How to Accept Bitcoin as Payment in 2026: Detailed Guide

Bitcoin, once a niche speculative asset, is now a mainstream financial tool, attracting both individual users and companies from various industries. By 2026, nearly 560 million people worldwide own cryptocurrency, signalling a decisive shift toward digital currencies.

The crypto market is seeing unprecedented momentum, with Bitcoin hitting new highs of $90,000 and analysts projecting it may reach $100,000 in the coming months. This surge in value and increasing adoption are creating an opportune moment for businesses to explore Bitcoin as a payment option.

This guide outlines the practical steps, benefits, and challenges for companies interested in how to accept Bitcoin as payment, providing a roadmap to harness the full potential of this powerful digital currency.

Key Takeaways

- Accepting Bitcoin can help businesses tap into a global customer base while reducing transaction fees and enhancing privacy.

- Choosing a secure wallet and reliable payment processor, such as BitPay, Coinbase Commerce, B2BINPAY or PayPal, is essential for smooth Bitcoin payment integration.

- Staying compliant with evolving regulations and implementing best practices in security are critical for businesses accepting Bitcoin.

- As Bitcoin reaches new highs and adoption grows, integrating it as a payment option positions businesses for the future of digital finance.

Why Accept Bitcoin as Payment?

As Bitcoin adoption increases globally, more businesses are discovering the benefits of accepting Bitcoin as a mode of payment. Currently, over 30,000 global merchants accept Bitcoin, according to the report by Cointelegraph. The number is expected to rise as companies seek alternatives to traditional payment methods.

Accepting Bitcoin as payment brings significant advantages, positioning businesses for growth, security, and operational efficiency:

- Lower Transaction Fees: Traditional payment systems charge processing fees of 1.5% to 3.5% for credit card transactions, which can add up for businesses with large sales volumes. In contrast, Bitcoin transaction fees are often under 1%, and some cryptocurrency solutions allow businesses to reduce fees further based on transaction volume.

- Access to a Global Market: Bitcoin is borderless and not tied to any central bank, making it an appealing option for international customers. With Bitcoin, businesses can reach customers worldwide without managing multiple currencies or international transfer fees.

- Enhanced Privacy and Control: Bitcoin transactions occur directly between the customer and the business, avoiding third-party intermediaries. This setup provides businesses with direct control over funds and minimises privacy concerns.

Bitcoin is rapidly becoming mainstream, with approximately 85% of U.S. retailers anticipating crypto payments becoming standard in the next five years, according to Deloitte.

Many notable companies, such as Apple, PlayStation, Starbucks, and PayPal, already accept Bitcoin. Offering crypto as a payment option can attract a tech-savvy customer base and enhance brand loyalty.

Handling Bitcoin’s Volatility

Bitcoin’s value can fluctuate significantly, with daily price movements of up to 5%. Many businesses use payment processors that offer instant BTC-to-fiat conversion to manage this volatility. BitPay, for example, allows businesses to choose from multiple currencies, ensuring revenue stability regardless of Bitcoin’s market price.

Companies looking to accept Bitcoin as a payment method can use stablecoin options like USDT or USDC. These currencies maintain a fixed value relative to fiat currency, making them a good option for businesses that want to hold digital assets but avoid Bitcoin’s price fluctuations.

How to Accept Bitcoin as Payment on Website: Step-by-Step Guide

If your business is ready to accept Bitcoin as a payment option, here’s a detailed step-by-step guide covering the technical setup, best practices, and options available.

Step 1: Check Legal and Compliance Requirements

Before diving into Bitcoin payments, ensuring that your business is on solid legal ground is important. Compliance may sound intimidating, but it’s really about setting up a foundation for smooth, worry-free transactions.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

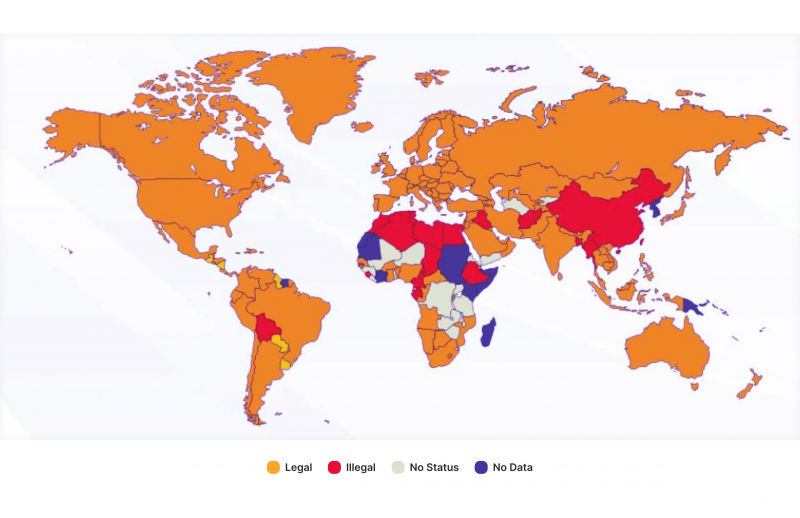

Confirm Bitcoin’s legality in your area. Is it legal to accept Bitcoin as payment? The good news is that it’s perfectly legal for businesses to accept BTC in most parts of the world, but regulations can vary by country:

- In the United States, for example, Bitcoin is classified as property, making it legal to use for payments, although it is subject to capital gains tax.

- In the European Union, the Markets in Crypto-Assets Regulation (MiCA) provides a legal framework for crypto businesses, making offering Bitcoin payments across the EU easier.

- Asia presents a mixed picture: Japan, for example, has clear regulations supporting crypto, while other countries like India have implemented stricter controls.

Understand Tax Implications

Bitcoin is treated as property in many regions, so you’ll need to track its value for tax purposes and report any gains or losses. To make this easy, consult a tax advisor familiar with crypto or use an accounting tool to keep everything organised.

Accounting software like Coin Ledger or CoinTracking can assist in recording each transaction’s details, helping you meet tax obligations efficiently. Proper tracking is essential, as tax authorities like the IRS and HMRC are increasingly focused on crypto compliance.

Prepare for KYC and AML Compliance

If you’re accepting large payments or work in a regulated industry (like finance or real estate), you need to follow Know Your Customer (KYC) and Anti-Money Laundering (AML) guidelines. These are simple steps to verify customer identity and ensure transactions are secure.

Keep an eye on crypto regulations, as they’re evolving quickly. By checking in on regulatory updates now and then, you’ll stay one step ahead and ensure your business remains fully compliant.

Most top payment processors, like BitPay and B2BINPAY, have built-in KYC/AML tools. These tools help verify customer information automatically, keeping your business compliant without much extra effort.

Step 2: Set Up a Bitcoin Merchant Account

A Bitcoin merchant account allows you to process and manage Bitcoin transactions efficiently. Payment processors simplify the setup and offer smooth transaction handling and revenue tracking tools.

Each of these processors provides distinct features, so choose the one that best aligns with your business needs:

- BitPay: Trusted by thousands of businesses globally, BitPay offers seamless BTC-to-fiat conversion and integration options for easy website setup. BitPay also has low transaction fees, allowing you to avoid Bitcoin’s volatility by instantly converting payments to fiat currency.

- B2BINPAY: An all-in-one crypto ecosystem for both large and small businesses, B2BINPAY offers cryptocurrency solutions with robust security and competitive transaction fees. The platform instantly converts received crypto into fiat and supports hundreds of coins and tokens across 10+ blockchain networks.

- Coinbase Commerce: Ideal if you already use Coinbase, this processor provides both custodial and non-custodial payment options. It’s a flexible option for businesses seeking a simple solution.

- PayPal: If you already accept PayPal, this may be a convenient option as it enables users to pay with Bitcoin, Ether, and other cryptocurrencies across multiple regions.

Test each platform’s customer experience to see which fits your business best. Consider transaction fees, security features, and ease of integration.

Step 3: Choose a Secure Bitcoin Wallet

If you prefer not to go through a payment gateway, setting up a secure Bitcoin wallet is an alternative way to handle crypto transactions directly.

A Bitcoin wallet will store your digital assets, allowing you to independently manage and safeguard your earnings. There are two primary types of Bitcoin wallets to consider:

Hot Wallets

Hot wallets are connected to the internet, making them convenient and ideal for frequent transactions. Because they’re online, they allow easy access to funds, but they are also more exposed to security risks, such as hacking. Popular hot wallets include Coinbase Wallet, Phantom Wallet and Trust Wallet.

Cold Wallets

Cold wallets offer much higher security for businesses planning to store Bitcoin in the long term. These wallets are offline, keeping your private keys disconnected from the internet and, therefore, less vulnerable to attacks. Popular options include Trezor and Ledger.

A combination of hot and cold wallets can give you the best of both worlds—easy access for daily transactions with a hot wallet and safe, offline storage for larger amounts in a cold wallet.

Step 4: Integrate Bitcoin Payments on Your Website

For online businesses, adding the option to accept Bitcoin as payment on your website is straightforward with the right tools. Most e-commerce platforms offer Bitcoin plugins that make setup simple and efficient.

If your website doesn’t provide such tools, most payment processors provide APIs for custom integrations, allowing developers to tailor the setup to your needs. Consult with your developer or in-house tech team to ensure a seamless integration.

Step 5: Develop a Bitcoin Payment Workflow

Creating a straightforward workflow for Bitcoin payments will help your business handle transactions efficiently and build customer trust.

- Automate Conversion (If Desired): Decide upfront if you want to hold Bitcoin or convert it immediately to fiat currency. If you believe in Bitcoin’s long-term potential, you might consider keeping a portion in Bitcoin and converting the rest.

- Establish Refund Policies: Establish clear guidelines for handling refunds in Bitcoin. Some businesses prefer to issue refunds in fiat or stablecoins, while others process them in Bitcoin. Whatever you choose, make it clear to customers so they know what to expect.

Step 6: Set Up Security Measures

Bitcoin is secure by design, but it’s important to implement additional security practices for your business operations.

- Enable Multi-Factor Authentication (MFA): MFA adds a layer of protection to your wallet and payment processor accounts, requiring a second verification form (like a code sent to your phone) before access is granted. This helps guard against unauthorised access, adding a valuable security buffer.

- Use Multi-Signature Wallets: Consider using a multi-signature wallet if multiple people in your business handle Bitcoin transactions. These wallets require more than one person’s approval to complete a transaction, making it much harder for unauthorised transactions.

- Back Up Private Keys and Recovery Phrases: Your private keys and recovery phrases are your lifeline to accessing your Bitcoin. Store them offline in a secure place, like a fireproof safe, to protect against loss, damage, or unauthorised access.

Step 7: Promote Bitcoin as a Payment Option

Now that you’re ready to accept Bitcoin, let your customers know. Promoting this option will drive usage and set your business apart as a tech-forward brand.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Place Bitcoin logos and icons alongside other payment methods on your website, at checkout, and even in-store if you have a physical location. Seeing these symbols lets customers know that Bitcoin is a welcome payment option.

For customers unfamiliar with Bitcoin, consider creating a simple FAQ or guide. Topics to address could include:

- How to make a payment

- Security of Bitcoin transactions

- Refund policies for Bitcoin transactions

Announce your new payment option through email newsletters, social media posts, and other marketing channels. Share the news that customers can now pay with Bitcoin, highlighting the convenience and innovation of digital payments.

Step 8: Monitor and Adapt

As Bitcoin grows in popularity, staying agile is key to maximising its benefits and ensuring smooth operations.

- Monitor Customer Feedback: Collect and review feedback from customers who pay with Bitcoin to improve the payment experience and address any questions or issues. Their input can help you fine-tune the process.

- Stay Updated on Regulations: Cryptocurrency regulations constantly evolve, so watch for changes in tax laws or compliance standards.

Conclusion

Adopting Bitcoin as a payment method opens up a world of opportunities for businesses, from reaching new customer segments to reducing transaction costs. Businesses can easily integrate Bitcoin into their operations by setting up the proper infrastructure and staying informed on compliance.

With Bitcoin’s value rising and adoption increasing, accepting Bitcoin is a strategic move to stay ahead in the evolving landscape of digital payments.

FAQ

Can I accept Bitcoin as payment on eBay?

eBay doesn’t support Bitcoin virtual currency payments like BTC or ETH. However, many sellers use third-party options like BitPay or invoice systems to accept Bitcoin.

How long does it take to process a Bitcoin transaction for payments?

Transaction times vary based on network congestion, typically ranging from 10 minutes to an hour. Some businesses use the Lightning Network or payment processors that allow instant transactions for a faster checkout experience.

How many merchants accept Bitcoin as a means of payment?

Currently, over 30,000 merchants worldwide accept Bitcoin as a payment method, according to a report by Cointelegraph.

Do I need to understand blockchain technology to accept Bitcoin payments?

Not necessarily. Payment processors handle the technical aspects, so businesses don’t need in-depth blockchain knowledge to start accepting Bitcoin.