Dark Pool Trading Explained – How Do These Ambiguous Markets Work?

This is where dark pools come into play. Let’s shed some light on dark pool trading and if there are any benefits to these private liquidity pools.

Financial markets form a complex system of several underlying exchanges, corporations and market makers that interconnect and depend on each other. A new trader trying to grasp trading elements tends to focus on trading instruments, liquidity levels and market prices.

However, other elements play a major role in the stability of the system. Imagine if a multi-billionaire investor wanted to sell 100,000 shares of company ABC. This news would flip the public market upside down.

Key Takeaways

- Dark pools are private exchange markets where large financial institutions and multi-millionaire investors execute massive trading orders.

- Dark pools were introduced by the SEC in 1979 and are heavily regulated.

- Dark pool trading can be done through broker-dealers, private brokers, or electronic market maker models.

- Companies engage in dark pooling to avoid affecting public markets with massive trading orders and to hide their strategies from competitors.

Understanding Dark Pools

Dark pools are private exchanges where stocks and other securities are traded among selected financial institutions, exchanges and significant investors. These pools are not accessible to secondary markets and public traders, which triggers some criticism over the transparency of dark pools.

Large corporations and investors conduct block trading in dark pools’ stock markets without affecting the public market and the security price. Otherwise, if corporations trade in bulk in open markets, they can severely affect a company’s stock price, causing a significant price increase or decrease.

At the same time, dark pools of liquidity got this name from the lack of transparency, which raises concerns regarding the conflict of interest and the intention of key market players who can dramatically manipulate the market to their favour.

However, dark pool exchanges are totally legal and are regulated by the US Security and Exchange Commission (SEC), which administrates the market and ensures that participants act in good faith.

History of Dark Pools

According to the CFA Institute (chartered financial analyst), a global entity responsible for investment ethics, code of conduct and education, dark pools were created in the 1980s, alongside the emergence of high-frequency trading (HFT) technology.

HFT-powered programs use algorithms-based models to execute trades multiple trades almost instantaneously. Using HFT in daily trading became a common practice for traders, where institutional investors and firms could trade large volumes of securities within milliseconds. Traders raced to gain a fractional advantage by placing market orders before other market participants and capitalising on these opportunities to maximise their gains.

Subsequent traders, after a bulk execution using HFT, are more likely to face delays and price increments. Then, traders could close their positions after a subsequent execution takes place and make substantial gains.

These activities caused major shifts in the open market, swinging the underlying securities price severely. Moreover, the increasing use of HFT technology made it difficult to execute orders timely because of the lack of the changing liquidity levels these activities caused.

Therefore, in order to avoid excessive market swings and possible manipulation, investment banks and large financial corporations created private exchanges. These closed marketplaces have less transparency to mitigate their impacts on market prices, hence the name of dark pools.

By February 2020, over 50 dark pools were reported by the SEC in the United States.

How Do Dark Pools Work?

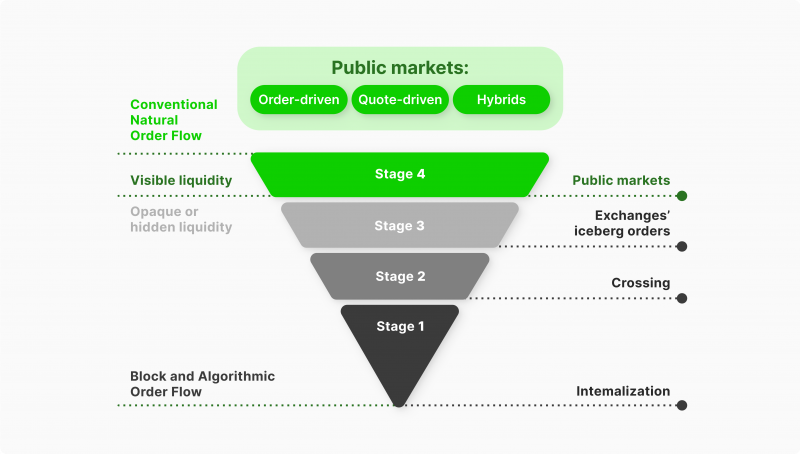

Dark pool data are only accessible to a selected group of hedge funds and financial institutions, and they use an alternative trading system to hide their trading activities from competitors and mitigate their impact on open-market prices.

Block trades take place in dark pools, where a massive number of securities are privately negotiated and agreed between two parties away from the public eye. Large financial institutions and the SEC govern dark pool trades.

The dark pool stock market exchanges define a block trade, which values $200,000 at least, or over 10,000 shares, whereas most dark pool block trades, in reality, involve much more than these figures.

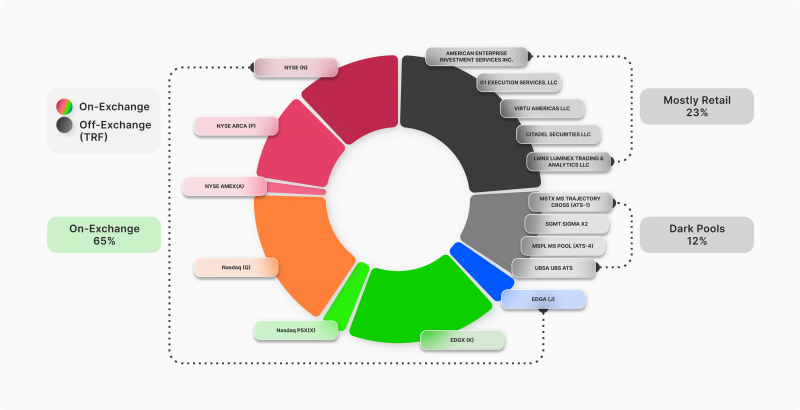

Non-exchange (dark pool) trading has expanded over the years, accounting for around 40% of the overall stock trading in the US, growing from 16% in 2010.

Large investors and financial institutions increasingly prefer dark pooling over public marketplaces to secure large quantities of securities without causing major shifts in the market. Moreover, these pools involve lower transaction fees because they do not entail multiple exchange platforms and intermediaries.

Dark Pool Trading

Trading stocks in dark pools is not available for retail investors, and only significant financial institutions and hedge funds willing to trade exceptionally large amounts of shares and securities deal with dark liquidity pools.

Key market players prefer private markets because they entail lower fees since fewer intermediaries are involved, whereas trades only happen through a broker. Moreover, corporations are more likely to find a buyer/seller to trade with them in private pools rather than secondary markets.

These companies usually trade hundreds of thousands of securities with values over millions of dollars, and the rumour of these events is sufficient to dramatically decrease or increase the price of the security in question.

The opaque nature of these pools assists traders in securing a better deal at a suitable price than if the transaction were to happen in an open market setting.

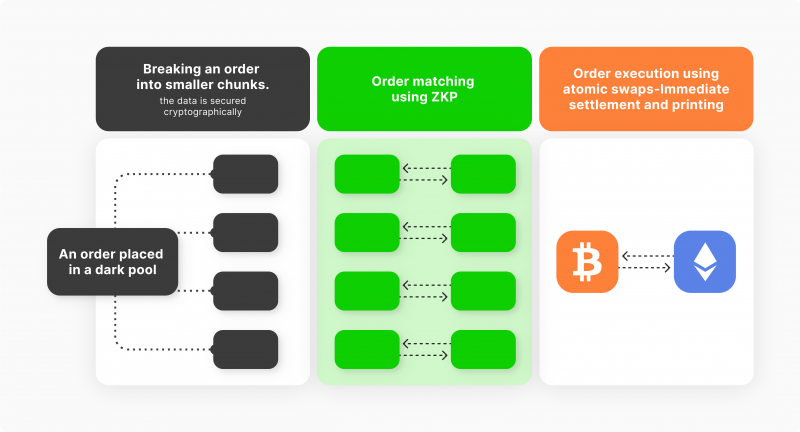

The buyer and seller in the dark pool agree on the trade price and volume through a broker. A price improvement can also happen when both parties agree at a middle point between bidding and asking prices.

However, the secrecy of these details is crucial to ensure that public markets do not receive this news. Also, information must be kept private from other dark pool traders who can take the front runner and execute orders using HFT technology to capitalise on the planned block trade.

Types of Dark Pools

Dark pools and other types of non-public exchanges work through private brokers, who are subject to SEC regulations. Therefore, the US Securities and Exchange Commission controls these exchanges despite the lack of transparency and unfair opportunities it may create for large institutions.

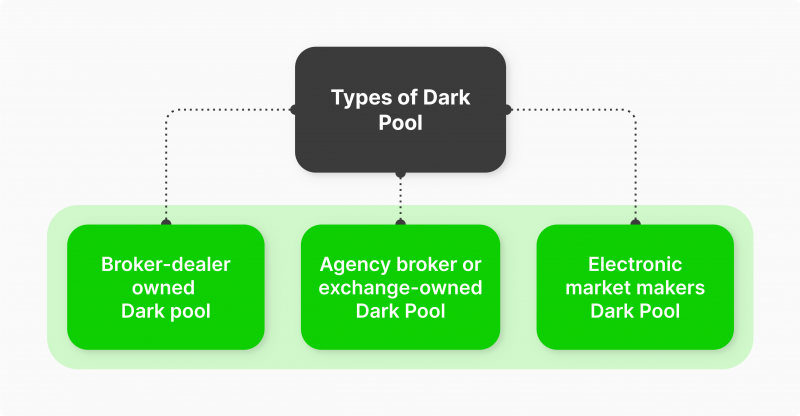

Dark pools have three types, determining the technology or broker type used in the execution of block trades.

Broker-Dealer-Owned Dark Pool

The first type of dark pool is the one provided by broker-dealers, who engage in financial markets to grow their own wealth besides executing trades on behalf of their clients to earn some commissions.

Broker-dealers provide prices based on trading volume and price discovery. The process of price discovery entails setting an acceptable security price according to the supply and demand levels, risk tolerance and overall economic well-being.

Credit Suisse CrossFinder is a famous dark pool that uses algorithms in electronic trading systems. However, it was recently acquired and shut down by UBS. Other examples of broker-dealer dark pools are Goldman Sachs’ SigmaX and Morgan Stanley’s MS Pool.

Agency Broker or Exchange-Owned Dark Pool

Agency-broker dark pools are another common private trading system that acts as agents instead of a principal. These exchange-owned dark pools do not involve price discovery because they use the National Best Bid and Offer model to reach a price midpoint.

The NBBO is a quoting method that consolidates the highest bid price and the lowest asking price from various exchanges and trading systems. This model ensures the tightest spread possible while trading the agreed security.

Some of these types of pools are owned by famous stock exchange marketplaces like the NYSE’s Euronext and BATS, owned by the Chicago Board of Trade.

Electronic Market Maker Dark Pools

Private financial corporations independently create these dark pools and use the market maker model to trade for their own benefit. Market makers engage in financial markets, buying and selling various assets consistently to increase liquidity and attract more traders.

Therefore, dark pool traders enjoy high liquidity in these types of dark pools when they trade tens or hundreds of thousands of assets and dollars.

The pricing in this approach does not include the NBBO quoting model, so a price discovery is included in the independent electronic dark pools.

Uses of Dark Pools

Dark pools exist as a way out for large companies that want to place massive trading orders that cannot be fulfilled in secondary markets due to liquidity and availability constraints.

Assume a financial corporation wants to sell 1,000,000 shares in public exchanges. The process goes as follows. The company initiates the order with a floor broker for several days to make price estimations and trade valuations and find the best bidding and asking prices.

Then, the seller company would need to sell these stocks in several batches of 100,000 shares each, or even less, depending on the market conditions.

Other market participants will eventually notice this massive movement and start speculating on the stock price, short-selling more shares, which can create a domino effect, sinking the stock price.

Therefore, dark pools help large investors and companies place their trading orders much faster using HFT and algorithmic software. These automated trading systems split the block trade volume into smaller bits and place them on multiple private exchanges at the best price possible.

Other large financial companies can be found in various dark pools that would accept these market orders and fulfil the execution with the seller within seconds. This process is done quickly and secretly to avoid information leakage or front running.

Dark Pool Exchange Regulations

Despite the ambiguity of dark pools and the apparent advantage they provide for large institutions over public market participants, they are heavily regulated by the SEC, which passed the law for dark pool creation in April 1979. The rule entails that listed stocks can be traded off the exchange using over-the-counter platforms.

Dark pool trade was limited to a few companies and contributed little to the overall trade volume. For around 20 years, “upstairs trading” accounted for less than 5% of the total trades.

The creation of the high-frequency trading system spurred the trading speed, where companies raced to execute market orders and front-run each other to capitalise on publicly traded opportunities. However, this created unfair conditions for companies that were front-ran by others, rendering them losing on their trades.

In 2007, the SEC passed the National Market System rule, allowing companies to bypass the public market and directly trade in private exchanges to gain a price advantage. This rule, besides the rise in HFT technology, increased the number of private exchange traders and saw the creation of more privately held exchanges.

In 2022, the SEC proposed a rule that would require dark pool operators to execute market orders in public secondary markets rather than privately unless an evident price advantage was offered in dark pools.

However, this potential change to the dark pool alerts corporations who raised concerns that it would change the dynamics and scene of dark pools, exposing large corporations’ movements to the public.

Criticism of Dark Pooling

Although the SEC scrutinises dark pool trades and private stock exchanges, these markets’ lack of transparency and ambiguity raises concerns and criticism from the average retail trader.

Public stock exchange operators point out that off-exchange trading creates an unfair price advantage for institutional traders who might also own a significant share in the public market. This gives them a further advantage to multiply their gains over other traders.

Other critiques of these pools indicate that the lack of reporting and price disclosure may lead to misleading information and conflict of interest. The SEC doubled down on dark pools, calling for a trade-at rule for the traders to act in good faith.

However, private exchange operators claim that dark pool liquidity is higher than public markets, especially for high-frequency traders.

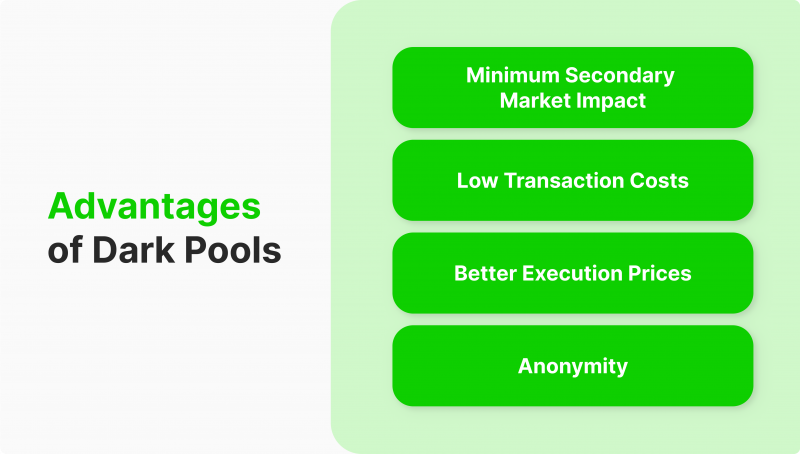

Advantages of Dark Pools

Privately held pools and mutual funds provide several perks for large corporations, benefiting from trading with minimum transparency and other advantages.

Minimum Secondary Market Impact

Large trades usually affect public markets and drive price speculations. However, trading securities in bulk over private markets does not affect secondary markets.

Low Transaction Costs

Trading in dark pools utilises alternative trading systems that consolidate prices from various exchanges and provide tight spread ranges, which lowers the broker’s commission. Additionally, these pools involve fewer intermediaries, which leads to lower transaction fees.

Better Execution Prices

Dark pools involve significant market players who are more likely to match a block order requested by an institutional investor. Moreover, the high liquidity in this market and the midpoint quote model provide traders with the best trading conditions.

Anonymity

Large corporations can trade securities with massive volumes without exposing their information to competitors, which preserves their plans or strategies and avoids front-running.

Disadvantages of Dark Pools

Private stock trades and exchanges raise concerns and criticism from multiple operators and traders because of the following disadvantages they create.

Unfair Price Competition

Off-exchange trades can be executed at a price that is far from public market value, creating unfair advantages for large corporations over retail traders. Also, Most dark pools use an order flow to estimate financial securities prices, which can be much lower than in the public exchange.

Manipulation

Conflict of interest and front running are the major private market pressures that concern large corporations and other investors in dark pools.

Predatory Activities

The increasing usage of HFT systems allows companies to place different small market orders to identify large trading volumes, capitalise on these opportunities and front-run them.

Conclusion

Dark pools are privately held exchanges and markets where large corporations and financial institutions trade various asset classes and instruments. These pools were founded in the 1980s to enable corporation trade with less transparency while executing massive orders, such as selling 500,000 shares or trading orders valued at millions of dollars.

These pools can be held by popular exchanges like NYSE, broker-dealer operators, or independent electronic market makers. Significant market players utilise dark pool trading to execute orders without revealing their movements to competitors to minimise the rippling effect on public markets.

FAQ

What is a dark pool in trading?

A dark pool is a privately held exchange where large corporations and institutional investors trade massive shares of securities without disclosing them to public markets.

Is dark pool trading illegal?

The US Securities and Exchange Commission regulates dark pool trading and has been subject to control and regulations since 1979.

Who operates dark pools?

Private brokerage companies facilitate dark pool trading by matching buying and selling orders, consolidating bidding, and asking prices to provide the best trading conditions.

How do you invest in dark pools?

Dark pools are only available to large corporations like Morgan Stanley and Barclays Bank, who trade significant assets worth millions of dollars.

Recommended articles

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Recent news

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer