How Crypto Accelerates B2B Payments Globally

Articles

Payments using crypto coins have become a real breakthrough method of transformation of mutual settlements between individuals, investors, traders, and within the business environment, both classical and digital, expanding the boundaries of the payment process.

With enormous potential and vast application possibilities, crypto payment projects and projects have gained unprecedented popularity, undergoing significant changes to surpass classical payment systems.

Today, B2B payments are an experimental example of crypto innovations in the business environment, the possibilities of which exceed the expectations of experts and provide tangible positive sides over classical payment forms while bringing the efficiency of financial institutions to a new level on a global scale.

This article will explain what B2B payments are and what methods exist for making them. You will also learn how crypto revolutionises B2B payments globally and how to accept them within a business.

Key Takeaways

- B2B payments play an important role in today’s business environment, and crypto technologies form the foundation for their development.

- Thanks to the benefits of distributed ledger, the B2B sector is undergoing a transformation process on many levels, offering a completely new way of settlement between companies of different classes.

- Crypto provides access to new industries that have emerged at the intersection of technology and finance, where B2B payments play a bridging role, bringing together different concepts and ideas of the payment space.

What are B2B Payments?

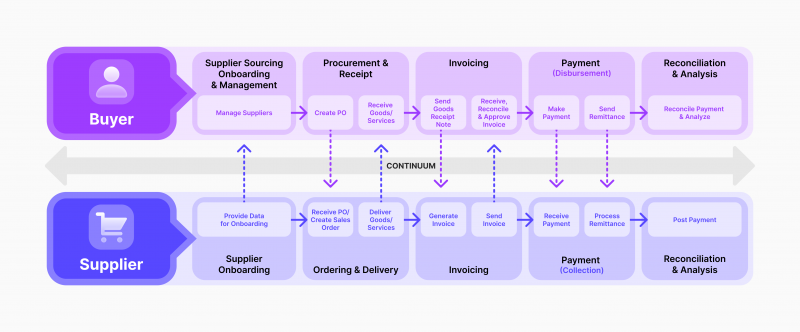

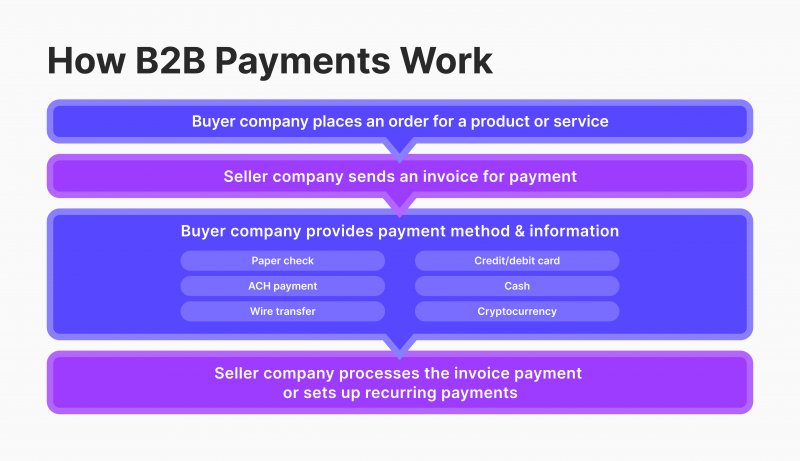

B2B payments, or business-to-business payments, refer to the exchange of value in the form of currency between a buyer and supplier for the goods or services rendered. These payments can be one-time or recurring, depending on the agreement between the parties.

The process of B2B payments is more complex compared to B2C payments, as it involves a longer settlement time that can take days or even weeks to complete.

This is due to the need for meticulous approval and verification procedures for each transaction. In contrast, B2C payments usually happen instantly, simplifying the transaction process.

Today, B2B payments occupy a special place in the financial sphere, as there is a high demand for solutions that provide full-fledged work with processing currency transactions.

The large number of companies providing their services and wares creates the need to use modern, efficient payment methods that do not require high costs for the maintenance and repair of equipment and infrastructure.

All this has led to a dynamically developing tendency to use automated payment systems in the business processes of most firms and corporations in many areas of activity, which in turn has eliminated the problems associated with old-fashioned methods of mutual settlements, which are still used today.

Types of B2B Payment Methods

Today, there are a number of methods used within the framework of B2B payments between one financial institution and another. Efficient payment processing, to a certain extent, depends on the equipment and technologies used to support payment processes; however, it also depends on the form of payment used in practice. The main ones are summarised below:

Cryptocurrency

Cryptocurrency has become the most popular among all existing forms of payment, not only within the B2B sphere but also in a large number of other spheres and areas of the financial world. Due to its novelty and a solid list of advantages, digital assets are actively used for B2B cross-border transactions between firms of different sizes.

This enables everyone to save time and money, as well as to cooperate in developing new payment processing solutions, which have a great potential to replace classic processing solutions soon.

Paper Checks

Paper checks, despite their old-fashionedness and little practicality, are still used in the modern world. Their popularity is gradually disappearing, as well as their practicality, which is not expressed in any way. It should be noted that this way of conducting B2B payments is used in a very narrow circle of companies that are committed to tradition, but even they keep up with the times and steadily introduce new technologies to be able to use their advantages.

ACH Payments

ACH (Automated Clearing House) is a network of money transfers between bank accounts. It is managed by the organisation NACHA (National Automated Clearing House Association). It is also referred to as the ACH network or the ACH scheme. The ACH network includes several types of payments.

ACH payments are electronic payments that pass through the ACH network. Funds are moved from one bank account to another using a centralised system that routes the funds to their final destination. These computerised payments can benefit both merchants and customers: payments are inexpensive, they can be automated, and record keeping is often easier with electronic payments.

Wire Transfer

A bank transfer is a simple order of a commercial bank to its correspondent bank to pay a certain amount of money at the request and at the expense of the transferor to a foreign recipient (beneficiary) with an indication of the method of reimbursement to the paying bank of the amount paid by it.

Bank transfer is carried out non-cash using payment orders addressed by one bank to another. The main difference between bank transfers is their territoriality and speed of money turnover.

S.W.I.F.T. is considered to be the most widespread system of bank transfers today. Any funds transfer, including international bank transfers, are made between all states through this channel.

Credit/Debit Card

B2B payment processing also includes the use of credit and debit cards, giving the strengths of distinct payment services to both the business and the customer.

This method of mutual settlement is still one of the most popular due to its global availability and relative cheapness. In this case, acquiring — technology of cashless payment acceptance using bank cards and contactless payment forms — is actively used. A special terminal is used to process and transmit the client’s payment information.

Cash

B2B payment can also be made using conventional cash currency, depending on the country. This method still has high popularity because it is a classic payment instrument, the role of which in the modern economy remains quite important despite the high tendency to manage cash flow with the help of modern cryptocurrency computing systems and technologies.

The B2B sector was one of the first to get the opportunity to use cryptocurrency technologies as part of payment processing.

How Crypto Revolutionises B2B Payments on a Global Scale

Active development of the cryptocurrency market and public ledger technology causes their rapid integration into the global financial system supported by state regulators, financial institutions and international corporations.

The formation and development of the cryptocurrency market, supported by the evolution of digital technologies in general, may challenge the monopoly of official fiat currencies controlled by central banks.

In recent years, cryptocurrencies have been increasingly used as a means of exchange in everyday life, and global transactions have become an integral part of the business processes of any company, regardless of its line of business. This has become possible due to certain effects created by the arrival of such technologies.

1. Overcoming the Limitations of Traditional Banking Systems

In the realm of cross-border B2B payments, the conventional approach necessitates the involvement of numerous intermediaries, such as correspondent banks.

As a result, businesses often face many obstacles, including high transaction fees, unfavourable exchange rates, and delays in processing, which can significantly impact their cash flow, operational expenses, and overall competitiveness.

Cryptos are a unique digital currency type that differs from traditional payment forms in many ways. Cryptocurrencies operate on decentralised networks, unlike traditional payment methods that rely on intermediaries such as banks or financial institutions to facilitate transactions.

This means that transactions can be directly conducted between peers without the need for any intermediary involvement. The absence of intermediaries can lead to lower transaction fees, faster processing times, and better exchange rates, making cryptocurrencies a highly attractive alternative for international B2B transactions.

2. Improved Security and Transparency

Virtual currencies have emerged as a reliable medium for facilitating B2B cross-border transactions, offering superior security and transparency. The advanced cryptographic techniques in the transactions guarantee their authenticity and protect them from tampering, ensuring that the funds are transferred to the intended recipient without interference or manipulation.

Furthermore, all the transactions are documented on a public ledger, providing a transparent record of all payments that can be easily accessed and verified by all parties involved.

By utilising enhanced security methods, businesses can safeguard against fraudulent activities and unauthorised transactions. This, in turn, simplifies the payment tracking and reconciliation process and enables businesses to ensure that all transactions are legitimate.

Additionally, the transparent nature of cryptocurrency transactions can greatly aid firms in complying with regulatory requirements, mainly anti-money laundering (AML) and counter-terrorist financing (CTF) rules. Businesses can improve their reputation and build trust with customers and partners by demonstrating their adherence to these regulations.

3. Efficient and Seamless Cross-Border Payments

B2B cross-border crypto payments offer several advantages, including the ability to conduct seamless, hassle-free transactions. This means businesses can send and receive payments in different types of digital assets, such as Bitcoin, Ethereum, and stablecoins, without needing to deal with multiple currencies or navigate through complex banking procedures.

With B2B crypto payments, companies can enjoy a faster, more secure, and more convenient way of conducting cross-border transactions, which can ultimately help them save time and money while expanding their global business operations.

Cryptocurrencies have gained popularity for their ability to process payments faster than traditional bank transfers. In fact, it only takes a few minutes or hours to complete a crypto transaction, compared to several days with bank transfers.

This speed can significantly enhance businesses’ cash flow management, allowing them to respond to market trends quickly. Additionally, cryptocurrencies offer the benefit of micropayments and fractional payments, which can help businesses make precise transactions for services and wares and lessen the risk of overpayment or underpayment.

4. Financial Inclusion and New Markets Access

One of the most exciting applications of cryptos is their ability to facilitate cross-border payments between businesses. By adopting B2B cross-border crypto payments, companies can expand their reach and work with partners in countries with limited access to traditional banking services.

Cryptocurrencies can bridge different financial systems, enabling businesses to conduct transactions easily and efficiently. With the power of blockchain technology, businesses can tap into new markets and collaborate with partners worldwide, creating endless possibilities for growth and innovation.

5. New Industries Access

With the increasing popularity of cryptocurrencies, several related industries have emerged, each playing a vital role in the digital currency ecosystem. One such industry is cryptocurrency exchanges, which enable the seamless transfer of cryptocurrencies from one party to another.

On the other hand, some industries are indirectly related to digital currencies, such as those that use blockchain technology, including NFTs and Web3. These industries utilise blockchain technology to create decentralised applications, digital art, and other innovative solutions that transform our lives and work.

How to Accept B2B Payments in Crypto

Today, many firms are striving to keep up with the times and technological progress, thereby expanding their business opportunities. By utilising the full potential of B2B payment solutions, businesses open new horizons by offering their clients modern, secure and efficient payment tools.

To achieve all this, innovative crypto processing solutions for accepting B2B payments make it possible. In order to start working with B2B payments, you need to follow a number of simple steps described below.

1. Research Client Needs

Before accepting crypto payments, it is necessary to understand the needs of existing customers. In this case, it is necessary to conduct a survey and find out important aspects of how crypto processing will work in the future. You need to find out which digital assets customers would like to work with, as well as which blockchain networks.

It is also necessary to take into account their wishes regarding forms of payment, be it QR codes or direct links to crypto wallets. All the data obtained will help to form an idea of how customers will find it easier to interact with payment systems, especially if they need to work with large sums of money.

2. Compliance with Regulatory Standards and Rules

Working in the crypto niche today is not an easy task in terms of the legal aspects of regulating its activities. The same applies to payment systems working on the basis of crypto transactions of any format. In many countries, legislative restrictions and prohibitions impact the use of digital assets. Therefore, it’s crucial to analyse and verify the legality of using crypto-technological payment systems.

Additionally, understanding the appropriate use of digital instruments for international payments between legal entities is essential. This approach helps to prevent problems and misunderstandings with regulatory authorities.

3. Connecting Cryptocurrency Payment Gateway

At this stage, a crypto payment gateway provider that meets all the criteria and requirements of the company and will be implemented in the company’s infrastructure is searched for and selected.

A crypto gateway is selected based on its functionality and features of operation that provide access to certain advantages. In turn, the combination of certain advantages of the gateway determines the conditions in which it will be operated.

Therefore, it is important to favour a flexible and secure solution that will be able to adapt to changing operating conditions, as well as be able to support the process of payment processing even in non-standard situations.

4. Setting up Cryptocurrency Payment Gateway

It is worth customising it after connecting a crypto payment solution for B2B crypto payments. Today’s payment processing products have flexible settings and customisation of almost all internal elements and parameters, allowing the flexibility to adjust the system to the company’s requirements and preferences.

Among such customisations, you can find, first of all, the choice of coins that can be handled, as well as many other variables involved in processing each business-to-business payment. In addition, it’s needed to set up the API and integration elements that are directly involved in the processing.

Misconfiguration of any of them can lead to a malfunction or decrease in its efficiency, which will negatively affect the system’s overall efficiency.

5. Preparing Payment Infrastructure for Payment Acceptance

At this stage, it is necessary to take care of the elaborateness and feasibility of appropriate modules that will help to make payments. As a rule, there are dialogue boxes on the web page (if the payment is made on the site) or corresponding terminals with specialised software allowing you to make payments by debit/credit cards, QR codes and other payment systems.

This stage includes software development and interaction with various utilities and programs that allow you to work with code, web page layout and other operations to implement a crypto gateway in the site’s web interface. Hence, it requires a good knowledge of these areas and experience.

Conclusion

B2B payments are undergoing a global transformation thanks to the widespread embracement of crypto innovations that provide access to the full potential of the distributed ledger. Using B2B prime solutions, businesses of all formats and sizes are pushing the boundaries of what is possible, increasing the efficiency and security of cooperation through reliable crypto processing services that also provide significant cost savings and high transaction speeds.

FAQ

What is a B2B payment?

A B2B payment is a standard form of conventional wire transfer between several business units in a particular currency.

What are the methods of making B2B payments?

The types available today are wire transfers, ACH payments, cash, debit/credit cards, and cryptocurrencies, which are the most popular of them all.

What are the benefits of crypto technologies within B2B payments?

Crypto technologies allow real-time payments using digital assets, providing advantages such as reduced fees, high bandwidth of payment channels, security, and transparency of crypto transactions.

How do you start accepting B2B payments within a business?

To receive cross-border payments or make payments, it is necessary to find and connect a reliable payment gateway (bridge) necessary for the processing of transactions and then implement it into the company’s infrastructure.