Best Trading Software in 2026 – How to Find a Suitable One for You

Finding the right tech stack is key to your operations when planning your brokerage startup. For example, the trading software is where most of your core operations take place, and your clients interact with financial markets, trade assets, and manage their funds.

However, the journey to finding the right solution is tiresome and entails rigorous research to find a suitable provider offering relevant features and services.

This becomes more challenging if you offer multi-asset trading or futures contracts and need a platform that combines both and ensures fast execution, optimum user experience and direct market access.

Stick around to find the best trading software that suits your needs. Whether you are a Forex, futures, or crypto broker, you will find what you are looking for in this article.

Key Takeaways

- The trading software is the core functionality of online brokers, allowing traders to interact with financial markets.

- Determining your brokerage type (Forex, cryptocurrency, or futures) is key to finding the best trading platform that suits you.

- Launching a multi-asset brokerage firm allows you to increase your chances of converting investors of different preferences and styles.

- B2TRADER and MetaTrader are among the top Forex trading software for brokers looking to offer competitive spreads with deep liquidity coverage.

Who Needs a Trading Software?

Trading software is essential for brokerage firms, financial institutions, and prime brokers aiming to streamline market access.

Executing brokers rely on software to provide their clients with robust, feature-rich platforms to invest their money in Forex, crypto, futures, and multi-asset markets.

Proprietary firms and retail brokers depend on these capabilities to offer algorithmic trading, market analysis, and secure execution. At the same time, tier-1 financial institutions, hedge funds, and market makers use these systems to execute high-frequency trades and manage liquidity efficiently.

In essence, trading software is a cornerstone for businesses looking to remain competitive while offering a seamless experience to their clients.

What Should You Look for in Software?

Choosing a brokerage solution requires thorough research underlining performance, scalability, and client satisfaction. Firstly, you must set priorities and determine your objectives and type of brokerage, then find suitable software that offers the following qualities:

- Multi-Asset Compatibility: Ensure the software supports diverse trading instruments, like Forex, crypto, futures, and equities, to cater to a broad client base.

- Customisation and White-Label Solutions: Look for software offering branding options and APIs to integrate seamlessly with your existing systems and launch your trading service quickly.

- Robust Performance: Prioritise low-latency execution and high uptime to meet the demands of professional traders and avoid customer turnover.

- Security and Compliance: Ensure the platform adheres to global regulations and offers top-tier encryption and risk management tools.

- Advanced Features: Include algorithmic trading, real-time market data, and access to deep liquidity pools to attract more traders.

- User Experience: The interface must combine simplicity for retail clients with advanced tools for sophisticated users.

- Scalable Infrastructure: Opt for software that can handle increased traffic and high-frequency trading volumes as your client base grows.

- Customer Support: Ensure reliable, multilingual, 24/7 support to minimise downtime and resolve issues swiftly.

Nevertheless, finding all these qualities running simultaneously at high performance might be challenging. Therefore, it is crucial to find the right balance between these features and prioritise what matters most to you.

Finding The Best Trading Software

Locating a suitable trading platform to integrate with your brokerage firm depends on your target. For example, if you aim to offer crypto trading, a crypto spot platform is more suitable than holistic software, as it is more focused and customised for digital assets, crypto liquidity pools, and relevant market dynamics.

The same applies to futures or Forex trading strategies, where a specialised platform works better in terms of liquidity connections, market access and fund management. However, integrating a multi-asset platform is a better approach if you want to increase your chances and attract as many traders as possible.

Best Forex Trading Platform

Forex remains the top destination for new and professional traders, as it is the busiest financial market and the most significant money pool.

Offering FX trading capabilities is almost necessary for every broker, and standing out in this competitive market requires offering the most demanded features and tools. Here are the top three software providers.

B2TRADER

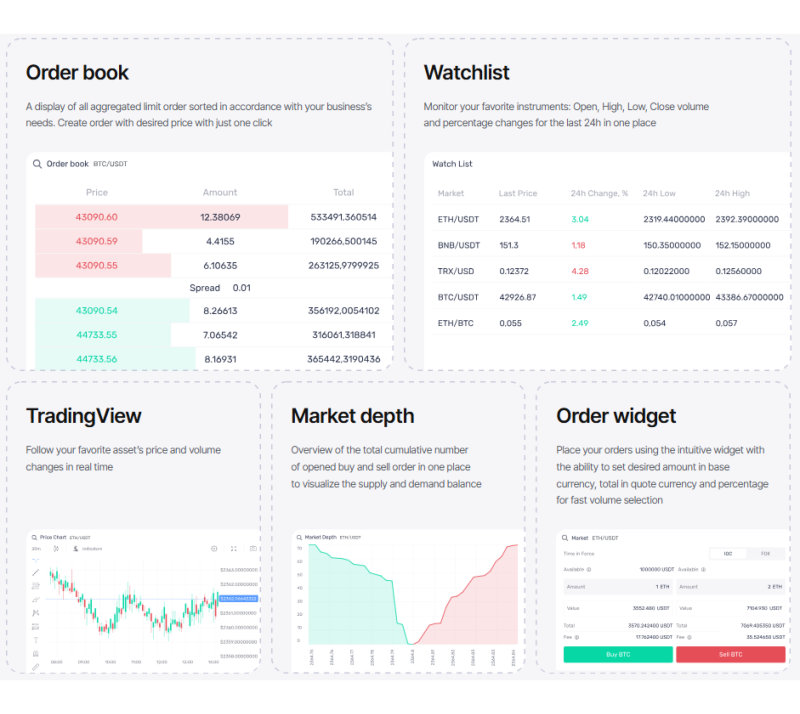

B2TRADER is an excellent Forex trading platform for brokers due to its wide market access and liquidity connections. It has a multi-asset approach to fiat currencies, facilitating execution on almost any FX pair.

B2TRADER is powered by B2BROKER’s liquidity technology, ensuring deep market access and competitive spreads across over 3,000 financial instruments.

It has an advanced matching engine to process high-frequency trades efficiently, real-time price tracking for optimum experience, and sophisticated tools to manage funds and transactions effortlessly, making it one of the best Forex trading platforms to integrate.

In its recent upgrade, B2TRADER introduced the cross-margin collateral management dashboard for brokers to optimise leverage and margin requirements on each currency according to market conditions.

MetaTrader 5

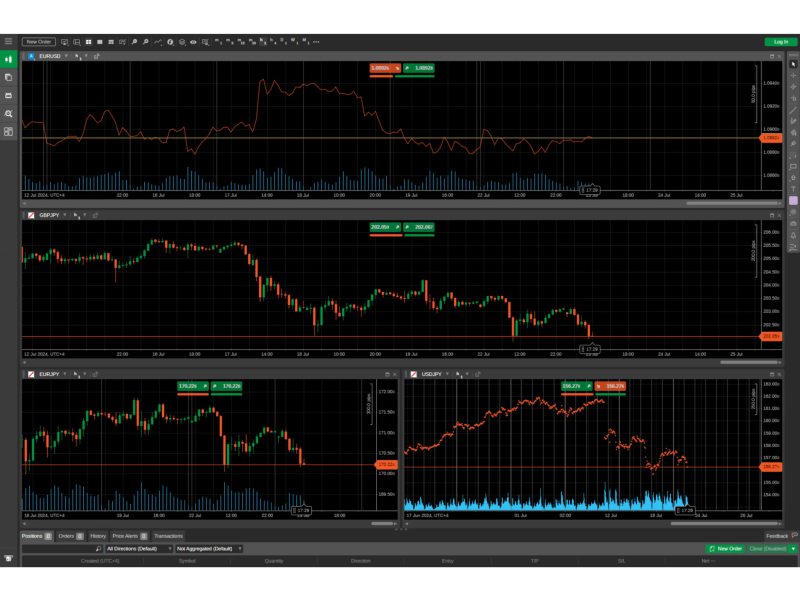

MT5 by MetaQuotes is a go-to solution for most brokers seeking to launch FX trading services. It supports multiple asset classes, including Forex, stocks, and commodities, making it a versatile option for diverse client bases.

MetaTrader 5 offers advanced charting tools, built-in technical indicators, algo-trading via MQL5, and a readily available economic calendar. Its multi-account manager functionality allows brokers to manage multiple client accounts efficiently.

With robust backend capabilities, admins can customise their desktop trading platform to suit their branding needs while ensuring fast trade execution and comprehensive reporting tools, essential for regulatory compliance.

cTrader

cTrader by Spotware is a broker-friendly platform designed for Forex and CFD instruments. It provides access to deep liquidity pools, enabling tight spreads and high-speed execution.

Known for its intuitive interface, cTrader caters to both retail and professional clients, allowing brokers to extend their market reach. It supports algorithmic trading through cAlgo and includes features like detachable charts, advanced order types, and detailed analytics.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Brokers benefit from its custom white-label solutions and API integrations, allowing seamless incorporation into their existing systems. Moreover, cTrader’s regulatory compliance tools simplify reporting and ensure adherence to financial regulations.

Best Crypto Spot Trading Platform

Cryptocurrencies are becoming increasingly popular among the new wave of Web 3.0 enthusiasts looking for sophisticated digital investments and traditional investors looking to diversify and boost their portfolios.

Starting a crypto brokerage is one way to take advantage of the surging coins’ prices, trends and market capitalisation. This year, Bitcoin recorded an all-time high price multiple times, recently reaching $100,000. Other coins, like Ethereum and Solana, experience similar runs, almost doubling their previous year’s prices.

Therefore, finding the best crypto spot trading platform is necessary to succeed in this growing market. Here are the top providers you can find.

B2TRADER

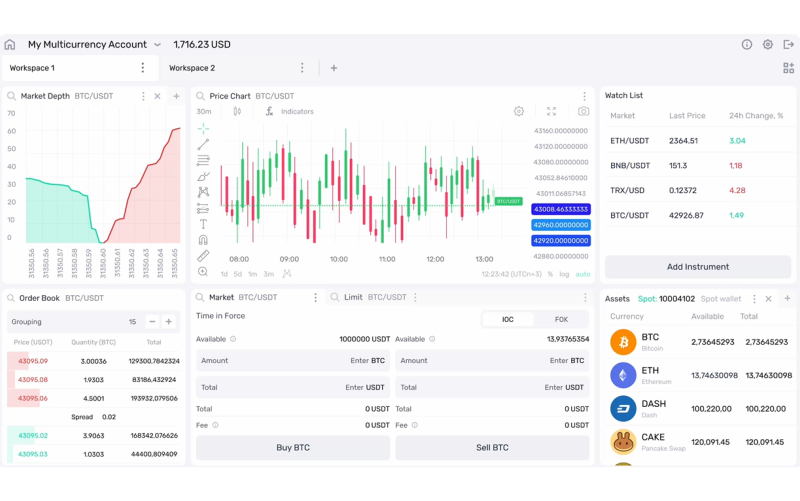

B2TRADER is a powerful crypto trading software tailored for brokers aiming to offer comprehensive CFD and spot instruments.

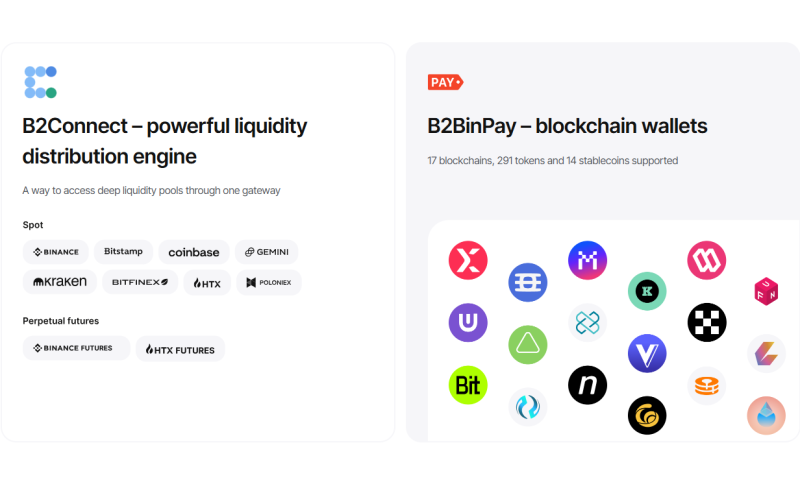

Thanks to its integration with B2BINPAY, It supports a wide range of digital assets, including 17 blockchains, 291 tokens, and 14 stablecoins, enabling brokers to provide diverse investment options.

The platform integrates seamlessly with leading liquidity providers through bridge technologies (OneZero, PrimeXM, and B2CONNECT), granting access to deep liquidity pools through a single gateway.

This ensures tight spreads and efficient trade execution, enhancing the user experience and making B2TRADER a solid option for crypto brokers.

Additionally, B2TRADER utilises smart cross-rate tree routing to find trading instances between almost any crypto pairs at the best rates. All combined with a high-performing engine that processes up to 3,000 requests per second at minimum latency.

Binance Broker API

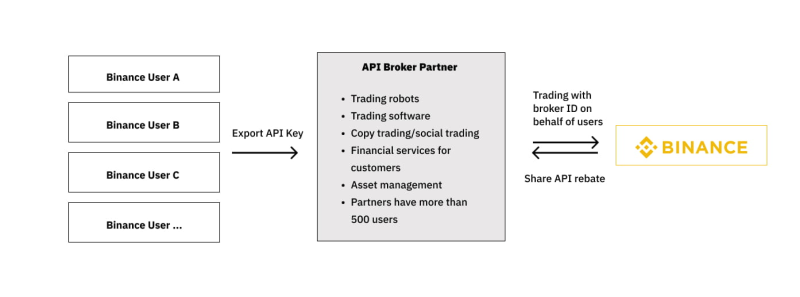

Binance’s Broker API enables operators to integrate its liquidity, market depth, and trading infrastructure into brokerage platforms, allowing them to offer a wide range of cryptocurrencies, including Bitcoin, Ethereum, and altcoins.

The API offers effortless integration capabilities with flexible customisation options, powering brokers to create a branded trading experience and launch their platforms very shortly.

Binance’s API ensures low-latency execution, advanced order types, and secure wallet management. Its liquidity depth is a key advantage, allowing brokers to offer low spreads and a seamless experience.

Coinbase Cloud

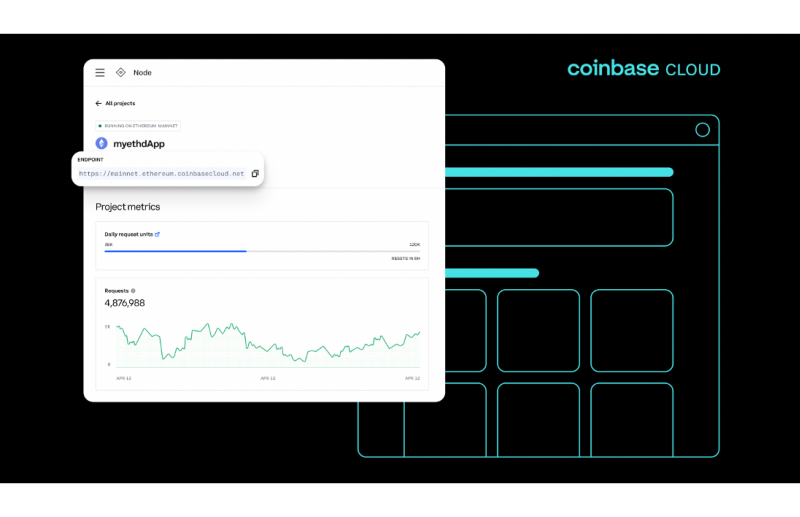

Coinbase Cloud offers brokers a comprehensive toolkit for launching crypto trading services to work effectively in this thriving market with access to over 200 cryptocurrencies and cater to a diverse client base.

The platform includes APIs for trading, payments, and wallet management, ensuring smooth end-to-end functionality and effortless integration.

Coinbase Cloud is highly secure, with features like multi-signature wallets and encryption protocols to secure platform and user funds. Additionally, its regulatory compliance solutions help brokers meet global standards, ensuring a trustworthy platform for crypto trading.

Best Multi-Asset Trading Platform

Offering multi-asset trading opportunities allows brokerage firms to expand their reach and target many clients from different categories and preferences.

They cater to traders who want to pick and choose assets based on recent trends, as well as professionals who want to diversify their portfolios to minimise exposure risk.

Therefore, finding such software requires careful research to find a provider with liquidity connections to multiple markets without compromising execution speed, user experience and regulatory compliance. Here are the best multi-asset trading platform developers.

B2TRADER

B2TRADER is a genuine multi-asset, multi-market solution offering access to Forex, CFD, Crypto spot markets, and other derivatives instruments from a single account.

Its liquidity-agnostic design allows easy access to top liquidity providers, ensuring deep liquidity pools and competitive spreads across multiple asset classes, allowing brokers to compete effectively.

Additionally, B2TRADER offers dynamic leverage adjustments, allowing end-users to choose their preferred leverage ratio and enabling brokers to control risks associated with margin accounts based on market conditions.

Its user-friendly interface, combined with comprehensive API access, facilitates seamless integration and customisation to launch your brokerage in a record time, making B2TRADER an efficient solution for brokers seeking to offer a comprehensive multi-asset trading experience.

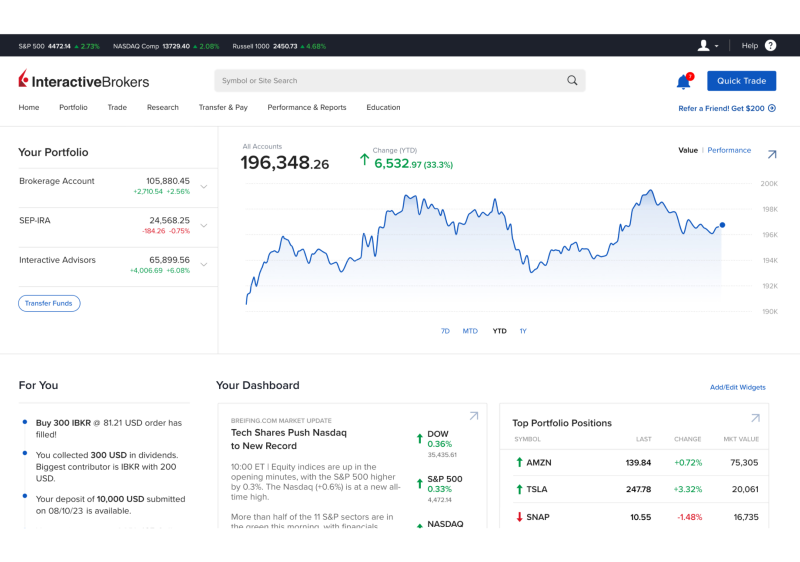

Interactive Brokers

Interactive Brokers provides an API that enables brokers to offer day trading across a vast range of asset classes, including stocks, options, Forex, and futures.

Its powerful portfolio management and risk analysis tools are ideal for brokers targeting retail and institutional clients, especially those executing large-volume trades and significant FX lots.

The IB API structure supports integration with existing systems, allowing effortless customisation and scalability for brokers to access global markets and seek international exposure.

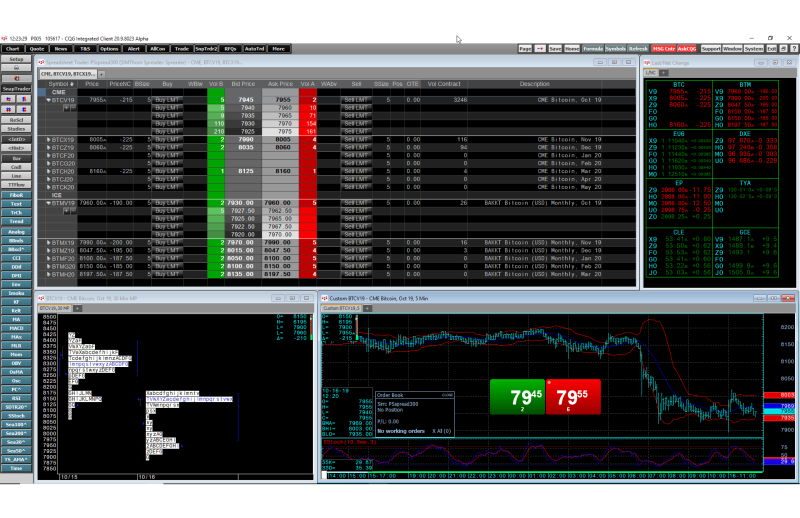

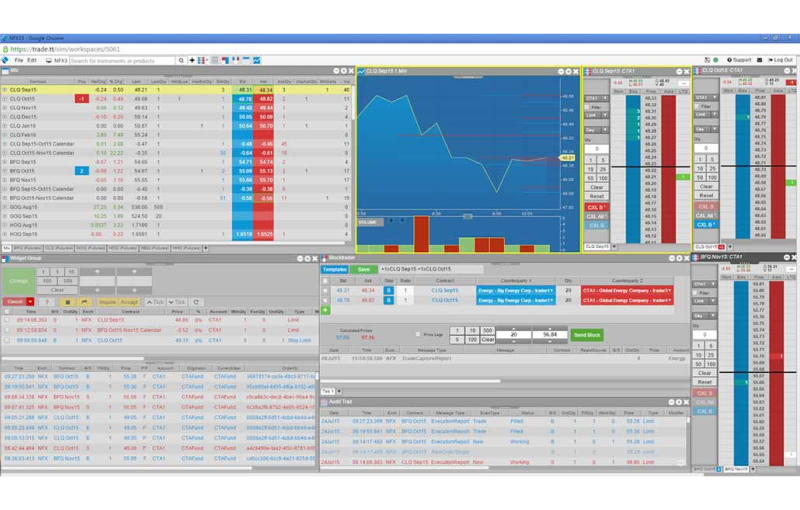

CQG

CQG is a professional-grade platform offering multi-asset trading capabilities, including Forex, futures, and equities, with advanced analytics, charting tools, and direct market access.

Its multi-asset framework allows brokers to serve diverse client needs with innovative automation tools to streamline administrative activities and monitoring.

Moreover, CQG supports API integration, making it easy for brokers to incorporate into their platforms and utilise secure and scalable infrastructure under high trading volumes.

Best Futures Trading Platform

Futures contracts are evolving markets, especially during uncertainties or increased risks, allowing users to protect their positions.

Futures trading platforms are essential for brokers to offer clients access to highly leveraged derivatives markets, enabling speculation or hedging on price movements across commodities, indices, Forex, and more.

These platforms include day trading software that handles high-speed execution, robust risk management, and deep market connectivity to support the fast-paced nature of futures markets.

For brokers, a good platform ensures scalability, regulatory compliance, and flexibility to cater to retail and institutional clients. Here are the best futures trading platform providers from which you can choose.

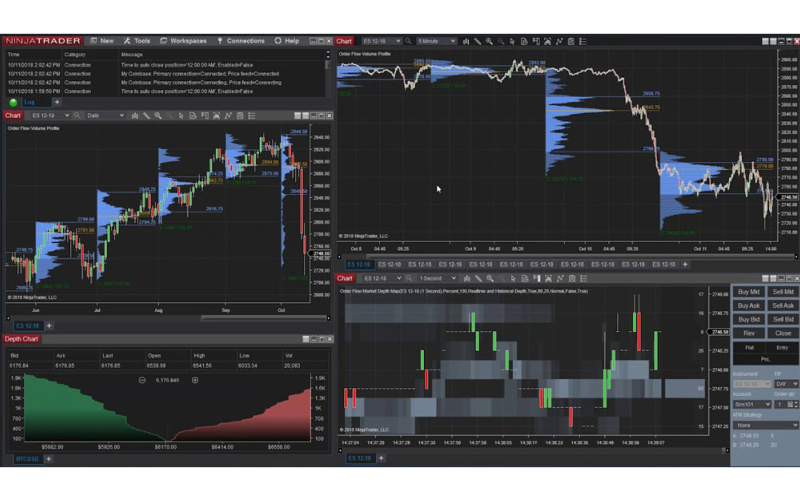

NinjaTrader

NinjaTrader is one of the best trading platforms for futures contracts. It is known for its advanced charting and technical analysis tools, as well as low-cost requirements.

Brokers can integrate NinjaTrader to offer futures trading services with access to global markets, utilising no minimum deposits, reasonable commissions and low margins.

The platform supports automated trading, backtesting, demo accounts, and custom strategy development, which are the features most demanded by retail and institutional traders.

Its scalability and cross-device functionality make it a reliable choice for brokers targeting active traders and institutions, combined with white-label solutions to create a branded experience more effectively.

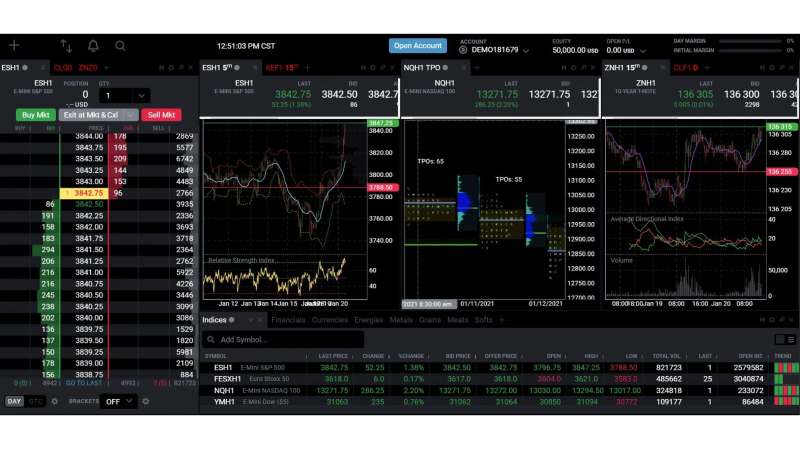

Tradeovate

Tradovate is an innovative, cloud-based futures trading platform offering a commission-free experience and advanced analytics combined with on-demand streaming market replay and built-in futures trading tools.

It supports API integration with multiple third-party service providers, enabling seamless incorporation in a broker’s infrastructure and making it an ideal choice for brokers who want to provide a modern, user-friendly trading experience.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Its mobile and web compatibility ensures clients can trade futures from anywhere, with cloud-based trading that minimises reliance on local networks. The platform also includes risk management tools and supports multiple order types, appealing to active traders and professionals.

Trading Technologies

TT is a high-performance multi-asset trading platform designed for institutional and retail brokers, offering futures and options contracts.

It provides direct market access, low-latency execution, and powerful order management tools to improve the trader’s experience, with API structure and white-label options to simplify the broker’s integration.

The platform also features advanced analytics, spread trading capabilities, and risk management tools, ensuring a comprehensive solution for brokers entering the futures market.

How to Integrate Trading Software?

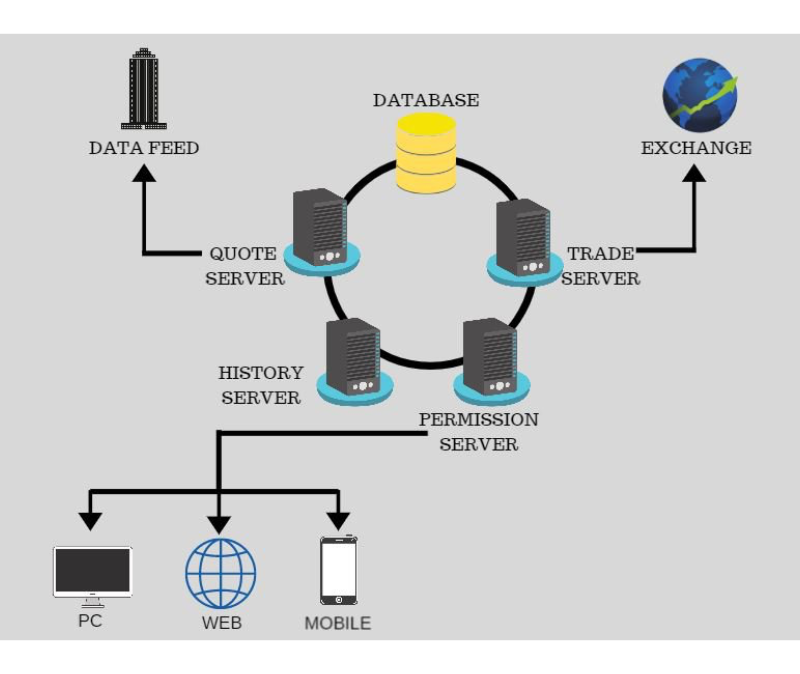

Incorporating the software on your platform can take considerable time, based on your requirements and the complexity of functions. It also depends on the provider’s integration and API environment that allows you to brand and launch the system as yours.

The process is very technical, and you must have a team of technicians and programmers leading it to ensure backend compatibility and smooth operation. Here’s how you can start.

Define Requirements

Identify the markets, assets, and features you want to offer (Forex, crypto, futures, or a combination of them). Choose a provider that supports these needs and aligns with your business and price plans.

Select the Right Provider

Evaluate your choices based on scalability, compatibility, and support. Select a solution offering robust APIs for seamless integration and white-label capabilities to build your software quickly and effortlessly.

API Integration

Connect the trading software to your platform using the provided APIs. This involves linking order management systems, liquidity providers, payment gateways, real-time newsfeeds, and back-office CRMs.

Customise Your Solution

Tune the platform to your preferred features and operational needs. Configure functions like trading pairs, leverage, user dashboards, account settings, KYC verification, and risk management settings.

You can also rebrand the solution as yours, using your name and logo to instil professionalism and confidence in your traders.

Test & Launch Your Platform

Conduct rigorous testing to ensure the platform works seamlessly, including trade execution speed, data accuracy, and user interface functionality. You can offer an initial release to selected users to evaluate the performance in a real trading situation.

After successful assessment, deploy the platform and onboard clients. Continuously monitor performance, security, and customer feedback to refine and improve the user experience.

Conclusion

Finding the best trading software to integrate with your platform is the central aspect of creating a brokerage. It is the core function of your business and the main interaction point between your users and trading venues.

Therefore, you must rigorously determine your needs, select trading instruments you want to offer, and find a provider that facilitates integration and customisation of your newly launched trading platform.

FAQ

How do you find trading software for brokers?

Determine your objectives and the financial instruments you want to offer, then look for scalable, secure, and feature-rich platforms with multi-asset support. Prioritise providers with strong liquidity connections, regulatory compliance tools, and reliable support.

What is the best Forex trading platform?

B2TRADER, cTrader, and MetaTrader 5 are the top three platforms for their advanced analytics, algorithmic trading capabilities, and multi-device compatibility. They offer excellent choices for brokers seeking to provide a robust Forex trading experience.

What is the best software to trade stocks?

Interactive Brokers and CQG offer extensive stock trading capabilities, including access to global markets, advanced order types, and portfolio management tools, making them ideal for brokers offering equities.

What trading platform is better for beginners?

B2TRADER and cTrader are popular user-friendly software with intuitive interfaces, detailed educational resources, and straightforward tools while offering advanced features for scaling with client needs.