How to Get Liquidity for a CFD Trading Platform

Articles

CFDs are popular among market participants because they allow for the speculation of changes in the underlying price of securities without the need actually to hold them.

This article offers a thorough grasp of the distinctive characteristics of CFDs and assists in selecting the finest liquidity provider for your CFD trading platform.

Key Takeaways

- CFDs are agreements between buyers and sellers for the disparity between the asset price valid at the time of the contract’s conclusion and its value at the contract’s expiry.

- Many types of CFD contracts exist, like commodity, index, crypto contracts, and many others.

- CFD trading has its benefits, like high liquidity and hedging options, and drawbacks, like counterparty risks and vulnerability to market conditions.

Explaining CFDs

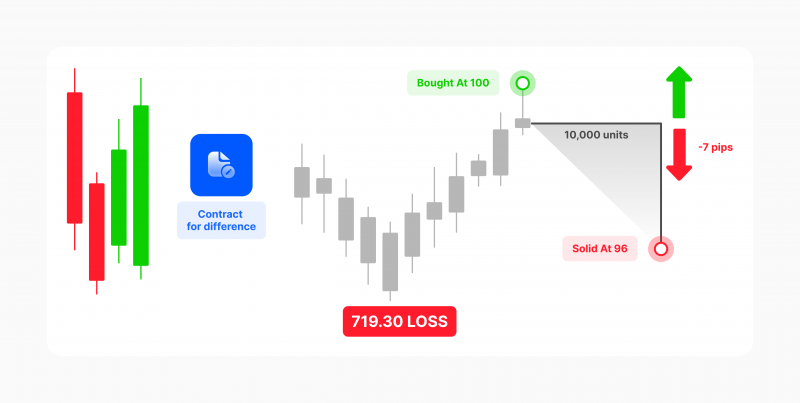

An agreement between a buyer and a seller to exchange the difference in the value of an asset from the opening to the closing of a contract is known as a Contract for Difference (CFD). It serves the same purpose as a product supply agreement, but neither the ownership nor the delivery of the asset is necessary for its operation. The buyer gets a cut if the asset’s value goes up, and the seller gets a cut if it goes down.

Without actually owning the asset, traders may still profit from CFDs by speculating on its price changes. Because these contracts do not expire, traders may profit from both rising and declining market movements by taking long or short positions.

CFDs provide exposure to a wide range of markets, including stocks, indices, foreign exchange, and cryptocurrencies, allowing for diversification.

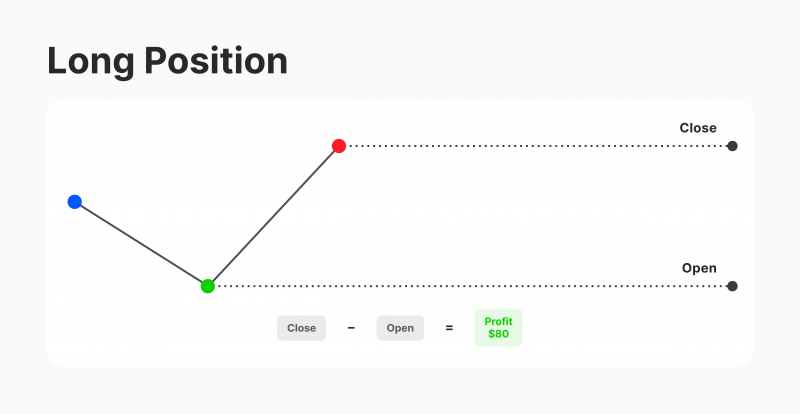

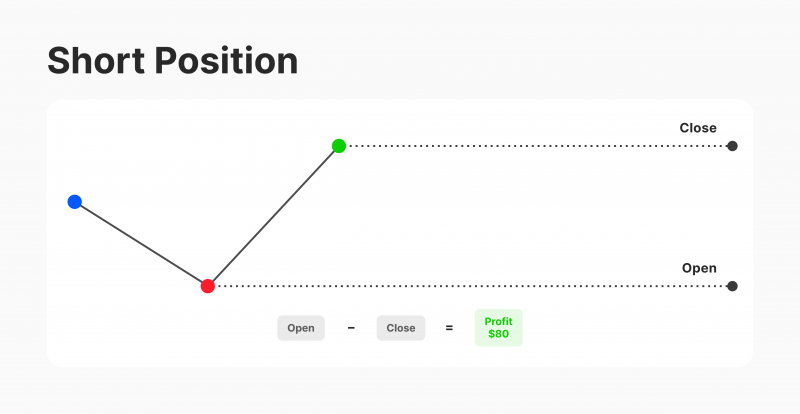

The contracts are versatility, offering to go long or short on an asset and buying with the expectation of an asset’s price rising or declining, respectively.

Choosing a long position involves placing a buy trade at a low price, expecting the asset value to rise over time.

For example, a trader buys 100 CFDs of Apple shares at $160 per share. The total trade value is $16,000. If Apple’s price rises to $170, the trader makes a $1,000 profit. However, if it falls to $150, the trader loses $1,000.

With a short position, a trader anticipates a decline in the asset’s value and chooses a sell position. They plan to repurchase the contract later if the asset’s value increases, potentially profiting or losing from the entire exchange. For example, if you short-sell 100 Apple shares at $150 a share, you could close your position at $145 a share, resulting in a $500 profit ($150 – $145) per share.

One important aspect of CFDs is Leverage, which lets traders start positions without having to pay the whole transaction value at once. The alternative is to open the transaction with a margin, which is a proportion of the overall deal amount. This enables a leverage ratio of 5:1, which is an enormous benefit in CFD trading as it means positions may be launched five times bigger than the margin amount.

Types of CFDs

CFDs can be traded on various finance instruments, depending on the broker’s access to market price feeds. The main CFD market types include global stock, stock index, forex, industry sector, commodity, metals, and energy. The range of markets available to trade constantly expands, making CFD contracts a versatile and convenient acquisition option. Here are the most popular CFDs:

Share CFDs – These are the most commonly traded CFDs, with the price derived from the underlying stock price.

Cryptocurrency CFDs – Crypto contracts enable traders to speculate on virtual money like BTC, ETH, and Litecoin’s price movements with leverage without owning the base asset, allowing them to trade volatile markets.

Commodity CFDs – Commodities are physical assets in demand, classified into hard and soft categories. Hard commodities are mined, like coal or oil, while soft commodities are grown, like corn or coffee. Typical commodities for the contracts include precious metals, corn, soybeans, wheat, gasoline, crude oil, and heating oil.

Index CFDs – Index CFDs are contracts tied to a specific index’s performance, offering high leverage, liquidity, and volatility. Popular indices include Dow Jones, NASDAQ, London Stock Exchange, Australian Stock Exchange, and Japan’s Nikkei.

Traders believe a specific market will rise, benefiting from high trading volume, low margin, high leverage, low trading costs, and access to international markets that would otherwise be difficult or costly.

Currency CFDs – Currency CFDs are popular among forex market traders as they allow traders to speculate on currency pair price movements, offering leverage and low transaction costs for trading a wide range of currency pairs.

CFD Benefits and Drawbacks

CFDs are widely traded globally as a powerful way to leverage financial business expertise. Contract trading has many advantages, among which are the following:

Long and short positions – CFDs offer flexibility in trading, allowing investors to profit from both rising and falling markets. Long positions benefit from upward price movements, while short positions benefit from downward price movements, allowing for a wide range of market contexts.

Hedging – CFDs offer hedging strategies, allowing you to hedge your physical market positions or offset potential losses by taking opposing CFD positions, thereby effectively managing risk and protecting your portfolio against adverse market conditions.

Liquidity – CFDs are traded on liquid markets, allowing easy entry and exiting of positions, bringing price movement advantage and increased control over trading activities.

Cost-efficiency – CFD trading offers lower transaction costs and tighter spreads than classic investment methods, as it doesn’t involve stamp duty or fees of brokerage firms associated with owning the underlying asset.

Admission to various markets – CFDs provide a diverse range of tradeable instruments, enabling diversification of trading portfolios and leveraging opportunities across various markets.

Despite the many perks CFD trading might deliver, it also comes with significant risks any trader should know.

Complex nature – CFDs are complex products, prone to misunderstandings and trading errors. While shares suit new and experienced investors, CFDs are best suited to experienced traders.

Leverage risks – CFD trading is more risky than traditional share trading due to leverage. Traders only need to put forward a small amount of the total trade value, often 5%, and if the trade goes in their favour, they are entitled to 100% of the profits. But they are also responsible for 100% of the losses that they may face if the market goes against them.

Default risks – CFD providers may not always act in the best interest of clients, causing counterparty risk. This can lead to delayed execution of CFD orders, potentially worsening the price. If a trade is failing, the provider may close the trade without consulting the client. The success of a CFD trade depends on both the client’s speculation and the CFD provider.

Susceptibility to market conditions – Speculating on changes in the price of financial assets that are impacted by general market circumstances is a part of trading CFDs. You may lose a lot of money if the market declines even a little. Risk is magnified when trading occurs during times of economic uncertainty, such as political elections. Even seasoned traders have a hard time predicting market swings due to unpredictable circumstances.

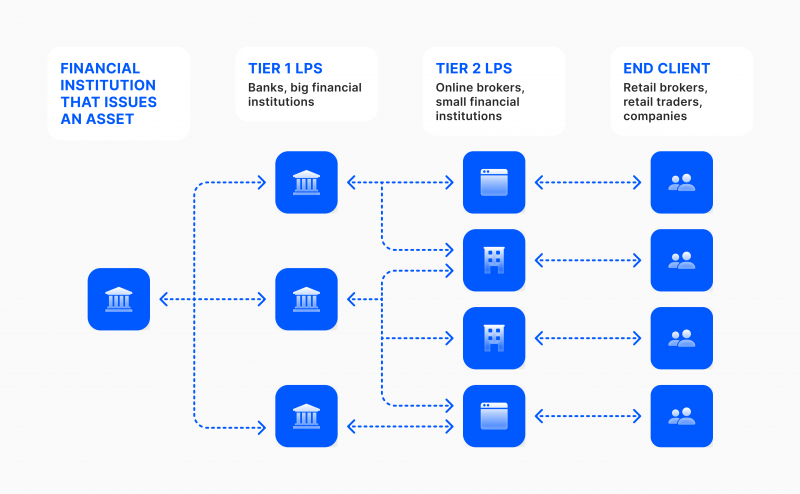

How CFD Liquidity Providers Work

CFD Liquidity Providers (LPs) counteract trades made against CFD trading instruments by retail brokers, institutions, and individual traders, ensuring seamless liquidity for CFD trading venues and facilitating seamless trade entry and exit.

CFD LPs maintain a low difference between bids and asks, providing high CFD liquidity to exchange venues.

CFD LPs typically provide an API or Liquidity Bridge to CFD brokers and other trading venues. They have a set list of CFD instruments for which they can provide liquidity, and a CFD broker chooses among the instruments they want liquidity for.

CFD LPs have specific volume and deposit requirements, with higher volumes offering better deals.

After the set of instruments and volumes are accepted by a broker and LP, an agreement is signed, and the broker makes a deposit.

Once terms and conditions are met, CFD LPs’ tech and support team establish the liquidity connection, and the liquidity flow starts. The broker decides whether all clients’ trades will be sent to LP or a specific group of traders.

How to Choose a Liquidity Supplier for CFD Trading Platform

To effectively execute commercial procedures with CFD, it is critical to choose an LP responsible for the presence of easy-to-use commercial tools, access to state-of-the-art frameworks, and the counterparty’s financial position. A professional CFD company can ensure the best customer experience.

Establishing effective communication with LPs is essential, especially when outsourcing user bargains to a third party. CFD agent activities are more complex than Forex brokers’, as counterparties may claim various instruments.

To pick which queries to grant and reject, analyse the popularity of various mechanisms and inquire about liquidity and commission rates. Establishing effective communication with LPs is paramount for guaranteeing thriving CFD broker operations.

Traders should consider working with respected brokers who offer clear pricing, reliable platforms, and effective risk-handling instruments.

Understanding different CFDs provides a wide range of prospects for market players, allowing them to make knowledgeable decisions and increase their chances of success.

Final Thoughts

Providers of CFD liquidity are in great demand because of their substantial impact on CFD trading. The rapid execution of trades with less slippage and narrower spreads made possible by CFD trading’s high liquidity levels has the power to stabilise market prices, reduce trading costs, and boost trader profitability.

It takes extensive knowledge of trade and business to choose an LP to use on the CFD trading platform.