Elon Musk’s X and Visa Partnership: The Birth of an ‘Everything App’?

For years, Elon Musk has envisioned turning X (previously Twitter) into an “everything app.” That vision took a step forward with the recently announced partnership between X and Visa.

The collaboration is set to integrate Visa’s payment solutions into X’s ecosystem, enabling direct peer-to-peer transactions, digital wallets, and seamless bank transfers.

Visa Integration: The Evolution of X Money

At the heart of this partnership is the launch of X Money, a digital wallet and payment solution integrated into the platform. Visa will serve as the first partner for X Money, allowing users to fund their wallets, connect debit cards, and initiate peer-to-peer transactions. The service will also enable users to transfer funds from X Money to traditional bank accounts in real time, powered by Visa Direct.

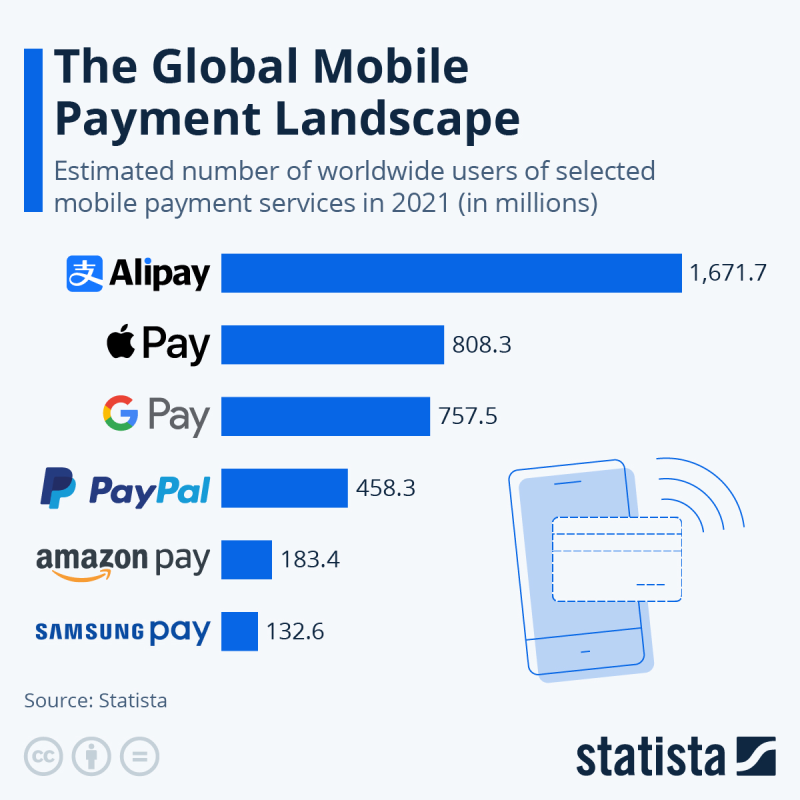

While numerous social media platforms have flirted with integrating financial services, X is boldly moving into the sector. The platform aims to streamline transactions, making it easier for content creators, businesses, and everyday users to send and receive payments without relying on external institutions like PayPal or Apple Pay.

This aligns perfectly with Musk’s long-standing ambition to transform X into a Western version of WeChat—a single app that consolidates messaging, shopping, streaming, and financial services.

Elon Musk’s Quest for an Everything App

Musk’s fascination with financial services is nothing new. Long before X, he co-founded X.com, an online banking startup that eventually became PayPal.

His early vision of a comprehensive digital financial ecosystem was sidelined by PayPal’s focus on becoming an online payment processor. Now, over two decades later, Musk is reviving and expanding that idea, leveraging X’s vast user base to build an integrated and frictionless financial ecosystem.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

His push for an everything app comes at a time when digital payments are more relevant than ever. Services like Venmo, Cash App, and Zelle have normalised peer-to-peer transactions, and crypto wallets have introduced new financial paradigms. X Money seeks to consolidate these functionalities under one roof, effectively blurring the lines between social networking and digital finance.

A Challenge to the Status Quo

For years, Apple and Google have dominated mobile payments through their respective wallet services, while traditional banks have struggled to innovate at the same pace. X Money’s entrance into this space is bound to intensify competition, especially if it attracts users with lower fees, faster transactions, and additional perks.

However, X’s move isn’t without hurdles. Any company seeking to offer financial services faces regulatory scrutiny. The U.S. government has historically been wary of tech giants encroaching into banking territory, citing concerns over consumer protection, data privacy, and market monopolisation.

X Payments LLC, the company’s financial arm, has already secured money transmitter licenses in 41 states and is registered with the Financial Crimes Enforcement Network (FinCEN). However, as X Money expands, further regulatory challenges could emerge.

Additionally, consumer trust remains a critical factor. Since Musk acquired Twitter in 2022, the platform has seen significant changes, from mass layoffs to a shift in its moderation policies, leading to a polarised user base. The question remains whether users will trust X with their financial transactions, particularly in a space where security and reliability are paramount.

X’s Move Beyond Social Media

The partnership between Visa and social media signals that X is no longer merely a social media company. By embedding financial services within its platform, it is positioning itself as a multi-functional ecosystem like WeChat, which dominates China’s digital landscape.

WeChat users can send money, shop online, book services, and even pay bills without ever leaving the app. If X successfully replicates this model, it could become a digital powerhouse unlike anything currently available in the Western market.

Moreover, X Money could reshape how content creators and businesses monetise their presence on the platform. Traditional social media monetisation relies heavily on ad revenue, brand partnerships, and external payment processors like Patreon.

However, by integrating direct payment options, X Money provides an alternative model where users can support creators instantly, much like TikTok’s gifting system or Twitch’s donations. This could help X retain influential content creators often swayed by better monetisation opportunities on rival platforms.

Where’s Bitcoin and Dogecoin?

One of the most surprising aspects of this rollout is the complete absence of cryptocurrency. Musk, known for his vocal support of Bitcoin and Dogecoin, has notably left digital assets out of the initial X Money launch. Given Musk’s influence in the crypto space, many expected some level of blockchain or tokenised payment integration.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

The decision to sideline cryptocurrency could be strategic. While integrating blockchain payments would align with Musk’s broader interests, the regulatory hurdles are significantly higher. Adding cryptocurrency could complicate compliance efforts for a platform that is still acquiring financial service licenses.

However, this doesn’t mean crypto will be absent from X Money forever—Musk has a track record of making unexpected pivots.

Final Thoughts

For now, all eyes are on the rollout of X Money. Will it live up to its promise of seamless digital transactions? Or will regulatory and adoption hurdles slow down its momentum? One thing is certain—Elon Musk’s X is far from just a social networking platform. It’s becoming a financial powerhouse in its own right.

Recommended articles

Recent news