

- Why are crypto ETFs popular?

They remove friction. No wallets, no private keys, no direct custody risks. Crypto ETFs let investors access digital assets through familiar financial instruments—with the added security of regulation and transparency.

- Are crypto ETFs a good fit for beginner traders?

Yes. They’re one of the easiest and safest entry points into crypto. Beginners can trade them via brokerage accounts, just like stocks or traditional ETFs—without having to learn how blockchains or wallets work.