How to Choose the Right Bitcoin Trading Platform Software for a Business

Articles

Any Bitcoin trading platform serves as the pivotal component within the digital trading system of cryptocurrency assets, encompassing a sophisticated structure comprising numerous interconnected and autonomous elements.

These elements encompass specialised, proficient, and versatile software designed for cryptocurrency exchange purposes, which undertakes specific responsibilities and functions to guarantee the seamless operation and integrity of the interaction process between clients, the exchange, and the market.

This article focuses on what Bitcoin trading platform software is, what key features it offers, and how it is categorised. You will also learn about a number of criteria to consider when choosing the right one.

Key Takeaways

- Bitcoin trading platform software is a set of utilities, services, and applications that perform a specific function, but together, they create conditions for the system’s stable operation.

- Such software provides security, continuity, and scalability for the system so that it can be expanded and modernised if necessary.

- CRM systems, API modules, crypto gateways, and trade execution systems are among the most popular technologies used in crypto trading platforms.

What is The Bitcoin Trading Platform Software?

The software utilised by Bitcoin trading platforms is essential for safeguarding the security of both users’ funds and personal data. Providing a secure environment for individuals to engage in cryptocurrency transactions is critical.

These platforms implement robust security measures, such as encryption and multifactor authentication, to protect against hacking and unauthorised access. Additionally, they often store users’ funds in cold wallets, and offline storage devices are less susceptible to cyber-attacks.

Another key feature of cryptocurrency trading software is its ability to provide users with access to a wide range of crypto coins. In addition to Bitcoin, these platforms frequently support other popular cryptos like Ethereum, Shiba Inu, Doge and so on. This allows traders to diversify their portfolios and exploit different investment ideas within the crypto market.

Bitcoin trading software offers various trading options for different trading strategies and preferences. Users can choose between spot trading, where they buy and sell cryptocurrencies for immediate delivery, or derivatives trading, where they speculate on the price movements of cryptocurrencies without actually owning them. These platforms also regularly provide margin trading, which allows users to trade with borrowed funds and potentially amplify their profits (but also their losses).

Additionally, online crypto trading platform software typically includes sophisticated trading interfaces and services to assist users in making informed trading decisions. These tools may include technical analysis tools, charting algorithms, and trading bots that automatically execute trades based on predefined strategies. This helps users save time and effort monitoring the market and executing trades manually.

Bitcoin trading platform software can be built from scratch, turnkey or used on a White Label model, which is a popular solution due to its affordability and flexibility.

Key Functionality of Bitcoin Trading Platform Software

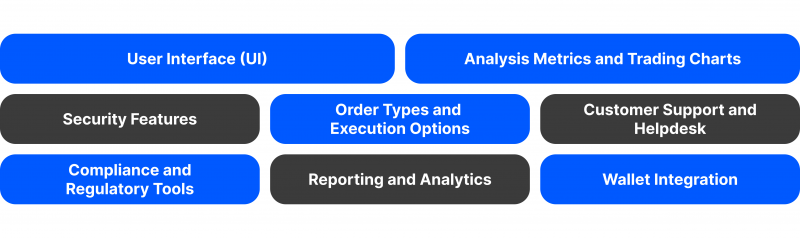

Bitcoin trading platform software typically consists of several key components that work together to facilitate the trading process. Here are the fundamental components of such software:

User Interface (UI)

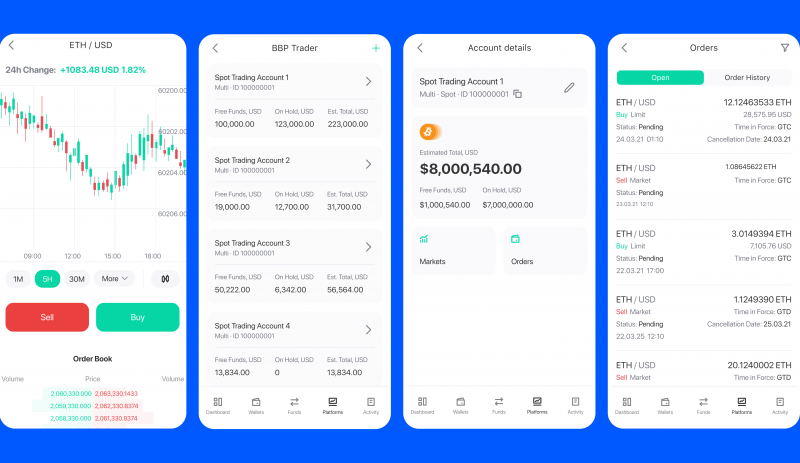

The user interface is the front-end component that traders interact with. It includes a graphical layout, charts, order placement forms, account information, and other visual elements that make it easy for users to navigate and execute trades.

Analysis Metrics and Trading Charts

Trading platforms often provide real-time price charts, technical analysis metrics, and other tools to help traders analyse market trends, identify patterns, and make informed trading decisions. These tools can include candlestick charts, moving averages, volume indicators, and more.

Security Features

Robust security measures are crucial for protecting user funds and sensitive information. This includes encryption of data, two-factor authentication (2FA), withdrawal whitelisting, cold storage for funds, and regular security audits.

Order Types and Execution Options

Trading platforms offer a variety of order types to cater to distinct trading strategies. These include market orders, limit and stop orders, and so on. The software must support multiple order types and provide users with the flexibility to set order parameters such as price, quantity, and time validity. By offering these options, traders can effectively manage their trades and execute them according to their specific requirements.

Customer Support and Helpdesk

Trading platforms should offer customer support channels, such as live chat, email support, or ticket systems, to assist users with their inquiries, technical issues, or account-related matters.

Compliance and Regulatory Tools

To meet legal and regulatory requirements, trading platforms may include compliance features such as Know Your Customer (KYC) verification, anti-money laundering (AML) checks, and transaction monitoring systems.

Reporting and Analytics

Trading platforms often provide reporting and analytics features that allow users to track their trading performance, generate transaction histories, and access other relevant data for tax reporting or portfolio analysis purposes.

Wallet Integration

Wallet integration allows users to securely store and manage their cryptocurrency holdings within the trading platform. It enables depositing and withdrawing funds, tracking balances, and generating unique wallet addresses for each user.

Main Categories of Bitcoin Trading Platform Software

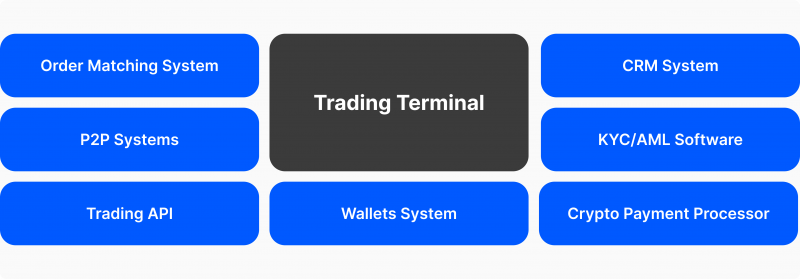

Presently, all Bitcoin trading platforms provide users with convenient and straightforward access to the cryptocurrency market. They offer a range of trading options, fiat and crypto transaction methods, and integration solutions that streamline the trading process, market analysis, analytics, and more. Some of the key and widely used software tools in crypto trading platforms include:

1. Order Matching System

The order matching engine is the core component responsible for matching buy and sell orders. It matches orders based on price, quantity, and other parameters. Efficient order matching ensures timely and accurate execution of trades.

2. P2P Systems

The P2P system revolutionises the way individuals trade by eliminating the need for intermediaries and enabling direct transactions. By leveraging distributed ledger technology, this system ensures the utmost safety, transparency, and efficiency at every stage of the transaction process.

P2P crypto software plays a crucial role in settlements using crypto assets and fiat currencies. It facilitates seamless trading and enhances user experience by offering a diverse range of digital assets for buying and selling. Additionally, it incorporates a merchant rating system and various supplementary features to guarantee transaction transparency and security.

3. Trading API

Bitcoin trading platform software relies heavily on trading APIs, which play a crucial role in enabling users to execute their trading strategies and styles. These application programming interfaces are designed to fulfil essential trading functions and offer support for various API types, such as WebSocket. By incorporating these APIs, the platform ensures efficient and responsive trading that caters to the specific demands of the market.

4. Wallets System

A wallet system refers to a collection of distinct and independent crypto addresses that form a specific exchange framework, such as savings, margin trading, or spot trading. It serves as the platform for all transactions involving the movement of crypto tools, covering activities like transferring assets between addresses, receiving deposits from other addresses and blockchain networks, initiating withdrawals, and securely storing assets using established protocols.

Each Bitcoin trading system has an integrated interface and software that facilitates the above-mentioned operations for any digital assets traded. However, external solutions can also be employed if required, including those that operate based on the White Label model. These additional solutions provide flexibility and customisation options to cater to specific needs and preferences within the crypto trading architecture.

5. CRM System

The CRM system is a powerful and adaptable tool for engaging clients on a crypto platform. It plays a crucial role in developing crypto spot trading software by enabling in-depth analysis of lead generation and customer interactions within the platform.

This software is designed to gather, organise, process, and evaluate all customer-related data and activities within the business framework. CRM solutions help businesses access valuable insights into customer interactions with the exchange, allowing for a precise understanding of each client’s journey. Ultimately, this leads to creating detailed customer profiles and establishing strong, lasting relationships with them.

6. KYC/AML Software

KYC/AML software plays a crucial role in ensuring security when establishing relationships with new clients. The software effectively minimises the risks associated with fraudulent activities, money laundering, and other illicit behaviours by utilising systems that facilitate comprehensive identity verification, assessment of trading goals, and analysis of transaction conditions.

This software comprises a suite of tools and applications seamlessly integrated into the infrastructure of cryptocurrency trading platforms, specifically within the security module that operates continuously during registration and throughout client engagement with the platform interface. Its proactive approach to risk mitigation and compliance enforcement underscores its significance in safeguarding the integrity of trading processes and upholding regulatory standards within the financial niche.

7. Crypto Payment Processor

The payment processor is a sophisticated combination of hardware and software, streamlining the payment process for various currencies on a crypto trading platform. Acting as a bridge between the trading platform and users’ wallets, the payment processor enables seamless operations such as storing and transferring different assets across multiple wallets and blockchain networks. Bitcoin payment providers are instrumental in facilitating Bitcoin exchange by offering this essential software.

Criteria to Consider When Choosing a BTC Trading Platform Software

The challenging landscape in which the majority of cryptocurrency brokers and exchanges operate has resulted in a situation in which selecting truly top-notch software for business purposes can pose a considerable challenge.

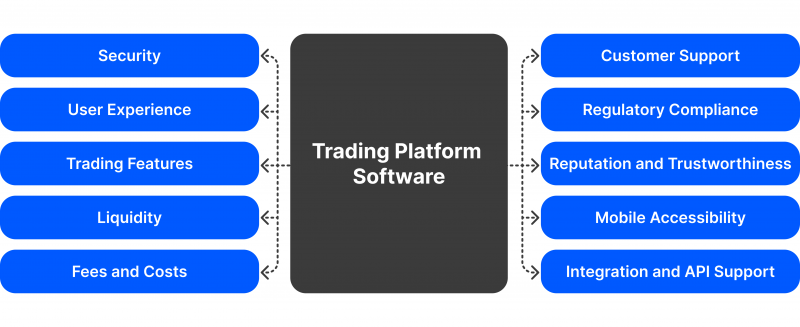

Choosing the right Bitcoin trading platform software is influenced by several factors that will impact the ease and effectiveness of the solution in the long run. Therefore, it’s imperative to evaluate the following factors when making this choice.

Security

When looking for a cryptocurrency trading platform, it’s crucial to ensure that it has robust security measures in place. These include encryption to protect your data and transactions, two-factor authentication (2FA) to add an extra layer of security to your account, and cold storage for your funds. Cold storage ensures your assets are stored offline, making them less vulnerable to hacking attempts.

User Experience

Assessing the user interface (UI) and user experience (UX) of a trading platform holds significant significance, as it directly influences the overall trading experience. A well-designed and user-friendly interface not only improves your ability to navigate the platform seamlessly but also simplifies the execution of trades and access to vital information, resulting in a more efficient and pleasurable trading journey.

Trading Features

Consider the range of trading features offered by the platform. Look for features like multiple order types (market, limit, stop), charting functionality, real-time market data, and access to various trading pairs. The availability of advanced trading features like margin trading and futures contracts may also be important, depending on your trading strategy.

Liquidity

In order to ensure a smooth and efficient trading experience, it is crucial to have sufficient liquidity on the trading platform. This means that there should be enough trading volume and depth in the order books, which facilitates easy execution of trades at desired prices. So, it is always recommended that you choose a platform with adequate liquidity provider integrations to avoid any inconvenience during trading.

Fees and Costs

When selecting a trading platform, assessing its fee structure is essential to determine its cost. You should take into consideration the trading fees, deposit and withdrawal fees, and any other charges that may be applicable.

To make an informed decision, it’s recommended that you compare the fee models across different platforms to find a balance between competitive pricing and the features offered. This will help you pick a platform that best fits your needs while also minimising the costs.

Customer Support

When selecting a platform, evaluating the quality of customer support they offer is important. You should look for platforms that provide prompt and efficient customer support channels, such as live chat, email, or phone support.

This will ensure that you can easily reach out to the platform if you have any questions or face any technical issues that need to be resolved. You can be assured of a smooth and hassle-free experience by choosing a platform with reliable customer support.

Regulatory Compliance

Ensure the platform complies with relevant regulations, especially if you are operating in a regulated jurisdiction. Look for platforms that have implemented Know Your Customer (KYC) procedures and adhere to anti-money laundering (AML) regulations.

Reputation and Trustworthiness

Research the platform’s reputation and reliability. Consider important aspects such as its history, user reviews, and the team behind it. Platforms with a strong reputation and positive user feedback are generally more trustworthy.

Mobile Accessibility

If you prefer trading on the go, it’s indispensable to evaluate whether the trading platform offers mobile applications compatible with your device’s operating system. Mobile accessibility allows you to conveniently manage your trades and offers enhanced flexibility. Assessing the availability of mobile applications ensures that you can easily monitor and execute trades anytime and anywhere, providing you with greater convenience and control over your trading activities.

Integration and API Support

If you need to integrate the trading interface with other systems or utilise algorithmic trading bots, verifying whether the platform provides robust API support is essential. A reliable API allows seamless integration and communication between the trading platform and external systems or bots. It enables you to automate trading strategies, access real-time market data, and execute trades programmatically.

By ensuring the platform offers comprehensive API capabilities, you can effectively integrate the platform with your existing infrastructure and leverage the power of automation and algorithmic trading to enhance your trading operations.

Conclusion

The determination of Bitcoin trading platform software is essential in the decision-making process regarding implementing trading activities in the crypto market. It directly impacts the comfort of working with elements of the crypto trading ecosystem, which in turn is a prerequisite for achieving investment goals within the chosen trading strategy.

FAQ

What factors should I consider when choosing a Bitcoin trading platform software for my business?

When selecting a bitcoin trading platform software, consider factors such as safety precautions, available cryptocurrencies, trading tools and features, fees, statutory compliance, customer support, mobile compatibility, liquidity, and reputation.

Can I integrate the Bitcoin trading platform software with my existing systems or algorithmic trading bots?

If you require integration, check if the platform offers robust API support. A well-documented and feature-rich API allows for seamless integration, automated trading techniques, and accessing real-time market insights.

What are the key elements of any Bitcoin trading platform?

In most cases, these platforms have payment processing systems, API modules for integration, order entry systems, trading terminal, KYC authentication systems and CRM tools.