Free Cash Flow (FCF): What It Measures & Calculation Formula

For investors, financial professionals, and business owners, evaluating a company’s financial health requires more than just looking at traditional metrics like net income. A more insightful approach is to examine the cash a business generates after covering its expenses, which can be used for growth, dividends, or debt reduction. This essential measure of financial strength is known as Free Cash Flow (FCF).

This article explores Free Cash Flow, why it matters, the FCF calculation formula, and how investors can use it in practice.

Key Takeaways

- FCF is closely tied to shareholder value, as it provides funds for dividends, share buybacks, and growth investments.

- The FCF Conversion Ratio measures the efficiency with which a company turns net income into cash flow, highlighting earnings quality.

- Positive FCF indicates strong financial health, while negative FCF may signal strategic investments for future growth, especially in capital-intensive sectors.

What is Free Cash Flow?

Free Cash Flow (FCF) is the cash a business generates from its normal business activities after deducting expenses needed to maintain or expand its asset base.

In simple terms, it’s the cash left over after covering costs like new equipment, buildings, or other investments. This leftover cash can be used to pay dividends, buy back shares, or fund new initiatives.

This concept gained traction in the 1980s when investors started looking beyond accounting earnings to cash-based measures for assessing financial stability. FCF is rooted in the cash flow statement, a vital document that discloses a company’s cash inflows and outflows.

Why Free Cash Flow Matters

Free Cash Flow offers a clear view of the cash available for discretionary spending. It is considered a more accurate indicator of financial strength than net income.

Investors find FCF a valuable metric of a company’s ability to generate cash profits. A consistently positive FCF suggests that the company is not only making money but also efficiently converting its earnings into cash, which is vital for sustaining growth or weathering financial downturns.

For example, according to the Motley Fools, companies with higher Free Cash Flow margins show better stock price performance in the long term compared to those with lower yields.

Link to Shareholder Value

FCF is directly linked to shareholder value as it determines the funds available for dividends, share buybacks, and growth initiatives. Companies with high FCF often reward shareholders with regular dividend payments.

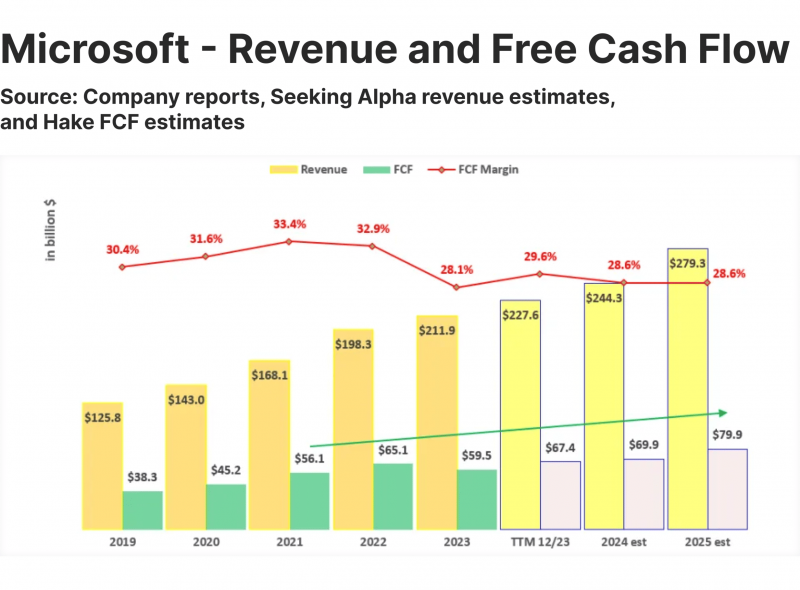

Take Microsoft, for example. In fiscal Q4 of 2024, Microsoft generated $23.3 billion in Free Cash Flow, which made up 36% of its $64.73 billion revenue for the quarter. This strong FCF was achieved despite a 27% rise in capital spending on AI initiatives. Over the 12 months, Microsoft’s Free Cash Flow reached $74 billion, or 30.2% of its annual revenue.

Analysts on Wall Street predict that Microsoft’s FCF could average $92 billion by 2025 as revenues are expected to grow. With this projected growth, the company’s market value could rise by nearly 22%, pushing the stock price to around $495 per share.

This highlights how rising Free Cash Flow not only enables Microsoft to fund dividends and investments but also signals potential stock price growth, making FCF a key metric for assessing shareholder value.

Use for Company Managers

For managers, FCF provides insights into the company’s operational efficiency and capital allocation. For example, if a company’s Free Cash Flow is declining due to high CapEx, it may be a sign that the company is aggressively reinvesting in growth.

Components of Free Cash Flow

Free Cash Flow is composed of two main elements:

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Operating Cash Flow (OCF)

OCF represents the cash generated from regular business activities, excluding non-operational expenses. It reflects the money flowing in and out of a company’s main activities, like sales, services, and expenses. For instance, if a retail chain generates $200 million in revenue and incurs $150 million in operating expenses (salaries, rent, etc.), its OCF is $50 million.

Capital Expenditures (CapEx)

CapEx refers to funds used by a company to acquire or upgrade physical assets like property, buildings, or equipment. Companies that invest heavily in CapEx, such as utility companies or manufacturers, often report lower FCF temporarily but expect higher returns in the future. For example, in 2024, Tesla promised to reach a CapEx of $11 billion from $9 billion in 2023, reflecting its commitment to scaling production capacity.

Working Capital Changes

In some cases, changes in working capital can affect Free Cash Flow calculations. Working capital is the gap between a corporation’s assets and liabilities. If a business increases its inventory or extends more credit to customers, it ties up cash, reducing FCF.

How to Calculate Free Cash Flow?

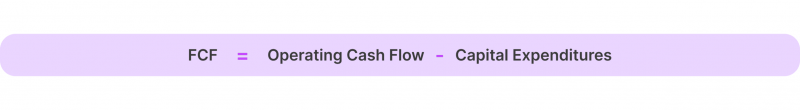

The basic Free Cash Flow formula looks like this:

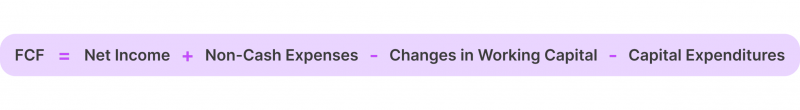

However, a detailed Free Cash Flow equation incorporates net income and changes in working capital:

Step-by-Step Example

Suppose Company X reported the following figures for the fiscal year:

- Net Income: $150 million

- Non-Cash Expenses: $20 million

- Changes in Working Capital: $10 million

- CapEx: $30 million

Step 1: Calculate Operating Cash Flow

OCF = Net Income + Non-Cash Expenses – Changes in Working Capital = 150+20-10 = 160 million

Step 2: Calculate FCF

FCF = OCF − CapEx = 160−30 = 130 million

Bonus Step: You can calculate FCF using the detailed formula:

FCF = 150+20−10−30 = 130 million

Thus, Company X’s Free Cash Flow is $130 million, indicating it has sufficient cash flow after necessary expenditures to fund further growth or reward shareholders.

What Is FCF Conversion?

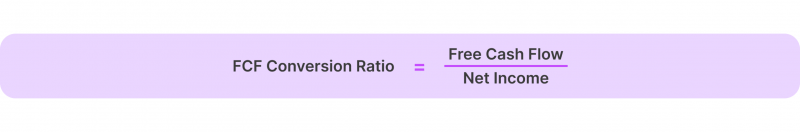

Free Cash Flow Conversion is a ratio that evaluates how well a business converts its net income into actual cash flow. It’s an important indicator of earnings quality and cash efficiency.

This ratio is calculated as:

Step-by-Step Example

Continuing the previous example:

- Net Income: $150 million

- Free Cash Flow (FCF): $130 million

FCF Conversion Ratio = 150 / 130 = 0.87

In this case, Company X’s FCF Conversion Ratio is 0.87, indicating that 87% of its net income is being converted into actual cash. A ratio below 1.0 suggests that some earnings are not translating into cash flow, possibly due to factors like working capital changes or non-cash expenses. A higher conversion ratio would signal stronger cash flow efficiency and healthier financial management.

Types of Free Cash Flow

There are two main types of FCF:

Free Cash Flow to the Firm (FCFF)

FCFF shows a company’s free cash for both its creditors and stockholders. It is especially useful for valuation as it reflects the cash flow the firm makes before paying interest on debt. FCFF is often used in discounted cash flow (DCF) valuation models.

Free Cash Flow to Equity (FCFE)

FCFE measures the cash available for stockholders after deducting expenses, debt payments, and CapEx. It represents the cash a company could pay out to shareholders in the form of dividends. For instance, if a company has a high FCFE, it has a higher potential to pay generous dividends or conduct stock buybacks.

How to Interpret Free Cash Flow

Analysing FCF can be beneficial for both shareholders and industry watchers.

Positive vs. Negative

Positive FCF signals a company generates more cash than it needs to fund operations and investments, signalling financial strength. For instance, analysts forecast Apple’s Free Cash Flow to reach $124.9 billion in 2025, significantly higher than its projected net income of $114.4 billion, which makes it an attractive stock for investors.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

One reason for Apple’s strong FCF is that it doesn’t spend a lot to integrate AI into its products, unlike some competitors. Its capital expenditures are expected to grow moderately, reaching just over $10 billion next year. The controlled CapEx and high FCF combination underscores Apple’s effective capital allocation and operational efficiency.

At the same time, negative FCF isn’t always a red flag. It shows that the company is making significant investments in future growth. Startups or tech companies often show negative FCF in their early stages due to heavy investments in research and development.

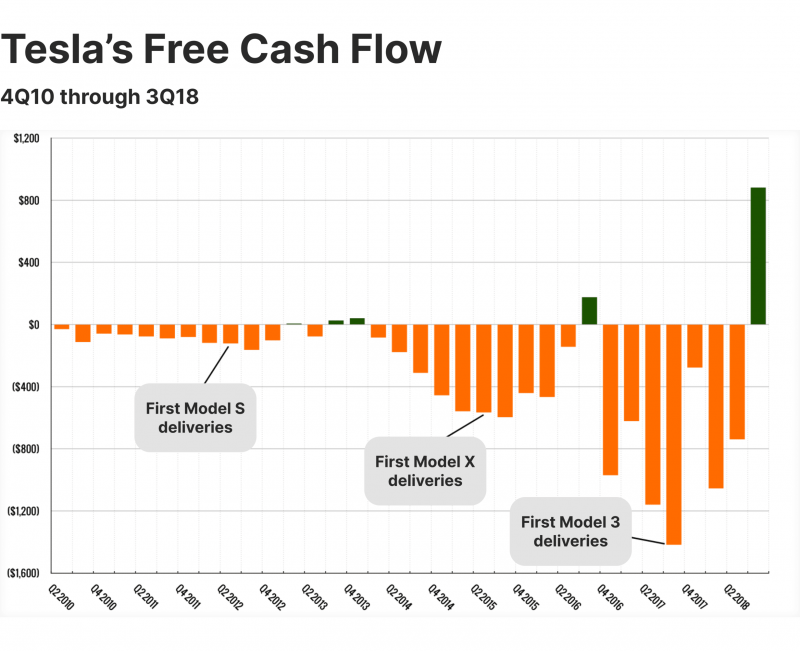

In its early years, Tesla consistently reported negative FCF as it invested heavily in scaling production, building new factories, and advancing battery technology.

Warning Signs

A persistent decline in FCF or large discrepancies between net income and FCF can indicate trouble. If a company’s net income is consistently positive but FCF is negative, it may suggest that the firm is struggling with cash management or making unwise investment decisions.

Real-World Applications

Prominent investors like Warren Buffett emphasise the importance of FCF in evaluating companies. Buffett’s investment in Coca-Cola in the late 1980s was largely influenced by the company’s ability to generate stable FCF, which led to consistent dividend growth.

Amazon is a prime example of a company that managed its Free Cash Flow effectively. In the early 2000s, Amazon reinvested its FCF into expanding infrastructure and technology, allowing it to scale exponentially. In 2022, Amazon generated an FCF of approximately $26 billion, reinforcing its market dominance.

Conclusion

Free Cash Flow offers insights into a company’s cash-generating capabilities beyond traditional profit measures. While positive FCF typically signals financial strength, it’s essential to take into account the company’s strategy and industry specifics.

Whether you’re a seasoned investor or a budding financial analyst, incorporating FCF analysis into your financial assessments can lead to more comprehensive and strategic decision-making.

Disclaimer: The information provided in this article is for educational and informational purposes only. It is not intended as financial or investment advice.