Commodities Liquidity: How it Works for Behind the Scenes

Articles

Commodities are the raw materials that drive the global financial system and the world as we know it today. Some examples of commodities include natural gas, oil, and precious metals. Investing in these securities can be profitable due to their frequent price volatility. However, investing in commodities needs specialized expertise and may be riskier than investing in more traditional assets such as bonds and stocks, especially during market turmoil.

Since commodities tend to be more unpredictable than other alternative investments, liquidity is vital. A liquid asset is the asset that can be bought or sold quickly without affecting the market price. A high amount of trade on an asset usually results in high liquidity. Due to the ease of entering and exiting positions, trading with these assets is much smoother than in illiquid ones.

In this article, we will look at what commodities liquidity is and how it works, its benefits, and how a business or a brokerage can get commodities liquidity. Finally, we will discuss the role of modern technology in the commodities market and give some modest predictions on the future of commodities.

What Commodities Liquidity Is And How Does It Work?

First, let’s take a brief look at what commodities are. There are several methods of how people can invest in these materials, including the physical commodities market. Some of the tangible commodities at the core of such markets include items you hear about daily, such as a barrel of oil, a bar of gold, a load of grain or wheat, coffee, and so on.

Physical commodities are traded between suppliers, traders, and final consumers. Every trading product is known as a derivative and is liquid thanks to the derivative markets full of traders, speculators, and other involved parties. Moreover, the price of this asset represents the worth of the core raw commodity.

But what does liquidity in commodities represent? There are several rates of liquidity available for various commodity raw resources. Let’s examine some of the more and less liquid commodities markets and industries to further grasp the concept of liquidity.

Rare materials: For instance, gold represents the most liquid precious metal since it is traded the most out of all the rare metals. In addition to the OTC forward (forward contracts) and exchange markets, gold is traded on the physical market and used in many industries globally. Along with ETF products based on the metal, liquid gold futures and options contracts are available on exchanges. There are also less liquid precious metals, for example, rhodium. Note that rhodium is only traded on a physical market. As a result, when we compare those two metals, you can see that gold is much more used and liquid than rhodium because rhodium futures cannot be traded “digitally.”

Energy: As of today, crude oil, natural gas, and other essential commodities are regarded as the most widely traded and predominant commodities in the world. Contrarily, coal does not trade as widely or with as many derivatives as crude oil or gas. So, that leads us to a conclusion that compared to coal, crude oil is a more liquid energy resource.

And how does it all work?

The purchaser of the futures contract earns a profit if the underlying commodity’s price increases. Consequently, he receives the contract at the reduced price that was mutually agreed upon and is now available to resell at the going market rate. If the price drops, the seller of the futures receives the revenue. He can acquire the product at the current lower market price and sell it to the futures buyer at the higher price mutually promised.

Now, let’s look at the benefits of commodities liquidity.

Advantages Of Commodities & Their Liquidity

Many investors and brokerages consider commodity trading one of the riskiest yet most attractive and profitable. Some market participants are discouraged from engaging in commodities because of the markets’ turbulence and their sophistication, especially during a challenging time across the world. Nevertheless, a carefully thought-out commodity investment could be highly beneficial for investors’ portfolios and brokerages. Moreover, commodities themselves and commodities liquidity also provide several advantages. Here are a few remarkable benefits:

High Returns

As already mentioned, these markets are often fairly turbulent. Due to that, they are subject to significant price spikes. For instance, oil prices could skyrocket during a war or if a significant conflict breaks out in a sizable oil-producing nation like Iraq, Venezuela, etc. Experienced investors might use these price fluctuations as an opportunity to profit. Compared to other assets, investments in commodities are likely to produce higher returns with careful planning. Brokerages, therefore, often offer the most used and liquid assets, such as oil, gold, wheat, etc.

Portfolio Diversification

Commodities are great assets for additional diversification for both traders and brokerages. Typically, there is little or no link between the returns on commodities and those on other significant asset groups. Commodities frequently rise in prices when bonds and stocks decline. Therefore, there might occasionally be no correlation at all between the outcomes. For instance, factors that influence returns on stocks and bonds do not have the same impact on returns on commodities. In addition, commodities may respond differently from other investments in various economic and geopolitical situations. That said, returns from a diversified portfolio with low asset correlation typically have lower volatility. Consequently, investment in commodities ensures diversity and boosts profits after adjusting risk.

Sufficient Commodities Liquidity

Note that commodities liquidity is relatively high thanks to investments in these assets offered by the most significant brokerages. It is undoubtedly higher when compared to, say, investing in assets like real estate or art. Anytime a position needs to be liquidated, an investor can do so. Besides that, commodity futures can be bought and sold with ease.

Trading With A Lower Margin

A commodity futures trader may deposit a fixed quantity with the brokerage as a margin. The margin can be in the range of 5–10% of the contract’s combined worth. This is far less than the margin needed for other asset classes. As a result, the investor can purchase with less capital while taking on more significant positions. Additionally, this increases the possibility of greater revenues.

Hedge Against Potential Risk

The investments of market participants slowly but surely depreciate due to catastrophic events, wars, conflicts, and economic crises. Stocks or bonds are dramatically affected by such situations. However, these events may cause the price of some commodities, and their liquidity, to increase. For instance, supply disruptions brought on by armed conflict may increase the price of commodities like oil. Therefore, these commodities may be used as a setback hedge against certain event risks.

How to get commodities liquidity (for brokerages)

Now, let’s say you wish to start a brokerage. To begin with, having a liquidity provider (LP) is crucial. It is so because trades are sent and executed by such providers. In the market, they serve as a “gate” for selling and purchasing a specific asset class. A liquidity provider is commonly known as a “market maker” because LP creates and delivers the liquidity the market needs.

Quality brokers need a trustworthy, reliable company with a variety of resources and tools. As a broker, you must take your time when selecting a liquidity provider and conduct a thorough analysis of costs, economic productivity, the efficiency of the trading equipment, monitoring of the system, and legal considerations.

Below are some ideas on what to look for while seeking commodities liquidity offered by a particular provider:

Demand Accuracy & Speed Of Trade Execution

A serious liquidity provider must offer fast execution as a primary aspect, as well as complete post-trade clarity. The execution mechanism should be thoroughly examined, especially when new market data is released and unforeseen situations occur. If they are using automated trading software or an app that enables you to gather comprehensive statistics, you should be able to assess transaction performances quickly.

Ask For Multiple Trading Instruments

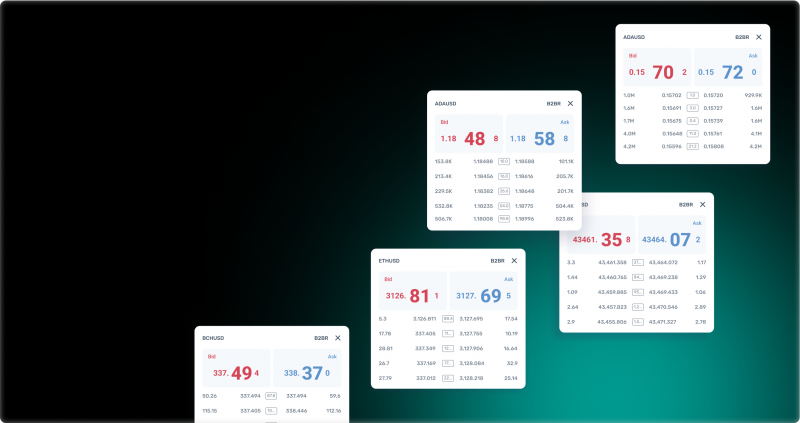

Another essential factor when looking for additional liquidity is the order book transparency and multi-asset liquidity, which must be included in every serious liquidity provider. Speaking more broadly, Forex, bonds, stocks, equities, CFDs, commodities (such as agriculture, energy, and metals), cash indices, futures indices, and ETFs should all be included on the list of market tools. You should be given access to a complete order book by a liquidity provider via a trading platform and the FIX protocol to view the order book’s historical tick data.

Pricing For Liquidity

Ensure your liquidity provider has reasonable maintenance costs, spreads, and commissions. Verify that instruments based on futures, such as commodities and indices, are not subject to swap fees.

Look For An STP Or Other Models

Straight-Through Processing, also known as STP, is a method where LPs provide the ask and bid prices. Traders place orders with brokerage firms, which are sent immediately to liquidity providers.

Now, let’s look at what modern technologies bring to the markets and why they have become more accessible for traders.

Modern Technology In The Commodities Market

Traditionally, only industry insiders used to have access to data about the demand and supply of commodities like oil, metals, and others, making commodities trading a private business. But in the twenty-first century, very few companies have remained unaffected by technological advancements. Trading with commodities is no exception.

In current conditions, thanks to trustworthy and reliable suppliers, the information previously required to conduct lucrative trades is now commonly available as a result of technological advancements. Furthermore, information became more thorough and up-to-date. A certain level of democratization of commodities trading has resulted from this; while significant capital is still required to acquire and operate on the markets and see good profits, becoming successful today depends more on how you use the publicly available information rather than on “connections.”

Publicly Available Insights

A wide range of factors influences the value of a commodity. The output, transit, usage, and other factors of a commodity should be constantly monitored for traders to make the best decisions. This information is mainly gathered from hundreds of sources, such as newsfeeds, AIS (Automated Identification System), customs, etc.

Independent data and analytics providers now play a crucial role in commodities markets, even though “whales” have experts analyzing markets.

As mentioned above, commodity traders now have access to more sources, quality data, and accuracy, which have improved due to technological advancement. For example, the position and quantity of storage facilities for commodities like crude oil may now give investors a more transparent image when making investment decisions. When analyzing the flow of products, additional levels of knowledge give buyers a competitive advantage, mainly thanks to instant access.

Democratization Of The Market

Smaller enterprises can now compete on an even playing field in the commodities market because of the availability of data and improved access to analytics platforms.

For instance, some traders immediately changed their trading plans due to reconfiguring vessels when the container ship Ever Given was blocked in the Suez Canal in March 2021. The most important aspect was that everyone had access to the information, not just a select group of “chosen ones.”

The Future Of Commodities Liquidity

In the current world, planning for the future is challenging yet essential for commodities and their liquidity. The outlook is uncertain for several of them, but it appears promising for those related to electric vehicles (EVs).

In the following decades, the EV market is anticipated to expand rapidly. Government initiatives in the EU, China, and the US, along with reducing battery prices, seem to motivate carmakers to set affordable EV prices. This should increase EV demand and mitigate the risks associated with infrastructure and driving range restrictions. Furthermore, by 2025, increased EV adoption and technology advancements are estimated to lead to cost reductions of 10 to 25% per component, significantly lowering prices and enhancing EV popularity.

That would lead to the increasing demand for commodities such as lithium, cobalt, and graphite – three vital materials used in EVs and batteries, which are already beginning to rise.

The imbalance between supply and demand for minerals, however, can cause serious problems in some countries. Future demand for these products will increase the liquidity of those commodities as potential buyers could battle to secure their sources of supply.

Long-term, commodities investments may be profitable. However, success will largely depend on the ability of a trader to capitalize on the latest developments. Trying to predict the future—whether it involves EVs or yet another revolutionary development—will be more important than ever.

To conclude, most assets, not just commodities, need liquidity. It is a vital part of trading, thanks to which execution has become easy. That encourages more investors and speculators to enter the market. Since fewer trades might lead to less stable pricing, an illiquid market tends to be significantly more turbulent than a liquid one. Thus, liquidity does lower the cost of trading, which is the most significant attribute for all market participants.