Bitcoin ETF Inflows and Its Impact on The Crypto Market

The crypto market could experience a transformation with the availability of ETFs for ETH and BTC, allowing investors to choose from regulated investment options. These financial instruments have greatly influenced the value of digital money and provide a secure and regulated avenue for people to invest in the market.

In this article, we will discuss how BTC ETF approval has influenced the virtual coins market and how Bitcoin ETF inflows can change the future of the crypto landscape.

Key Takeaways

- ETFs are stock exchange-traded investments similar to regular stocks. They are popular among small and large investors due to their efficiency and ease of use.

- BTC Spot ETF was approved by the SEC in January 2024, followed by the approval of ETH Spot ETFs in May 2024.

- BTC Spot ETFs face various challenges, such as BTC volatility and regulatory uncertainties.

- The approval of BTC Spot ETFs led to increased liquidity and attracted more investors to the market.

Explaining ETFs And Their Popularity Among Traders

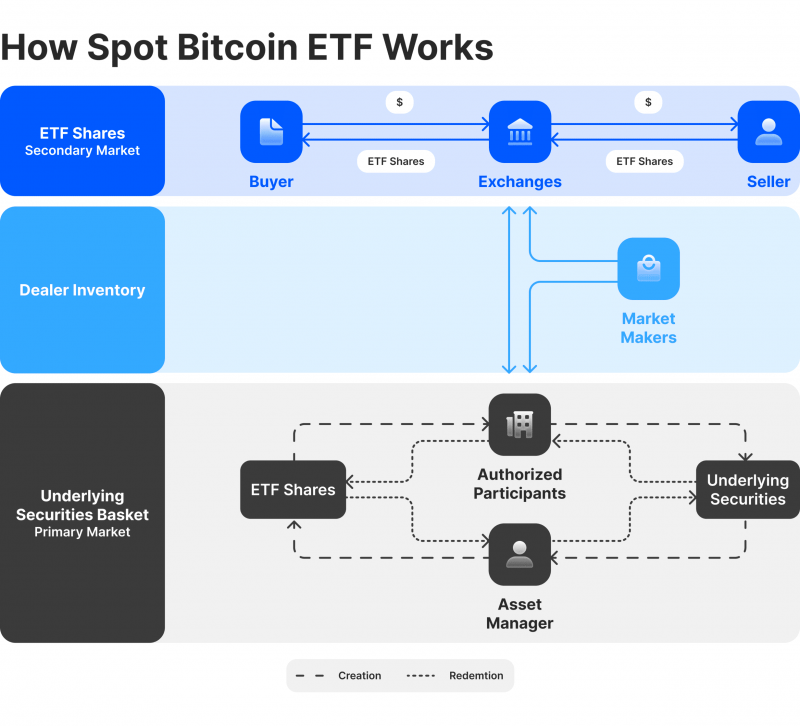

Exchange-traded funds (ETFs) are baskets of investments that can be bought or sold on stock exchanges, similar to regular stocks. They are popular among both everyday and big investors due to their efficiency and ease of use. ETFs offer flexibility and ease of access for institutional investors, with lower expense ratios compared to traditional mutual funds and a unique in-kind creation and redemption process that minimises capital gains taxes.

Crypto ETFs are a blend of traditional ETF structures and the digital currency market. They provide direct exposure to a specific cryptocurrency’s market price, similar to buying BTC but without the complexities of managing a digital wallet.

Crypto ETFs operate by tracking the price of blockchain money and trading on stock exchanges, making them appealing to investors accustomed to the stock market but seeking entry into the blockchain space without the direct complexities of digital currency transactions. Such ETFs may trade at higher or lower values compared to the actual market price of the assets they represent, resulting in a variation in the ETF’s price compared to its underlying asset value.

Crypto ETFs offer several advantages, including an easier way to invest, dealing with trusted businesses, and avoiding the risk of losing the key to your BTC wallet. These ETFs can be bought, held, and sold using a normal brokerage account, eliminating the need for setting up a cryptocurrency wallet or trading on unregulated exchanges.

They are issued by regulated companies and trade on mainstream exchanges, ensuring all parties involved are checked and monitored to prevent market abuse or illegal activities. Additionally, ETFs are physically backed and in the custody of regulated entities, mitigating the risk of fraud and scandals associated with unregulated exchanges.

Bitcoin ETF

BTC ETFs have been circulating in the finance world since the first proposal in 2013. The idea was to create an ETF that tracked Bitcoin’s performance, allowing investors to buy shares and indirectly invest in BTC without managing cryptocurrency wallets and exchanges.

Despite facing scrutiny and rejection by the SEC, proponents have continued their efforts, enhancing security measures, market tracking mechanisms, and compliance with regulatory standards and the evolving crypto market landscape. Key milestones include the introduction of blockchain technology into traditional finance, growing institutional interest in cryptocurrencies, and the maturing of the BTC market in terms of liquidity and price discovery mechanisms.

In recent years, the narrative around BTC ETFs has shifted significantly due to the growing acceptance of cryptocurrencies as a legitimate asset class, advancements in regulatory frameworks, and the launch of BTC futures ETFs, which represent a significant step towards mainstream financial recognition of BTC.

Lower fees do not automatically mean higher returns, so investors should consider net-of-fee returns when comparing ETFs with similar funds. The size of a fund is also important, as bigger ETFs are traded in higher volumes and more frequently than smaller similar funds. In Europe, the largest BTC ETF is the oldest, Coinshares BTC Tracker Euro ETC, while the newer BTCEetc BTC Exchange Traded Crypto ETC (BTCE) has seen assets surge rapidly.

BTC Spot ETF

A spot Bitcoin ETF exposes ordinary investors to BTC price moves, offering a regulated way to invest in BTC through brokerage accounts.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Distinguished Characteristics of BTC Spot ETF

Bitcoin Spot ETFs and derivatives-based Bitcoin ETFs differ in their structure and exposure to BTC’s price changes. Spot Bitcoin ETFs directly hold BTCs, making them more intuitive for investors and transparent. They can be more transparent as each share corresponds to a specific number of BTCs held.

On the other hand, derivatives-based ETFs are more opaque due to their value derived indirectly from futures contracts, which can be influenced by market factors beyond Bitcoin’s spot price.

Spot BTC ETFs purchase a selected amount of BTCs held in a secure digital wallet by a custodian, often air-gapped in cold storage. These custodians issue shares that represent the BTCs held by the fund, priced to reflect the current spot price of BTC and can be traded on conventional stock exchanges. This makes it easier for retail investors and traders to buy and sell an asset tied to the current value of BTC without holding the coin itself.

To maintain the price of a spot ETF, authorised participants (APs) create or redeem large blocks of shares, profiting from the arbitrage opportunity presented when the ETF’s price is higher or lower than the underlying asset’s value.

A Brief History of BTC ETF Approval

Cameron and Tyler Winklevoss filed in 2013 to launch the Winklevoss Bitcoin Trust, a BTC ETF tracking the price of digital assets like BTC. The SEC denied Winklevoss’s attempt in 2017, citing concerns about fraudulent practices. In November 2021, the SEC denied spot BTC ETF applications, similar to its ruling on the Winklevoss Bitcoin Trust.

Ark Invest and 21Shares launched the latest wave of BTC ETF approvals in April 2023. BlackRock revealed its intention to launch a Bitcoin ETF last June, managing over $9 trillion in assets. Grayscale’s court victory against the SEC in August has made US spot Bitcoin ETF approval more likely.

On January 10th, 2024, the SEC approved 11 spot BTC ETFs, opening the door to cryptocurrencies for many new investors. Today, BTC ETFs are a competitive market with 14 funds available worldwide, with European investors having a wider range of options than transatlantic counterparts. The cheapest BTC ETF is the Canadian-listed CI Galaxy Bitcoin ETF (BTCG), charging an annual fee of 40bps. The most expensive ETFs charge 250bps, equivalent to $25 for every $1,000 invested.

Challenges Faced By BTC ETFs

Bitcoin ETFs are gaining popularity due to their potential to diversify the market and provide investors with a more stable investment option. However, there are several potential risks and challenges that BTC ETFs may face. Thus, crypto ETFs are not primarily investment assets but rather physical assets that can be volatile and make it difficult to gauge their fair value.

For example, Farside Investors’ data shows that BTC spot ETF ARKB, launched by Ark Invest and 21Shares, experienced a net outflow of $87.5 million on April 3rd, marking the second consecutive day of net outflows. This indicates a shift in investor sentiment towards the ETF, requiring monitoring for potential market impact.

A spot Bitcoin ETF is backed by physical BTCs, allowing investors to directly invest in Bitcoin without buying coins on a crypto exchange. If the value of the digital coins increases, the investment’s value should also. However, ETFs are limited to trading within traditional market hours for regulated securities exchanges, unlike crypto markets, which trade 24/7.

Regulatory uncertainties and compliance requirements are also significant challenges for Bitcoin ETF providers, as they must ensure investor protection and market transparency and prevent market manipulation.

The inherent volatility of Bitcoin and the concentration of ownership in Bitcoin’s supply, held by a small number of entities, raises concerns about potential market manipulation. Arbitrage between the ETF and the underlying BTC market could lead to market distortions.

The decentralised nature of Bitcoin could be affected by the introduction of a BTC ETF, which could be seen as a move towards centralisation. Additionally, the entry of more institutional investors through a Bitcoin ETF could change market dynamics, potentially altering how BTC is used and perceived.

Impact of BTC ETF on The Market

Bitcoin ETFs have significantly impacted Bitcoin crypto price dynamics by attracting institutional investors who were previously hesitant due to regulatory and security concerns. This influx of capital contributes to market liquidity and stability, reducing volatility in the long run.

The approval of BTC ETFs serves as a regulatory endorsement of BTC as a legitimate investment asset, boosting investor confidence and driving demand for the digital currency. Institutional engagement, due to its strategic and long-term investments, is expected to dampen volatility.

The approval of BTC ETFs has opened the floodgates for institutional capital, signalling a shift towards mainstream acceptance of cryptocurrencies. The market initially experienced mixed reactions, but analysts predict significant Bitcoin ETF inflows in the coming years.

Institutional investments bring substantial net inflows, increasing the overall market capitalisation of cryptocurrencies, enhancing liquidity and making the market more resilient to large trades or sudden price movements.

As the market matures, institutional investors take a longer-term approach, leading to more stable pricing and reduced volatility. Their requirements for robust, secure, and compliant platforms have driven improvements in the market infrastructure of cryptocurrencies. Their participation has also accelerated the push for clear regulatory frameworks, making cryptocurrencies a more integral part of the global finance system.

Ethereum Spot ETFs Also Approved. What’s Next?

Ethereum ETFs are investment vehicles that track the price of ETH. They offer a regulated and accessible way for both traditional investors and those interested in digital assets to participate in the ETH market.

The SEC approved BTC ETFs in January, leading to speculation that Ethereum ETFs could receive similar treatment. On May 23, 2024, the U.S. SEC approved a rule change allowing exchanges to list eight spot ETH ETFs, including VanEck, Franklin, Grayscale, Fidelity, Bitwise, ARK Invest & 21Shares, BlackRock, Invesco, and Galaxy.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

This move aims to catch up with the European crypto ecosystem, where cryptos are available to investors via structured notes, such as exchange-traded notes (ETN). The SEC took over four months to approve spot ETH ETFs, possibly due to differing views on staking.

The SEC has backed off on tightly regulating Ether to avoid more legal battles following a loss in a lawsuit against Grayscale for blocking the conversion of Grayscale Bitcoin trust into an ETF. This loss softened the SEC’s position and allowed for the first BTC ETFs.

Blockchain company Consensys also sued the SEC for its refusal to recognise Ether as a commodity. Grayscale currently holds nearly $11 billion in assets in its GrayScale Ethereum Trust (ETHE 0.84%), which it is attempting to convert into a spot-price ETF.

The SEC’s decision to allow the listing of ETH ETFs broadens investment opportunities for U.S. investors and may signal other regulators in the decision-making process for spot digital money products.

These new Ether ETFs might attract some attention from mainstream and institutional investors, but they may not gain as much momentum as the BTC spot price ETFs earlier this year. Investors should be mindful of fees, see if they match Ether’s spot price, and realise they cannot stake their holdings.

Final Takeaways

The crypto ETF market has grown significantly, becoming a $9 billion industry in recent years. Spot Bitcoin ETF inflows directly affect Bitcoin prices by increasing adoption, market validation, and trading activity. They attract mainstream investors, validate BTC’s legitimacy, create more trading avenues, and reduce the premium for institutional investors to acquire BTC through trusts and private funds.

BTC and ETH ETFs offer diversification, regulatory oversight, and ease of access to the cryptocurrency market. However, investors must be aware of volatility and market sentiment risks. A balanced, informed approach is crucial for leveraging these ETFs’ potential.

FAQ

What are the risks of investing in a BTC ETF?

The main risks include Bitcoin’s volatility, regulatory changes, fee discrepancies in ETF price tracking, and market manipulation due to inherent fees and other factors.

What is a BTC ETF, and how does it work?

A BTC ETF is an investment fund that tracks BTC’s price on stock exchanges, allowing investors to indirectly invest in BTC without purchasing, storing, or securing it themselves.

What are the alternatives to BTC ETFs?

BTC can be purchased directly from exchanges, ATMs, futures investors, or specialised platforms, each with its own set of risks and benefits.

How can BTC ETF affect the crypto market?

Spot BTC ETFs offer enhanced liquidity, stable prices, and easier price discovery in the BTC market despite higher expenses associated with securing and trading cryptocurrency.