How SEC Regulation Will Change Crypto Market?

Articles

The emergence of cryptocurrency technology has paved the way for the modernization of the financial systems for all countries, putting the existing payment technologies into a new form. On the other hand, the shortcomings that were discovered in the practical application of cryptocurrencies became the reason for the question of regulation of the crypto sphere among many organizations of the world, the most influential of which is rightly considered the U.S. Securities and Exchange Commission (SEC).

In this article, you will learn what the SEC is and how it relates to the crypto market. In addition, we will look at the main reasons why the SEC will regulate the crypto market and how it will affect it in the future. Ultimately, you will learn about the outlook for the crypto market under the SEC’s regulatory action.

Key Takeaways

- Today, the SEC is one of the most authoritative commissions working in the sphere of financial markets regulation.

- Attempting to subject the crypto market to total control could lead to an outflow of investment capital and a decrease in the quotation of many crypto coins.

- On the other hand, stricter crypto regulation could help improve security and prevent money laundering and crypto-fraud.

What is the SEC and How Does it Relate to the Crypto Market?

SEC (Securities and Exchange Commission) – an agency of the U.S. government and the primary governing body responsible for regulating the U.S. stock market. The regulator’s main task is to ensure transparency of transactions and counteract fraudulent schemes to maintain investor confidence in the stock market. For this purpose, the SEC establishes rules for registering securities and monitors their fulfillment. The Commission also monitors the circulation of stocks and bonds, the activities of brokers, the trading operations of private investors and investment companies, the emergence of bubbles, manipulation, etc. The SEC is interested in all operations with securities in the United States.

The SEC has an indisputable authority in the economic sphere and an independent judicial system, due to which it is involved in the most complicated legal disputes in the market. The tools and methods used by the regulator to resolve various processes and conflict situations have become a benchmark and example for international regulators. Any company whose shares are traded on U.S. exchanges falls under the control of the SEC. Any violations of law in the sphere of securities turnover and investor servicing may become grounds for investigation by the SEC. Among such circumstances is the refusal to provide financial information to the supervising bodies.

The emergence of crypto technologies has led to increased attention from criminal and fraudulent organizations, as well as associations involved in the development of hacker software to hack crypto structural objects, which prompted the SEC to develop and implement a set of measures to control and regulate the crypto market as part of crypto trading on crypto exchanges. SEC plans to control the crypto market also involve tracking illegal operations involving money laundering and sponsoring criminal organizations.

The SEC is one of the few organizations whose authority to regulate the financial markets extends around the world.

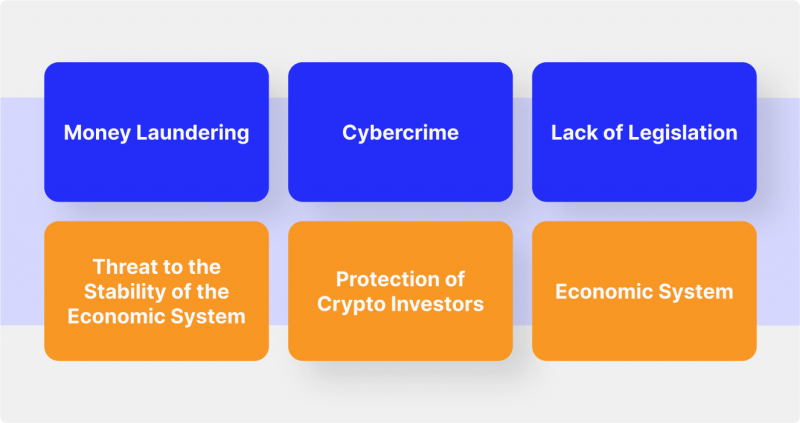

Main Reasons the SEC Wants to Regulate Crypto Market

The SEC, one of the most influential and reputable financial regulators in the world, is now in the process of planning a package of effective measures that will allow the control of crypto companies that offer services for trading crypto assets. Given the fact that the SEC considers digital assets as securities, presumably the regulatory measures to control the crypto market will have to be based on federal securities laws. Below is a look at the main reasons for the SEC to regulate the crypto sphere and crypto transactions.

Money Laundering

In the modern world, the problem of money laundering is particularly acute, not only when it comes to trading crypto tokens. The spread of crime within the crypto industry in recent years has become a severe concern that not only threatens the security of many crypto financial institutions, but also undermines public confidence in a technology that has already proven itself on the positive side. The SEC seeks to implement a comprehensive control system for each organization in the crypto-financial markets involved in implementing financial transactions with digital assets.

Cybercrime

Cybercrime, as well as money laundering within the crypto market in recent years, has become a real cause for concern not only from different categories of investors and traders but also from government agencies and institutions involved in combating illicit activities concerning financial markets. In particular, the SEC has decided to take decisive steps to secure the crypto space against organizations working in malware development and hacking systems for programs and applications involved in maintaining crypto ecosystems (e.g., cryptocurrency exchange).

Lack of Legislation

The modern crypto market is not only experiencing difficulties associated with cryptocurrency but also suffers from an underdeveloped regulatory framework, which is reflected in the complexity of regulation of crypto exchanges, in particular crypto asset securities trading, operations on the movement of crypto funds between different wallets and accounts, as well as storage methods and principles of customer crypto assets storage. The lack of a reliable and full-fledged legislative framework in crypto regulation is also expressed in frequent attempts to manipulate the crypto asset’s price, which is often used by well-known media personalities in their own interests. A vivid example of such personalities is famous multibillionaire Elon Musk, whose publications on Twitter have repeatedly caused a stir around various crypto coins, significantly impacting their price.

Threat to the Stability of the Economic System

Since the development of the crypto market, the emergence of new crypto projects and digital coins, the desire of many individuals to manipulate the price of the latter has also become one of the large-scale problems of the digital space, which in the short term puts the stability of the economic system at risk, provoking not only an outflow of capital from the crypto market due to decrease confidence in its tools against the background of suspicious, unjustified jumps in the price of coins, but also increased pressure from regulatory bodies such as the SEC to exclude the possibility of market manipulation.

Protection of Crypto Investors

Despite the fact that not everyone is positive about the SEC policy to strictly regulate crypto activities with securities laws, which will be aimed at controlling transactions that are in the form of a so-called investment contract, today are working not only to develop a program of regulation of crypto exchanges, brokers and other crypto financial institutions, but also the introduction of regulations to protect market participants, such as private and institutional investors, traders, etc., which will limit the amount of credit used by crypto-exchanges.

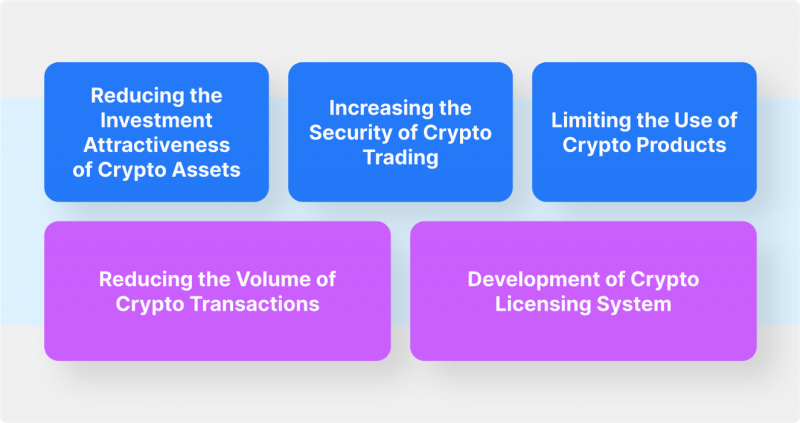

How SEC Regulation Will Affect the Crypto Market?

The unexpected collapse of the Luna crypto coin in May 2022, and the equally famous bankruptcy of the FTX crypto exchange, which shocked the crypto industry, was a clear signal for regulators to pay close attention to the legality of digital asset transactions. For its part, the SEC has repeatedly shown its determination to do everything possible to ensure total control over all elements of the crypto market, without exception. Such an attitude will certainly have consequences, but it is not clear whether it will be positive or negative. Below is a list of theoretically possible results of the SEC’s regulatory policy on the crypto market.

Reducing the Investment Attractiveness of Crypto Assets

Different from the SEC’s way of regulating securities exchanges, controlling crypto markets involves taking into account the fact that the crypto market is exceptionally dynamic and decentralized, which could be a difficult task in the way of total oversight. However, on the other hand, if the intentions are realized, the investment attractiveness of many crypto assets will likely decrease due to stricter oversight of financial transactions with their participation, which may provoke capital outflow from the cryptocurrency market and a sharp decline in quotations, which in theory may lead to the collapse of the entire crypto industry.

Increasing the Security of Crypto Trading

Tightening of norms of crypto sphere regulation, in particular, will help to improve security at all levels of both trading process and other activities related to circulation of crypto assets. At the same time, it will be possible to streamline and organize the procedures of passing the identification process and other tools that give access to trading on the crypto market with the help of an authentication system. Moreover, the probability of fraudulent actions and other types of cryptocurrency will be almost completely eliminated.

Limiting the Use of Crypto Products

Total regulation of the crypto market by the SEC could lead to drastic restrictions on the use of crypto products, whether it be staking, lending, crypto lending, or trading in futures contracts. Theoretically, it is likely that systems will emerge to assess the availability of a particular trading instrument to a certain investor by passing special tests or other evaluation systems, based on the results of which a decision will be made to allow them to trade. As of today, there is already unconfirmed information about the SEC’s intentions to limit the use of staking by private investors.

Reducing the Volume of Crypto Transactions

Today, the volume of crypto transactions per day for Bitcoin alone, according to various estimates, fluctuates around 350,000 thousand, not to mention the total volume of transactions involving all digital currencies. Using the advanced technology of blockchain networks, crypto payment transactions have become a real salvation in trying to pay less fees and greatly accelerate the speed of transferring payments. The regulation policy of the SEC can significantly affect the volume level of daily crypto transactions, reducing the benefits of using the blockchain, which stems from the first problem on this list.

Development of Crypto Licensing System

Licensing is an important step in making a financial institution a trustworthy and legitimate provider of certain services. Since today the licensing system for cryptocurrency activities is underdeveloped due to the lack of aspects providing for the peculiarities of the crypto market, the SEC is likely to develop a special system that takes into account the full licensing process of financial institutions working with digital assets.

These regulatory requirements may affect both crypto-exchanges, which are the most popular crypto-organizations, and various companies involved in the development of software, programs, and applications for working with cryptocurrency assets, among which may be crypto-purses, instruments for investment portfolio control, asset managers, investment advisers and so on.

Crypto Market Development Prospects in the Framework of SEC Control and Regulation

The SEC control zone is planned to include operations for exchanging traditional fiat currencies for cryptocurrencies, crypto exchanges, intermediaries providing access to crypto wallets and services, and any economic entities that accept payments in both conventional currencies and crypto. Payment systems will be standardized, and certification of transaction storage and clearing services providers will be introduced. Cryptocurrency mining will fall under separate control and, in several countries, under a ban.

According to the SEC, regardless of the initial powers, all supervisory authorities of states, from central banks and financial and fiscal regulators to securities control authorities, should receive additional powers to regulate crypto assets and coordinate their actions at the international level to eliminate the risks arising from various types of use of cryptocurrencies and their derivatives.

The crypto market is expected to remain in a neutral position for some time as the hemolytic situation in the world makes adjustments to the plans of regulators and other government organizations. However, in the short term, it will be possible to observe the gradual introduction of regulations, according to which the traditional banking system will urgently need to take control of the crypto-assets market due to the threat posed by decentralized finance since finances from banks pass into the hands of individuals (legal and natural), who operate outside the legal field, seek to capture a significant share of the crypto market and resist regulatory changes.

Conclusion

The current concept of crypto market regulation is crude and needs to be fully understood in all aspects of its functioning. The SEC, in an attempt to bring the entire crypto infrastructure under its control, may begin to implement regulatory rules in the banking sector and end with restrictions on the use of crypto products, which in all likelihood, could lead either to capital outflow from the crypto sphere and its collapse, or, if the plans are not implemented, help to maintain market neutrality, but increase the security of work with crypto assets.