Crypto Hack Cases Surge in 2024: Can the Industry Adapt?

The year 2024 has been marked by an unsettling trend in the crypto world: a noticeable shift in the tactics, targets, and scale of crypto hacking incidents. Despite technological advancements and heightened awareness, major security breaches have tested the industry’s resilience.

The question remains: is the crypto industry becoming more secure, or are crypto hack methods evolving faster than defences?

Biggest Crypto Hacking Incidents in 2024

Crypto-hacking continues to be a major threat, from sophisticated phishing schemes to vulnerabilities in decentralised finance (DeFi) protocols.

According to the FBI report, North Korean hackers are responsible for the year’s biggest crypto hack, stealing 4,502.9 BTC (approximately $308 million) from the Japanese-based DMM Bitcoin exchange.

The attackers utilised social engineering, exploiting human vulnerabilities to access critical systems. By posing as recruiters on LinkedIn, they tricked an employee into executing a malicious script disguised as a pre-employment test, ultimately exposing the exchange’s unencrypted communication channels.

This was not an isolated incident. WazirX, an India-based exchange, was another high-profile target of North Korean crypto hacker groups, losing $234 million in June. The breach underscored vulnerabilities in private key management—the most exploited vector in 2024.

Once stolen, cryptocurrency is often laundered through decentralised exchanges, mixing services, or cross-chain bridges, making tracking funds exceptionally challenging.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

In the case of the DMM Bitcoin hack, the attackers used a combination of intermediary wallets, Bitcoin CoinJoin Mixing Services, and bridging platforms to obfuscate the trail before transferring funds to entities associated with illicit operations.

According to Chainalysis, North Korean hacking groups, such as the infamous Lazarus Group, were responsible for 61% of all stolen cryptocurrency in 2024, amounting to $1.3 billion in illicit gains.

By leveraging techniques such as private key mismanagement and transaction obfuscation through mixing services, North Korean hackers demonstrated a level of sophistication that remains a significant challenge for the industry, Chainalysis researchers note.

The Shift from DeFi to Centralised Platforms

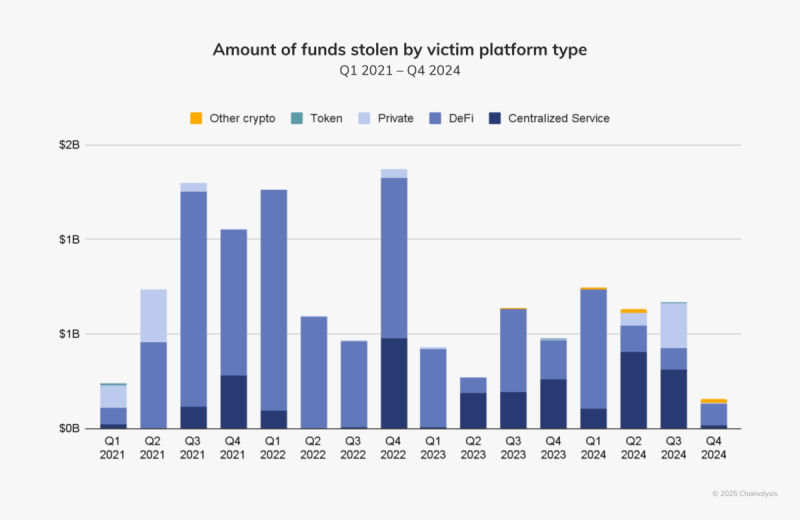

Between 2021 and 2023, DeFi platforms were the primary targets for crypto hackers. Developers’ prioritisation of rapid growth often came at the expense of robust security measures, making these platforms attractive to attackers.

However, according to the recent Chainalysis report, 2024 marked a notable shift, with centralised exchanges becoming the primary focus in Q2 and Q3.

The reason for this transition lies in the scale of opportunity. Centralised services, managing vast amounts of user funds, present a more lucrative target for crypto hackers.

Moreover, the compromise of private keys—responsible for 43.8% of stolen crypto in 2024—demonstrates that centralised platforms must urgently enhance mechanisms for safeguarding these critical access tools.

A Stagnation in Hacking Activity in the Second Half of the Year

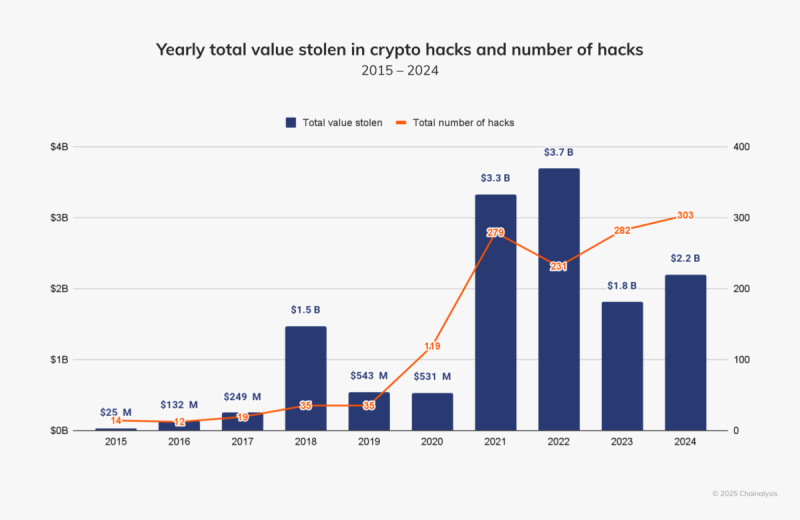

While the total value of theft in 2024 increased 21% year over year, the pace of hacks slowed in the latter half of the year. By July, $1.58 billion had already been stolen, but hacking activity tapered off following a June North Korea-Russia summit.

Analysts speculate that geopolitical factors, including North Korea’s military commitments in Ukraine, may have diverted resources away from cyber operations.

Nevertheless, the number of incidents rose from 282 in 2023 to 303 in 2024, indicating a worrying trend.

Is the Industry Becoming More Secure?

The crypto industry faces a paradox: while technological advancements offer more robust defences, hackers continually evolve tactics. The relative stagnation in stolen volumes during the latter half of 2024 is encouraging, but the increasing frequency of incidents reveals persistent vulnerabilities.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

However, advancements in blockchain analytics and predictive technologies are promising in mitigating the threats posed by these threats and potentially recovering stolen crypto assets. Chainalysis, for instance, has integrated machine learning tools through its acquisition of Hexagate to detect suspicious activities proactively.

A key takeaway from 2024’s crypto hack cases is the need for a multi-faceted approach to security. The industry must balance technical innovation with organisational vigilance and cross-sector collaboration.

By addressing gaps in both technology and human factors, the crypto ecosystem can move closer to achieving its promise of a secure and decentralised financial future.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.