Bull Flag Pattern vs Bear Flag Pattern: Master These Powerful Trading Patterns to Stay Ahead

Trading in forex and cryptocurrency markets has exploded in popularity in recent years. With fast price changes and the chance for big profits, these markets are exciting but can also be unpredictable. That’s why learning to recognise specific candle formations is essential for making smarter trading decisions.

Flag patterns are especially popular because they happen often and are known for their reliability. Data shows that bull flags, for example, successfully predict price movements around 67% of the time, making them a powerful tool for traders.

This article will explain the differences between two popular flag formations: the bull and the bear flag pattern. Knowing how these patterns work will help you navigate the market’s ups and downs more precisely.

Key Takeaways

- Bull and bear flag patterns signal the potential resumption of an uptrend or downtrend, respectively.

- A bull flag has a sharp rise followed by a small pause or pullback, while a bear flag has a sharp drop followed by a small bounce or pause.

- Watching trading volume helps confirm these patterns, with higher volume during the breakout or breakdown making them more reliable.

- Set clear entry points, stop-loss levels, and profit targets based on the size of the flagpole to manage your trades better.

What is a Bull Flag Pattern?

A bull flag pattern is a chart formation that shows a temporary pause during an uptrend before the price continues to rise. Traders use this bullish pattern to find good opportunities to buy and ride the trend higher.

The bull flag pattern consists of two main parts:

- The Flagpole: A sharp, steep rise in price that shows strong buying momentum.

- The Flag: A short pause where the price moves slightly down or sideways, forming a shape like a small rectangle or parallelogram.

The pattern completes when the price moves above the flag, continuing the upward trend.

On a chart, the bull flag shows red (downward) candles during the flag phase, but these candles are smaller than the green (upward) candles in the flagpole.

During the flagpole phase, trading volume is typically high, reflecting strong buying interest. Volume decreases during the flag formation and then spikes again during the breakout.

How Traders Use It

Traders use bull flag patterns as signals to open long positions. Entries are typically placed just above the breakout point of the flag, while stop-losses are set below the flag’s lowest price. The potential target is calculated by adding the height of the flagpole to the breakout level, projecting the likely development of the trend.

What is a Bear Flag Pattern?

A bear flag pattern meaning is the opposite of a bull flag. It shows a pause during a downtrend before the price continues to fall. Traders use this pattern to find good opportunities to sell or “short” the market.

The bear flag candlestick pattern also consists of two main parts:

- The Flagpole: A steep and sharp price drop showing strong selling momentum.

- The Flag: A short pause where the price moves slightly up or sideways, forming a shape like a small parallelogram.

The formation is confirmed when the price breaks down below the flag, continuing the prior downtrend.

On a chart, the bear flag shows green (upward) candles during the flag phase, but these candles are smaller than the red (downward) candles in the flagpole.

Trading volume is usually high during the sharp drop of the flagpole, then decreases during the flag’s formation. Volume typically rises again when the price breaks down, confirming the pattern.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

How Traders Use It

Traders use bear flag patterns to enter short positions. Entry points are set below the flag’s breakdown level, with stop-loss orders above the flag’s height. Profit targets are determined by measuring the height of the flagpole and projecting that distance downward from the point of the breakdown.

Patterns on longer time frames are more reliable but require more patience.

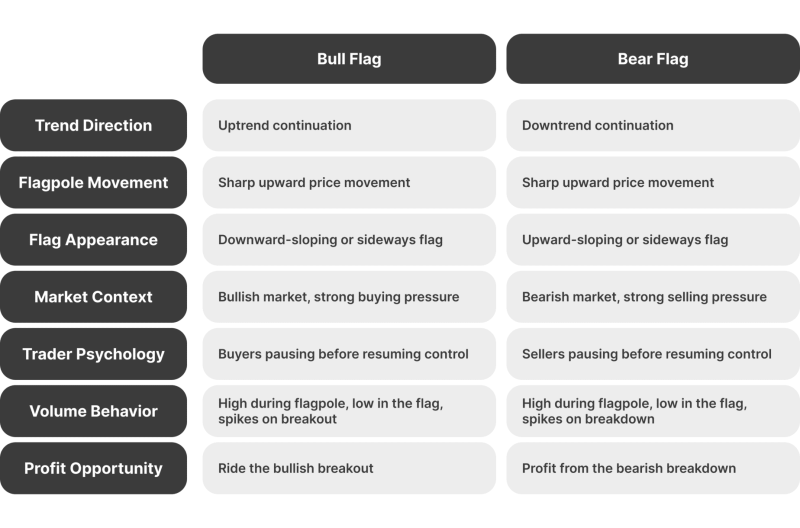

Bull Flag Pattern vs Bear Flag Pattern

Bull and bear flag patterns might look similar but point to very different market movements. Here’s a simple breakdown of how these patterns differ:

Direction and Meaning

Bull and bear flags tell traders where the market might be heading.

- A bull flag shows up during an uptrend and suggests the price will continue to rise after a short pause.

- In contrast, a bear flag forms during a downtrend and signals the price will likely keep falling.

Traders use these patterns to align with the current trend. For instance, a bull flag is most useful in a market already moving upward, while a bear flag works best when the market is trending down.

Chart Appearance

On a chart, bull and bear flags look like small rectangles or flags on a pole, but their direction sets them apart.

- A bull flag chart pattern starts with a steep price rise (the flagpole) followed by a slight downward or sideways movement (the flag).

- On the other hand, a bear flag pattern chart begins with a sharp price drop (the flagpole) and is followed by a small upward bounce or sideways movement (the flag).

Both patterns are named for their resemblance to a flag on a pole. The difference lies in the flagpole’s direction and the flag’s slant. A bull flag’s flag slants downward, while a bear flag’s flag slants upward.

Market Context

Bull flags form in markets where buyers are in control but need a moment to take profits or rest before pushing the price higher. This creates a small pause or pullback before the uptrend resumes.

Bear flags, on the other hand, form in markets where sellers dominate. Prices may bounce slightly during the pause, but the overall trend continues downward.

Both formations show that the market is taking a breather before continuing its original direction. Recognising this context helps traders anticipate the next big move and align their trades with the trend.

Trader Psychology

The psychology behind these patterns reflects market behaviour.

- During a bull flag, buyers take a break, causing the price to pull back slightly. When the price breaks above the flag, it signals renewed optimism, and buyers come back with more strength.

- On the other hand, a bear flag reflects temporary hesitation among sellers, leading to a slight upward bounce. Once the price drops below the flag’s support level, bearish sentiment takes over, and sellers regain control.

Understanding the emotions driving these patterns can help traders interpret market behaviour and avoid getting caught in fake breakouts or breakdowns.

Risk and Reward Potential

Both patterns offer good profit opportunities if traded carefully. In a bull flag, traders buy when the price moves above the flag and aim for a target based on the length of the flagpole. In a bear flag, traders short-sell during the breakdown and use the flagpole’s length to estimate how far the price might drop.

Stop-loss orders are essential to limit potential losses if the pattern doesn’t work as expected. Properly managing risk and reward ensures that the overall strategy remains profitable even if some trades fail.

How to Identify and Trade Flag Patterns?

Flag formations can help predict where prices are heading next, but to use them well, you need to know how to spot and confirm them.

Spotting a Flag Pattern

A flag on the chart has two parts: a steep price move called the flagpole, followed by a short pause or consolidation, which forms the flag. This flag can slope slightly or move sideways.

For example:

- Bull Flag: On a 1-hour chart, the price of XYZ stock rises quickly from $100 to $120 (the flagpole). Then, it consolidates between $115 and $118, forming the flag.

- Bear Flag: On a 15-minute Bitcoin chart, the price drops sharply from $70,000 to $65,000 (the flagpole). Then it retraces a bit, moving between $65,200 and $66,000, creating the flag.

Choose a chart timeframe that matches your trading style. For short-term trades, use 15-minute or 1-hour charts. For longer-term trades, look at daily or weekly charts. Well-formed patterns with clear flagpoles are the most reliable.

Confirming the Pattern

Before entering a trade, you need to confirm that it’s a valid flag formation. This means looking for a price breakout (bull flag) or breakdown (bear flag) with increased trading volume.

- Bull Flag: If XYZ stock breaks above $118 and volume increases significantly, it confirms the bull flag. This shows the uptrend is likely to continue.

- Bear Flag: If Bitcoin falls below $65,200 and volume spikes, it confirms the bear flag. This signals the downtrend is resuming.

Volume is key to confirmation. A breakout or breakdown without higher volume could be a false signal, so patience is important.

Placing Stop-Losses

Stop-loss orders are essential for protecting your trade from unexpected reversals.

- Bull Flag: Place the stop-loss slightly below the lower boundary of the flag or a key support level.

- Bear Flag: Position the stop-loss slightly above the upper boundary of the flag or a resistance level.

This ensures that your losses are limited if the pattern fails.

Setting Profit Targets

Profit targets help you plan your trade exits in advance. Find the flagpole’s height and project it from the breakout or breakdown point. This gives you a clear and realistic target for where the price might move, allowing you to secure profits while avoiding emotional decisions.

Avoiding Common Mistakes

There are a few common errors to watch out for when trading flag patterns:

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

- Misidentifying the Pattern: Make sure the flagpole is steep, and the flag is compact. If the price moves sideways for too long, it might not be a flag pattern anymore.

- Ignoring Volume: A breakout or breakdown without high volume is less reliable. Always check that the volume supports the pattern.

- Entering Too Early: Don’t enter a trade before the price confirms the breakout or breakdown. For instance, buying XYZ stock at $117 before it breaks $118 could leave you stuck in a sideways market.

By waiting for clear signals and confirmation, you can avoid unnecessary losses.

Using Indicators for Support

Additional tools like technical indicators can make flag patterns more reliable and easier to trade.

- Moving Averages: Check the trend with moving averages. If XYZ stock is above its 50-day moving average, it supports the idea of a bull flag.

- RSI: Check if the market is overbought or oversold. Avoid buying a bull flag if RSI indicates extreme overbought conditions.

- MACD: Use to gauge momentum. A bullish MACD crossover supports a bull flag breakout, while a bearish crossover confirms a bear flag breakdown.

For example, if Bitcoin’s MACD shows a bearish crossover while the flag is forming, it adds confidence that the bear flag will likely lead to a further price drop.

Managing Risk

Effective risk management is vital for consistent trading success. Keep your trade size proportional to your overall account balance and ensure you only risk a small percentage of your capital on any single trade.

Aim for a favourable risk-reward ratio, such as 1:2, where potential profits outweigh potential losses. Regularly review your trades to refine your strategy and learn from past mistakes.

Final Thoughts

Flag patterns are simple yet powerful tools that help traders predict where the market might go. A bull flag shows that prices will likely keep rising, while a bear flag suggests prices will probably keep falling. Learning how to spot patterns and use them in your trading can help you make smarter decisions.

Here’s how to get better at trading:

- Practice spotting patterns: Look for them on historical charts to understand how they form.

- Complement with other tools: Use indicators like volume, moving averages, or RSI to confirm the movement.

- Start with a demo account: Practice trading risk-free to refine your strategy before risking real money.

With time, patience, and practice, flag patterns can become a valuable part of your toolkit, helping you trade more confidently.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Trading in financial markets involves significant risk, and you should only trade with capital you can afford to lose.

FAQ

What happens after a bearish flag?

After a bearish flag forms, the price usually drops below the lower edge of the flag, signalling the continuation of the downtrend. This signals that selling pressure is resuming, and prices will likely fall further. Traders often sell or short during this breakdown to take advantage of the move.

Is the flag pattern bullish or bearish?

Flags can be both bullish and bearish, depending on the trend before the flag. A bull flag happens after a strong price rise and signals the uptrend will likely continue.

How long does a flag pattern last?

Flag patterns are typically short-term and can last anywhere from a few hours to a few weeks. The exact length can differ depending on market conditions and the specific asset being analysed.