Crypto Market Liquidation: $527M Worth Crypto Liquidated, Bitcoin Below $62,000

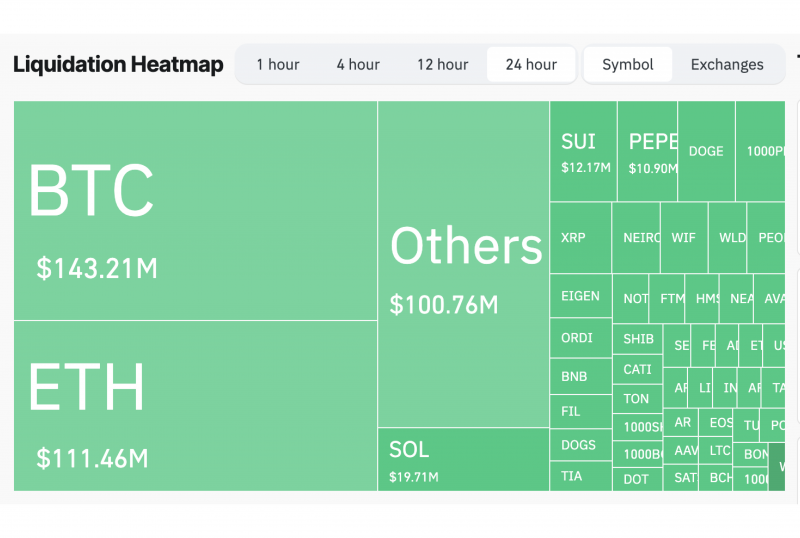

The crypto market experienced major volatility recently, with over $527 million liquidated as Bitcoin’s price dropped below $62,000. This sharp decline has dampened the optimism that typically surrounds “Uptober”—a month historically known for bullish trends in BTC and broader crypto markets. The massive liquidation impacted more than 155,000 traders, with long positions contributing the majority of the total liquidation heatmap.

What Triggered the Crypto Selloff?

The ongoing conflict in the Middle East and increasing global economic uncertainty have contributed to risk-off sentiment among investors. Amid these tensions, Bitcoin’s drop was further fueled by investors rotating into safer assets, including gold. Data from the crypto liquidation chart highlights that $448 million in long positions were wiped out within 24 hours, with the largest liquidation order on Binance valued at $12.66 million.

The crypto selloff was compounded by concerns over spot BTC ETFs, particularly as regulatory clarity from the SEC remains elusive. In fact, the market briefly reacted to rumours about a Bitcoin ETF approval before corrections were made, amplifying uncertainty and leading to the crypto market liquidation of over $214 million earlier this year due to a false SEC tweet.

Market Sentiment and Analyst Opinions

Despite this setback, the crypto market has seen resilience in the past. Historically, October has been a favourable month for Bitcoin, posting an average gain of 22% since 2013.

However, analysts are divided on whether this trend will hold in 2024, given the heightened volatility and external pressures like inflation and geopolitical instability. The upcoming November Fed meeting is expected to provide further clarity on interest rates, which could either buoy or further sink the market, depending on the outcome.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

Broader Implications: Institutional BTC ETF Outflows

In addition to the recent crypto market liquidation event, Bitcoin ETF outflow has surged. Notably, the week ending October 2 recorded the highest outflow in almost a month, reflecting growing caution among institutional investors. With global economic uncertainty persisting, institutional players may continue adjusting their positions in crypto assets, potentially leading to further market volatility.

What Lies Ahead?

While the current crypto market liquidation and massive selloff raise questions about “why is Bitcoin going down?” the crypto market has historically bounced back from similar downturns. Investors are advised to watch key economic indicators closely, including the Federal Reserve’s interest rate policy and further developments regarding Bitcoin ETFs, as these will likely influence market movements in the coming weeks.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.