Best Trading Platforms Other Than MT4: What Alternatives Brokers Have Today?

The Forex trading landscape has long been dominated by the MetaTrader 4 and MetaTrader 5 platforms, but the tides are turning. As the industry evolves, traders and brokers alike are exploring a diverse array of sophisticated trading platforms that offer enhanced features, improved user experiences, and greater flexibility.

We delve into the top trading platforms other than MT4 and uncover the unique advantages and capabilities that these platforms bring to the table.

Key Takeaways

- TradingView, cTrader, and B2TRADER are among the top alternatives to MetaTrader.

- Selecting the right platform requires an analysis of factors such as financial capacities, technical proficiency, client preferences, and regulatory compliance requirements.

- Brokers should consider the provider’s reputation, pricing models, functionality, and the platform’s scalability and integration capabilities.

Best MetaTrader Alternatives for Brokers

Here are other trading platforms like MT4 that brokers can consider to diversify their solutions:

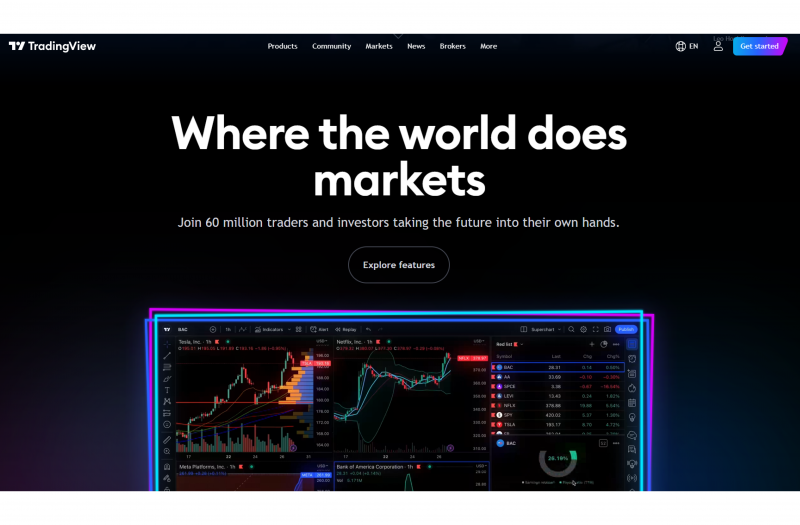

TradingView

TradingView is considered the best day-trading platform today. It rivals established competitors such as MetaTrader in delivering an outstanding trading experience. This browser-based platform’s superior charting capabilities set it apart from the competition.

TradingView boasts an expansive library of technical indicators, drawing tools, and chart types, empowering traders to conduct in-depth market research and uncover lucrative trading opportunities. The platform’s collaborative features, such as sharing trading ideas and accessing real-time data across various asset classes, have made it a popular choice among traders worldwide.

A remarkable feature of TradingView, often lacking in many MetaTrader installations, is the accessibility of a wide range of asset classes and instruments. With TradingView, traders have access to data feeds for a range of financial markets, such as futures, commodities, stocks, and foreign exchange, all in one place, making TradingView a compelling alternative for MT4.

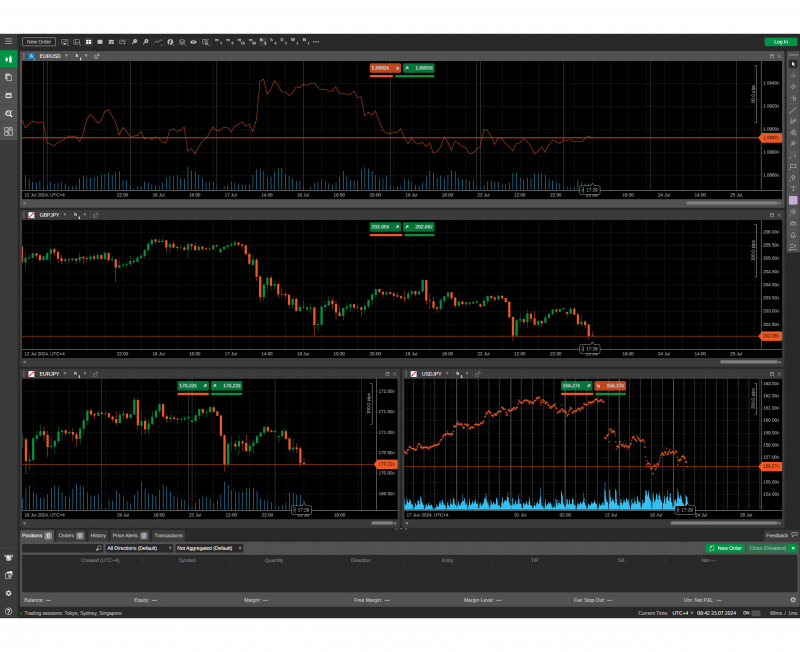

cTrader

cTrader, a top-tier MT4 alternative in the Forex market, is renowned for its lightning-fast order execution and ability to handle large volumes of market data. It has garnered the attention of experienced traders for its extensive trading functionality.

Automation and customisation are two of cTrader’s greatest strengths. Traders can seamlessly develop and deploy algorithmic trading strategies using the platform’s cAlgo functionality. Additionally, the platform’s diverse ecosystem allows users to easily exchange trading tools, indicators, and strategies, fostering a vibrant community of traders and developers.

cTrader is available on desktop, mobile, and web-based platforms, ensuring Forex traders can access their accounts and execute trades from anywhere. The platform’s support for multiple asset classes, including Forex, stocks, and commodities, ECN trading, further expanding the trading opportunities available to its users.

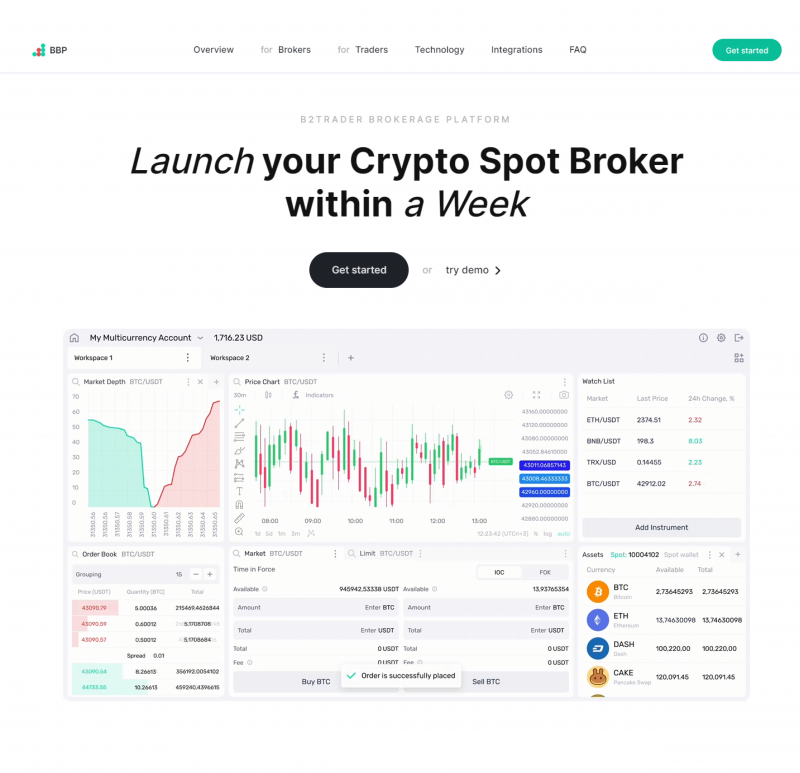

B2TRADER

B2TRADER is a specialised trading platform tailored for brokers and institutions seeking to penetrate lucrative crypto spot and CFDs markets. Developed by B2BROKER, B2TRADER offers a proprietary platform for trading that can be quickly deployed by companies as a turnkey or white-label solution.

Capable of processing more than 3000 requests per second and supporting over 3000 assets, B2TRADER is designed to deliver a seamless and efficient trading experience for crypto enthusiasts. The platform’s seamless integration with third-party systems through API connection ensures a streamlined workflow for brokers, allowing them to quickly establish their own spot trading options within a matter of days.

Beyond its technical capabilities, B2TRADER is further enhanced by B2BROKER’s comprehensive ecosystem of brokerage solutions. This includes features such as CRM and back-office integration, copy trading software, crypto payment processing, and access to deep liquidity pools – all of which contribute to a well-rounded and versatile trading platform for brokers and their clients.

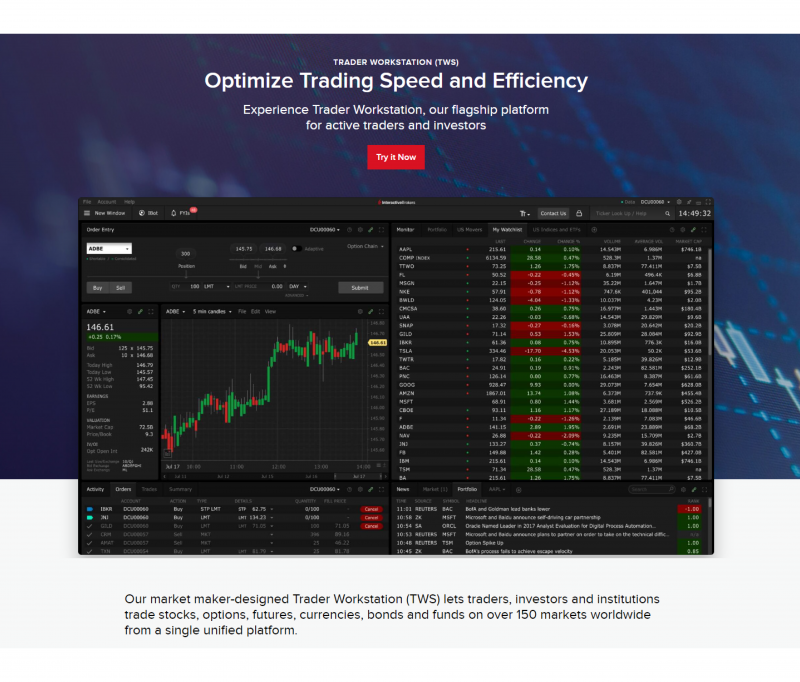

Trader Workstation

Trader Workstation, proprietary to Interactive Brokers, is an outstanding trading platform that captures novice and seasoned traders’ attention with its flexible Mosaic interface and comprehensive range of order types.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Traders can tailor the Mosaic interface to suit their trading needs and preferences. Additionally, this robust platform supports a variety of order types, extending traders’ control over their trading strategies. Trader Workstation’s vast asset range across different markets and industries broadens the trading opportunities available to its users.

Another compelling feature is Trader Workstation’s accessibility, with its availability on desktop, mobile, and web-based platforms. This ensures traders can access their accounts and conduct trades from anywhere at any time. InteractiveBrokers offers the platform as a white-label solution for brokerage firms, making it an attractive choice for those looking to expand their brokerage services.

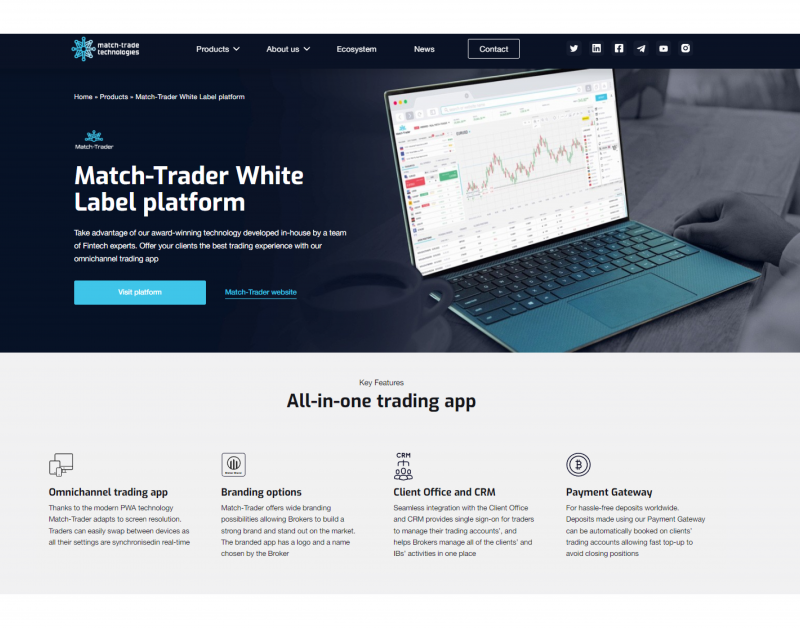

Match-Trader

The Match-Trader is another viable alternative to the MT4 online trading platform ecosystem. Powered by web-based technology, Match-Trader ensures accessibility from any device with an internet connection, providing traders with a seamless and adaptable trading experience.

The platform’s lightweight design offers full functionality without taking up significant storage space on your device. This high-performance platform is ideal even for users with basic smartphones, making trading accessible to all.

Match-Trader empowers traders with its unique self-management features. Automatic registration and instant deposits allow users to access and manage their trading accounts swiftly and seamlessly. With just an email address and password, traders can enter the platform and engage in trading without the burden of lengthy registration or deposit delays. Coupled with an embedded payment solution, Match2Pay, traders can top up their accounts instantly and securely without leaving the platform.

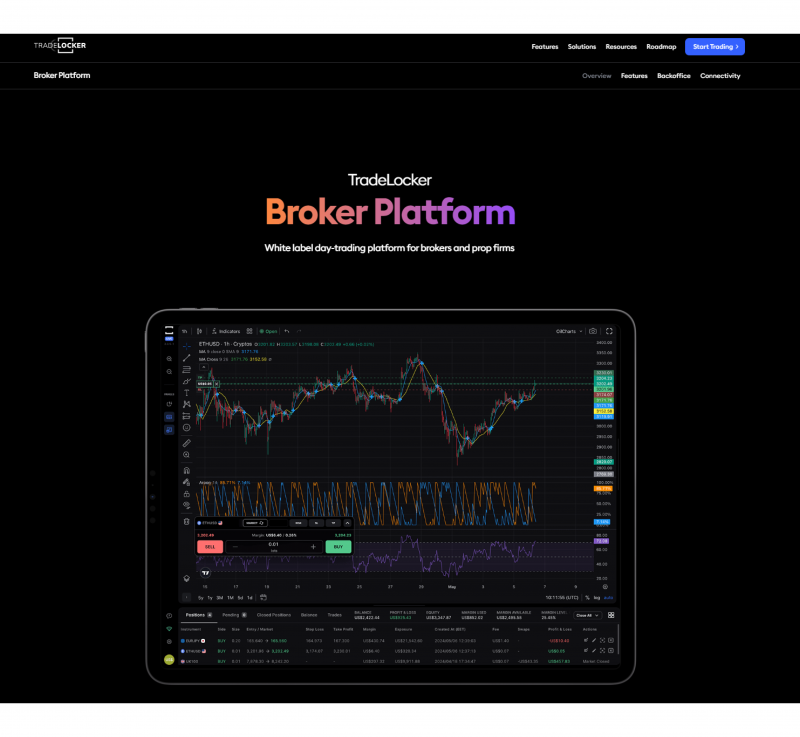

TradeLocker

TradeLocker is an all-inclusive brokerage solution that combines the power of a trading platform with a user-friendly interface. Integrating with the aforementioned TradingView, TradeLocker provides traders with access to a robust and feature-rich charting and analysis engine.

TradeLocker’s focus on user experience is clear in its easy-to-navigate interface, complete with On-Chart Trading and One-Click Trading features, which streamline the trading process. This emphasis on automation, customisation, and simplicity could make it a worthy alternative to platforms like cTrader.

Seamless integration with existing setups and efficient automated trading capabilities, courtesy of its API integration, make TradeLocker a suitable MetaTrader alternative for both brokerages and proprietary trading firms.

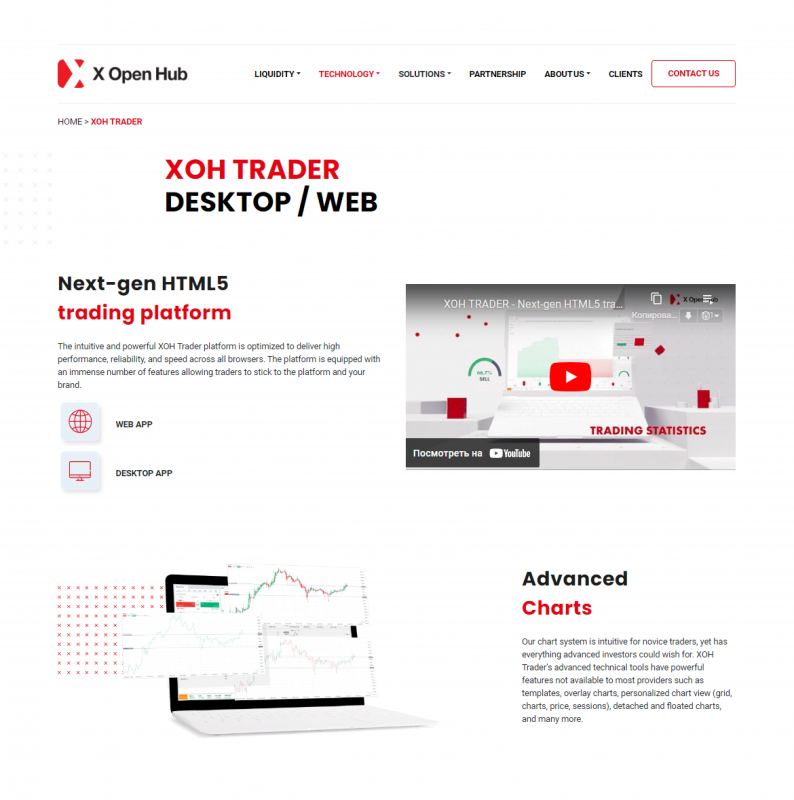

XOH Trader

XOH Trader, developed by X Open Hub, a London-based regulated multi-asset liquidity and technology provider, offers a wide range of customisable chart templates and overlay charts. Accessible via any web browser, XOH Trader offers a seamless trading experience without the need for cumbersome software downloads.

XOH Trader features a variety of chart options, tools and features easily accessible through the main tabs at the top of the page. The built-in global market insights ensures traders can easily stay updated about market trends without having to navigate away from the platform. XOH Trader also incorporates a comprehensive calendar feature and powerful analytical tools like stocks scanner and heatmaps.

XOH Trader’s cloud-based system ensures accessibility anytime and anywhere. Brokers leveraging the XOH Trader white label solution benefit from extensive customisation options, allowing them to refine their branding elements, such as logos, colours, and default settings, standing it among the top alternatives to MetaTrader.

WOW Trader

Presented by TradeSmarter, WOW Trader is an all-inclusive trading platform which features advanced risk management capabilities, varying levels of leverage, and numerous social components, including trading competitions and rankings.

WOW Trader delivers a smooth, consistent user experience across various asset classes: FX and CFD margin trading. The platform can be personalised with various themes for a unique brand image. Moreover, it consists of multiple risk settings that can be adjusted to fit the business requirements, including account-based and tiered risks.

WOW Trader’s extensive connection to over 300 payment gateways and access to a vast network of liquidity providers significantly broaden the trading opportunities available to brokers and their clients. Combined with the platform’s focus on social features and data visualisation, this creates a trading environment that not only facilitates but also encourages an immersive and collaborative experience.

Quadcode Trading

Designed with the trader in mind, Quadcode Trading provides a bespoke white-label platform that is the upshot of accumulated wisdom from experienced traders, engineers, and designers. Tailored to enhance the operations of brokerage businesses, this platform stands out for its comprehensive functionalities and vast selection of multi-asset liquidity.

The strength of Quadcode Trading is found in its flexibility. This platform provides brokers with the autonomy to tailor their trading instruments, assets and menu options to their preference. On top of that, the package also includes a branded app and a crucial Know Your Customer (KYC) compliance module — all aiming to facilitate smoother operations of a thriving brokerage platform.

How to Choose a Suitable Trading Platform?

Before exploring the various trading platforms available, it’s vital to conduct a self-assessment of your capabilities, resources, and industry experience.

For instance, established brokers with extensive market knowledge might prefer a customisable platform, whereas newcomers may find a comprehensive white-label solution more beneficial.

Another core component of your self-assessment should be to review your financial capacities, including your budget for the initial platform acquisition and ongoing maintenance, possible upgrades, and other essential services or tools you may need.

In terms of technical proficiency, if your team is adept at handling the development, integration, and maintenance of a custom platform, your choices can be more flexible. However, considering a white-label solution with comprehensive support could be a more sensible option if your technical capabilities are somewhat limited.

Your selected trading software should cater to your client’s needs and preferences. Depending on your clients’ trading strategies and technological sophistication, you might offer automated trading options, a user-friendly design, copy and social trading capabilities, or a mobile-first approach.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Finally, regulation compliance and risk management are essential components of a successful white-label solution. Any reputable trading platform provider should offer tools and features to ensure brokers comply with regulatory requirements and help mitigate potential risks.

What to Look for in a Trading Platform

To choose the most suitable software, brokers must consider their business and clients’ unique needs.

Reputation of the Provider

Pay close attention to their reputation, industry standing, and track record. Providers should offer a wide range of tools and services that can support your brokerage operations. In addition, they should provide customisation options, allowing you to tailor the platform to your unique business requirements and brand identity.

Pricing Models

Aim for a balance between the platform’s quality and the solution’s overall cost-effectiveness. You should compare different pricing models, considering setup fees, subscription costs, and transaction-based commissions.

Rich Functionality

Regardless of the platform you end up with, it must offer a comprehensive suite of features and tools to meet the changing needs of your traders and your own business operations. For your active traders, a seamless and engaging user experience matters most, while as a broker, you’ll require a diverse range of back-end tools and applications for effective business management. Also, considering the highly regulated nature of the Forex industry, the platform must incorporate strong regulatory compliance and risk management features.

Scalability and Integration Capabilities

As your brokerage grows, the selected platform should be capable of scaling to accommodate increasing trading volumes and expanding client bases. Also, it should offer robust integration capabilities to support third-party applications, plugins and APIs.

Conclusion

When considering online trading platforms, MT4 and MT5 are often the top choices that come to mind. However, as the trading landscape evolves, many brokers are exploring alternative platforms that offer a wider array of features.

By offering multiple platforms simultaneously, brokers can quickly adapt to market changes and provide clients with a more comprehensive range of services tailored to their specific trading needs. This approach enhances the broker’s flexibility and enriches the client experience.

FAQ

Is cTrader better than MT4?

It ultimately depends on personal preference and specific trading needs. cTrader offers powerful charting tools, impressive execution speeds, and a user-friendly interface. MT4 has a larger community and more available plugins.

Is MT4 only for Forex?

No, MT4 is not limited to just Forex trading. In fact, it can also be used for crypto, commodities and other asset classes through trading CFDs. Additionally, MT4’s flexible platform allows users to customise and add plugins for trading other financial instruments, making it a versatile tool for various markets.

Why do traders prefer MT4?

Traders prefer MT4 because of its advanced trading tools, customisable interface, and support for automated trading strategies. It also has a large community of users and a wide range of indicators and plugins.

Do people still use MT4?

Yes. MT4 remains one of the most popular platforms for Forex trading, even after the release of newer versions like MT5. Many traders are already comfortable and familiar with its features and tools, making it their preferred choice for many.