How Does Nvidia Stock Influence the Market?

The software and technology giant is having the best year so far, as its market capitalisation is going over the roof, with rock-solid clouding hosting capabilities and a significant footprint in artificial technology developments that make Nvidia the number one when it comes to technology solutions.

The company went from a chipmaking crisis to global AI developments and today’s most valued corporation. This tremendous growth caused a stir-up in the equities market.

In this article, we will track Nvidia’s phenomenal growth, highlight the critical events along the company’s timeline and how Nvidia stock influences the overall financial market.

Key Takeaways

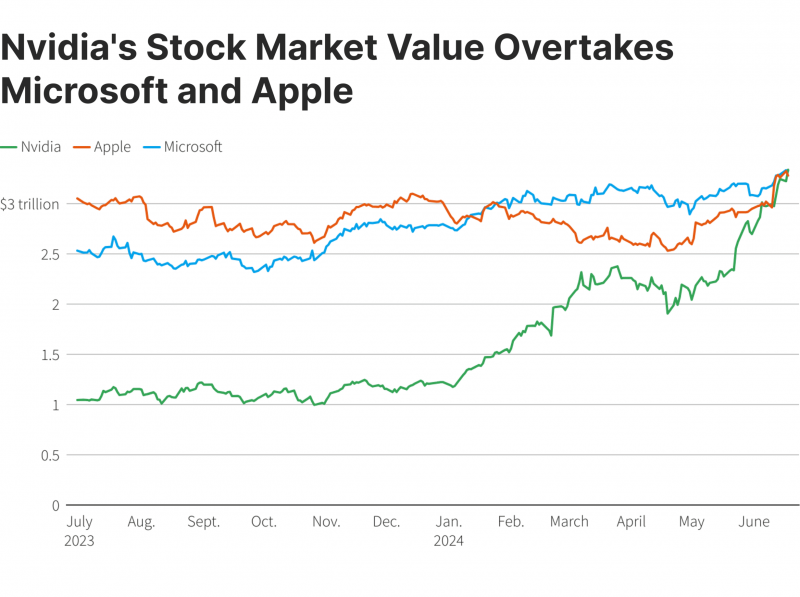

- Nvidia became the most valuable company after reaching $3.34 trillion market capitalisation, overtaking Microsoft.

- Nvidia’s AI investments triggered its massive valuation and stock price increase in 2024.

- S&P 500 and other tech stocks moved upwards due to the significant growth in Nvidia’s stock.

- Nvidia’s future investments in data centres, generative AI, and electric vehicles can potentially drive its stock price higher.

Overviewing Nvidia

Nvidia was founded in 1993 by three engineers, including the current CEO of Nvidia, Jensen Huang, who hatched the idea of creating processing chipsets that enable personal computers to support 3D graphics.

Advanced Micro Devices (AMD) and Intel dominated the semiconductor manufacturing market at the time, leaving no space for newcomers like Nvidia.

However, Nvidia focused on developing graphics processing units (GPU) for video games, which were experiencing significant advancements and technological shifts, making it an attractive niche for GPU developments.

Other manufacturers tried to catch up by developing their graphic processors. However, Nvidia had the first-mover advantage, establishing its name in the video game industry and empowering software and gaming developers with advanced hosting and computing capabilities.

The company, which used to supply GPUs to Sega gaming consoles, is now found in self-driving vehicles, AI infrastructure data centres, Bitcoin mining, cloud hosting and other complex computing capabilities.

The tech company that started with $40,000 in the bank is now valued at over $3.3 trillion, overtaking tech giants such as Microsoft and Apple.

Another move that spurred massive growth in Nvidia company worth is venturing into AI applications and machine learning technologies.

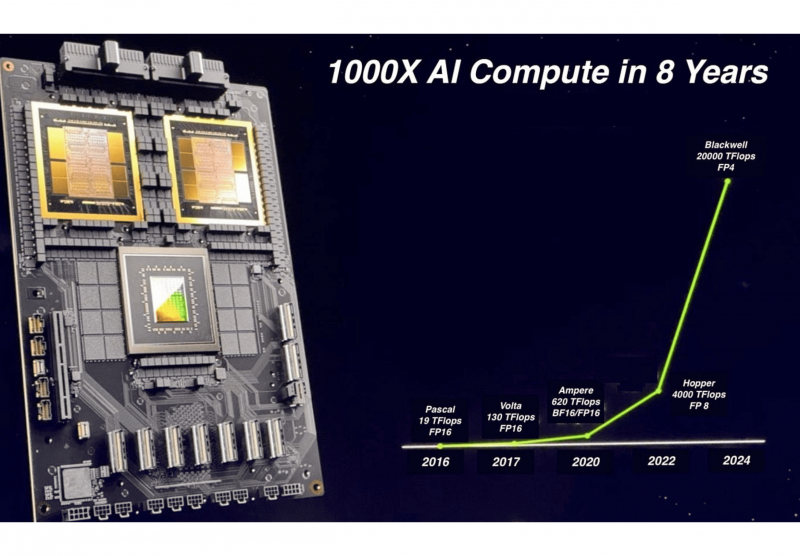

Nvidia started its AI investments very early in 2006 by creating (CUDA), a compute unified device architecture that utilised the GPU’s parallel compute engine to solve multiple complex computational problems simultaneously much better than a CPU.

Many believe that this invention was the stepping stone for AI development.

Nvidia’s Top Products

Over the years, Nvidia has founded various business lines that have contributed to the company’s success. Most of these products revolve around processing units, wireless communication devices, cloud computing, and automotive hardware and software.

- Nvidia GeForce and RTX GPU: Graphics processing units that support video games and equip personal computers to generate real-like visuals and AI-processed graphics.

- NVS for Enterprise: Multi-display solution for businesses and financial marketplaces that require graphical solutions. NVS powers market price screens, statistical dashboards, performance visualisation and more.

- Tegra: System processing unit for smartphones and tablets. Tegra chips are used to support various HTC, LG and ZTE.

- Nvidia Data Center GPUs (ex. Tesla): Superconductors produced by Nvidia that power high-end image processing and generation. These accelerator GPUs aid scientific and research fields.

Nvidia Stock Influence on The General Stock Market

On June 5th, Nvidia’s market cap reached $3 trillion, overtaking Apple in market capitalisation. The tech giant continued its upward movement and exceeded $3.34 trillion in valuation in the current quarter, this time overtaking Microsoft.

Nvidia’s stocks shot up from $94 to $135, recording a 43% growth in 30 days and a 3.85% increase in 24 hours. This increase led to an upswing in indices and ETF markets where NVDA shares are traded.

Nasdaq 100 and S&P 500 experienced a noticeable increase, which, despite not being as strong as Nvidia’s stock price, was enough to realise the weight of Nvidia’s valuation.

Being called the most valuable company in the world with such fascinating growth accompanies significant market impact. In fact, experts estimate that Nvidia’s daily value moves more than the value of American Express and Disney.

Nvidia’s economic influence can shift the entire market sideways as an increasing buying pressure drives the stock price higher.

At this point, there are two types of traders. Investors are expanding their investments in Nvidia shares to capitalise on this massive growth and make significant returns.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

However, other traders speculate on the price slide, anticipating this surge will eventually decline. These market dynamics encourage speculators to short stocks to earn as shares could potentially fall.

NVIDIA GeForce RTX 3090 is commonly used for Bitcoin mining due to its Ampere architecture, offering high clock speed and unmatched computational power for solving Bitcoin’s equations.

Nvidia Stock News

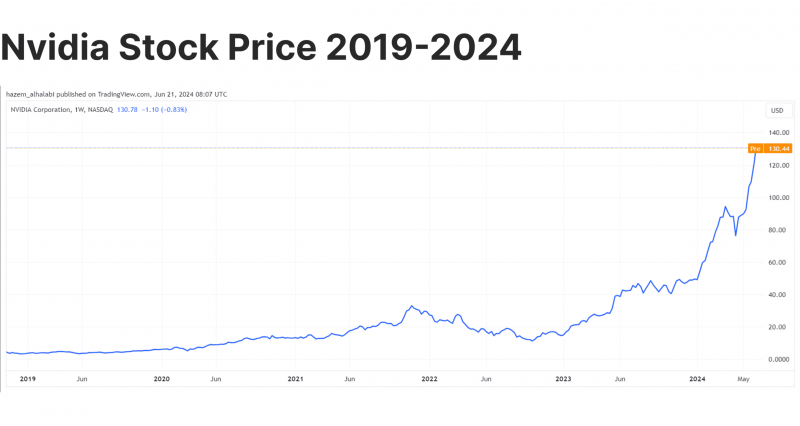

Nvidia’s valuation and stock price grew exponentially over the past five years, and two significant events have driven this growth: the global pandemic and crypto mining. Let’s explain the various factors affecting the company’s growth.

Nvidia Stocks Surge During COVID-19

In 2019-2020, when the COVID-19 pandemic took over the world, corporations switched to work-from-home, increasing the demand for remote co-working capabilities, such as cloud computing and hosting.

Additionally, as households were locked inside their houses, the video game industry popped up, dictating significant demand for GPUs and gaming processors.

Moreover, when the pandemic affected the labour market, people switched to Bitcoin mining practices, which Nvidia’s advanced chips, driving the demand higher for these processing units.

These events increased the demand for Nvidia’s products, and in the few quarters following the first pandemic wave, the company doubled its production and experienced massive revenue growth.

After experiencing a stock decline in Q2 2019, as prices decreased by 26%, the company finished the year with a better stock performance that kept shares slightly above their average price.

In 2020, Nvidia stock jumped from $58 per share to $130, marking significant growth, which continued throughout 2021, when the stock price peaked at $340.

The impact of this surge remains until today. After stocks dropped in 2022 due to post-COVID economic factors, shares surged sharply, achieving a 257% increase in 2023 from $140 to $500.

This was the starting point of tremendous growth today, as prices jumped from $500 to $900 in the first quarter, followed by another massive increase in May-Jun, reaching $1,200. Nvidia announced a stock split on June 10th, taking the share price down to $120, which continued growing as the stock price reached $140 a few days later.

Nvidia Stock Splits

Nvidia issued five stock splits during its lifetime, excluding the most recent one. During its stock split history, company shares declined directly after the announcement before picking up in the following weeks or months.

However, the stock’s price kept growing this time due to the massive company valuation and speculations. On June 7th, Nvidia issued a 10-to-1 stock split that would take place after the trading session ended.

This meant that every shareholder registered until June 6th would have nine more shares on the next trading session, but the overall holdings value would remain the same.

Companies conduct share splits to maintain steady economic growth and to keep the stock price affordable for more market participants. Nvidia considered this decision necessary because the stock price grew exponentially, reaching $1,200 per share.

Nvidia’s stock split has enabled more traders to buy and own shares in the company at affordable prices, as $500, for example, was not enough to buy a single share; however, now, they can buy 4 or 5 shares.

After this stock split, Nvidia shares remained at the same price the next trading day. However, The stock price jumped by $10 in five days and grew to $140 by June 20th.

Nvidia and AI

Nvidia was at the forefront of artificial intelligence and machine learning, especially during the latest boom, which started with the emergence of ChatGPT and generative AI in late 2022. Nvidia harnessed its powerful GPU chipsets for AI research and development.

Nvidia’s graphics processing units are so advanced that they can be used for AI testing and development at research labs and data centres.

These trends lifted the company’s stock price throughout 2023 as demand for Nvidia’s GPUs skyrocketed, growing the stock price by 257% in one year and reaching a $1 trillion market cap for the first time.

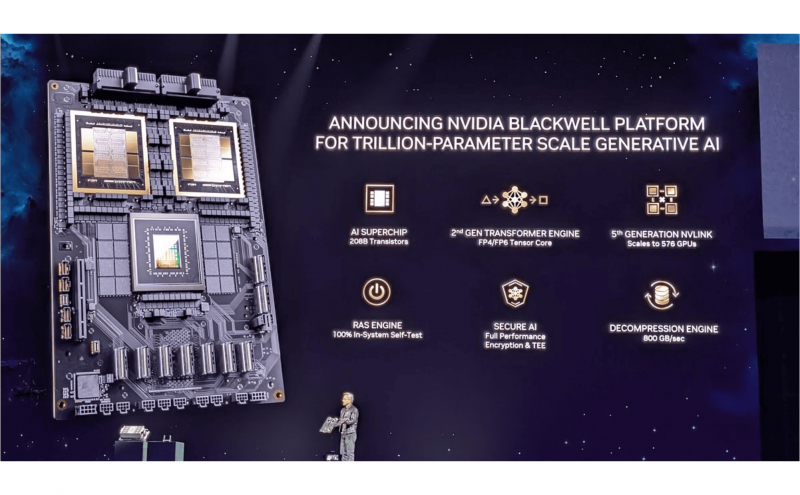

In 2024, the company capitalised on this demand to produce even stronger processors, such as Blackwell GPU, which fosters AI automation and accelerated computation.

Nvidia moved its products and development efforts closer to global tech hubs and the region where its chipsets are manufactured, Southeast Asia. The company opened its AI data centre in Indonesia after investing $200 million in a local telecommunications company and tech firm.

The company opened another data centre in Singapore and Malaysia, bolstering its AI efforts, which picked up its stock price to $95 by the end of Q1 2024.

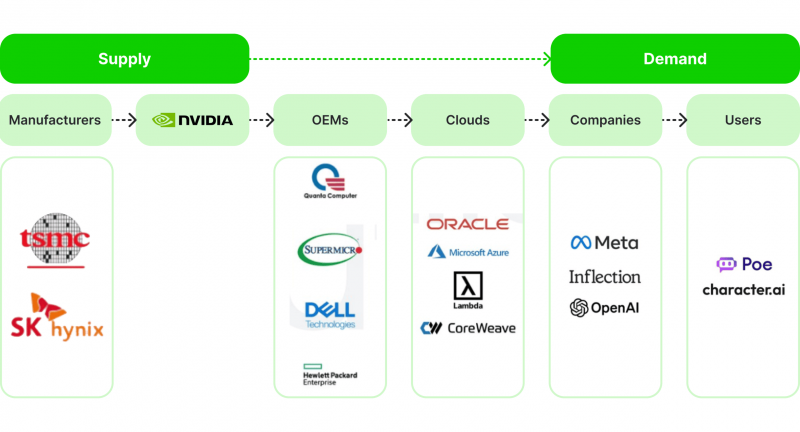

The company’s AI chips are highly demanded by top firms that harness AI capabilities for their services, including chatbots, generative AI, automation, self-driving vehicles, and more.

Nvidia’s Market Cap History

Nvidia’s company worth grew exceptionally in 2024, adding $1 trillion to its valuation only in 96 days!

After reaching its first trillion mark in June 2023, expectations were even higher for the next. The company started 2024 with a valuation of $1.2 trillion and reached $2 trillion in March, primarily driven by its newly introduced chipsets, which are driving AI developments.

The company reached $3 trillion early in June, overtaking Apple as the second-largest company. However, this growth skyrocketed as Nvidia’s market capitalisation crossed $3.34 trillion, overtaking Microsoft as the largest corporation in the world.

Is it Too Late to Buy Nvidia Stock?

In a nutshell, no, it is not too late. Despite many speculations about the Nvidia stock bubble, it is less likely to burst and cause severe damage to shareholders. The newest stock split is a preventive procedure to protect against price overheating.

The AI developments are preliminary. Although we have seen multiple technological innovations, experts predict that more unprecedented AI-powered utilities will arise soon, triggering another market inflammation and raising Nvidia’s company valuation and stocks.

As Nvidia plays a significant role in pushing the AI development wheels, these stocks are expected to soar again, marking a significant investment choice and possibly high gains.

Factors Driving Nvidia Shares

Despite the company’s massive growth, other factors affect this valuation and can potentially dwindle its stocks.

Global Geopolitical Instability

Nvidia relies on the Asia market, including Taiwan as a manufacturing source and China for exporting Nvidia’s GPUs. The ongoing tension between China, the USA and Taiwan can massively affect Nvidia’s ability to continue producing its chips, potentially affecting its valuation and earnings report.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

USA-China Relations

The China embargo the US government imposed in 2022 placed restrictions on American firms dealing with Chinese partners, especially in the tech industry. As the sanctions package continued throughout 2023, the impact reached Nvidia, as the company was restricted from exporting its chipsets to China, a significant importer of Nvidia GPUs.

Any update on US-China relations can reinforce or weaken Nvidia’s performance, as the company sees the Asia giant as a crucial partner.

AI Market Competition

Artificial intelligence developments are rapidly moving, with considerable market players investing massively in AI technology. Amazon, Apple, and Microsoft are key competitors for Nvidia.

The recent Apple and OpenAI partnership can significantly affect Nvidia, as it may drive tech firms and global players to chase these products rather than Nvidia’s.

US Presidential Elections

The US 2024 presidential elections can cause critical shifts in the market. The return of Trump’s administration could worsen relations between China and Taiwan. However, if the government introduces any subsidiary for local firms, Nvidia’s position may improve.

Moreover, the period before and after the presidential elections is usually characterised by increased volatility and investor sentiment as traders draw their investment decisions. These speculations can drive the market sideways, especially if investors prefer to minimise their investments.

Nvidia Future – What’s Next for The Company?

Many believe that the AI development wheel has just started to turn, and more introductions and innovations are to come in the near future. Nvidia’s next-gen Blackwell GPU is believed to be the main driver of the company’s shift from instruction-based models to intention-understanding AI software.

CEO of Nvidia commented, “The next industrial revolution has begun—companies and countries are partnering with Nvidia to shift the trillion-dollar installed base of traditional data centres to accelerated computing and build a new type of data centre —AI factories—to produce a new commodity: artificial intelligence.” The spending on AI is expected to reach $1 trillion by 2030.

Nvidia’s models are anticipated to play a vital role in the rise of electric cars. Xiaomi’s first EV, announced this year, uses Nvidia Drive Orin. Other advanced driver assistance and AI cockpit models are expected to be integrated into more electric automotive manufacturers in 2025.

Conclusion

The tremendous growth in market cap and Nvidia stocks influences significant shifts in the tech industry and the broader market. The newly pronounced most valuable company in the world, with $3.3 trillion worth, is leading the race in the AI revolution and complex computing technologies.

Nvidia’s market capitalisation went from just under $1 trillion to over $3.3 trillion in almost one year, driven by massive AI data centre investments and GPU and accelerated computing units that global corporations demand to develop their own AI models and capabilities.

After issuing a 10-to-1 stock split to maintain healthy economic growth, the company’s growth in AI is expected to continue as Nvidia makes new AI models powering electric vehicles, robotics, automated computation and more.

FAQ

Is Nvidia stock a good investment?

After the recent stock split, soaring shares and record market cap, Nvidia’s stock price target is more likely to continue growing as more AI technologies come into existence, making it a good stock investment.

Why is Nvidia’s worth growing so fast?

The company’s rapid introduction of GPUs, accelerated computing, and data centres has placed Nvidia at the forefront of developments. As more organisations and tech firms demand Nvidia chips to design their AI models, Nvidia’s shares and worth have grown exceptionally.

Should I sell my Nvidia stock?

Nvidia’s shares are growing steadily. The recent stock split might have slowed the growth rate, but Nvidia’s considerable AI investment can keep the price growing, making it a good long-term investment.

How is Nvidia affecting the S&P 500 Index?

The S&P 500 index is market-cap-weighted, meaning that firms with a larger valuation impact the index more significantly. Therefore, Nvidia’s latest worth and shares increase trigged more than 30% growth in the S&P 500 index.