What is a Margin Call?

If you’re new to the financial trading world, the word “margin call” can be scary. But once you understand what it is and how it works, you’ll find that it’s actually a useful tool for investors, protecting against losses in volatile markets. In this blog post, we’ll look at what is a margin call, why it occurs, and what to do if you received it.

Margin Call Definition

A margin call is an order from the brokerage services or financial institutions to a trader requiring the customer to deposit additional funds or securities into the account. This occurs when the overall value of the assets in a margin account falls below a designated level – the maintenance margin requirement.

If the trader does not add money to the margin account, the broker may be forced to take drastic measures, such as liquidating current positions and realizing a loss.

Margin trading is a popular strategy for increasing market buying power. Traders can increase their position size beyond what they could typically afford with their own capital by getting a margin loan from a broker. The trader would basically borrow money from the brokerage to use for trading. More leverage means more potential earnings and more risk if the market moves against them.

That is why traders need to understand the concept of margin and keep enough funds or other assets in their brokerage account. Brokers impose the maintenance requirement to protect themselves from potential losses, but they also protect traders from major losses caused by negative market moves.

Regulators and Мargin

Financial regulators are responsible for setting the minimum maintenance requirement to ensure that traders have the proper risk management tools in place. In the US, the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC) set a minimum margin for brokers.

In most cases, you’ll need to hold at least 25% of the value of your margin account in cash or other readily transferable assets. However, some brokerages choose to set their own, higher, maintenance requirements, some as high as 40%

These regulations help protect both investors and brokers from excessive losses due to poor trading decisions or market volatility. The margin level set by FINRA and the SEC are designed to limit the amount of leverage traders can use, therefore reducing risk exposure.

Key Points

- If you fail to maintain the minimum levels on your margin account, you will get a margin call, which is a demand from the broker to deposit cash or securities.

- If a trader fails to add more cash, brokerage firms will often force them to sell assets at any market price in order to meet the margin call.

- Investors may avoid margin calls by monitoring their equity and having enough money in the account to maintain the value over the specified level.

Why Does It Happen?

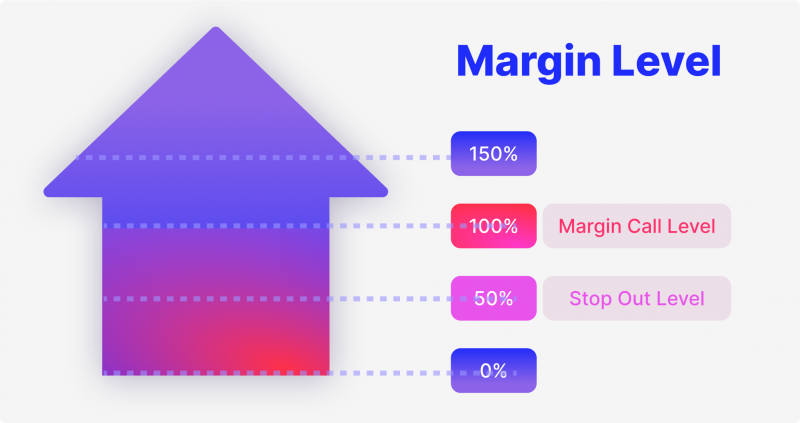

A margin call is initiated when volatility causes the customer’s account value to fall below the broker’s requirements. To trade on margin, traders must deposit a certain percentage of the amount of their position into their margin account. The owner of the margin account does not need to make any further deposits as long as the value of the assets in the margin account stays above this level. But, if the trader’s account balance goes below the thresholds set by the broker, the user will get a margin call.

Understanding the impact of market volatility and modifying your position sizes accordingly while margin trading is critical. High market volatility can significantly raise the likelihood of receiving a margin call.

When markets are volatile, prices tend to move quickly and unpredictably. Such unpredictability in the market makes it hard for traders to maintain the initial margin requirement.

When the value of an asset plummets, it can quickly become difficult to keep the position open because its size is too large relative to its current market value. This may result in a margin call since the consumer does not have enough funds in their margin account to meet the necessary maintenance margin for their existing trades.

It is also critical to be informed of your broker’s margin requirements. Each broker may have their own varying initial and margin maintenance requirement, so traders should be aware of these before making a trade. This will help them prevent any unexpected margin calls in the future.

Margin Call Example

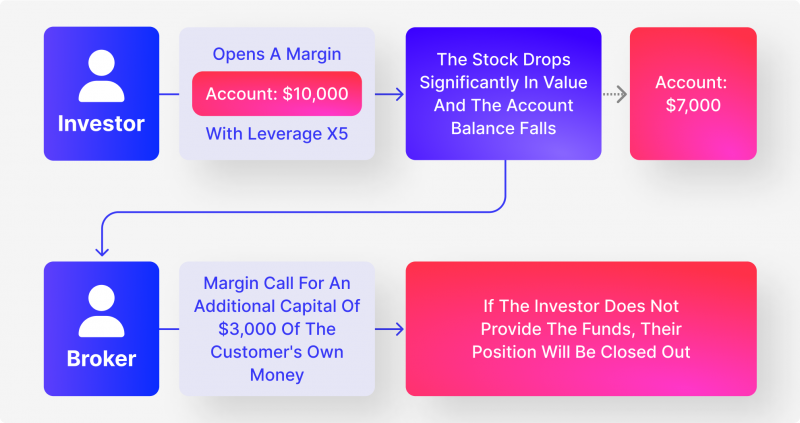

An investor opens a margin account with $10,000 and uses leverage to increase his purchasing power to $50,000 and buy stocks. In this case, the loan amount would be $40,000. After several days the stock drops significantly in value and the account balance falls, thus reducing the equity in their account down to $7,000. The broker will issue a margin call for an additional capital of $3,000 of the customer’s own money.

If the investor does not provide the funds by the deadline set by the brokerage firm, their position will be closed out to cover any potential losses from further price movements. In this case, if the investor cannot provide the needed funds, they would need to sell some or all of their existing holdings and realize a loss.

What Happens During a Margin Call?

During a margin call, the broker will notify their client that they must make up the difference to keep their current positions. The trader is then given a deadline by which they either close their position or fill the gap. If the trader does not comply with the request, all active positions may be liquidated in order to meet maintenance margin requirements.

It’s worth noting that during a margin call, traders may still manually close out part of their holdings to enhance liquidity and decrease risk. If more is needed, the broker may be obliged to liquidate open trades to protect itself from future losses.

When faced with a margin call the trader has several response options. The most obvious option is to deposit the trader’s own cash in order to meet the level set by the broker. This will allow the trader to keep their positions open and continue trading.

Another possible option is to liquidate some of the current holdings to minimize overall risk exposure. Nevertheless, this should be done with caution since it entails incurring losses that may not have been required if other actions had been taken sooner.

Finally, traders might search for additional investors or lenders prepared to supply sufficient capital quickly to satisfy maintenance margin levels and prevent liquidation.

How to Avoid Margin Calls

While margin calls can be a formidable problem for traders, a few options are available to avoid them. Knowing these strategies and applying them correctly can make all the difference in whether you experience significant losses or stay profitable in the market.

Manage Open Positions

Closely monitoring positions and maintaining adequate margin levels is one of the most efficient techniques to avoid a margin call. It’s important to understand a trader’s risk tolerance and keep an eye on the open positions to identify any potential issues before they become large enough to trigger a margin call.

Keeping adequate amounts of margin in one’s margin account can also help avoid a margin call; it allows traders to stay in control of their positions and reduces the chances of having their trades forcibly closed due to insufficient funds.

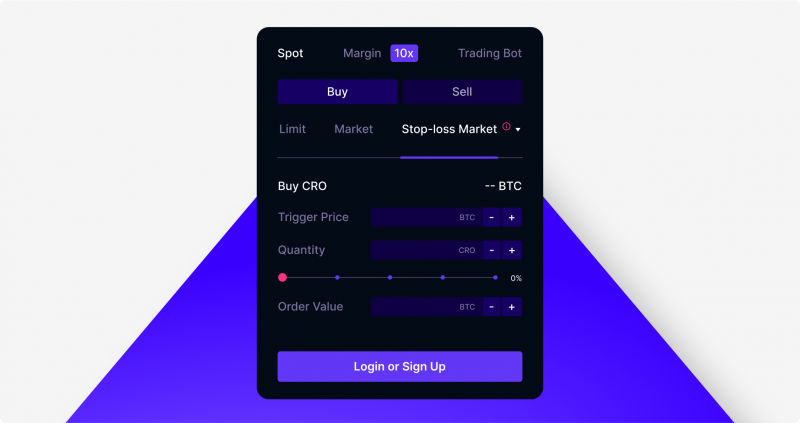

Use Stop-Losses

Traders must use stop-loss orders when trading to protect themselves from significant losses. This strategy is especially useful when using high leverage levels since it allows traders to set predetermined limits on potential losses. Once these limits are reached, the trader’s positions will automatically be closed out, and they will not have to worry about getting hit with a margin call due to excessive losses.

Diversify Trading Portfolio

Traders should also diversify their trading portfolios. Spread trading across multiple asset classes and strategies can reduce the risk of large losses from any single investment. This means that if one position results in a significant loss, the other positions may still be profitable, mitigating the overall impact on the account.

Limit Leverage

Traders should also consider limiting their leverage when trading, especially if they are inexperienced or have limited capital available. Leverage amplifies both gains and losses, so traders must remain aware of the risks involved. By limiting leverage, traders can reduce their risk exposure and avoid making large deposits to meet the maintenance requirement to avoid a call.

Risks and Pitfalls

The biggest risk of margin calls is losing more than expected of your original investment. If you do not respond quickly enough to a margin call and don’t come up with the additional funds or securities requested by your broker, the broker may sell a portion of your holdings without notice. Because you’d be selling near the bottom of the market, your losses could exceed your expectations.

In addition to the possible loss of your funds, this may also have substantial financial ramifications that may jeopardize your future economic stability. If you cannot satisfy the demands of a margin call and are forced to liquidate certain holdings to do so, you may lose more money than you originally invested.

Lastly, if sufficient funds are not provided in a timely manner, margin calls might result in the margin account being closed. When presented with a margin call, it is critical to be aware of all risks and to react immediately and appropriately.

An investor may avoid the dreaded margin call, and significant losses, by utilizing stop loss orders.

Conclusion

If traders are not prepared, a margin call may be a disastrous event. Traders may lower their risk exposure and achieve higher market performance with thorough planning and preparation.

Traders may better protect themselves from possible losses and prevent margin calls by regularly monitoring holdings and keeping proper margin levels, minimizing leverage, diversifying portfolios, and employing stop-loss orders. Whilst there is no guarantee of success, these measures may assist reduce risk and enhance the likelihood of avoiding unpleasant surprises.

This article is exclusively for educational and informational purposes only, and should not be interpreted as any type of advice. Past performance is not indicative of future results, and all investments carry the risk of loss. Before making any decisions regarding your investments, please consult with a qualified professional advisor. The author does not assume any responsibility for the actions taken by readers based on the opinions expressed in this article.

Recommended articles

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Recent news

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer