How to Start a Prop Firm of Your Own: Detailed Guide

Articles

The brokerage service industry is continually evolving, with digitalised platforms opening the door for more innovation and globalisation of trading services and activities.

Proprietary trading is making a buzz in the financial markets. Its challenging nature and unique characteristics set it apart from current market trends. More investors demand prop trading services, making it a highly profitable business.

This niche market was valued at $6.7 billion in 2020 and is expected to grow by a CAGR of 4.2% between 2021 and 2028. More impressively, the search for the term “prop trading” increased massively by 8,409% between 2020 and 2024.

So, what is all this hype about, and how to start a prop firm successfully?

Key Takeaways

- A proprietary trading firm is a brokerage platform that offers traders the chance to trade on the company’s behalf, using its resources and capital after completing particular challenges.

- Professional traders participate in a prop firm’s challenges to complete specific investing challenges before trading for the broker’s own capital and resources.

- Creating a prop firm requires significant investment and careful planning to integrate a technology solution, liquidity, legal license, and marketing.

- Prop firms can be highly lucrative, offering broad market access, revenue diversification and a cost-efficient client acquisition plan.

Understanding Prop Trading

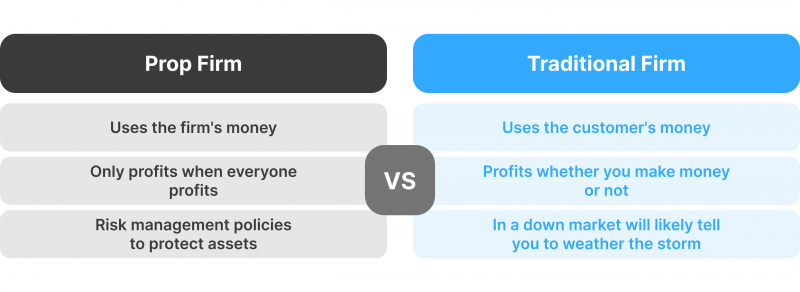

Proprietary trading means that a financial institution uses its resources and capital to invest in the market and generate income. This model requires the organisation to trade across different asset classes and financial instruments rather than offering brokerage services.

Classically, brokerage firms utilise their clients’ money to invest in various markets and make income from commissions and other service fees. However, in proprietary trading, the institution uses its prop fund to increase its wealth.

The prop firm can use its in-house brokers to invest in the market or attract professional investors to trade on its behalf.

Can You Start a Prop Firm?

Existing brokerage firms can integrate a prop trading solution, adding a new business line and increasing their revenue or start a prop trading firm from the ground up.

However, when hiring experienced investors, brokers must set several challenges to find the most elite professionals with years of practice and advanced skills.

The challenges involve several investment objectives, such as achieving specific returns, doubling the given capital, and avoiding losing more than a minimum amount. Investors must make accurate and timely decisions to pass the challenges, which qualify them to use the firm’s funds, resources, and software and share the profits with the broker.

Are Prop Trading Firms Profitable in 2025?

Prop trading opens up more monetisation opportunities for brokers. They can implement profit-sharing models to earn a cut from the challenging traders’ activities. The firm can also share earnings with those who complete the objectives and trade using the company’s resources.

Moreover, brokers can set a fee for participating in the competition, and those who do not achieve their goals can re-take the challenge for a fee.

Benefits of Starting a Proprietary Trading Firm

There are many reasons why starting a prop firm is a lucrative idea. Whether as a standalone business or an extension of an existing brokerage firm, here are the advantages of proprietary trading.

Broad Market Access

Prop trading is a global trend in which brokers, retail traders and institutional investors are increasingly interested. This growth is still in its early stages, and brokers can capitalise on its massive potential.

Therefore, it is an innovative way for businesses to open a prop firm and compete on a global level by offering the most in-demand services.

Income Diversification

Launching a prop trading solution expands your reach to new markets, more clients and more revenue streams. There are different profitability models in proprietary trading.

You can earn from charging entry fees to challenges for new participants and those who want to re-take the challenge. You can receive investment revenues from the trader’s activities as they attempt to reach their objectives. Some goals may include investing in growing markets or doubling a given capital in actual markets.

Once you hire investors who complete their tasks successfully, you can implement several profit-sharing methods to earn from the traders’ activities. Nevertheless, you can create investing templates from successful trading systems and sell them as copy-trading strategies.

Client Acquisition Strategy

Contrary to traditional brokerage practices to acquire clients, which include different marketing strategies, advertisements, and social media campaigns, prop trading enables you to attract clients with a single offering.

Not only this, but you can also attract top-notch investors with vast experience and analytical skills to trade for their and your goals, creating a win-win scenario.

This approach contributes significantly to your income diversification strategy, allowing you to earn from offering brokerage services and direct investing activities that these experienced investors implement.

Lowering Operational Costs

Converting leads from interested individuals to clients can be costly. There are different sales funnels, lead generation firms and other intermediaries that will charge you for their services.

Retail brokers employ different marketing campaigns and advertising efforts to capture potential customers, which can be costly. Moreover, inexperienced traders require broad educational materials, support efforts and other investments before they become experienced.

However, attracting skilled traders whose trading is their bread and butter lowers your cost-per-action and enables you to focus on the main platform’s operations and offer your investors the best features.

Easier Money Management

Conventional brokerage firms deal with funds from a massive number of clients, each in different currencies, payment methods, tax systems, and settlement cycles. This financial complexity requires advanced accounting and money management skills.

Brokers must utilise advanced security systems to safeguard deposited user funds and transactions. However, prop trading firms deal with their own funds, leading to simpler money management and more flexible financial practices.

This approach also results in fewer fees payable to payment processors because the broker trades with their funds and enters two-way transactions.

Fewer Regulatory Complexities

Prop trading is still in its preliminary stages, and financial regulators have yet to create formal jurisdictional regulations and frameworks. As such, proprietary brokerage firms can try innovative approaches to capitalise on these opportunities and make as much money as possible.

It is easier now to start a prop firm of your own because the nature of this niche requires fewer financial requirements for account segregation, investor compensation schemes, and other financial insurance programs.

How Much Money Do You Need to Start a Prop Firm?

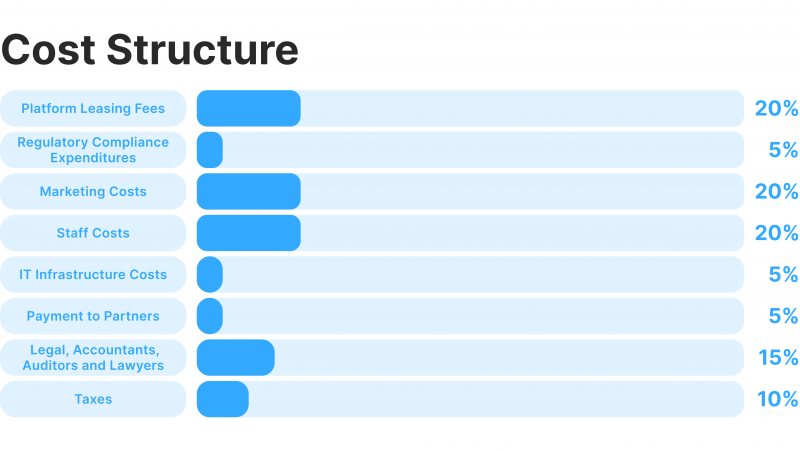

The costs depend on the target market where you are launching your prop trading business and the license requirements for operating legally.

A significant portion of your budget will go to integrating a prop trading solution. This cost depends on the features offered, trading software, challenge monitoring, and client acquisition program. You can estimate a yearly fee between $10,000 and $50,000.

Afterwards, you will pay to obtain the license and apply to become a legal financial service provider. Although prop trading might not have dedicated license requirements, as a brokerage firm, you will need to get a particular financial license that can go up to $10,000.

Moreover, some jurisdictions might require an initial operational capital in your bank account. This is not practically a fee you must pay, but it is a financial requirement that you must consider.

Other payments that you need to consider are marketing efforts and ad campaigns. You might integrate various services, such as payment gateways, live chat, AI capabilities, e-mail service, CRM system, and trading software, which are paid differently.

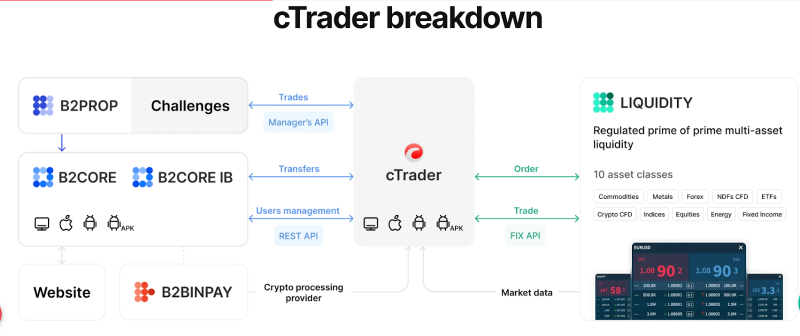

B2BROKER’s cTrader White-Label Prop Trading Solution: Review & Features

B2BROKER empowers you to reach your full potential using tailored solutions to expand your business, improve your operations and boost your revenues. The white-label (WL) approach enables you to customise a platform based on the popular trading software, cTrader.

This way, you can attract more traders to your brokerage, including active cTrader users who seek to diversify their investment portfolios.

Let’s review how it works and what competitive advantages you can get.

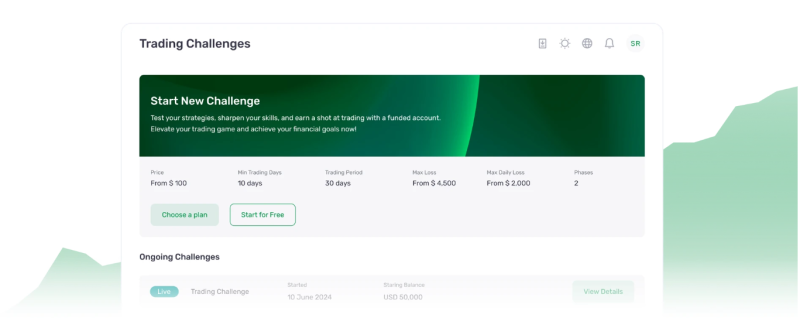

Easy Challenge Configuration

B2BROKER offers easy-to-use tools to create, edit, and track financial challenges, which are pivotal to every prop firm. You can set trading targets, daily profit and loss limits, margin thresholds, and other options, aligning with your objectives.

You can easily adjust these objectives based on industry changes and business needs, increasing flexibility and minimising capital exposure.

Advanced Support Tools

Our cTrader WL prop trading solution is packed with scalable tools that enable you to control your risks, track prop traders’ progress, and monitor platform performance more accurately.

You can also control pricing, manage liquidity streams, get real-time market data, and receive detailed reports from a sophisticated interface.

Fully Integrated Ecosystem

The solution is fully connected to our advanced infrastructure, including Prime-of-Prime liquidity streams, 10-asset market coverage, crypto payment gateways with B2BINPAY, and a cutting-edge Back Office management with B2CORE.

These capabilities enable you to manage all your prop firm activities, from offering trading to settling transactions in the same ecosystem.

Transparent Pricing

Whether you want a multi-asset trading platform or asset-specific liquidity for your prop firm, B2BROKER ensures that you pay for what you receive, making it fully transparent and convenient for brokerages of all types.

By launching a cTrader white-label prop trading platform, you save substantial costs from development from scratch, in-house maintenance, and internal team management.

Diversified Revenue Stream

Prop trading enables you to explore new revenue streams, benefiting from a new user base and sophisticated profit-sharing models. This includes:

- Challenge registration fees: Traders pay predetermined fees to participate in trading challenges and can pay again for retakes.

- Copy trading: You can replicate the trading strategies of a prop trader and scale your gains significantly more.

- Profit-sharing models: You can share prop trading profits with traders, earning between 50% and 80% on realised gains.

How to Start?

Starting your prop firm with B2BROKER is straightforward, thanks to the cTrader white-label setup, cutting time and resources and capitalising on current opportunities. Here’s how you can start a prop firm in five steps.

- Set up a Legal Entity

Depending on your area of operation, the financial regulator may require initial capital investment, background checks for board members, or financial recommendations. Hire a legal team and prepare these documents in time, as processing can take several weeks to months.

It might not be necessary to obtain a prop trader’s license, but you need to acquire a business permit to operate as a financial brokerage service provider. Additionally, you must submit an anti-money laundering protocol and risk assessment strategies to secure your traders’ funds.

- Contact Your Account Manager

Every B2BROKER client has a dedicated manager who ensures the delivery of a product or service that suits their business needs and requirements. Contact your account manager for consultation, initiation, and selection of the required features and services.

In this step, our experienced team will help you find the solution that responds to your specifications and modify it according to your specific market, clientele, and legal framework.

- Agree on Tech Stack, Customisation, and Preferences

Next, you must develop and integrate other technologies to support your system. These services include payment systems and crypto payment gateways to allow investors to withdraw their revenues using the preferred method.

You can also integrate a legal compliance tool like a KYC verification plug-in to conduct client background checks. You must also configure the hosting service provider for data storage and database structure.

To support your clients, you will require a customer service package that includes live chat, chatbot, and email. Social trading and copy trading are rising in popularity among trading venues, which you can also support to enable investors to copy and create copies of their trading systems.

- Create Trading Challenges

Key elements of your prop firm are the trading challenges. Create reasonable and competitive tasks to ensure that only the best investors with compelling trading strategies become prop investors at your firm.

Here’s what you need to know about trading challenges.

- Create challenges by setting trading objectives, profit targets, drawdown limits, daily trading thresholds and more.

- Traders buy challenges, start trading according to available instruments and funds, and pass when they reach their objectives.

- Successful traders who pass challenges get funded, where they execute orders on behalf of the firm and use its capital.

- Scale your earnings with pre-determined profit-sharing schemes and replicate trading strategies to boost your profits.

- Launch Your Proprietary Trading Firm

You will receive your ready product in a few days, enabling you to enter and compete in the market without delays. Follow the deployment guide and launch your operations.

Continuously test and monitor your platform’s performance to ensure all features are functioning as intended, and keep a close eye on market dynamics to adjust your risk profile accordingly.

Common Challenges For Prop Trading Firms

With various benefits and multiple revenue stream opportunities, prop trading seems like the ideal business in the brokerage industry. However, there are numerous drawbacks and challenges for prop firms.

Regulatory Uncertainty

The prop trading regulatory environment is evolving, and the industry’s future depends heavily on whether any restrictions are placed on prop proprietary brokerages and traders’ activities.

Increased Costs

Building a successful prop trading business requires a significant investment in developing sophisticated software and real-time tracking systems, creating and managing traders’ challenges, and accessing trading venues.

Unexpected Returns

Markets are unpredictable, and most prop trading firms rely on traders’ activities and profitability to generate income.

A significant amount of time is required before realising remarkable profits. The proprietary broker must invest substantially in promoting the platform before building consistent income sources.

FAQ

How to start a prop firm business?

Create a business plan to identify your goals, then search for a platform and liquidity provider. Develop your technology infrastructure and add integrations that support your platform. Get over the legal requirements, create trading challenges, market, and launch your prop firm.

How much does it cost to set up a prop trading firm?

Many factors determine the cost of your prop firm, such as the trading platform, software, legal requirements, and marketing activities. You can allocate a $50,000 to $100,000 investment to launch a prop firm.

Is prop trading profitable in 2025?

Yes. The proprietary trading industry is experiencing high demand, with a CAGR growth rate of 4.2%. More traders are looking for prop trading brokers, making it a highly profitable business.

Is there a license for prop firms?

Operating a proprietary trading brokerage does not entail a special prop license. However, as a brokerage firm, you must obtain a broker-dealer license or other permits required by your local authority.