How AI Will Affect Cryptocurrency Market?

Articles

Computer intelligence (or Artificial Intelligence AI) today is one of the most advanced areas of information technology elaboration, the basis of which is machine learning. This innovation has embraced all areas of human activity, including the cryptocurrency industry, which is currently experiencing incredible popularity. The inevitable introduction of artificial intelligence into the trading process or the creation of intelligent tokens is just around the corner, but what consequences will this have for the cryptocurrency market?

This article will discuss how cryptocurrency technology relates to artificial intelligence within the new stage of FinTech industry development. In addition, you will learn how artificial intelligence will affect the cryptocurrency market and what are the factors that prevent the full implementation of this technology. At the end of the article, it will become clear whether AI can change the fundamental principles of the cryptocurrency industry.

Key Takeaways

- AI technology will help in the development of crypto security, optimize the crypto trading process and offer tools to improve the mining process.

- Among the effects that AI will have on the crypto market are improved mining, improved blockchain security, development of smart contracts and implementation of tools for market forecasting.

- The symbiosis of AI and blockchain, in addition to the formation of many other aspects, will be mainly aimed at improving technologies for detecting suspicious activity and preventing criminal activity in the crypto space.

Cryptocurrencies and Artificial Intelligence – A New Phase of FinTech Development

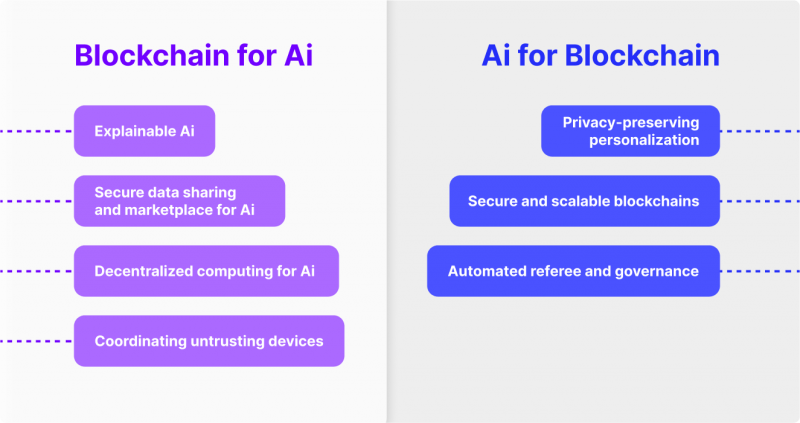

Blockchain and artificial intelligence are two of the hottest technology trends today. Despite the fact that they are two radically different trends, researchers are actively discussing the benefits of combining the two technologies. PwC predicts that AI will add $15.7 trillion to the global economy by 2030, resulting in a 14% increase in global GDP. Gartner predicts that by the same year, business value added through blockchain technology will rise to $3.1 trillion.

Both blockchain and artificial intelligence technologies have their individual degrees of sophistication, but both AI and blockchain are technologies that can both benefit from joint symbiosis and help each other grow. Because both technologies interact with data in different ways, combining them can take data use to the next level. At the same time, integrating machine learning and AI into blockchain can improve the underlying system architecture. Artificial intelligence can significantly improve the efficiency of blockchain. AI solutions can overcome its limitations, for example, by making the distributed ledger more energy-efficient and secure. Machine learning will also be helpful for organizations that adapt their blockchain for specific tasks.

The application of AI in cryptocurrency trading is unlimited. In addition to automated trading and price forecasting, the technology can also be used in risk management and optimizing investors’ trading portfolios. AI systems can detect fraudulent schemes and are capable of long-term monitoring of market changes, which may make them a good risk management tool in the future. AI algorithms can also optimize cryptocurrency portfolios based on specific investment objectives and risk tolerance.

AI systems can be used to make optimal trading decisions or automate processes such as price tracking and order execution. Moreover, AI could potentially raise the safety and security of cryptocurrency transactions by identifying fraudulent schemes and verification procedures. Consequently, AI algorithms could make the cryptocurrency market relatively safe to enter and navigate, encouraging an influx of traders and investors and increasing market development potential

With the introduction of AI in the crypto sphere, AI cryptocurrencies, blockchains, and other crypto projects based on machine learning began to appear.

How Will Artificial Intelligence Affect the Cryptocurrency Market?

AI crypto technologies will be the next big trend because it has the potential to revolutionize the way we make transactions, manage assets, and make investment decisions. With this technology, the use of cryptocurrency could be faster, safer, and more efficient for individuals and entrepreneurs alike. Moreover, AI can help reduce the risk of fraud, market manipulation, and human error, making cryptocurrency investing more reliable and trustworthy. Below is a list of the main challenges that AI will be able to address within the crypto industry once fully implemented.

Market Prediction

Computational technologies based on artificial intelligence algorithms will make it possible to predict market movements and create a comprehensive analysis of the data obtained to improve the interaction mechanisms with the elements of financial markets. At this stage, crypto investing, like any other type, is based on technical and fundamental analysis, allowing an approximate and superficial idea of the market movement direction. The AI will analyze large amounts of information, such as news, forums, etc., to quickly and accurately forecast market trends for any crypto asset.

Development of Automated Trading

Thanks to the introduction of AI technology in the crypto market, it will be possible to significantly improve algorithmic trading, which will undoubtedly increase the profits of this trading strategy. Currently, algorithmic trading is developing mainly through the use of complex mathematical models, which are significantly inferior to AI due to their imperfect working principles, which are based on ordinary people’s writing of program code. AI will eliminate this problem, allowing on top of everything else to choose the best-balanced trading strategy for each level of risk.

Development of Crypto Security Solutions

The symbiosis of blockchain and AI technology will help fight cybercrime and fraud in all its forms. By introducing machine learning algorithms in recognizing suspicious activity, the security of the trading process will become much more reliable and advanced, allowing, among other things, to build solutions for identity management during registration, automate KYC processes, and analyze crypto data to prevent fraudulent transactions on the blockchain. Combined with existing security practices in the crypto market, AI will enhance the ability to combat cybercrime.

Smart Contracts Development

Currently, smart contracts are programmed by different people, which means there is a certain probability that such contracts are not free from loopholes and inefficiencies. The use of artificial intelligence in these processes could ensure the achievement of bug-free smart contracts and the achievement of blockchain 2.0, the realization of which could be enabled or enhanced by various artificial intelligence technologies.

Artificial intelligence can also be used to test smart contracts, in particular for formal verification: for example, for automated troubleshooting, for debugging and root cause analysis and detection, and for search-based software engineering (SBSE)

Mining Development

Mining is the process of mining new blocks of information on a blockchain network. This process is common to many cryptocurrencies on the market today and is often very costly, both in terms of finances and in terms of technological equipment and hardware. The use of AI will reduce the consumption of resources of video elements in the process of mining the blocks, as well as significantly increase the speed of mining by optimizing computational models and algorithms in the software code system used for mining. Such solutions are actively studied today and even applied in practice.

Data Analysis

AI fully implemented in the crypto sphere will help optimize trading activities through market analysis and construction of all scenarios of events, selecting the ideal trading strategy per the market sentiment indicators. This will significantly reduce the percentage of losing trades and help to learn not only manually select the trading style but also to predict the price movement based on available data analysis of the AI. In addition, AI will minimize (or completely eliminate) the risk of losing money due to the wrong system of steps aimed at making a profit on any single trading asset.

Optimization of Investment Activities

AI fully implemented in the crypto sphere will help optimize trading activities through market analysis and construction of all scenarios of events, selecting the ideal trading strategy per the indicators of market sentiment. Sentiment analysis AI-powered natural language processing could recommend which crypto is best to buy or sell. In addition, AI will minimize (or completely eliminate) the risk of losing money due to the wrong system of steps aimed at making a profit on any single trading asset. This will significantly reduce the percentage of losing trades and help to learn not only manually select the trading style but also to predict the price movement based on available data analysis of the AI.

Factors Constraining the Development and Practical Application of Artificial Intelligence in the Crypto Market

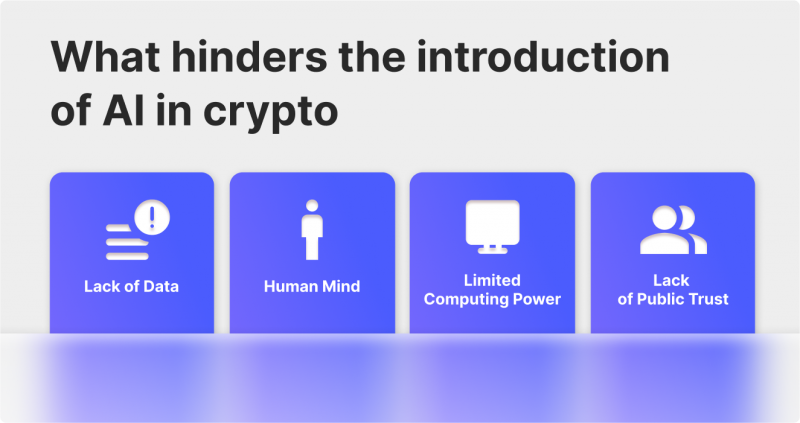

The cryptocurrency market is quite young and poorly understood, which sometimes becomes a big obstacle to the formation of the crypto industry, hindering the development and implementation of advanced technologies to increase the efficiency of trading digital assets. In order for AI technology to become widespread within the blockchain system, a lot of work is needed, which should be aimed at eliminating all kinds of negative factors that hinder its application, among which the following can be highlighted:

Lack of Data

To fully integrate and create a symbiosis based on blockchain and artificial intelligence today, more than the data is needed to build AI models that could predict market movements and optimize trading strategies. Moreover, in order to at least test AI in real market conditions and evaluate the quality of its work, it is necessary to fully study the principles of operation of blockchain networks, which today are hardly studied by at least 50%. Unlike the stock market, which has data to study the principles of its operation for almost 100 years, the cryptocurrency market cannot boast of such.

Human Mind

Nowadays, all the best engineering in crypto trading is still created by humans. This means that trading tools are subject to the biases and limitations of the average person, which consequently creates situations in which errors and bugs occur, sometimes leading to undesirable consequences. Lack of proper understanding of the crypto market due to its young age and complexity is an obstacle preventing us from using the potential of artificial intelligence technology to the full extent for the possibility of accelerating its development and modernization.

Limited Computing Power

Considerable computing power is required to be able to analyze historical market data, optimize human traders in cryptocurrency markets, or perform any other task related to digital assets based on AI. Since the process of AI operation is based solely on the operation of electronic computers that include advanced high-tech equipment, to ensure its stable and smooth operation, all the necessary connecting elements that form an ecosystem for implementing all programs related to crypto-trading will be required. High processing power for AI also requires the necessary tools for maintenance and troubleshooting.

Lack of Public Trust

The development of AI in the field of crypto will, with absolute certainty, contribute to the creation of both AI blockchains and AI cryptocurrencies, which will radically change the overall concept of technology. However, despite the numerous prospects and advantages that AI technologies have, the current public attitude to the issue of their widespread use is a matter of mistrust and skepticism. In order to address this issue, there may be trials and tests to demonstrate the practical benefits of using AI within the crypto industry, and in particular for digital asset trading.

Can Artificial Intelligence Fundamentally Change the Principles of the Cryptocurrency Industry?

Speaking about the impact of AI on the crypto market fundamentals, it is safe to say that among all the changes that will result from the full use of AI technology within the crypto industry, one of the most significant and priority will be improving security.

For example, unless a cybercriminal owns most of the mining resources, hacking a blockchain will be almost impossible, but applications built on a blockchain platform are unfortunately not as secure. Given the rapid progress of machine learning, a blockchain run by an intelligent algorithm could detect an attack and automatically trigger defense mechanisms. And if the damage is imminent, the AI could at least isolate the attacked component from the rest of the blockchain platform. Controlling the blockchain could improve the scalability and reliability of the distributed ledger. For example, if transaction volume increased dramatically, artificial intelligence could automatically increase the block creation rate, increasing throughput at the price of increased confirmation time.

If AI technology continues to evolve and revolutionize the crypto-trading market, it would be fair to expect it to be regulated to avoid abuse. As more people can enter this market, legal restrictions are necessary to maintain its stability and security. However, no measures will be taken to limit the use of AI in cryptocurrency trading. Instead, further efforts will likely focus on personal data protection, algorithm openness, and consumer protection.

Conclusion

The fusion of blockchain technology with AI technology will achieve incredible results in many aspects of crypto niche development, which will create favorable conditions for the transformation of not only individual elements of the cryptocurrency trading process, but also completely change the conceptual model of crypto market functioning to make it more secure, efficient and decentralized.