Donald Trump AI Bet: How This $500B Investment Could Impact the Stock Market?

The artificial intelligence (AI) industry is poised for a significant transformation following Trump’s announcement of a $500 billion investment in AI infrastructure. Joined by top executives from OpenAI, SoftBank, and Oracle, Trump unveiled the initiative to strengthen America’s leadership in the AI sphere.

As the market evaluates the broader impact of Trump’s return on the financial sector, investors are now wondering: Is this the right time to buy AI stocks?

Trump’s $500B AI Investment: What We Know So Far

During a White House announcement, Trump introduced Stargate, a new AI infrastructure venture backed by OpenAI, SoftBank, and Oracle. The project will start with an initial $100 billion investment, eventually reaching the $500 billion mark over the coming years.

Stargate’s primary focus is to build AI data centres across the U.S., creating 100,000 jobs and ensuring that the U.S. stays ahead of China in the AI race. OpenAI CEO Sam Altman, SoftBank’s Masayoshi Son, and Oracle’s Larry Ellison hailed the initiative as the largest AI infrastructure investment in history.

Trump’s commitment to AI marks a sharp pivot from previous administrations, particularly with the recent reversal of an executive order by former President Joe Biden that sought to regulate AI risks. Now, the focus is on expanding AI capabilities rather than limiting them.

How AI Stocks Reacted to Trump’s Announcement

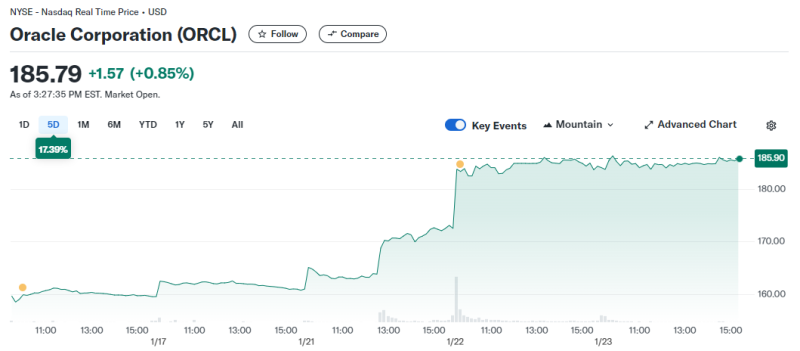

The announcement sent AI stocks soaring. Oracle’s stock surged 7% on the news, while Nvidia, Arm Holdings, and Dell also experienced gains. Given the scale of the investment, this could be just the beginning of a broader AI stock rally.

Trump’s endorsement of AI infrastructure has reinforced investor confidence in the sector, making it clear that AI will be a major economic driver in the coming years. But should investors jump in now, or is it better to wait?

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

Should You Buy AI Stocks Now?

AI stocks have been on a strong upward trajectory since OpenAI launched ChatGPT in 2022. With Trump’s investment plans, demand for AI infrastructure—including data centres, semiconductors, and computing power—is expected to skyrocket.

However, historical precedent suggests that large-scale infrastructure promises can sometimes fall short. Trump’s previous announcements, such as the 2017 Foxconn factory deal, failed to deliver the projected job creation and investments. Investors should remain cautious and assess whether AI firms can truly capitalise on these funds.

Nonetheless, AI is a long-term growth sector, and for those looking to invest in the industry, now could be an opportune time.

Best AI Stocks on the Market

If you’re considering investing in AI stocks, here are three strong contenders:

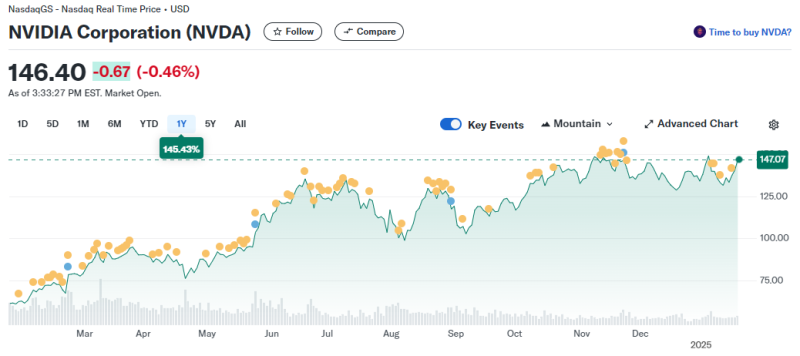

1. Nvidia (NVDA)

Nvidia is the undisputed leader in AI chips, and Trump’s AI push could further solidify its dominance. CEO Jensen Huang has already stated that $1 trillion worth of computers will need upgrades for AI capabilities, creating a massive market for Nvidia’s GPUs. With the upcoming Blackwell architecture rollout, Nvidia is poised for another record-breaking year.

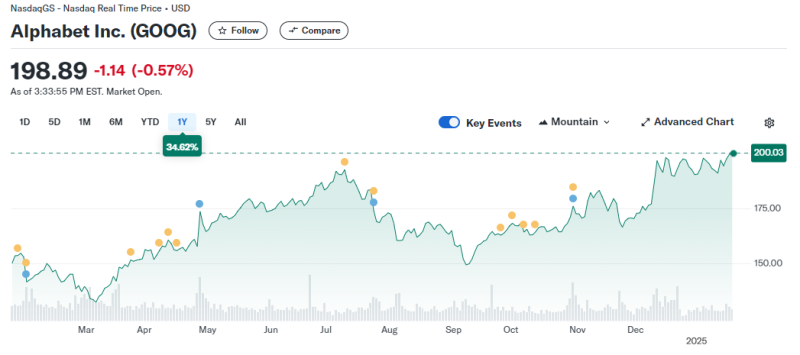

2. Alphabet (GOOGL)

Alphabet, Google’s parent company, is integrating AI across its entire business model, from Google Search to Google Cloud. Its AI-powered Gemini language model is already enhancing search results, advertising revenue, and enterprise AI services. At a relatively lower price-to-earnings (P/E) ratio than other AI giants, Alphabet remains an attractive AI stock.

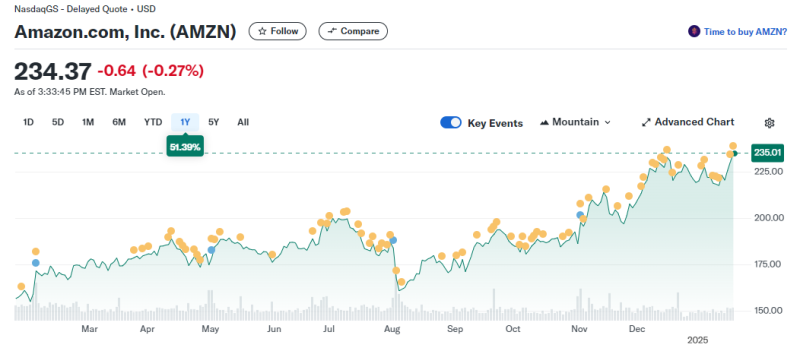

3. Amazon (AMZN)

Amazon is another major AI player, particularly through Amazon Web Services (AWS). AWS has built a robust AI infrastructure, offering AI chips, cloud computing, and large-scale AI models. As AI adoption accelerates, AWS could see exponential revenue growth, making Amazon a strong AI investment option.

Final Thoughts

Donald Trump AI plan of $500 billion investment marks a turning point for AI infrastructure in the U.S. The Stargate project will likely fuel significant AI stock growth, but investors should remain cautious of past failed infrastructure promises.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

AI stocks like Nvidia, Alphabet, and Amazon remain solid long-term investments. However, it’s essential to keep an eye on policy changes, infrastructure challenges, and market conditions before making investment decisions.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.